Region:Asia

Author(s):Rebecca

Product Code:KRAB0275

Pages:92

Published On:August 2025

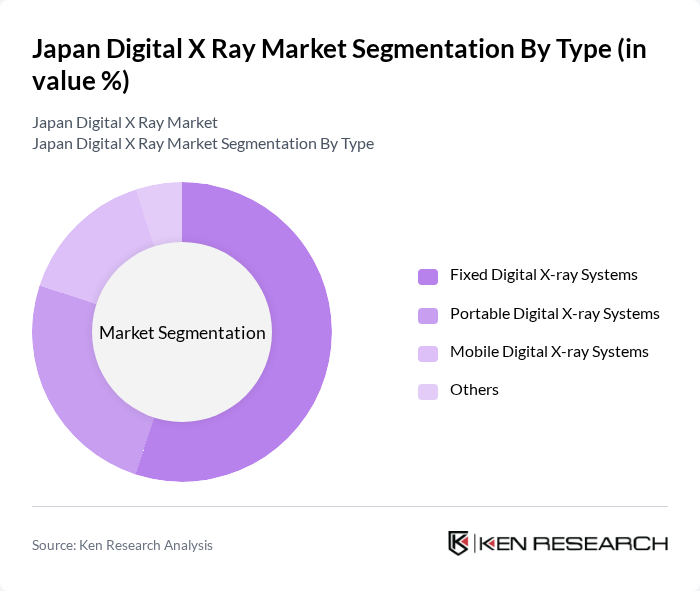

By Type:The market is segmented into Fixed Digital X-ray Systems, Portable Digital X-ray Systems, Mobile Digital X-ray Systems, and Others. Fixed Digital X-ray Systems dominate the market due to their widespread use in hospitals and diagnostic centers, offering high-quality imaging and reliability. Portable and Mobile Digital X-ray Systems are gaining traction, especially in outpatient settings and emergency care, driven by the need for flexibility, rapid diagnostics, and the ability to serve aging and remote populations. The adoption of portable and mobile systems is further supported by disaster preparedness initiatives and the need for point-of-care imaging .

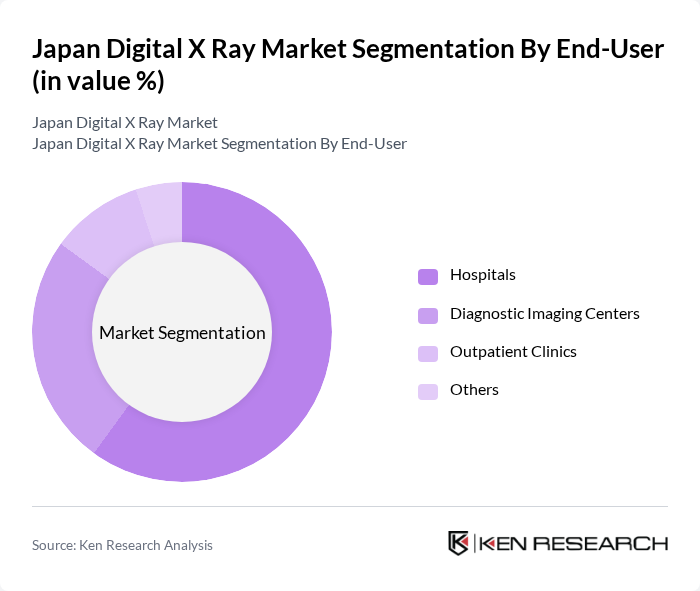

By End-User:The market is categorized into Hospitals, Diagnostic Imaging Centers, Outpatient Clinics, and Others. Hospitals are the leading end-users, driven by the high demand for advanced imaging technologies for patient diagnosis and treatment. Diagnostic Imaging Centers are also significant contributors, as they specialize in providing imaging services, while Outpatient Clinics are increasingly adopting digital X-ray systems for convenience, efficiency, and to meet the needs of an aging population. The trend toward decentralized healthcare and home-based diagnostics is further supporting the adoption of digital X-ray systems in non-hospital settings .

The Japan Digital X Ray Market is characterized by a dynamic mix of regional and international players. Leading participants such as Canon Medical Systems Corporation, Fujifilm Holdings Corporation, Siemens Healthineers, GE Healthcare, Philips Healthcare, Hitachi, Ltd. (Healthcare Business Unit), Carestream Health, Agfa-Gevaert Group, Hologic, Inc., Shimadzu Corporation, Samsung Medison Co., Ltd., Mindray Medical International Limited, Konica Minolta, Inc., Varian Medical Systems, Inc., MIKASA X-RAY CO., LTD. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital X-ray market in Japan appears promising, driven by ongoing technological advancements and a growing emphasis on patient-centric care. As healthcare providers increasingly adopt AI-driven imaging solutions, the efficiency and accuracy of diagnostics are expected to improve significantly. Additionally, the expansion of telemedicine and remote diagnostics will further enhance access to imaging services, particularly in rural areas, fostering a more integrated healthcare system that prioritizes patient outcomes and operational efficiency.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed Digital X-ray Systems Portable Digital X-ray Systems Mobile Digital X-ray Systems Others |

| By End-User | Hospitals Diagnostic Imaging Centers Outpatient Clinics Others |

| By Application | Orthopedic Imaging Cancer Imaging Dental Imaging Cardiovascular Imaging Pediatric Imaging Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Kanto Kansai Chubu Kyushu Tohoku Hokkaido Others |

| By Price Range | Low-End Mid-Range High-End |

| By Technology | Computed Radiography (CR) Direct Radiography (DR) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Radiology Departments | 100 | Radiologists, Imaging Technologists |

| Diagnostic Imaging Centers | 80 | Center Managers, Radiology Technologists |

| Healthcare Procurement Offices | 60 | Procurement Officers, Financial Managers |

| Medical Equipment Distributors | 50 | Sales Representatives, Product Managers |

| Regulatory Bodies and Health Authorities | 40 | Policy Makers, Health Administrators |

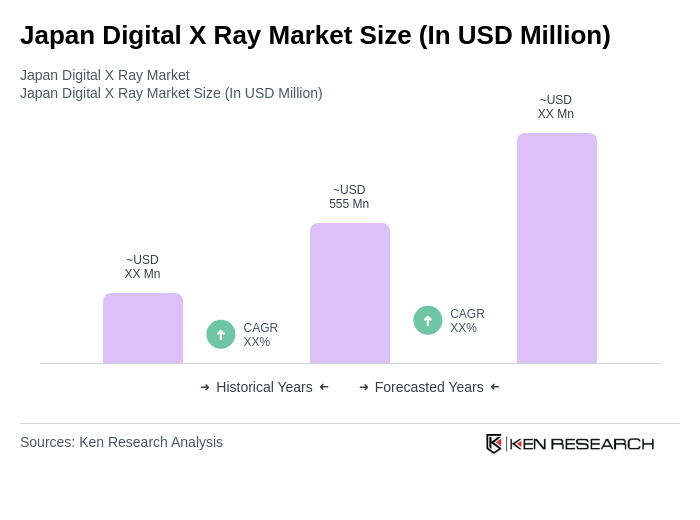

The Japan Digital X-ray Market is valued at approximately USD 555 million, reflecting significant growth driven by advancements in imaging technology, the rising prevalence of chronic diseases, and a focus on early diagnosis and preventive healthcare.