KSA Animal Health Market Outlook to 2030

Region:Middle East

Author(s):Yogita Sahu

Product Code:KROD5115

October 2024

88

About the Report

KSA Animal Health Market Overview

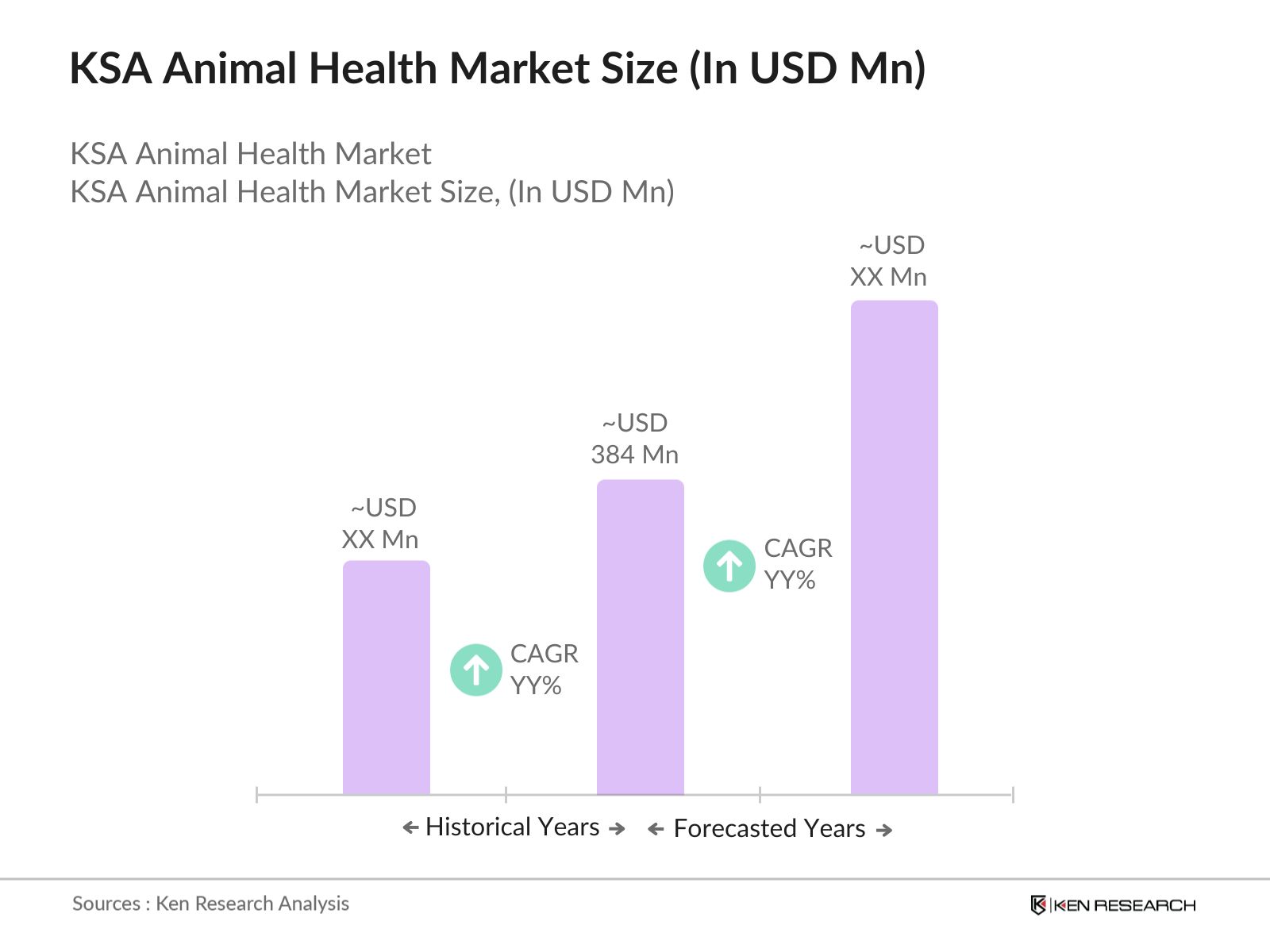

- The Saudi Arabia animal health market is valued at USD 384 million, driven by the expansion of livestock farming and the rising trend of pet ownership. The Kingdoms focus on improving livestock productivity and preventing animal diseases has led to an increase in demand for veterinary pharmaceuticals and services. The markets growth is largely influenced by the livestock sector, as cattle, sheep, and poultry farming dominate the agricultural industry.

- Riyadh, Jeddah, and the Eastern Province are the key regions that dominate the market in Saudi Arabia. These regions lead the market due to their large populations of companion animals and well-established livestock farms. Riyadh has emerged as a hub for veterinary services and animal health solutions, driven by the city's economic strength and its role as a center for both agricultural and urban animal care.

- MEWA has also initiated programs aimed at improving animal genetics and health. In 2024, the government invested SAR 3 billion in research and development for disease-resistant livestock breeds. These efforts are expected to improve the overall health of the livestock population, reducing the need for emergency veterinary care and increasing demand for preventive healthcare.

KSA Animal Health Market Segmentation

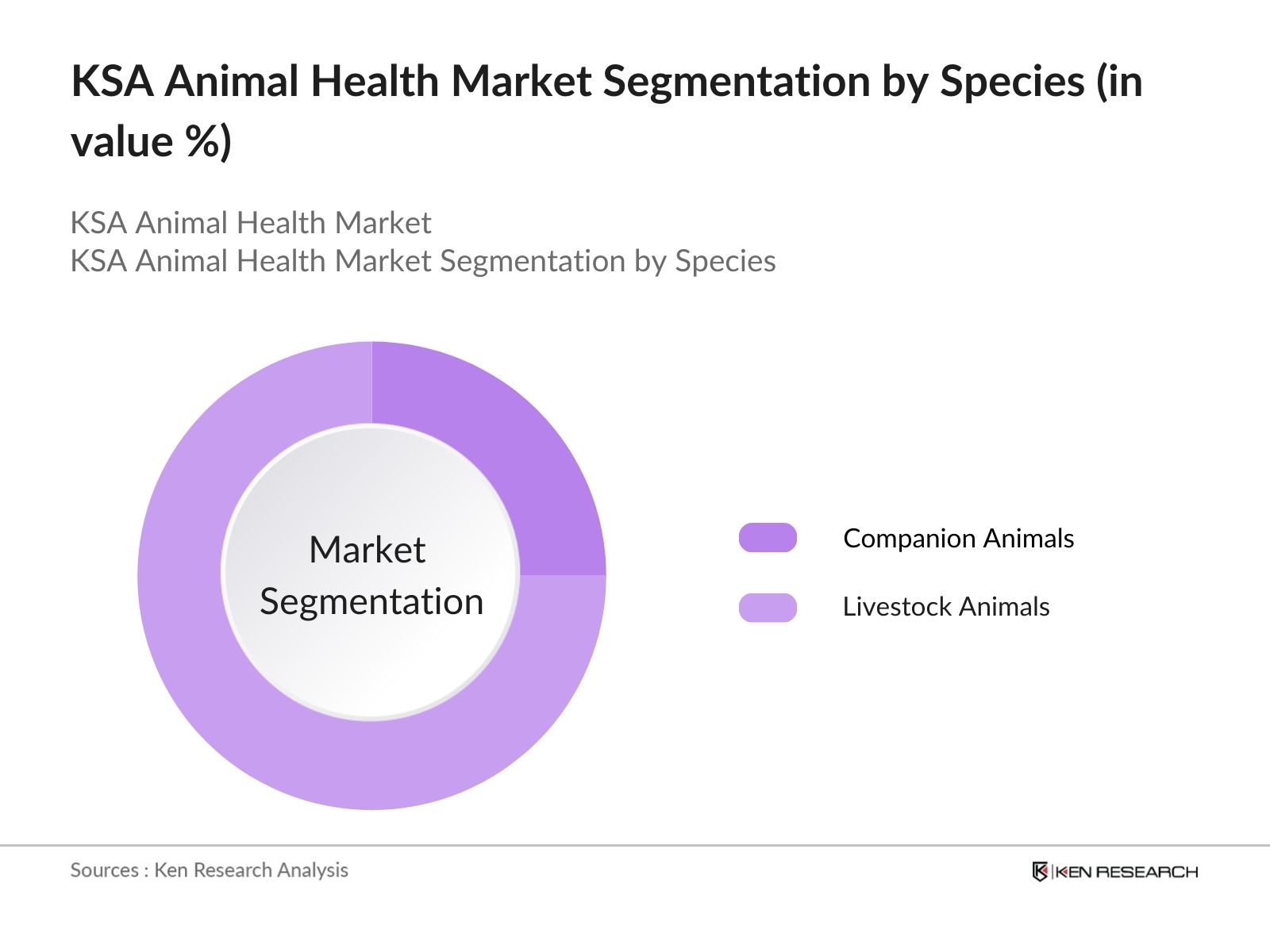

By Species: The market is segmented by species into companion animals and livestock animals. The livestock segment dominates the market due to the Kingdom's significant reliance on livestock for both food security and economic sustainability. Among livestock, poultry, cattle, and sheep are the most critical, as they form the backbone of the meat and dairy industries. Poultry has seen the largest market share due to its high consumption in local diets and substantial production growth driven by government subsidies and disease control measures.

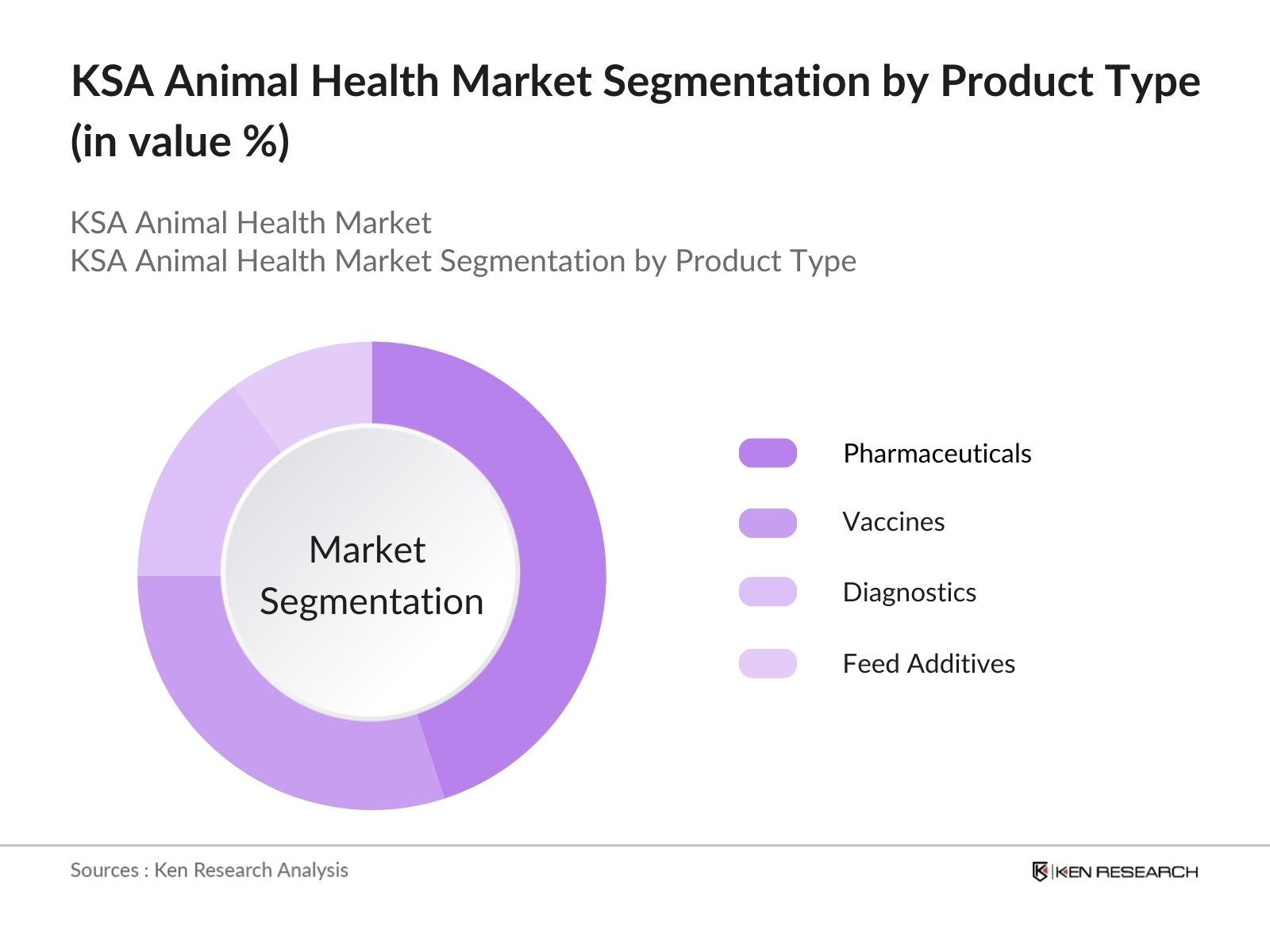

By Product Type: The market in Saudi Arabia is segmented by product type into pharmaceuticals, vaccines, diagnostics, and feed additives. The pharmaceuticals segment dominates the market, accounting for the largest market share. This dominance can be attributed to the increasing need for medication to treat prevalent animal diseases and the growth of livestock farming. Veterinary antibiotics, anti-parasitics, and hormonal products are in high demand due to the efforts to increase productivity and manage disease outbreaks in livestock.

KSA Animal Health Market Competitive Landscape

The market is highly competitive, with both global and local players influencing the market dynamics. International companies dominate, largely due to their advanced R&D capabilities and strong product portfolios. However, local firms are increasingly gaining traction through partnerships and joint ventures.

|

Company Name |

Establishment Year |

Headquarters |

Veterinary Portfolio |

R&D Investment |

Distribution Network |

Global Presence |

Local Market Strategy |

Product Innovation |

Partnerships |

|

Boehringer Ingelheim |

1885 |

Ingelheim, Germany |

|||||||

|

Zoetis |

1952 |

Parsippany, NJ, USA |

|||||||

|

Merck Animal Health |

1891 |

Rahway, NJ, USA |

|||||||

|

Almarai |

1977 |

Riyadh, Saudi Arabia |

|||||||

|

Elanco Animal Health |

1954 |

Greenfield, IN, USA |

KSA Animal Health Market Analysis

Market Growth Drivers

- Increased Focus on Livestock Productivity: In 2024, the Saudi Arabian government aims to boost livestock productivity to ensure food security, investing SAR 4.3 billion in modernizing farms and improving veterinary care. This substantial investment aligns with the Vision 2030 agenda, as the country relies heavily on animal agriculture. This initiative is expected to drive demand for veterinary pharmaceuticals, diagnostic tools, and animal healthcare services in KSA, creating growth opportunities in the animal health market.

- Rising Demand for Meat and Dairy Products: As of 2024, Saudi Arabia is importing 1.5 million tons of meat annually due to a rise in consumption driven by population growth and changing dietary habits. This increase in meat and dairy consumption necessitates enhanced animal healthcare services, pushing livestock owners to invest more in vaccines, nutrition, and preventive care, boosting the markets growth.

- Government Support for Animal Health Services: In 2024, the Saudi Arabian Ministry of Environment, Water, and Agriculture (MEWA) launched a series of initiatives totaling SAR 2 billion to subsidize veterinary services and medicines for rural farmers. This support improves access to modern animal healthcare products and services, especially in remote areas, encouraging market expansion and driving growth in veterinary pharmaceuticals and equipment.

Market Challenges

- Limited Local Production of Veterinary Medicines: In 2024, Saudi Arabia imports nearly 70% of its veterinary pharmaceuticals due to limited domestic manufacturing. This dependence on imports results in higher prices and potential supply chain disruptions. These factors present significant barriers for smaller livestock farmers who cannot afford high-cost veterinary services, slowing market growth.

- Lack of Veterinary Professionals: As of 2024, there are only around 3,500 registered veterinarians in Saudi Arabia, a figure insufficient to meet the growing demand for animal healthcare services, especially in rural and remote areas. This shortage hinders the ability to deliver timely and comprehensive care, impacting the overall development of the market and causing delays in veterinary treatments.

KSA Animal Health Market Future Outlook

Over the next five years, the Saudi Arabian animal health industry is expected to see substantial growth, driven by increased demand for livestock products, rising pet ownership, and government initiatives to ensure food security. The Kingdoms Vision 2030 emphasizes improving agricultural sustainability and animal welfare, further fueling the demand for veterinary services and products.

Future Market Opportunities

- Increased Focus on Preventive Healthcare: Over the next five years, Saudi Arabias animal health market will increasingly shift toward preventive healthcare. With government support and the rise in livestock and pet ownership, veterinary clinics and pharmaceutical companies will focus on prevention-based products and services such as regular vaccinations, nutritional supplements, and early disease detection methods, driven by ongoing investments in veterinary research.

- Growing Demand for Organic and Natural Animal Health Products: By 2029, the demand for organic and natural veterinary medicines is expected to rise. This trend will be driven by consumer preferences for healthier livestock and pets, particularly in urban areas like Riyadh and Jeddah. Veterinary pharmaceutical companies will likely invest in developing products free from synthetic chemicals and antibiotics, aligning with both global trends and local consumer demands.

Scope of the Report

|

By Species |

Companion Animals Livestock Animals |

|

By Product Type |

Pharmaceuticals Vaccines Diagnostics Feed Additives |

|

By Distribution Channel |

Veterinary Hospitals Online Pharmacies Retail Pharmacies Distributors |

|

By End-Use Application |

Preventive Care Therapeutic Care Diagnostic Care |

|

By Region |

North East West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

-

Government and Regulatory Bodies (Ministry of Environment, Water, and Agriculture)

-

Banks and Financial Instututions

-

Private Equity Firms

-

Animal Pharmaceutical Manufacturers

-

Veterinary Service Providers

-

Animal Nutrition Companies

-

Investors and Venture Capital Firms

Companies

Players Mentioned in the Report:

Boehringer Ingelheim

Merck Animal Health

Zoetis Inc.

Ceva Sant Animale

Vetoquinol

Elanco Animal Health

IDEXX Laboratories

Bayer Animal Health

Nutreco

Biogenesis Bago

Virbac

Neogen Corporation

Kemin Industries

Almarai

Saudi Pharmaceutical Industries

Table of Contents

1. Saudi Arabia Animal Health Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Saudi Arabia Animal Health Market Size (in USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Saudi Arabia Animal Health Market Analysis

3.1 Growth Drivers

3.1.1 Expansion of Livestock Farming

3.1.2 Rising Pet Ownership

3.1.3 Increasing Focus on Animal Disease Prevention

3.1.4 Government Support and Initiatives

3.2 Market Challenges

3.2.1 High Cost of Veterinary Care

3.2.2 Lack of Skilled Veterinary Professionals

3.2.3 Strict Regulatory Environment

3.2.4 Disease Control Complexity

3.3 Opportunities

3.3.1 Growing Demand for Advanced Veterinary Pharmaceuticals

3.3.2 Expansion of Veterinary Clinics and Hospitals

3.3.3 Digitalization in Animal Health Services

3.3.4 Partnerships with Global Animal Health Companies

3.4 Trends

3.4.1 Rising Adoption of Animal Health Technology

3.4.2 Growth in Veterinary Pharmaceuticals Market

3.4.3 Focus on Animal Welfare Regulations

3.4.4 Integration of Livestock Management Systems

3.5 Government Regulations

3.5.1 Saudi Vision 2030 Animal Welfare Initiatives

3.5.2 Import and Distribution Regulations for Animal Health Products

3.5.3 Veterinary Drug Approval Processes

3.5.4 Disease Control Programs and Vaccination Policies

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. Saudi Arabia Animal Health Market Segmentation

4.1 By Species (In Value %)

4.1.1 Companion Animals (Cats, Dogs, Others)

4.1.2 Livestock Animals (Cattle, Sheep, Poultry, Others)

4.2 By Product Type (In Value %)

4.2.1 Pharmaceuticals

4.2.2 Vaccines

4.2.3 Diagnostics

4.2.4 Feed Additives

4.3 By Distribution Channel (In Value %)

4.3.1 Veterinary Hospitals

4.3.2 Online Pharmacies

4.3.3 Retail Pharmacies

4.3.4 Distributors

4.4 By End-Use Application (In Value %)

4.4.1 Preventive Care

4.4.2 Therapeutic Care

4.4.3 Diagnostic Care

4.5 By Region (In Value %)

4.5.1 North

4.5.2 East

4.5.3 West

4.5.4 South

5. Saudi Arabia Animal Health Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Boehringer Ingelheim

5.1.2 Merck Animal Health

5.1.3 Zoetis Inc.

5.1.4 Ceva Sant Animale

5.1.5 Vetoquinol

5.1.6 Elanco Animal Health

5.1.7 IDEXX Laboratories

5.1.8 Bayer Animal Health

5.1.9 Nutreco

5.1.10 Biogenesis Bago

5.1.11 Virbac

5.1.12 Neogen Corporation

5.1.13 Kemin Industries

5.1.14 Almarai

5.1.15 Saudi Pharmaceutical Industries

5.2 Cross Comparison Parameters (Headquarters, Product Portfolio, Revenue, Global Presence, Market Share, No. of Employees, R&D Spending, Animal Health Focus)

5.3 Market Share Analysis (Company-wise and Product-wise)

5.4 Strategic Initiatives (Partnerships, New Product Launches, Collaborations)

5.5 Mergers and Acquisitions

5.6 Investment Analysis (Private Investments, Government Funding)

5.7 Venture Capital Funding

5.8 Government Grants and Incentives

6. Saudi Arabia Animal Health Market Regulatory Framework

6.1 Compliance Requirements for Veterinary Products

6.2 Import and Export Regulations for Animal Health Products

6.3 Veterinary Certification and Licensing Processes

7. Saudi Arabia Animal Health Future Market Size (in USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Saudi Arabia Animal Health Future Market Segmentation

8.1 By Species

8.2 By Product Type

8.3 By Distribution Channel

8.4 By End-Use Application

8.5 By Region

9. Saudi Arabia Animal Health Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial stage involves creating an ecosystem map of stakeholders in the Saudi Arabia Animal Health Market. This includes extensive desk research to identify key players, market dynamics, and significant trends that influence market growth, including livestock farming practices and veterinary care.

Step 2: Market Analysis and Construction

In this phase, we collect and analyze historical data on the Saudi Arabia Animal Health Market. Factors such as veterinary product sales, the number of livestock farms, and animal disease outbreaks are assessed to generate reliable market size estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through interviews with industry experts, including veterinarians, livestock farmers, and representatives from animal pharmaceutical companies. This step ensures accuracy in market data and insights.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing data from various sources and confirming findings through direct engagement with animal health companies. This ensures the report provides a comprehensive and accurate analysis of the Saudi Arabia Animal Health Market.

Frequently Asked Questions

01. How big is the Saudi Arabia Animal Health Market?

The Saudi Arabia animal health market is valued at USD 384 million, driven by growth in livestock farming and rising pet ownership.

02. What are the challenges in the Saudi Arabia Animal Health Market?

Challenges in the Saudi Arabia animal health market include high costs of veterinary care, a shortage of skilled veterinary professionals, and complex disease control issues among livestock.

03. Who are the major players in the Saudi Arabia Animal Health Market?

Key players in the Saudi Arabia animal health market include Boehringer Ingelheim, Zoetis, Merck Animal Health, Ceva Sant Animale, and Vetoquinol, who lead the market with strong product portfolios and distribution networks.

04. What are the growth drivers of the Saudi Arabia Animal Health Market?

The Saudi Arabia animal health market is driven by the expansion of livestock farming, increasing pet ownership, government disease control initiatives, and advancements in veterinary pharmaceuticals.

05. What trends are shaping the Saudi Arabia Animal Health Market?

Key trends in the Saudi Arabia animal health market include the adoption of animal health technology, increased focus on disease prevention, and the growth of veterinary services in urban regions such as Riyadh and Jeddah.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.