Region:Middle East

Author(s):Rebecca

Product Code:KRAD7510

Pages:100

Published On:December 2025

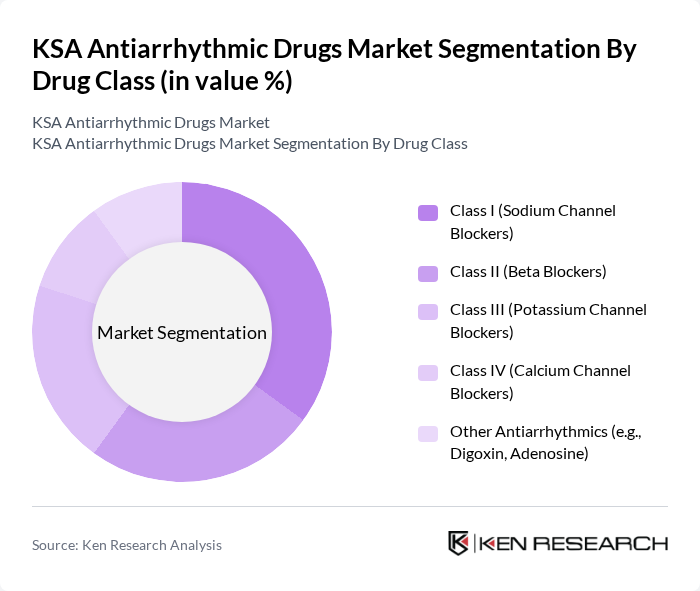

By Drug Class:

The KSA Antiarrhythmic Drugs Market is segmented by drug class into Class I (Sodium Channel Blockers), Class II (Beta Blockers), Class III (Potassium Channel Blockers), Class IV (Calcium Channel Blockers), and Other Antiarrhythmics (e.g., Digoxin, Adenosine), consistent with international clinical classification. In practice, Class II (Beta Blockers) and Class III (Potassium Channel Blockers) represent major revenue?generating categories globally due to their central role in atrial fibrillation and ventricular arrhythmia management, with beta blockers reported as the largest single drug?type segment in recent global analyses. Within KSA, these same therapeutic patterns apply in hospital?based cardiology and electrophysiology services, while sodium channel blockers, calcium channel blockers, and agents such as digoxin and adenosine are used according to guideline?directed indications, including rate and rhythm control as well as acute termination of supraventricular tachycardia.

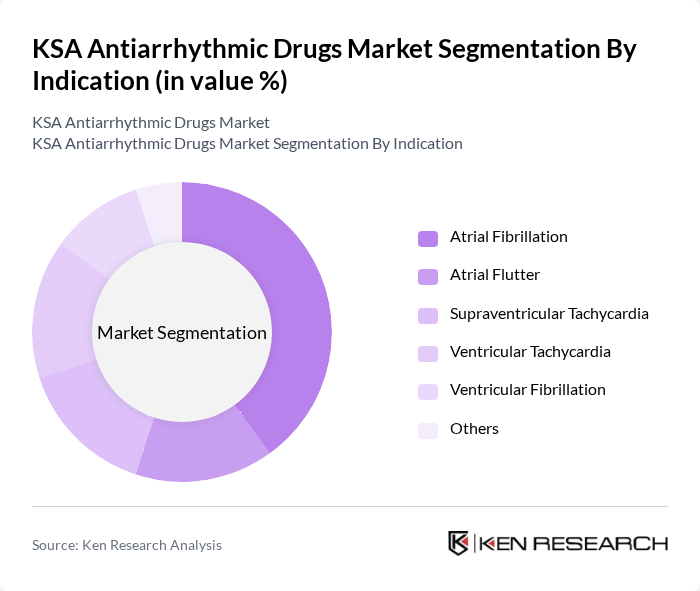

By Indication:

The market is also segmented by indication, including Atrial Fibrillation, Atrial Flutter, Supraventricular Tachycardia, Ventricular Tachycardia, Ventricular Fibrillation, and Others, in line with global antiarrhythmic drug market analyses. Atrial Fibrillation is the leading indication worldwide and in the Middle East, supported by evidence that atrial fibrillation is the most common sustained arrhythmia and that arrhythmias affect an estimated 1.5% to 5% of the general population. Its prominence in KSA is driven by an aging population, high prevalence of metabolic syndrome and diabetes, and increasing clinical focus on stroke prevention and rhythm control, which collectively raise the use of both rate? and rhythm?control agents.

The KSA Antiarrhythmic Drugs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pfizer Inc., Sanofi S.A., Novartis AG, Bayer AG, Boehringer Ingelheim International GmbH, AstraZeneca PLC, GlaxoSmithKline plc, Merck & Co., Inc., Abbott Laboratories, Johnson & Johnson (Janssen Pharmaceuticals), Teva Pharmaceutical Industries Ltd., Hikma Pharmaceuticals PLC, Tabuk Pharmaceuticals Manufacturing Company, Jamjoom Pharma, Saudi Pharmaceutical Industries & Medical Appliances Corporation (SPIMACO) contribute to innovation, geographic expansion, and service delivery in this space.

The KSA antiarrhythmic drugs market is poised for significant growth, driven by increasing healthcare investments and a focus on innovative treatment solutions. The integration of telemedicine and digital health platforms is expected to enhance patient access to care, while ongoing research will likely yield new drug formulations tailored to individual patient needs. As the healthcare landscape evolves, collaboration between pharmaceutical companies and healthcare providers will be crucial in addressing the challenges and maximizing the potential of antiarrhythmic therapies.

| Segment | Sub-Segments |

|---|---|

| By Drug Class | Class I (Sodium Channel Blockers) Class II (Beta Blockers) Class III (Potassium Channel Blockers) Class IV (Calcium Channel Blockers) Other Antiarrhythmics (e.g., Digoxin, Adenosine) |

| By Indication | Atrial Fibrillation Atrial Flutter Supraventricular Tachycardia Ventricular Tachycardia Ventricular Fibrillation Others |

| By End-User | Government & MOH Hospitals Private Hospitals Cardiac Care Centers & Specialty Clinics Ambulatory Surgical Centers Homecare Settings Others |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies E-commerce & Online Pharmacies Others |

| By Route of Administration | Oral Intravenous Other Parenteral Routes Others |

| By Patient Demographics | Adults Pediatric Geriatric Others |

| By Region (KSA) | Central Region (including Riyadh) Eastern Region (including Dammam & Khobar) Western Region (including Jeddah & Makkah) Southern Region Northern & Other Regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cardiologists in KSA | 60 | Cardiologists, Electrophysiologists |

| Pharmacists in Major Hospitals | 60 | Hospital Pharmacists, Pharmacy Managers |

| Patients with Arrhythmia | 120 | Patients diagnosed with arrhythmias, Caregivers |

| Healthcare Administrators | 40 | Healthcare Administrators, Policy Makers |

| Insurance Providers | 40 | Health Insurance Analysts, Underwriters |

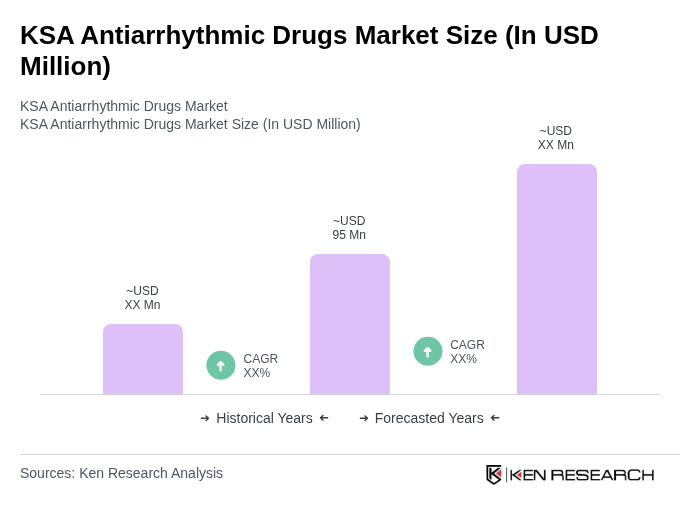

The KSA Antiarrhythmic Drugs Market is valued at approximately USD 95 million, reflecting a significant growth driven by the increasing prevalence of cardiovascular diseases and advancements in drug formulations and healthcare infrastructure in Saudi Arabia.