Region:Middle East

Author(s):Rebecca

Product Code:KRAC0186

Pages:82

Published On:August 2025

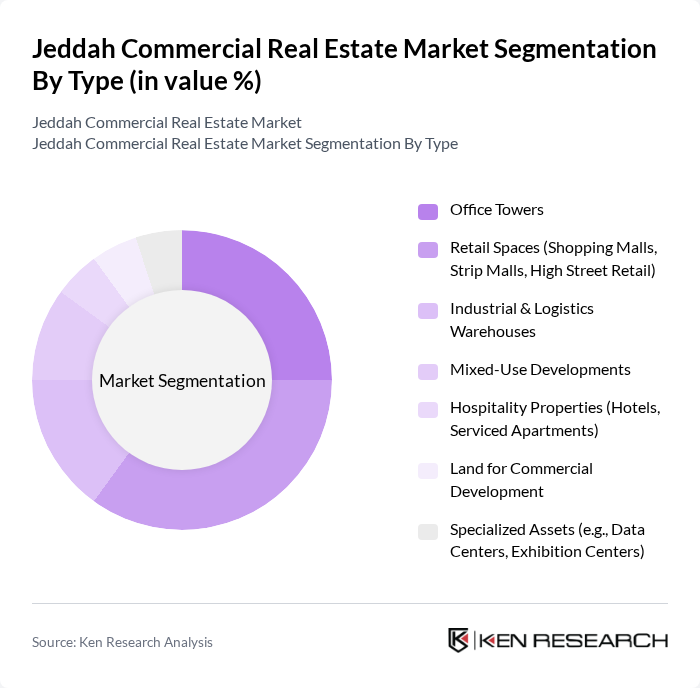

By Type:The commercial real estate market in Jeddah is segmented into various types, including office towers, retail spaces, industrial and logistics warehouses, mixed-use developments, hospitality properties, land for commercial development, and specialized assets. Among these, retail spaces have seen significant growth due to increasing consumer demand, the rise of e-commerce, and the expansion of shopping malls and high-street retail. Office towers are also gaining traction as businesses expand and seek modern, flexible workspaces, supported by a healthy development pipeline and new mixed-use projects .

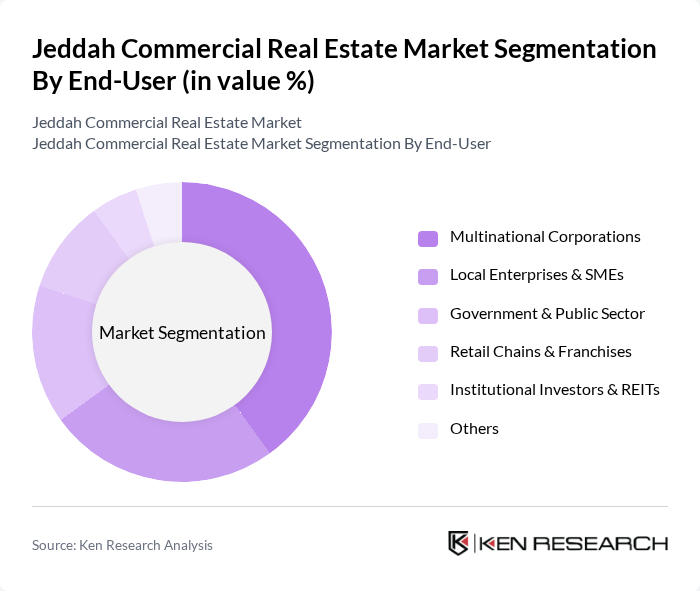

By End-User:The end-user segmentation of the commercial real estate market in Jeddah includes multinational corporations, local enterprises and SMEs, government and public sector entities, retail chains and franchises, institutional investors, and others. Multinational corporations are the leading end-users, driven by the city's strategic location, the influx of foreign investments, and government initiatives that have increased demand for office spaces and commercial facilities .

The Jeddah Commercial Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emaar The Economic City, Jeddah Economic Company, Jabal Omar Development Company, Dar Al Arkan Real Estate Development Company, Kingdom Holding Company, Al Rajhi Investment, Sedco Holding, Makkah Construction and Development Company, Al Oula Real Estate Development Company, Al Jomaih Holding Company, Al-Faisaliah Group, Al-Muhaidib Group, Al-Suwaidi Holding Company, Al-Mabani General Contractors, Al-Bawani Company contribute to innovation, geographic expansion, and service delivery in this space.

The Jeddah commercial real estate market is poised for transformation, driven by ongoing economic diversification and infrastructure enhancements. As the city evolves, demand for innovative spaces, such as co-working and mixed-use developments, is expected to rise. Additionally, the integration of smart technologies in buildings will likely become a standard, improving operational efficiency. With a focus on sustainability, developers are anticipated to prioritize eco-friendly projects, aligning with global trends and enhancing the market's attractiveness to investors and tenants alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Office Towers Retail Spaces (Shopping Malls, Strip Malls, High Street Retail) Industrial & Logistics Warehouses Mixed-Use Developments Hospitality Properties (Hotels, Serviced Apartments) Land for Commercial Development Specialized Assets (e.g., Data Centers, Exhibition Centers) |

| By End-User | Multinational Corporations Local Enterprises & SMEs Government & Public Sector Retail Chains & Franchises Institutional Investors & REITs Others |

| By Investment Source | Domestic Investors Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Sovereign Wealth Funds Others |

| By Application | Business & Corporate Use Retail & Consumer Use Industrial & Logistics Use Hospitality & Tourism Others |

| By Price Range | Affordable Segment Mid-Range Segment Premium Segment Luxury Segment Others |

| By Location | Central Business Districts (e.g., Al-Balad, King Abdullah Road) Suburban Commercial Zones Emerging Districts (e.g., Jeddah Waterfront, Jeddah Central) Airport & Port Vicinity Others |

| By Development Stage | Planned/Pre-Construction Under Construction Recently Completed Renovated/Refurbished Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Office Space Leasing | 100 | Property Managers, Corporate Real Estate Executives |

| Retail Property Investment | 80 | Retail Developers, Investment Analysts |

| Industrial Real Estate Trends | 70 | Logistics Managers, Industrial Property Owners |

| Commercial Property Valuation | 50 | Real Estate Appraisers, Financial Analysts |

| Market Entry Strategies | 60 | Business Development Managers, Market Analysts |

The Jeddah Commercial Real Estate Market is valued at approximately USD 2.2 billion, driven by urbanization, population growth, and significant investments in infrastructure and tourism, particularly under the Vision 2030 initiative.