Region:Asia

Author(s):Geetanshi

Product Code:KRAB0031

Pages:80

Published On:August 2025

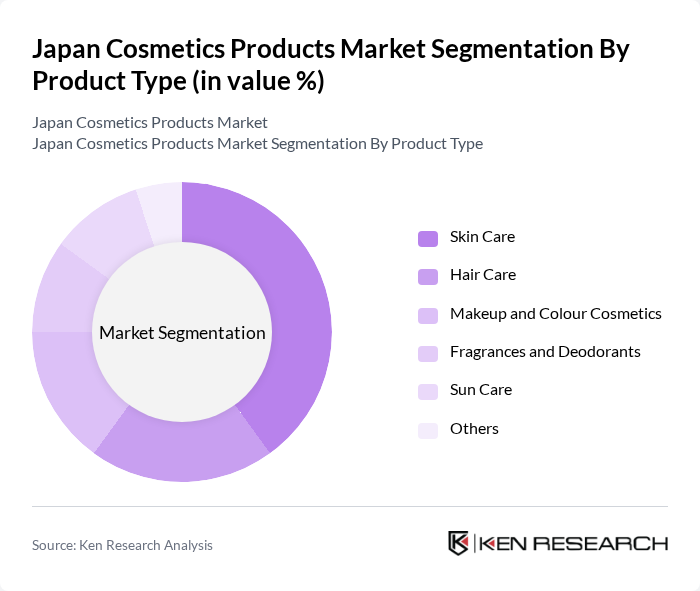

By Product Type:The product type segmentation includes various categories such as Skin Care, Hair Care, Makeup and Colour Cosmetics, Fragrances and Deodorants, Sun Care, and Others. Among these, Skin Care is the leading segment, driven by a growing focus on health and wellness, as well as the increasing popularity of anti-aging products. Consumers are increasingly investing in skincare routines, which has led to a surge in demand for moisturizers, serums, and cleansers .

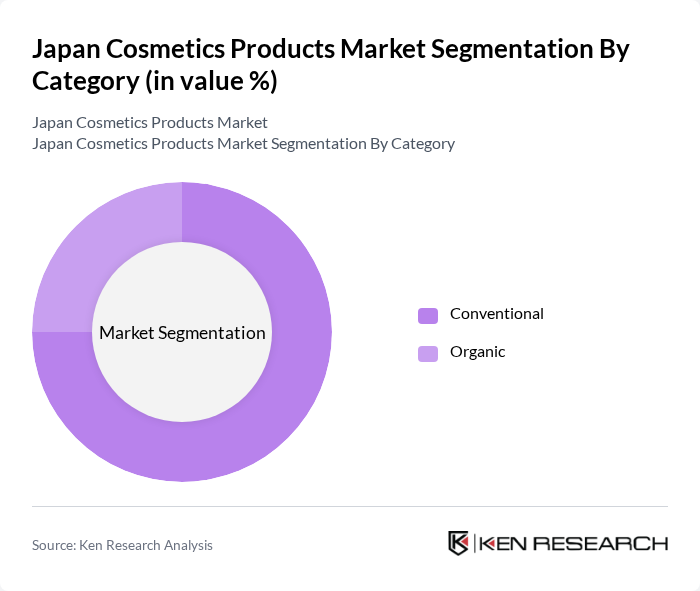

By Category:The category segmentation includes Conventional and Organic products. The Conventional segment dominates the market due to its established presence and wide availability. However, the Organic segment is gaining traction as consumers become more environmentally conscious and seek products with natural ingredients. This shift is particularly evident among younger consumers who prioritize sustainability and ethical sourcing in their purchasing decisions .

The Japan Cosmetics Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Shiseido Company, Limited, Kao Corporation, Kosé Corporation, L'Oréal Japan K.K., Procter & Gamble Japan K.K., Unilever Japan K.K., Amorepacific Japan Co., Ltd., Fancl Corporation, DHC Corporation, Mandom Corporation, Pola Orbis Holdings Inc., Aqualabel (Shiseido), Cezanne Cosmetics Co., Ltd. (Kao Group), Nivea (Beiersdorf Japan Co., Ltd.), The Body Shop Japan Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japanese cosmetics market appears promising, driven by evolving consumer preferences and technological advancements. As the demand for eco-friendly and personalized products rises, brands are likely to innovate and adapt their offerings. Additionally, the integration of augmented reality in online shopping experiences is expected to enhance consumer engagement. With a focus on sustainability and digital transformation, the market is poised for dynamic growth, reflecting broader global trends in beauty and personal care.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Skin Care Hair Care Makeup and Colour Cosmetics Fragrances and Deodorants Sun Care Others |

| By Category | Conventional Organic |

| By Gender | Women Men Unisex |

| By Price Range | Mass Premium |

| By Distribution Channel | Supermarkets and Hypermarkets Convenience Stores Specialty Stores Pharmacies Online Stores Others |

| By Region | Kanto Kinki Central/Chubu Kyushu-Okinawa Tohoku Chugoku Hokkaido Shikoku |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Skincare Product Users | 120 | Women aged 18-45, Skincare Enthusiasts |

| Makeup Product Consumers | 90 | Women aged 18-35, Makeup Artists, Beauty Influencers |

| Hair Care Product Buyers | 60 | Men and Women aged 20-50, Salon Owners |

| Natural and Organic Cosmetics Users | 50 | Health-conscious Consumers, Eco-friendly Advocates |

| Online Cosmetic Shoppers | 70 | Frequent Online Shoppers, E-commerce Managers |

The Japan Cosmetics Products Market is valued at approximately USD 27.5 billion, reflecting a significant growth driven by consumer demand for high-quality beauty products and a rising trend towards skincare and organic products.