Region:Asia

Author(s):Rebecca

Product Code:KRAA1450

Pages:87

Published On:August 2025

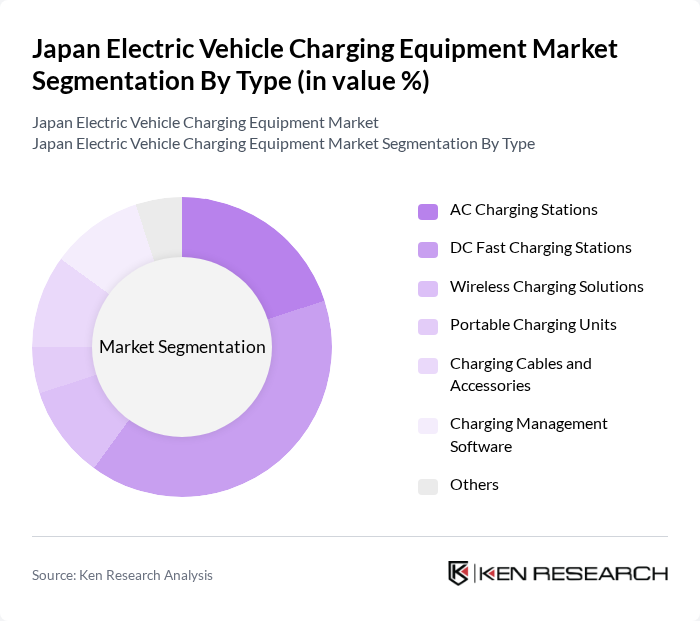

By Type:The market is segmented into AC Charging Stations, DC Fast Charging Stations, Wireless Charging Solutions, Portable Charging Units, Charging Cables and Accessories, Charging Management Software, and Others. Among these,DC Fast Charging Stationsare gaining significant traction due to their ability to charge vehicles rapidly, meeting the growing demand for quick charging solutions. The increasing number of electric vehicles on the road, coupled with the need for efficient and accessible charging options, is making this sub-segment a leader in the market. The adoption of smart charging and networked solutions is also rising, reflecting the market’s shift toward digital integration and user convenience.

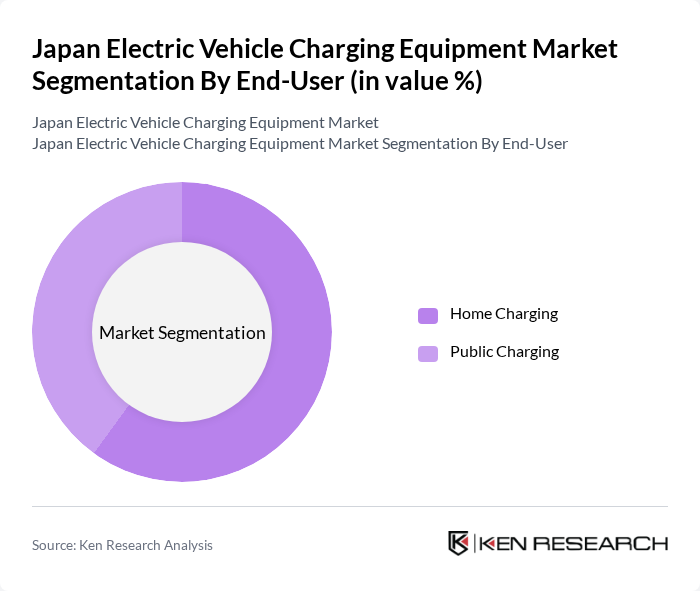

By End-User:The market is categorized into Home Charging and Public Charging.Home Chargingis increasingly popular as more consumers adopt electric vehicles and seek convenient charging solutions at their residences. This trend is driven by the growing number of EV owners who prefer the convenience of overnight charging.Public Chargingremains essential for supporting EV users without access to home charging, particularly in urban areas with limited private parking. Public charging infrastructure is expanding rapidly, with installations in high-traffic locations such as shopping centers, transportation hubs, and tourist destinations, reflecting its critical role in the overall market.

The Japan Electric Vehicle Charging Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Panasonic Corporation, Toyota Industries Corporation, Nissan Motor Co., Ltd., Mitsubishi Electric Corporation, NEC Corporation, ENECHANGE Ltd., Japan Charge Network Co., Ltd. (JCN), e-Mobility Power Co., Inc., ABB Ltd., Hitachi, Ltd., Takaoka Toko Co., Ltd., Nitto Kogyo Corporation, Fujikura Ltd., Nichicon Corporation, and Denso Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electric vehicle charging equipment market in Japan appears promising, driven by ongoing government initiatives and technological innovations. As the country aims for a 50% EV adoption rate in future, the demand for charging infrastructure will continue to rise. Additionally, the integration of renewable energy sources into charging stations is expected to enhance sustainability. The market will likely see increased collaboration between charging equipment manufacturers and automotive companies, fostering a more robust ecosystem for electric vehicles.

| Segment | Sub-Segments |

|---|---|

| By Type | AC Charging Stations DC Fast Charging Stations Wireless Charging Solutions Portable Charging Units Charging Cables and Accessories Charging Management Software Others |

| By End-User | Home Charging Public Charging |

| By Application | Public Charging Stations Private Charging Solutions Fleet Charging Solutions Workplace Charging |

| By Distribution Channel | Direct Sales Online Sales Distributors and Resellers |

| By Charging Speed | Level 1 Charging Level 2 Charging DC Fast Charging |

| By Investment Source | Private Investments Government Funding Public-Private Partnerships |

| By Policy Support | Subsidies Tax Exemptions Grants for Infrastructure Development |

| By Region | Kanto Region Kinki Region Chubu (Central) Region Kyushu-Okinawa Region Tohoku Region Chugoku Region Hokkaido Region Shikoku Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Charging Solutions | 100 | Homeowners, Electric Vehicle Owners |

| Commercial Charging Infrastructure | 80 | Facility Managers, Business Owners |

| Public Charging Stations | 60 | City Planners, Transportation Officials |

| Fleet Charging Solutions | 50 | Fleet Managers, Logistics Coordinators |

| Charging Equipment Manufacturers | 40 | Product Development Managers, Sales Directors |

The Japan Electric Vehicle Charging Equipment Market is valued at approximately USD 620 million, reflecting significant growth driven by the increasing adoption of electric vehicles and government initiatives promoting sustainable transportation.