Region:Asia

Author(s):Dev

Product Code:KRAB0475

Pages:90

Published On:August 2025

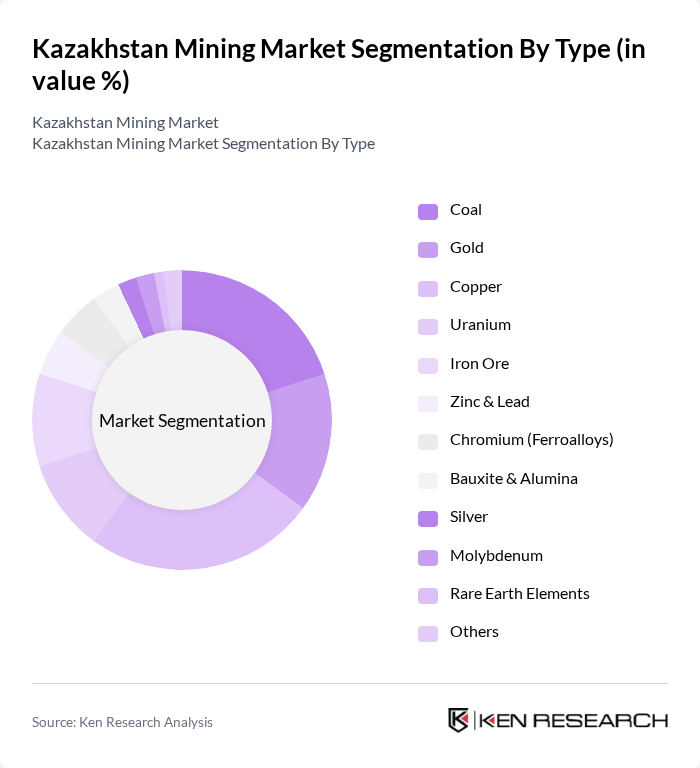

By Type:The mining market in Kazakhstan can be segmented into various types, including coal, gold, copper, uranium, iron ore, zinc & lead, chromium (ferroalloys), bauxite & alumina, silver, molybdenum, rare earth elements, and others. Each of these sub-segments plays a crucial role in the overall market dynamics, with specific demand drivers and applications.

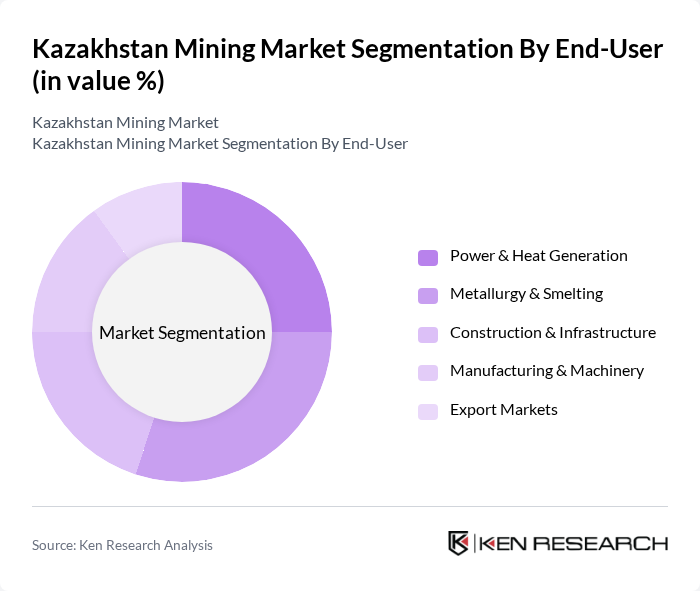

By End-User:The mining market serves various end-user industries, including power & heat generation, metallurgy & smelting, construction & infrastructure, manufacturing & machinery, and export markets. Each of these sectors has distinct requirements and contributes to the overall demand for mined materials.

The Kazakhstan Mining Market is characterized by a dynamic mix of regional and international players. Leading participants such as KAZ Minerals PLC, Eurasian Resources Group S.à r.l. (ERG), ArcelorMittal Temirtau JSC (now Qarmet JSC), Kazakhmys Corporation LLP, Central Asia Metals PLC (Kounrad), JSC AK Altynalmas, NAC Kazatomprom JSC, TNC Kazchrome JSC, Kazzinc LLP, National Mining Company Tau-Ken Samruk JSC, Aluminium of Kazakhstan JSC (ENRC/ERG), Sokolov-Sarbai Mining Production Association JSC (SSGPO), Shubarkol Komir JSC, Bogatyr Komir LLP, Kostanay Minerals JSC contribute to innovation, geographic expansion, and service delivery in this space.

The Kazakhstan mining sector is poised for significant transformation, driven by technological advancements and a growing emphasis on sustainability. As the government continues to invest in infrastructure and regulatory frameworks, the industry is expected to attract increased foreign direct investment. The integration of digital technologies and automation will enhance operational efficiency, while the focus on ESG criteria will shape future mining practices. Overall, the sector is likely to experience robust growth, positioning Kazakhstan as a key player in the global mining landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Coal Gold Copper Uranium Iron Ore Zinc & Lead Chromium (Ferroalloys) Bauxite & Alumina Silver Molybdenum Rare Earth Elements Others |

| By End-User | Power & Heat Generation Metallurgy & Smelting Construction & Infrastructure Manufacturing & Machinery Export Markets |

| By Region | Karaganda Region (Central) East Kazakhstan & Abay Regions Kostanay & Aktobe Regions (North/West) Turkistan & Zhambyl Regions (South) Pavlodar & Ulytau Regions |

| By Application | Industrial Use Energy Generation Construction Materials Battery & EV Supply Chain Inputs |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| By Policy Support | Government Subsidies Tax Exemptions Regulatory Support |

| By Distribution Mode | Direct Sales Distributors Online Platforms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Coal Mining Operations | 120 | Operations Managers, Mine Supervisors |

| Gold Extraction Processes | 90 | Geologists, Production Managers |

| Uranium Mining Sector | 80 | Environmental Compliance Officers, Safety Managers |

| Mining Equipment Suppliers | 70 | Sales Directors, Product Managers |

| Regulatory Bodies and Policy Makers | 50 | Government Officials, Industry Regulators |

The Kazakhstan Mining Market is valued at approximately USD 30 billion, driven by the country's rich mineral resources, including uranium, copper, and gold, alongside steady global demand for energy transition and industrial metals.