Region:Asia

Author(s):Geetanshi

Product Code:KRAA1319

Pages:85

Published On:August 2025

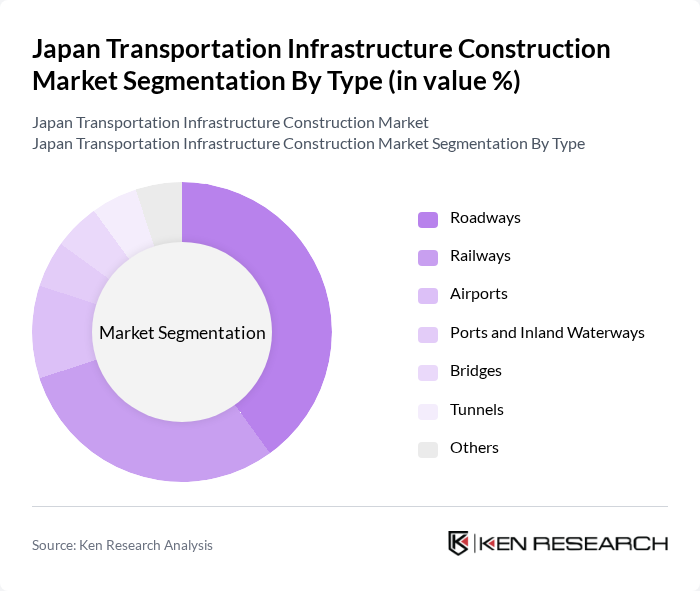

By Type:The market is segmented into roadways, railways, airports, ports and inland waterways, bridges, tunnels, and others. Roadways and railways are the most significant contributors, driven by the need for efficient transportation networks and the increasing volume of freight and passenger traffic. Airports are experiencing notable growth due to rising tourism and international events, while ports and inland waterways remain vital for goods movement and trade logistics. Bridges and tunnels are essential for connecting urban and regional areas, supporting both passenger and freight flows .

By End-User:The end-user segmentation includes government, private sector, public transport authorities, and construction firms. The government sector is the largest end-user, primarily due to its role in funding and overseeing major infrastructure projects aimed at enhancing national transportation capabilities. Private sector involvement is increasing, particularly in public-private partnerships and project financing, while public transport authorities focus on operational efficiency and service delivery. Construction firms play a critical role in executing large-scale projects and driving innovation in construction practices .

The Japan Transportation Infrastructure Construction Market is characterized by a dynamic mix of regional and international players. Leading participants such as Shimizu Corporation, Obayashi Corporation, Taisei Corporation, Kajima Corporation, JFE Engineering Corporation, Nippon Steel Corporation, Sumitomo Mitsui Construction Co., Ltd., Penta-Ocean Construction Co., Ltd., Daiwa House Industry Co., Ltd., Maeda Corporation, Tokyu Construction Co., Ltd., Kumagai Gumi Co., Ltd., Nishimatsu Construction Co., Ltd., Wakachiku Construction Co., Ltd., Toda Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of Japan's transportation infrastructure construction market appears promising, driven by government initiatives and technological advancements. With a projected increase in public-private partnerships, the sector is expected to attract significant investment. Additionally, the integration of smart transportation solutions will enhance efficiency and sustainability. As urbanization continues, the demand for modernized rail and road networks will grow, necessitating innovative construction practices and materials to meet evolving needs and environmental standards.

| Segment | Sub-Segments |

|---|---|

| By Type | Roadways Railways Airports Ports and Inland Waterways Bridges Tunnels Others |

| By End-User | Government Private Sector Public Transport Authorities Construction Firms |

| By Project Size | Large Scale Projects Medium Scale Projects Small Scale Projects |

| By Funding Source | Government Funding Private Investment International Aid Public-Private Partnerships |

| By Construction Method | Traditional Construction Modular Construction Design-Build Integrated Project Delivery |

| By Material Type | Concrete Steel Asphalt Composite Materials |

| By Policy Support | Subsidies Tax Incentives Grants Regulatory Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Infrastructure Projects | 100 | Project Managers, Civil Engineers |

| Railway Construction Initiatives | 80 | Transportation Planners, Operations Managers |

| Airport Expansion Projects | 50 | Airport Authorities, Infrastructure Developers |

| Urban Transit Systems | 60 | City Planners, Public Transport Officials |

| Logistics and Freight Infrastructure | 70 | Logistics Managers, Supply Chain Analysts |

The Japan Transportation Infrastructure Construction Market is valued at approximately USD 120 billion, reflecting significant growth driven by government investments, urbanization, and the adoption of sustainable infrastructure solutions.