KSA Commercial Vehicle Market Outlook to 2030

Region:Middle East

Author(s):Shubham Kashyap

Product Code:KROD3418

November 2024

92

About the Report

KSA Commercial Vehicle Market Overview

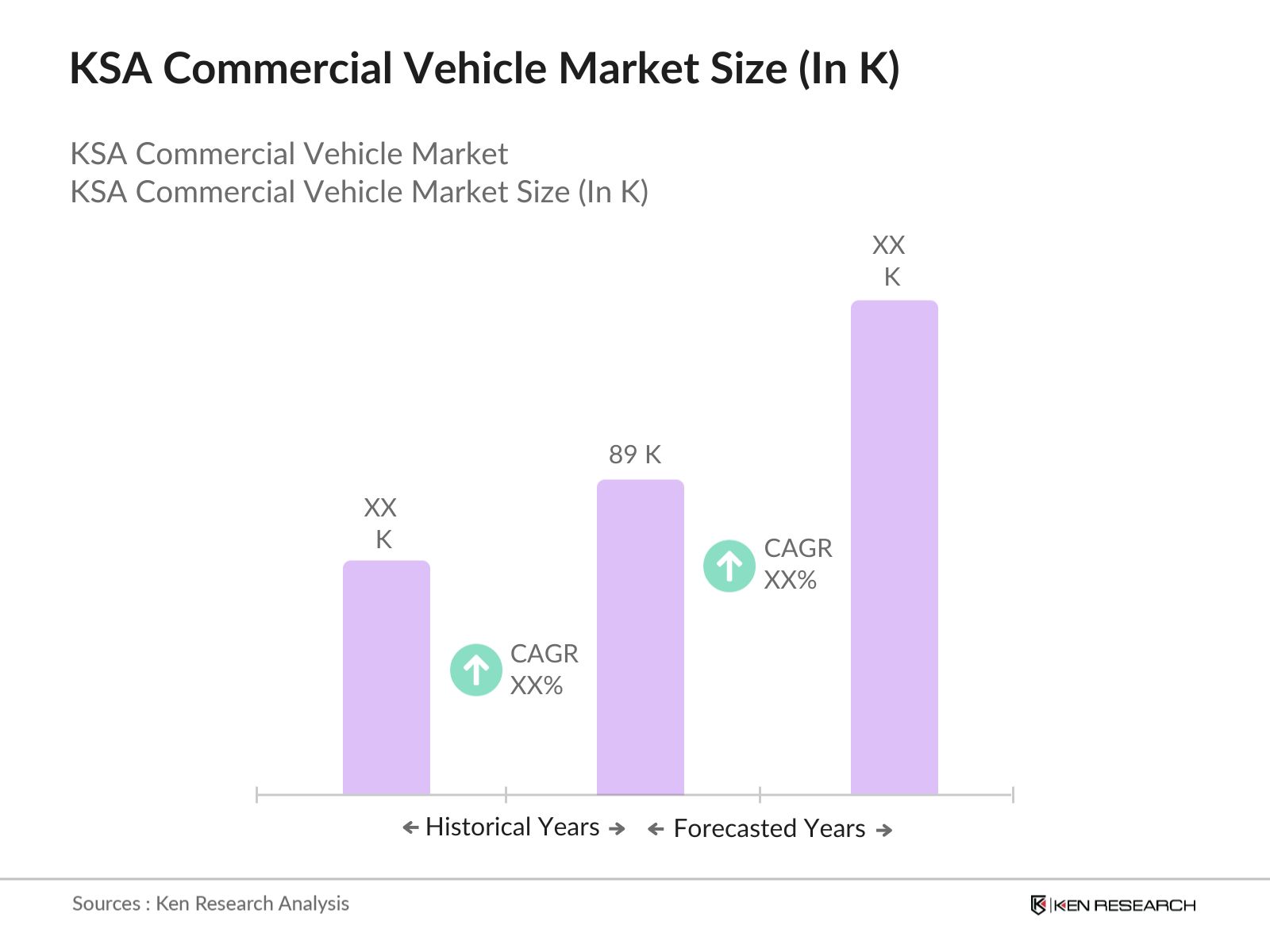

- The KSA Commercial Vehicle market has demonstrated consistent growth during recent years, reaching a market size of 89 K vehicles driven by increasing demand for trucks, buses, and other commercial vehicles across various industries. The markets expansion is driven by the countrys robust economic development, extensive infrastructure projects, and ongoing initiatives aligned with Vision 2030, which aims to diversify the economy away from oil dependency.

- Major demand hubs for commercial vehicles in KSA include Riyadh, Jeddah, and Dammam, where the construction, logistics, and public transportation sectors are concentrated. The governments investment in infrastructure development, including road networks, housing projects, and industrial parks, has fueled the need for commercial vehicles. The government allocated substantial amount to infrastructure projects in 2023, further increasing demand for heavy-duty trucks and buses.

- Saudi Arabias regulatory framework for vehicle safety and emissions, managed by organizations such as the Saudi Standards, Metrology, and Quality Organization (SASO) and the Ministry of Transport, ensures that commercial vehicles adhere to international standards. These regulations support the growth of the market by ensuring that vehicles on the road are efficient, safe, and compliant with environmental standards.

KSA Commercial Vehicle Market Segmentation

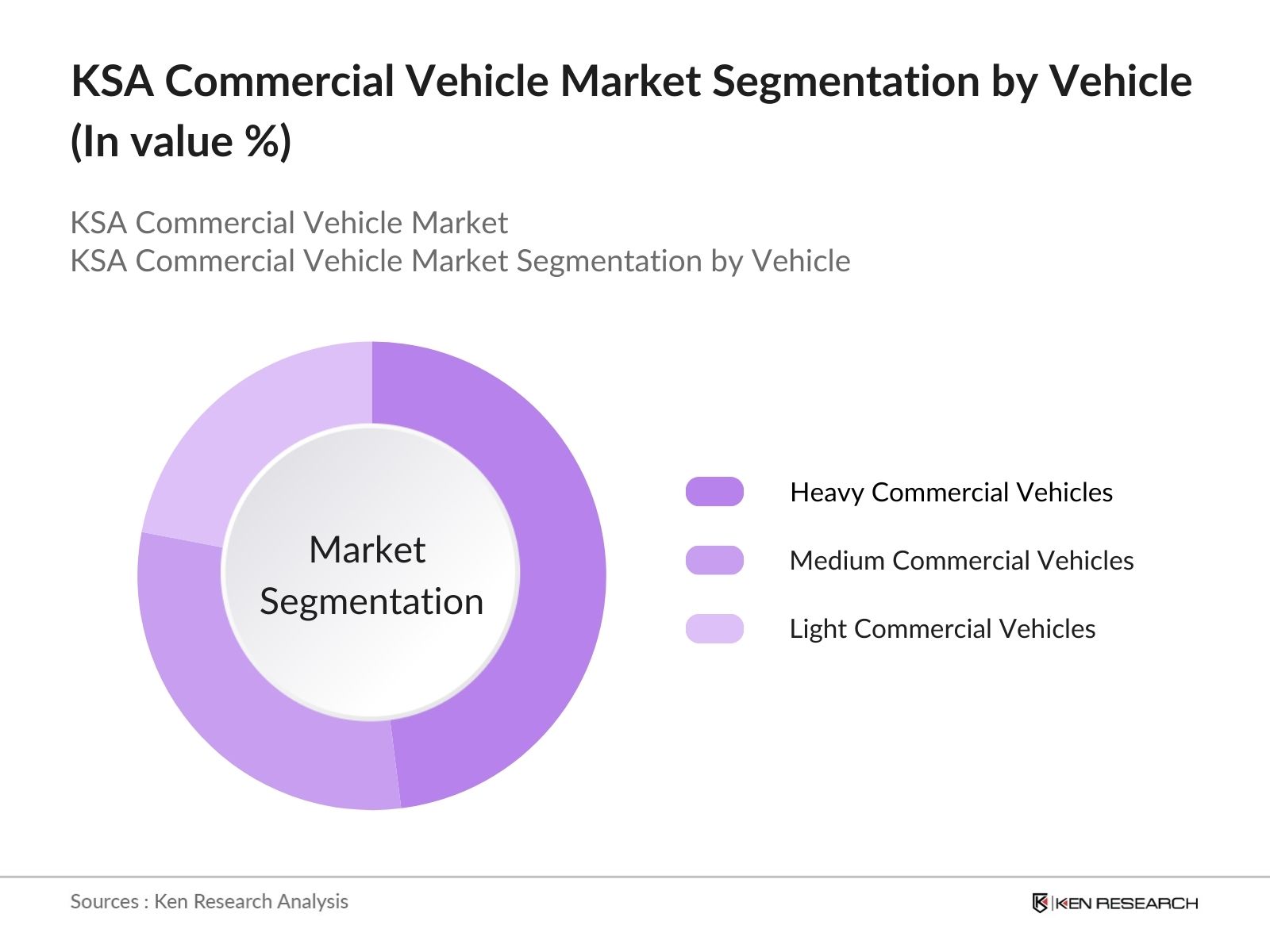

- By Vehicle Type: The market is segmented into light commercial vehicles (LCVs), medium commercial vehicles (MCVs), and heavy commercial vehicles (HCVs). The heavy commercial vehicles segment dominates the market due to its extensive use in construction, logistics, and long-haul transportation. In 2023, the construction industry was responsible for majority of the demand for heavy-duty trucks, driven by major government-funded projects such as the Neom city project. Meanwhile, LCVs play a role in urban deliveries and last-mile logistics, particularly in e-commerce and retail sectors.

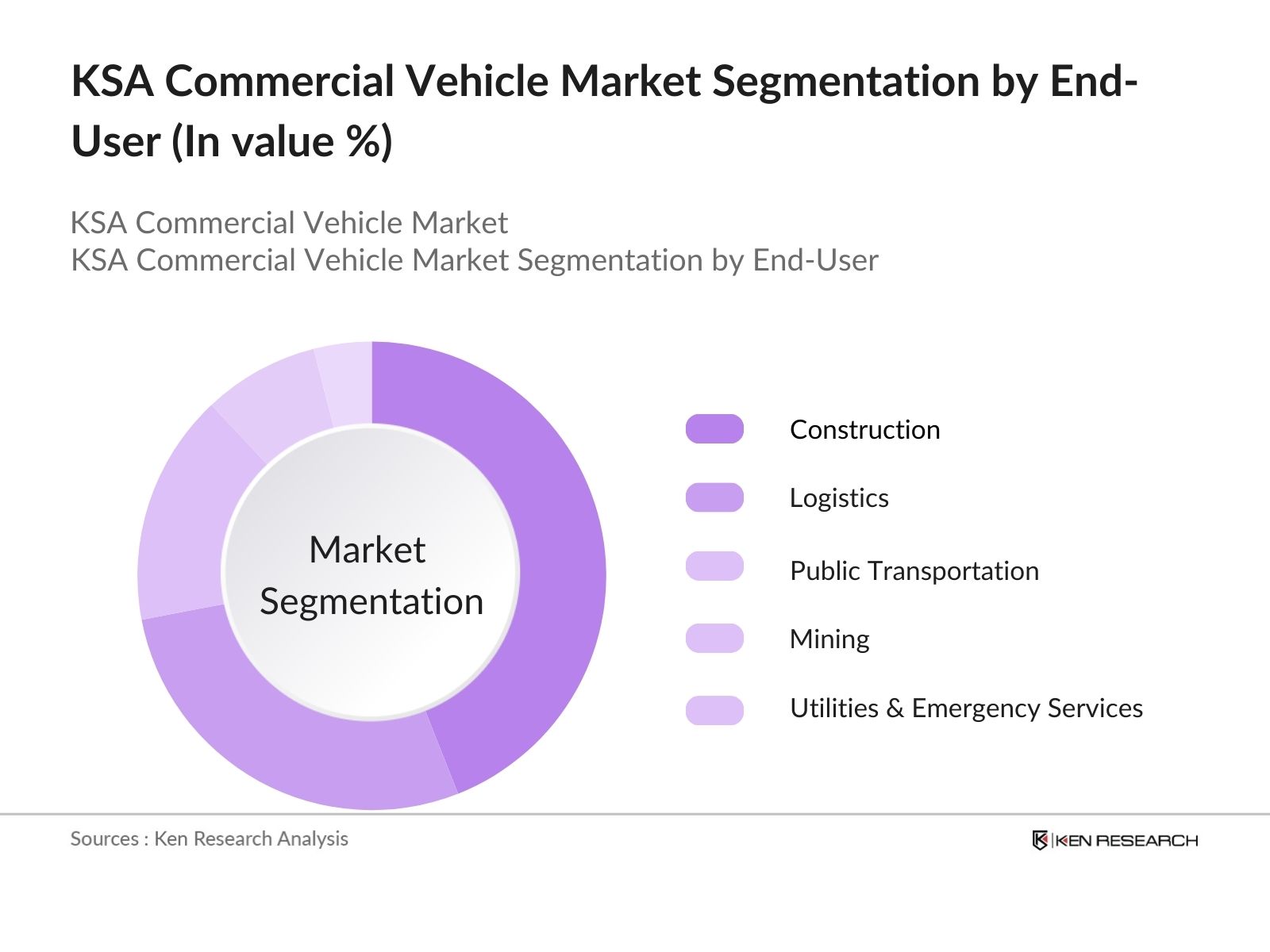

- By End-User Industry: The market is further segmented by end-user industries, including construction, logistics, mining, utilities & Emergency, and public transportation. The construction industry holds the largest share, driven by the country's ambitious infrastructure and development plans under Vision 2030. Logistics is another contributor to the market, as the countrys strategic location as a global trade hub has boosted demand for efficient transport systems. Public transportation is also growing, with initiatives such as the Riyadh Metro project driving the demand for buses and other public transport vehicles.

KSA Commercial Vehicle Market Competitive Landscape

The KSA Commercial Vehicle market is moderately competitive, with both global and regional players operating in the market. Major international manufacturers like Toyota, Isuzu, and Volvo dominate the heavy commercial vehicle segment, offering a range of high-performance trucks and buses. These companies focus on product innovation, technology integration, and strategic partnerships to maintain their competitive edge.

Local players such as Haji Husein Alireza & Co. and Zahid Tractor are also key participants, leveraging their strong distribution networks and service capabilities. These companies provide tailored commercial vehicle solutions to meet the needs of Saudi Arabian industries, with a particular focus on after-sales service and maintenance, which is a critical aspect for customers in the commercial vehicle space.

|

Company Name |

Establishment Year |

Headquarters |

Production Capacity (Units/Year) |

Revenue (2023) |

Key Products |

Market Presence |

Sustainability Initiatives |

R&D Investment |

Distribution Network |

|

Toyota Motor Corporation |

1937 |

Japan |

|||||||

|

Volvo Group |

1927 |

Sweden |

|||||||

|

Isuzu Motors |

1916 |

Japan |

|||||||

|

Zahid Tractor & Heavy Machinery |

1950 |

Saudi Arabia |

|||||||

|

Hino Motors |

1942 |

Japan |

KSA Commercial Vehicle Industry Analysis

Growth Drivers

- Expansion of Logistics & Transportation Sector: Saudi Arabia's logistics and transportation sector is growing rapidly, driven by the kingdom's strategic geographic position, which facilitates trade routes between Asia, Europe, and Africa. In 2023, the logistics sector contributed USD 5.36 billion to the national economy. The expansion of ports, such as the King Abdullah Port, has further increased the need for commercial vehicles to support supply chains and transportation. The growing e-commerce market in the kingdom has also escalated demand for light commercial vehicles (LCVs) for last-mile delivery services.

- Rising Demand for Heavy-Duty Trucks: The construction and mining sectors are crucial to Saudi Arabia's Vision 2030 goals, propelling demand for heavy-duty trucks. The ongoing development of the USD 500 billion NEOM city and other construction projects has led to a marked increase in the need for commercial vehicles, particularly in 2024. Additionally, the mining industry, growing by 7.3% annually, requires a continuous supply of specialized vehicles for transporting raw materials across the kingdom's expanding industrial zones. This growing demand highlights the significance of heavy-duty trucks in supporting critical industries.

- Increasing Urbanization & Public Transport Initiatives: Saudi Arabia is experiencing rapid urbanization, with cities like Riyadh and Jeddah growing at unprecedented rates. In 2023, the urban population reached 36.8 million, increasing the demand for efficient public transport systems, including buses and other commercial vehicles. The government's investment of USD 22 billion in public transport projects, such as the Riyadh Metro, reflects its commitment to modernizing transportation. These developments require a substantial fleet of commercial vehicles, including buses, to cater to the growing population and their mobility needs.

Market Challenges

- High Import Dependency: The KSA commercial vehicle market relies heavily on imports from countries like Japan, Germany, and the United States. While local players are expanding their presence, the market's dependency on imports makes it vulnerable to global supply chain disruptions. This dependency on imports increases vulnerability to supply chain disruptions and affects the availability of vehicles needed to meet the growing demand in sectors like construction and logistics. The COVID-19 pandemic and the subsequent semiconductor shortage in 2023 led to delays in vehicle deliveries, highlighting the challenges of import dependency in a rapidly growing market.

- Fluctuating Oil Prices: As a major oil producer, Saudi Arabias economy is closely linked to oil prices. Fluctuations in oil prices can impact government spending on infrastructure projects, thereby affecting the demand for commercial vehicles. The drop in oil prices in 2020 led to the postponement of several infrastructure projects, temporarily reducing the demand for construction vehicles and heavy-duty trucks. When oil prices drop, budget constraints lead to delayed fleet upgrades or purchases, whereas price hikes increase operational costs, reducing the profitability of fleet expansion. This volatility creates uncertainty in the commercial vehicle market.

KSA Commercial Vehicle Market Future Outlook

The KSA Commercial Vehicle market is expected to maintain steady growth, driven by continuous investment in infrastructure, logistics, and public transport projects. The government's Vision 2030 initiative, which aims to diversify the economy and develop non-oil sectors, will create opportunities for commercial vehicle manufacturers and suppliers. Additionally, the growing demand for eco-friendly and technologically advanced vehicles will shape the future of the market.

Future Market Opportunities

- Adoption of Electric Commercial Vehicles: Saudi Arabia is promoting the adoption of electric commercial vehicles as part of its Vision 2030 sustainability goals. In 2023, the Saudi government launched incentives, including tax breaks and subsidies, to encourage the shift to electric vehicles (EVs) for public transport and logistics. The country's commitment to achieving net-zero emissions by 2060 has accelerated the demand for electric buses and trucks, with the Riyadh Metro project expected to introduce hundereds of electric buses by the end of 2024. This shift creates opportunities for manufacturers and fleet operators in the EV sector.

- Localization of Commercial Vehicle Manufacturing: In 2024, Saudi Arabia plans to increase the localization of commercial vehicle manufacturing as part of its Vision 2030 industrial strategy. The kingdom is working to reduce its dependence on imports by developing local manufacturing capabilities, especially for buses, trucks, and vans. Currently, Saudi Arabia has set a target to manufacture 30,000 commercial vehicles domestically by 2025. The localization drive offers opportunities for both local and international companies to invest in manufacturing facilities, partnerships, and technology transfer within the country.

Scope of the Report

|

By Vehicle Type |

Heavy Commercial Vehicles Medium Commercial Vehicles Light Commercial Vehicles |

|

By End-User Industry |

Construction Logistics Public Transportation Mining Others (Utilities, Emergency Services) |

|

By Fuel Type |

Diesel Electric Hybrid Natural Gas |

|

By Transmission Type |

Automatic Manual |

|

By Region |

Riyadh Jeddah Dammam Makkah Medina |

Products

Key Target Audience

Commercial Fleet Operators

Heavy-Duty Truck Manufacturers

Logistics and Transport Companies

Construction Firms

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Saudi Standards, Metrology, and Quality Organization (SASO), Ministry of Transport)

Public Transportation Authorities

Energy and Utility Companies

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Toyota Motor Corporation

Volvo Group

Isuzu Motors

Zahid Tractor & Heavy Machinery

Hino Motors

Scania AB

MAN Truck & Bus SE

Tata Motors

Ashok Leyland

Mercedes-Benz (Daimler AG)

Navistar International Corporation

FAW Group

Hyundai Motor Company

Ford Motor Company

Renault Trucks

Table of Contents

1. KSA Commercial Vehicle Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy (Vehicle Type, End-User Industry, Fuel Type, Region, Transmission Type)

1.3 Market Growth Rate

1.4 Market Segmentation Overview (Heavy Commercial Vehicles, Light Commercial Vehicles, Medium Commercial Vehicles)

2. KSA Commercial Vehicle Market Size (In Units and USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. KSA Commercial Vehicle Market Analysis

3.1 Growth Drivers

3.1.1 Government Infrastructure Investment (Vision 2030 Projects)

3.1.2 Expansion of Logistics & Transportation Sector

3.1.3 Rising Demand for Heavy-Duty Trucks (Construction, Mining Sectors)

3.1.4 Increasing Urbanization & Public Transport Initiatives

3.2 Market Challenges

3.2.1 High Import Dependency on Commercial Vehicles

3.2.2 Fluctuating Oil Prices Impacting Fleet Demand

3.2.3 Regulatory Compliance with Emission Norms

3.2.4 High Maintenance Costs for Commercial Vehicle Fleets

3.3 Opportunities

3.3.1 Adoption of Electric Commercial Vehicles

3.3.2 Localization of Commercial Vehicle Manufacturing

3.3.3 Technological Advancements in Fleet Telematics

3.3.4 Public-Private Partnerships in Public Transport

3.4 Trends

3.4.1 Shift Towards Sustainable Transportation

3.4.2 Integration of Autonomous Driving Technologies

3.4.3 Growth in E-Commerce Accelerating Demand for LCVs

3.4.4 Adoption of Alternative Fuels (Natural Gas, Hydrogen)

3.5 Government Regulations

3.5.1 SASO Commercial Vehicle Emission Standards

3.5.2 Ministry of Transport Vehicle Safety Guidelines

3.5.3 Vision 2030 Industrial Strategy for Local Manufacturing

3.5.4 Policies Supporting the Adoption of Electric Vehicles

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem

4. KSA Commercial Vehicle Market Segmentation

4.1 By Vehicle Type (In Units/Value %)

4.1.1 Heavy Commercial Vehicles

4.1.2 Medium Commercial Vehicles

4.1.3 Light Commercial Vehicles

4.2 By End-User Industry (In Units/Value %)

4.2.1 Construction

4.2.2 Logistics

4.2.3 Public Transportation

4.2.4 Mining

4.2.5 Others (Utilities, Emergency Services)

4.3 By Fuel Type (In Units/Value %)

4.3.1 Diesel

4.3.2 Electric

4.3.3 Hybrid

4.3.4 Natural Gas

4.4 By Transmission Type (In Units/Value %)

4.4.1 Automatic

4.4.2 Manual

4.5 By Region (In Units/Value %)

4.5.1 Riyadh

4.5.2 Jeddah

4.5.3 Dammam

4.5.4 Makkah

4.5.5 Medina

5. KSA Commercial Vehicle Market Competitive Analysis

5.1 Detailed Profiles of Major Competitors

5.1.1 Toyota Motor Corporation

5.1.2 Isuzu Motors Ltd.

5.1.3 Volvo Group

5.1.4 Mercedes-Benz (Daimler AG)

5.1.5 Scania AB

5.1.6 Ford Motor Company

5.1.7 Hyundai Motor Company

5.1.8 Haji Husein Alireza & Co.

5.1.9 Zahid Tractor & Heavy Machinery

5.1.10 Tata Motors Limited

5.1.11 Ashok Leyland

5.1.12 MAN Truck & Bus SE

5.1.13 Navistar International Corporation

5.1.14 FAW Group

5.1.15 Hino Motors Ltd.

5.2 Cross Comparison Parameters (Production Capacity, Headquarters, Inception Year, Revenue, Product Range, Fleet Telematics Integration, R&D Expenditure, Sustainability Initiatives)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. KSA Commercial Vehicle Market Regulatory Framework

6.1 Vehicle Emission Standards

6.2 Compliance with Transport Ministry Guidelines

6.3 Import Tariff and Local Manufacturing Incentives

6.4 Certification Processes for Commercial Vehicle Safety

7. KSA Commercial Vehicle Market Future Market Size (In Units and USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. KSA Commercial Vehicle Future Market Segmentation

8.1 By Vehicle Type (In Units/Value %)

8.2 By End-User Industry (In Units/Value %)

8.3 By Fuel Type (In Units/Value %)

8.4 By Transmission Type (In Units/Value %)

8.5 By Region (In Units/Value %)

9. KSA Commercial Vehicle Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

DisclaimerContact Us

Research Methodology

Step 1: Identification of Key Variables

In this phase, a comprehensive ecosystem map of stakeholders in the KSA Commercial Vehicle Market is constructed. Extensive desk research is utilized to gather industry data from government reports, proprietary databases, and other sources. This step focuses on identifying key variables like market demand, production rates, and regulatory influences.

Step 2: Market Analysis and Construction

In this step, historical data on vehicle production, imports, and sales are compiled and analyzed. This includes evaluating the ratio of vehicles by type and end-user industry. An assessment of the operational efficiency of commercial vehicle fleets is also conducted to ensure the accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses based on market trends are developed and validated through interviews with industry experts, including commercial fleet managers, automotive suppliers, and regulatory authorities. These consultations offer valuable insights into current market dynamics, growth drivers, and competitive positioning.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the research through direct engagement with manufacturers and fleet operators. These consultations verify the findings and provide additional data on emerging technologies, sustainability practices, and future market opportunities.

Frequently Asked Questions

01. How big is the KSA Commercial Vehicle Market?

The KSA commercial vehicle market was valued at 89 k vehicles, driven by rising infrastructure projects, logistics, and public transportation investments under Vision 2030.

02. What are the challenges in the KSA Commercial Vehicle Market?

Challenges in the KSA commercial vehicle market include dependency on vehicle imports, fluctuating oil prices affecting fleet purchases, and the need to comply with increasingly stringent emissions regulations.

03. Who are the major players in the KSA Commercial Vehicle Market?

Key players in the KSA commercial vehicle market include Toyota Motor Corporation, Volvo Group, Isuzu Motors, Zahid Tractor & Heavy Machinery, and Hino Motors. These companies dominate due to their wide product offerings and extensive distribution networks.

04. What are the growth drivers in the KSA Commercial Vehicle Market?

The KSA commercial vehicle market is propelled by government infrastructure projects, the expansion of the logistics sector, and increasing demand for heavy-duty vehicles in construction and mining industries.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.