Region:Africa

Author(s):Rebecca

Product Code:KRAB6412

Pages:91

Published On:October 2025

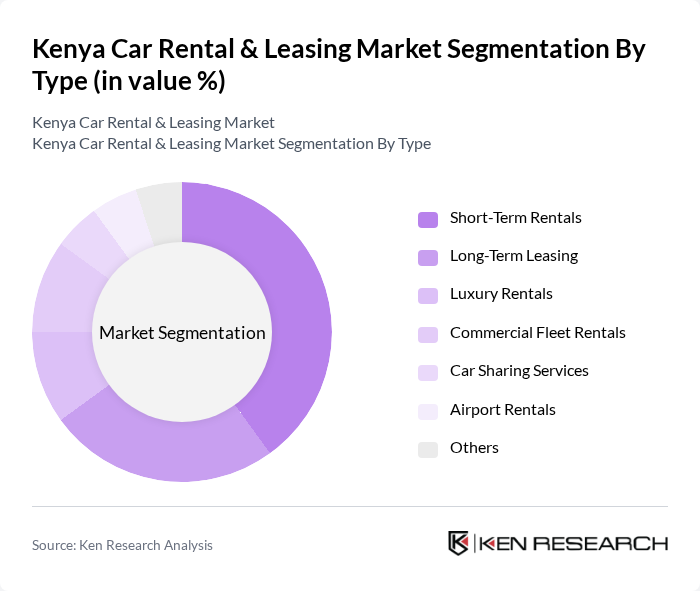

By Type:The market is segmented into various types, including Short-Term Rentals, Long-Term Leasing, Luxury Rentals, Commercial Fleet Rentals, Car Sharing Services, Airport Rentals, and Others. Among these, Short-Term Rentals are currently dominating the market due to the increasing number of tourists and business travelers seeking flexible transportation options for short durations. The convenience and accessibility of short-term rentals make them a preferred choice for many consumers, contributing significantly to the overall market growth.

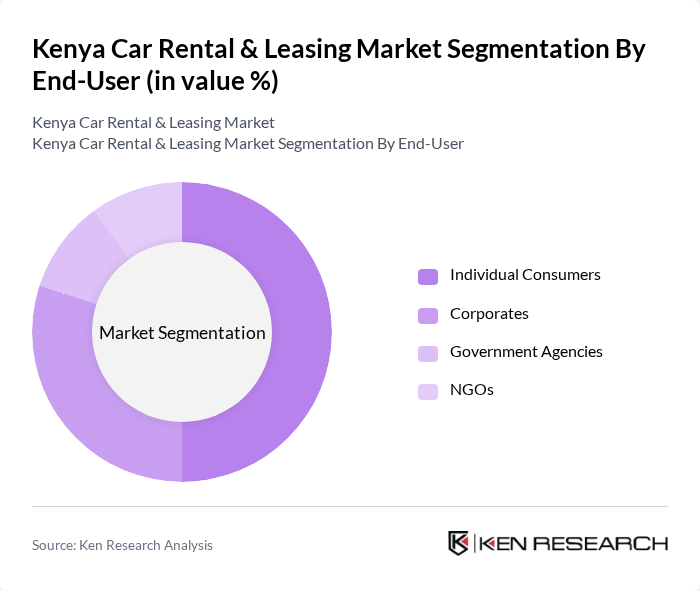

By End-User:The end-user segmentation includes Individual Consumers, Corporates, Government Agencies, and NGOs. Individual Consumers are the leading segment, driven by the growing trend of personal mobility and the increasing number of tourists visiting Kenya. The flexibility and convenience offered by rental services appeal to this demographic, making it a significant contributor to the market's overall performance.

The Kenya Car Rental & Leasing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Avis Kenya, Budget Rent a Car Kenya, Europcar Kenya, Hertz Kenya, Sixt Rent a Car Kenya, Kenya Car Hire, Kenatco, Rent a Car Kenya, Car Rental Kenya, Jiji Kenya, Drive Kenya, Kajiado Car Rentals, Nairobi Car Rentals, Safari Car Rentals, Zambezi Car Rentals contribute to innovation, geographic expansion, and service delivery in this space.

The Kenya car rental market is poised for transformative growth, driven by increasing tourism, urbanization, and rising disposable incomes. As the government invests in infrastructure, the demand for rental services will likely expand, particularly in urban areas. Additionally, the integration of technology in fleet management and the shift towards sustainable practices will shape the industry's future. Companies that adapt to these trends will be well-positioned to capitalize on emerging opportunities and navigate challenges effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Short-Term Rentals Long-Term Leasing Luxury Rentals Commercial Fleet Rentals Car Sharing Services Airport Rentals Others |

| By End-User | Individual Consumers Corporates Government Agencies NGOs |

| By Vehicle Type | Sedans SUVs Vans Trucks Electric Vehicles Others |

| By Rental Duration | Daily Rentals Weekly Rentals Monthly Rentals |

| By Pricing Model | Fixed Pricing Dynamic Pricing Subscription Models |

| By Distribution Channel | Online Platforms Travel Agencies Direct Rentals |

| By Customer Segment | Business Travelers Tourists Local Residents Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Car Leasing | 100 | Fleet Managers, Procurement Officers |

| Tourist Car Rentals | 150 | Travel Agents, Tour Operators |

| Local Car Rental Services | 80 | Small Business Owners, Rental Agency Managers |

| Long-term Vehicle Leasing | 70 | HR Managers, Business Executives |

| Ride-sharing and Mobility Services | 90 | Operations Managers, Technology Officers |

The Kenya Car Rental & Leasing Market is valued at approximately USD 300 million, reflecting a significant growth driven by increasing demand for mobility solutions, urbanization, and a rise in tourism.