Region:Asia

Author(s):Geetanshi

Product Code:KRAB3356

Pages:81

Published On:October 2025

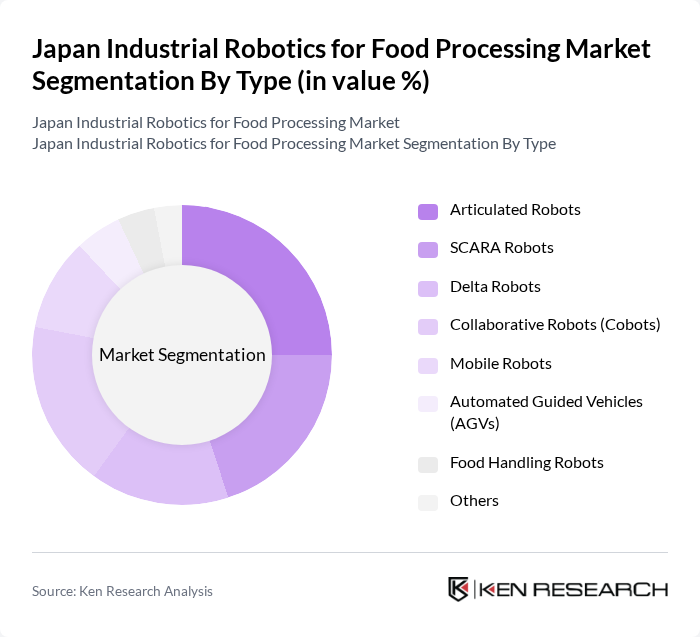

By Type:The market is segmented into various types of robots, each serving specific functions in food processing.Articulated robotsare widely used for their flexibility and precision in tasks such as packaging and assembly.SCARA robotsare favored for their speed and efficiency in pick-and-place operations.Delta robotsexcel in high-speed applications, whilecollaborative robots (cobots)are increasingly popular for their ability to work alongside human operators, enhancing safety and flexibility.Mobile robotsandautomated guided vehicles (AGVs)are gaining traction for logistics and material handling.Food handling robotsand other specialized types also contribute to the market, particularly in automating repetitive and hygiene-critical tasks .

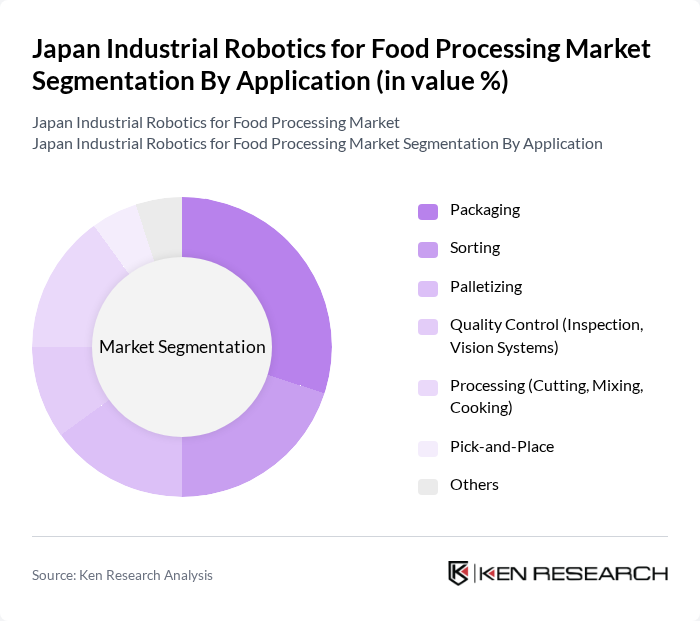

By Application:The applications of industrial robotics in food processing are diverse, includingpackaging,sorting,palletizing,quality control,processing, andpick-and-place operations. Packaging robots are essential for ensuring efficient and safe packaging of food products. Sorting robots enhance the accuracy and speed of sorting processes, while palletizing robots streamline the stacking of products for storage and transport. Quality control robots utilize advanced vision systems for inspection, ensuring product quality. Processing robots are crucial for tasks like cutting, mixing, and cooking, while pick-and-place robots facilitate the movement of items within production lines. These applications are increasingly supported by AI and machine learning, enabling greater customization and efficiency in food production .

The Japan Industrial Robotics for Food Processing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fanuc Corporation, Yaskawa Electric Corporation, Kawasaki Heavy Industries, Ltd., Mitsubishi Electric Corporation, Omron Corporation, Denso Wave Incorporated, Seiko Epson Corporation, Sony Corporation, Universal Robots A/S, ABB Ltd., KUKA AG, Stäubli Robotics, Connected Robotics Inc., ZMP Inc., Shibuya Corporation, CKD Corporation, Nachi-Fujikoshi Corp., AUBO Robotics, and Rethink Robotics contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Japan industrial robotics market for food processing appears promising, driven by ongoing technological advancements and a growing emphasis on automation. As companies increasingly adopt AI and machine learning, the efficiency and adaptability of robotic systems will improve, enabling better integration into existing workflows. Additionally, the push for sustainability in food production will likely lead to innovations that align with environmental goals, further enhancing the market's growth potential in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Articulated Robots SCARA Robots Delta Robots Collaborative Robots (Cobots) Mobile Robots Automated Guided Vehicles (AGVs) Food Handling Robots Others |

| By Application | Packaging Sorting Palletizing Quality Control (Inspection, Vision Systems) Processing (Cutting, Mixing, Cooking) Pick-and-Place Others |

| By End-User | Meat Processing Dairy Processing Bakery and Confectionery Beverage Production Seafood Processing Ready-to-Eat/Convenience Food Manufacturers Others |

| By Sales Channel | Direct Sales Distributors Online Sales Retail Others |

| By Component | Hardware (Robotic Arms, Sensors, Controllers) Software (AI, Machine Vision, Control Systems) Services (Installation, Maintenance, Training) Others |

| By Industry Standard | ISO Standards ANSI Standards CE Marking JIS Standards Others |

| By Price Range | Low-End Robots Mid-Range Robots High-End Robots Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Processing Automation | 120 | Production Managers, Automation Engineers |

| Robotics Manufacturers | 100 | Sales Directors, Product Development Managers |

| Food Safety Compliance | 80 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Supply Chain Optimization | 70 | Logistics Coordinators, Supply Chain Analysts |

| Research & Development in Robotics | 60 | R&D Managers, Innovation Leads |

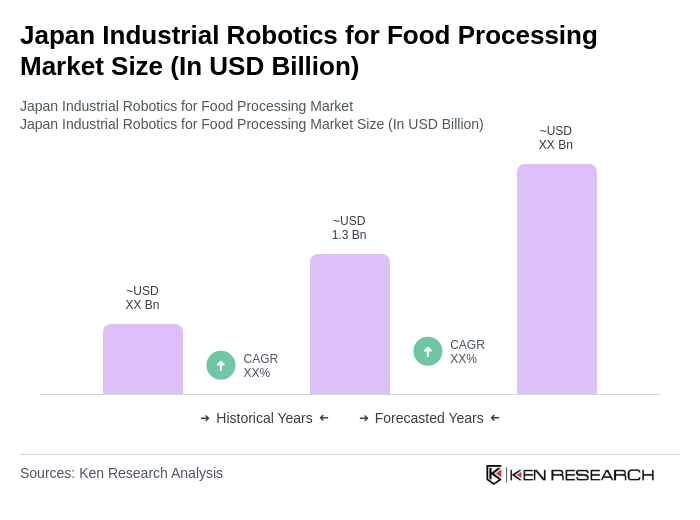

The Japan Industrial Robotics for Food Processing Market is valued at approximately USD 1.3 billion, reflecting a significant growth trend driven by the increasing demand for automation in food processing, enhancing efficiency, and improving food safety standards.