Region:Asia

Author(s):Dev

Product Code:KRAB0486

Pages:98

Published On:August 2025

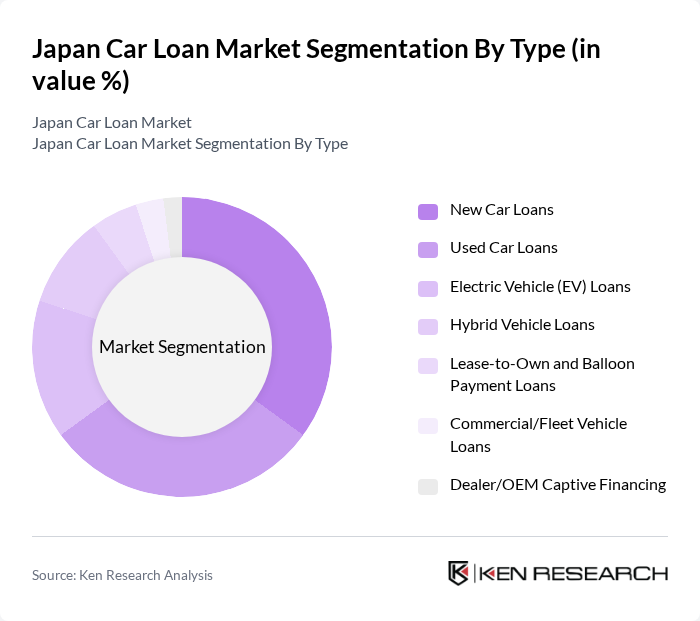

By Type:The segmentation by type includes various categories such as New Car Loans, Used Car Loans, Electric Vehicle (EV) Loans, Hybrid Vehicle Loans, Lease-to-Own and Balloon Payment Loans, Commercial/Fleet Vehicle Loans, and Dealer/OEM Captive Financing. Each of these subsegments caters to different consumer needs and preferences, reflecting the diverse landscape of vehicle financing in Japan. Growing attention to EV and hybrid models, together with competitive used-vehicle financing, is shaping lenders’ product design and promotional rates.

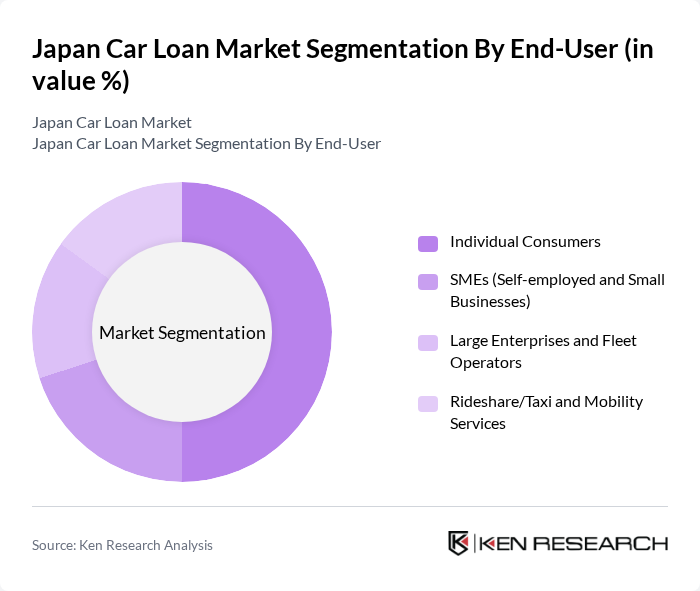

By End-User:The end-user segmentation includes Individual Consumers, SMEs (Self-employed and Small Businesses), Large Enterprises and Fleet Operators, and Rideshare/Taxi and Mobility Services. This categorization highlights the different customer bases that utilize car loans, each with unique financing requirements and purchasing behaviors. Urban household buyers, small businesses, and fleet operators are key originators, supported by banks, consumer finance firms, and OEM captives offering tailored tenures and APRs.

The Japan Car Loan Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toyota Financial Services Corporation, Nissan Financial Services Co., Ltd., Honda Financial Services (Honda Motor Co.), Mitsubishi UFJ Financial Group, Inc. (MUFG), Sumitomo Mitsui Financial Group, Inc. (SMFG) / Sumitomo Mitsui Banking Corporation, Mizuho Financial Group, Inc., Resona Holdings, Inc., Aozora Bank, Ltd., Shinsei Bank, Ltd. (A subsidiary of SBI Holdings), JACCS Co., Ltd., ORIX Corporation, Orient Corporation (Orico), SBI Sumishin Net Bank, Ltd., The Chiba Bank, Ltd., The Bank of Kyoto, Ltd., SMBC Trust Bank, Ltd., AEON Financial Service Co., Ltd., Rakuten Bank, Ltd., Sumitomo Mitsui Auto Service Company, Limited, Volkswagen Financial Services Japan Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Japan car loan market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The shift towards digital financing solutions is expected to streamline loan processes, enhancing accessibility for borrowers. Additionally, the rise of subscription-based car financing models will cater to younger consumers seeking flexibility. As the market adapts to these trends, opportunities for growth will emerge, particularly in the electric vehicle segment, supported by government incentives and increasing environmental awareness among consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | New Car Loans Used Car Loans Electric Vehicle (EV) Loans Hybrid Vehicle Loans Lease-to-Own and Balloon Payment Loans Commercial/Fleet Vehicle Loans Dealer/OEM Captive Financing |

| By End-User | Individual Consumers SMEs (Self-employed and Small Businesses) Large Enterprises and Fleet Operators Rideshare/Taxi and Mobility Services |

| By Loan Tenure | Less than 3 Years –5 Years More than 5 Years |

| By Interest Rate Type | Fixed Interest Rate Loans Variable Interest Rate Loans |

| By Application | Personal Use Commercial Use |

| By Sales Channel | Bank Branches and Direct Sales Online/Digital Platforms Dealership and OEM Captive Financing |

| By Credit Profile | Prime Borrowers Near-prime Borrowers Subprime Borrowers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Car Loan Borrowers | 150 | Individuals aged 25-55 with recent car loans |

| Automotive Dealership Finance Managers | 100 | Finance managers from major car dealerships |

| Financial Institution Loan Officers | 80 | Loan officers from banks and credit unions |

| Automotive Industry Analysts | 50 | Analysts specializing in automotive finance and market trends |

| Consumer Advocacy Groups | 40 | Representatives from organizations focused on consumer rights in finance |

The Japan Car Loan Market is valued at approximately USD 50 billion, reflecting sustained auto finance activity across banks and captive finance arms, driven by stable demand for vehicle purchases in major cities like Tokyo, Osaka, and Yokohama.