Region:Asia

Author(s):Dev

Product Code:KRAB0459

Pages:100

Published On:August 2025

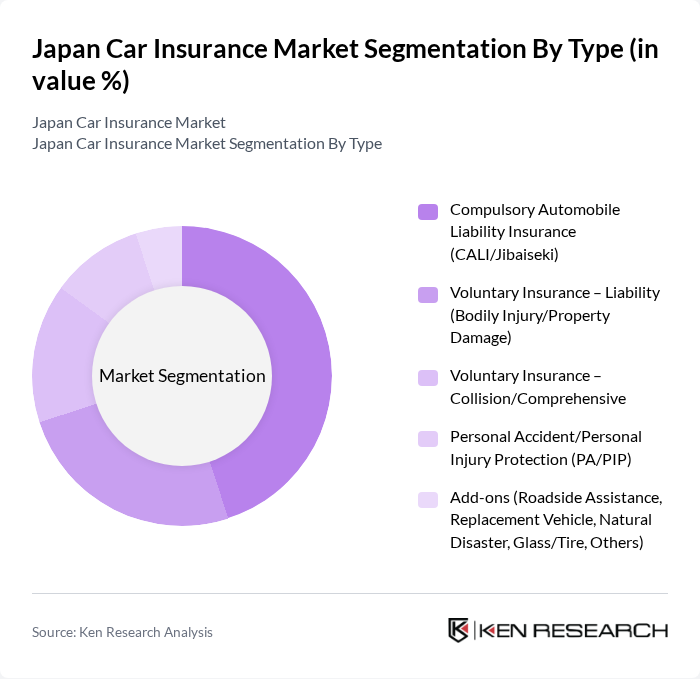

By Type:The segmentation by type includes various insurance products that cater to different needs of vehicle owners. The subsegments are Compulsory Automobile Liability Insurance (CALI/Jibaiseki), Voluntary Insurance – Liability (Bodily Injury/Property Damage), Voluntary Insurance – Collision/Comprehensive, Personal Accident/Personal Injury Protection (PA/PIP), and Add-ons (Roadside Assistance, Replacement Vehicle, Natural Disaster, Glass/Tire, Others). The Compulsory Automobile Liability Insurance is the most significant segment due to the legal requirement for all vehicle owners to have this insurance, ensuring a steady demand .

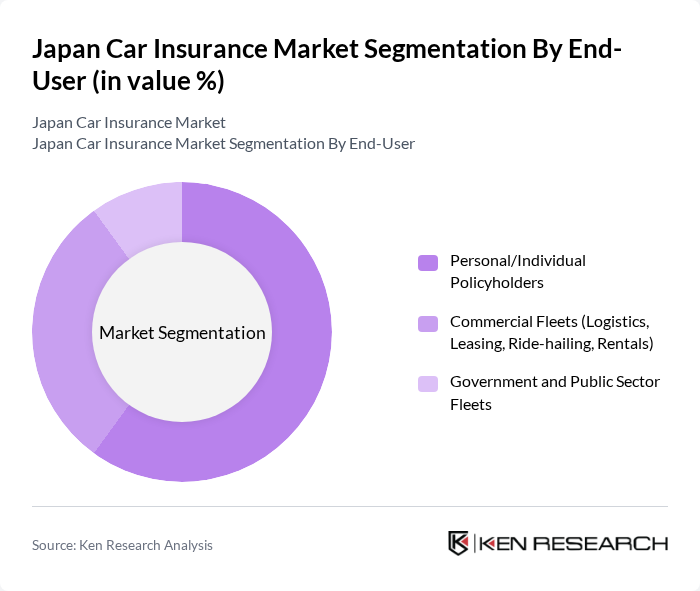

By End-User:The segmentation by end-user includes Personal/Individual Policyholders, Commercial Fleets (Logistics, Leasing, Ride-hailing, Rentals), and Government and Public Sector Fleets. The Personal/Individual Policyholders segment dominates the market as individual vehicle ownership is prevalent in Japan, leading to a higher number of policies issued for personal use .

The Japan Car Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tokio Marine & Nichido Fire Insurance Co., Ltd. (Tokio Marine Holdings, Inc.), MS&AD Insurance Group Holdings, Inc. (Mitsui Sumitomo Insurance Co., Ltd.), Sompo Japan Insurance Inc. (Sompo Holdings, Inc.), Aioi Nissay Dowa Insurance Co., Ltd. (MS&AD Group), Mitsui Direct General Insurance Co., Ltd. (MS&AD Group), SBI Insurance Co., Ltd., Rakuten General Insurance Co., Ltd., Sony Assurance Inc., Zurich Insurance Company Ltd., Japan Branch, AXA General Insurance Co., Ltd. (Japan), Chubb Insurance Japan, AIG General Insurance Company, Ltd. (AIG Japan), Allianz Global Corporate & Specialty SE, Japan Branch (Allianz Commercial), Tokio Marine dR Co., Ltd. (Telematics/UBI subsidiary), Nippon Life Insurance Company (Non-life via Mitsui Sumitomo/Nissay Dowa partnerships) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan car insurance market appears promising, driven by technological innovations and evolving consumer preferences. As electric and autonomous vehicles become more prevalent, insurers will need to adapt their offerings to meet new risks. Additionally, the expansion of digital platforms will facilitate easier access to insurance products, enhancing customer engagement. The market is likely to see a shift towards personalized insurance solutions, catering to the unique needs of consumers, thereby fostering growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Compulsory Automobile Liability Insurance (CALI/Jibaiseki) Voluntary Insurance – Liability (Bodily Injury/Property Damage) Voluntary Insurance – Collision/Comprehensive Personal Accident/Personal Injury Protection (PA/PIP) Add-ons (Roadside Assistance, Replacement Vehicle, Natural Disaster, Glass/Tire, Others) |

| By End-User | Personal/Individual Policyholders Commercial Fleets (Logistics, Leasing, Ride-hailing, Rentals) Government and Public Sector Fleets |

| By Vehicle Type | Passenger Cars Commercial Vehicles Kei Cars (Light Motor Vehicles) Electric and Hybrid Vehicles |

| By Distribution Channel | Direct Sales (Insurer-Owned) Agents and Insurance Shops Brokers Banks (Bancassurance) Online and Mobile Platforms |

| By Policy Duration | One-Year Policies Multi-Year Policies |

| By Premium Range | Low Premium Medium Premium High Premium |

| By Customer Segment | Young Drivers Senior Drivers High-Risk Drivers UBI/Telematics Users |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Private Car Insurance Policies | 150 | Policyholders, Insurance Agents |

| Commercial Vehicle Insurance | 100 | Fleet Managers, Business Owners |

| Claims Processing Insights | 80 | Claims Adjusters, Claims Operations Managers |

| Consumer Preferences in Coverage | 120 | Car Owners, Insurance Brokers |

| Impact of Technology on Insurance | 90 | IT Managers, Digital Product Managers |

The Japan Car Insurance Market is valued at approximately USD 20 billion, reflecting stable demand supported by mandatory liability coverage and robust voluntary insurance lines, according to multiple industry trackers.