KSA Cosmetic Pigments Market Outlook to 2030

Region:Middle East

Author(s):Abhinav kumar

Product Code:KROD3771

December 2024

92

About the Report

KSA Cosmetic Pigments Market Overview

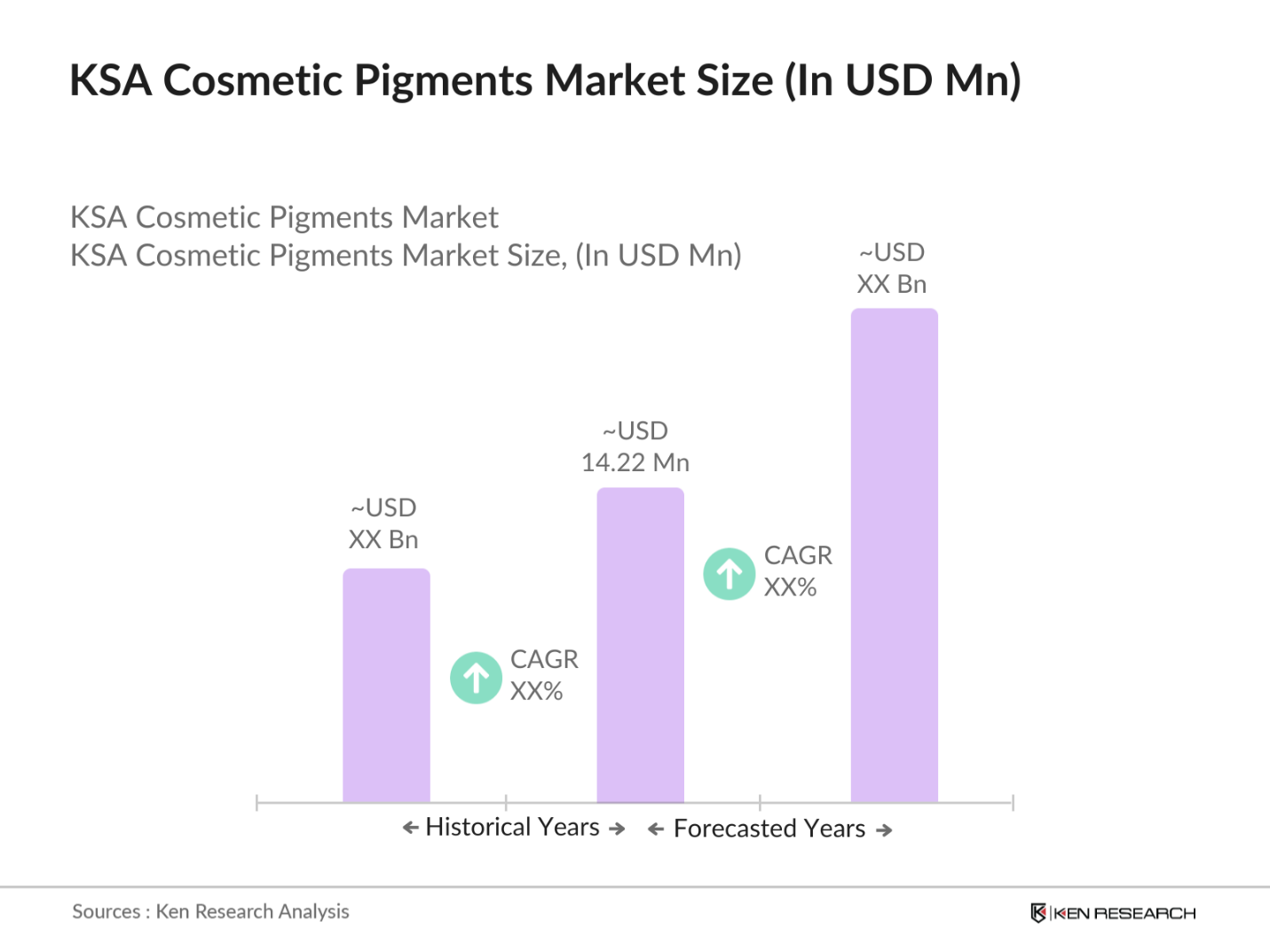

- The KSA cosmetic pigments market is valued at approximately USD 14.22 million, driven primarily by the rapid expansion of the beauty and personal care sector in the region. The rising disposable income of consumers and the increased demand for premium and organic cosmetic products contribute to this growth. Additionally, the preference for innovative cosmetic formulations, including long-lasting makeup and vibrant colors, fuels the demand for specialty pigments, further propelling the market's expansion.

- The dominance of cities like Riyadh and Jeddah is evident in the KSA cosmetic pigments market due to their concentration of luxury retailers and high-end beauty brands. These cities are home to a growing middle and upper-class population with an increasing inclination towards beauty products. Furthermore, the strong presence of retail chains and beauty salons in these regions enhances their dominance in the cosmetic pigments market.

- KSAs cosmetic regulatory framework, led by the Saudi Food and Drug Authority (SFDA), governs the use of cosmetic ingredients, including pigments. The SFDA mandates rigorous testing for safety and compliance, particularly for imported pigments. In 2023, the SFDA introduced stricter regulations that resulted in the rejection of over 10% of pigment-containing cosmetic imports due to non-compliance. These regulations ensure that only high-quality, safe pigments enter the Saudi market, influencing the types of pigments that manufacturers can supply.

KSA Cosmetic Pigments Market Segmentation

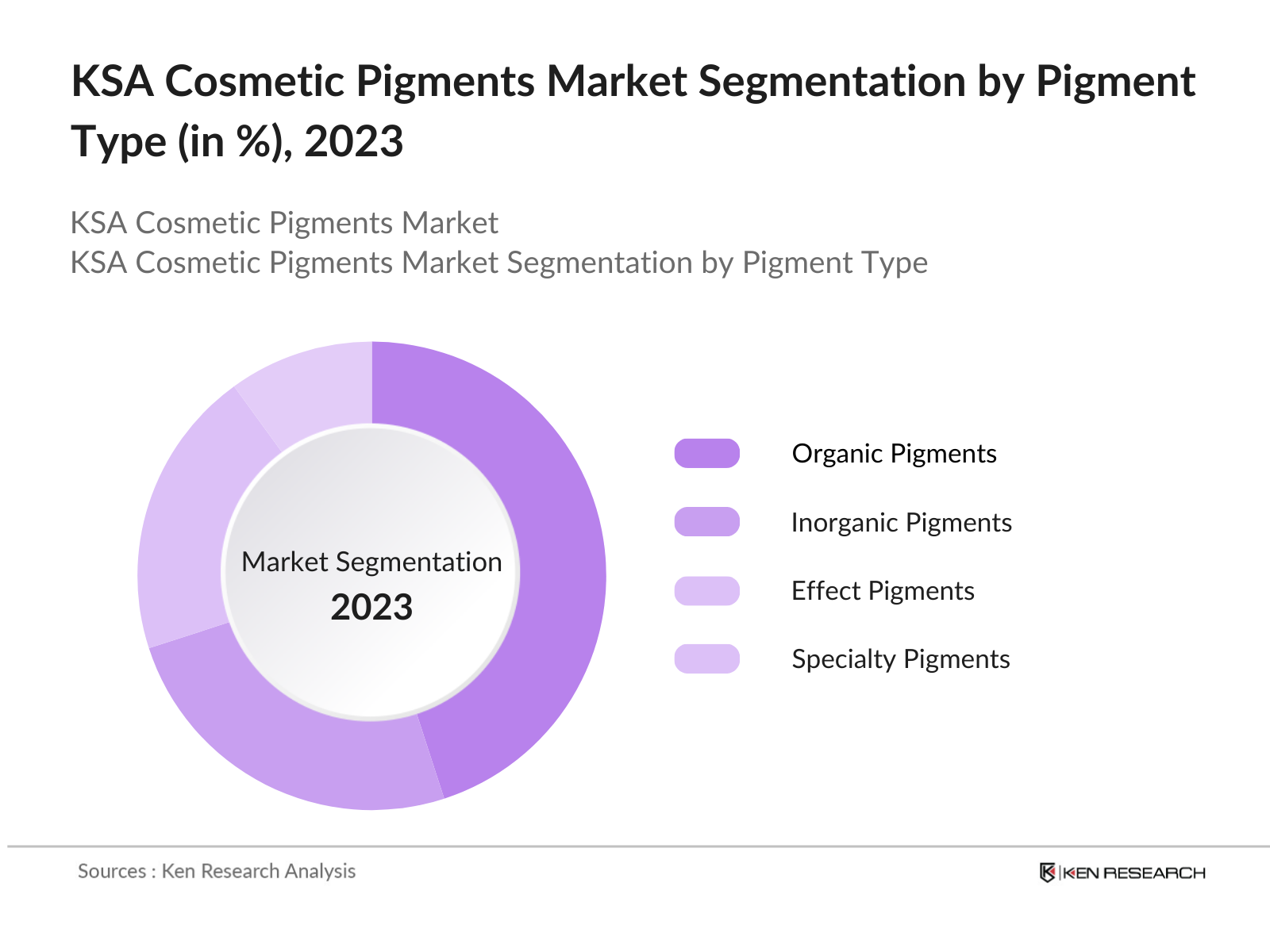

By Pigment Type: The KSA cosmetic pigments market is segmented by pigment type into organic pigments, inorganic pigments, effect pigments, and specialty pigments. Among these, organic pigments dominate the market due to their growing popularity in natural and organic beauty products. Organic pigments are widely preferred because of their non-toxic nature and vibrant color range, aligning with the increasing consumer preference for clean beauty products. Moreover, these pigments are biodegradable and free from synthetic chemicals, making them suitable for eco-conscious consumers.

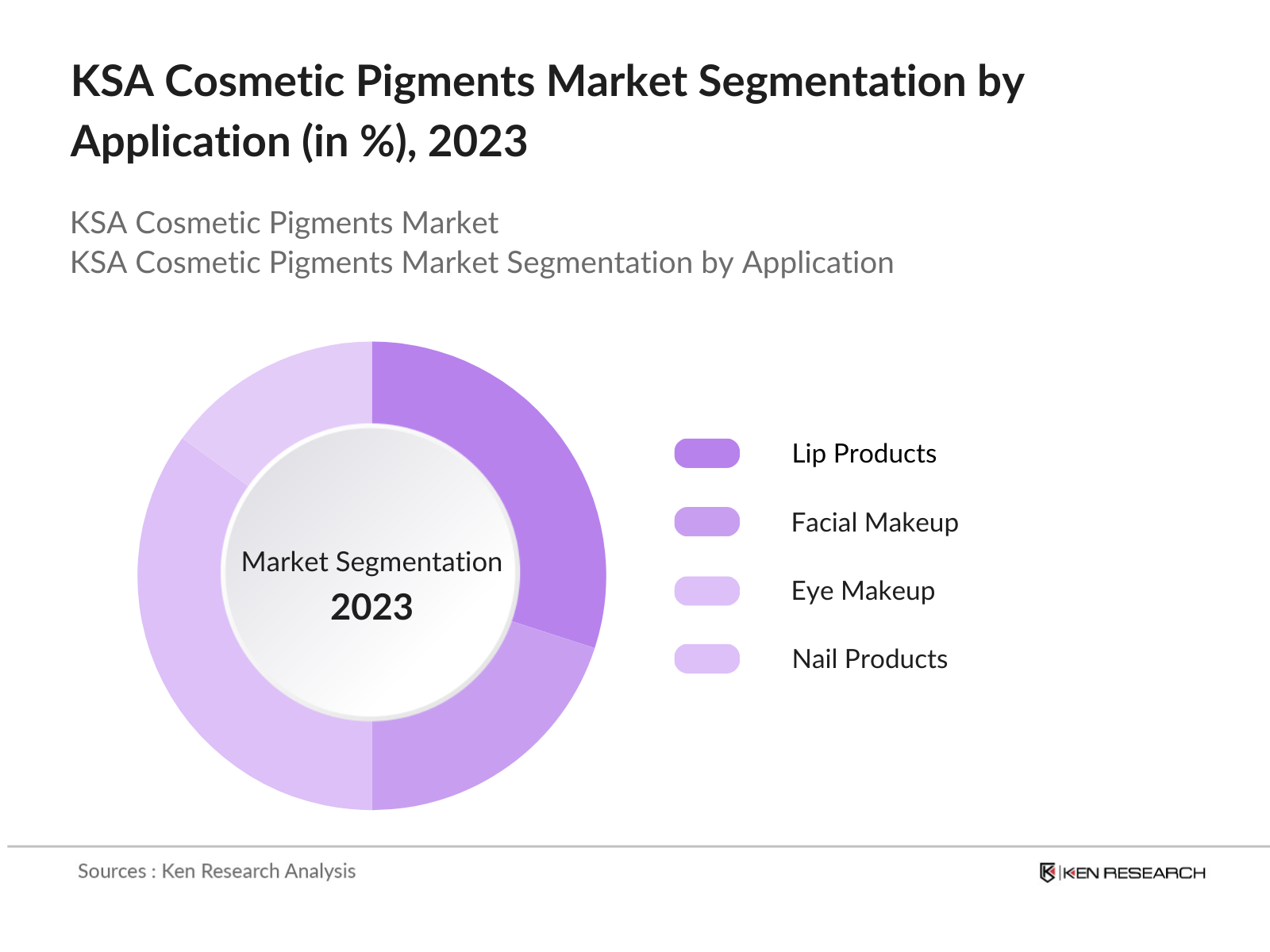

By Application: In terms of application, the market is segmented into facial makeup, eye makeup, lip products, and nail products. Lip products hold a dominant share in this segment due to the high demand for lipsticks and glosses that offer long-lasting color and smooth texture. Pigments used in lip products are designed to provide bold and vibrant colors that are highly sought after in the KSA market. Furthermore, consumers in the region are increasingly drawn towards premium lip care products, boosting the demand for quality pigments.

KSA Cosmetic Pigments Market Competitive Landscape

The KSA cosmetic pigments market is characterized by a mix of global and local players, with several companies investing heavily in research and development to introduce innovative products. Key players are focusing on sustainability and natural pigments to cater to the growing consumer demand for organic products. The markets competitive landscape showcases strong consolidation, with the major players holding significant influence over the market through product differentiation, strategic partnerships, and regional expansion.

|

Company Name |

Establishment Year |

Headquarters |

Product Portfolio |

R&D Investment |

Halal Certification |

Regional Presence |

Revenue |

Partnerships |

Product Innovation |

|

BASF SE |

1865 |

Germany |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Clariant AG |

1995 |

Switzerland |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Sun Chemical |

1945 |

USA |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Merck KGaA |

1668 |

Germany |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Sensient Technologies |

1882 |

USA |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

KSA Cosmetic Pigments Industry Analysis

KSA Cosmetic Pigments Market Growth Drivers

- Increasing Demand for Natural Pigments: The demand for natural pigments in the KSA cosmetic pigments market is seeing a significant boost due to a rising preference for organic beauty products. Consumers are opting for non-synthetic pigments, which aligns with the global clean beauty trend. The increasing demand for organic cosmetics is supported by the growth of the Kingdoms organic product sector, which saw a rise in sales of over $900 million in 2023, driven by a shift in consumer awareness and the availability of cleaner alternatives. As a result, cosmetic manufacturers are turning to natural pigments, adding growth momentum to the market.

- Expanding Cosmetic Industry: The growth of KSAs beauty and personal care industry, which reached over $5.6 billion in sales by 2023, has significantly fueled the demand for cosmetic pigments. A rapidly expanding retail landscape, coupled with the increasing participation of international beauty brands in the Kingdom, is driving this growth. The demand for innovative and high-quality pigments for personal care products has surged as beauty standards evolve, particularly with a focus on high-end and luxury cosmetic products. This sectoral expansion serves as a critical driver for pigment demand in the market.

- Rising Disposable Income: KSAs rising disposable income has enhanced consumer spending on premium cosmetic products, increasing the demand for advanced and diverse pigments in formulations. As per the World Bank, the average household income in Saudi Arabia increased by approximately $26,000 in 2023, allowing more consumers to spend on beauty and personal care items. The demand for pigment-rich products such as foundations, eyeshadows, and lipsticks continues to rise, driven by growing beauty awareness and disposable income, which are directly linked to higher sales of cosmetic pigments.

KSA Cosmetic Pigments Market Challenges

- High Manufacturing Costs: The production of specialty pigments in KSA faces a significant challenge due to the high cost of raw materials and the complex processes involved in pigment synthesis. For instance, the cost of raw materials, including titanium dioxide and iron oxides, has escalated, with prices exceeding $1,500 per metric ton by the end of 2023. This cost pressure has created barriers for local manufacturers and is making it harder to compete with imported pigments, thereby hindering the expansion of the domestic production base.

- Stringent Regulatory Policies: KSA's regulatory framework imposes stringent guidelines on the use of cosmetic pigments, which adds a layer of complexity to product approvals and market entry. The Saudi Food and Drug Authority (SFDA) mandates strict testing and certification for pigments used in cosmetics, ensuring they meet safety and halal compliance standards. In 2024, over 150 cosmetic products were denied approval due to non-compliance with pigment regulations. These regulatory hurdles delay market entry and increase compliance costs for both local and international pigment manufacturers.

KSA Cosmetic Pigments Market Future Outlook

Over the next five years, the KSA cosmetic pigments market is expected to witness substantial growth. This surge will be fueled by increasing consumer awareness towards clean and sustainable beauty products, alongside innovations in pigment technology. The demand for eco-friendly, non-toxic pigments is anticipated to further drive the market forward, with significant contributions from the premium beauty segment. As the beauty industry continues to evolve, the market for cosmetic pigments will likely see new entrants and heightened competition, especially in the organic pigment sector.

- Growth in Halal Cosmetic : The demand for halal-certified cosmetic products is rapidly increasing in KSA, which presents a lucrative opportunity for cosmetic pigment manufacturers. The halal beauty market in the region was valued at over $2.5 billion in 2023, with a significant share driven by halal-certified pigments. As the Kingdom enforces stringent halal certification standards for cosmetics, pigment manufacturers that offer certified products stand to gain a competitive advantage in meeting the rising consumer demand for religiously compliant beauty products.

- Technological Advancements: Advancements in pigment synthesis, such as the development of environmentally friendly and bio-based pigments, offer a significant opportunity in the KSA market. In 2024, several companies introduced new bio-based pigments that align with the Kingdom's Vision 2030 sustainability goals. These innovations not only meet the demand for non-toxic, sustainable products but also open new avenues for local production, reducing dependency on imports and fostering domestic industrial growth in the cosmetics sector.

Scope of the Report

|

Product Type |

Organic Pigments Inorganic Pigments Special Effect Pigments |

|

Application |

Facial Makeup Eye Makeup Lip Products Nail Products Hair Care Products |

|

Technology |

Nano-Pigments Surface Treated Pigments Encapsulated Pigments |

|

Raw Material |

Natural Pigments Synthetic Pigments Mineral Pigments |

|

Region |

Riyadh Jeddah Dammam Mecca Medina |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Beauty & Personal Care Companies

Contract Companies

Private Label Brands

Cosmetic Product Formulators

Government Regulatory Bodies (Saudi Food and Drug Authority)

Environmental Agencies (Saudi National Environmental Compliance Authority)

Investment and Venture Capitalist Firms

Companies

Players Mentioned in the Report:

BASF SE

Clariant AG

Sun Chemical

Sensient Cosmetic Technologies

Merck KGaA

Kobo Products, Inc.

Daito Kasei Kogyo Co., Ltd.

Sudarshan Chemical Industries

Venator Materials PLC

ECKART GmbH

Table of Contents

1. KSA Cosmetic Pigments Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Drivers

1.4. Key Market Segments Overview

2. KSA Cosmetic Pigments Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis (Market Development Milestones)

2.3. Key Market Trends (Pigment Composition, Application Expansion)

3. KSA Cosmetic Pigments Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Natural Pigments (Rise in Organic Products Demand)

3.1.2. Expanding Cosmetic Industry (Growth in Beauty & Personal Care Sectors)

3.1.3. Rising Disposable Income (Consumer Spending Power in KSA)

3.2. Market Challenges

3.2.1. High Manufacturing Costs (Cost of Production for Specialty Pigments)

3.2.2. Stringent Regulatory Policies (KSA Regulations on Pigment Use)

3.2.3. Limited Local Production (Dependence on Imports)

3.3. Opportunities

3.3.1. Growth in Halal Cosmetics (Halal Certification Demand)

3.3.2. Technological Advancements (Innovations in Pigment Synthesis)

3.3.3. Rising Male Grooming Sector (Male Cosmetic Product Usage)

3.4. Trends

3.4.1. Shift Towards Clean Beauty (Demand for Non-toxic Pigments)

3.4.2. Customizable Pigments (Tailor-Made Solutions for Cosmetics)

3.4.3. Increasing Use of Effect Pigments (Metallic and Pearlescent Pigments)

3.5. Government Regulation

3.5.1. Regulatory Framework for Cosmetic Ingredients (KSA Regulatory Environment)

3.5.2. Halal Certification (Regulation on Halal Pigment Use)

3.5.3. Import Tariffs and Duties (Impact of Import Costs)

4. KSA Cosmetic Pigments Market Segmentation

4.1. By Pigment Type (In Value %)

4.1.1. Organic Pigments

4.1.2. Inorganic Pigments

4.1.3. Effect Pigments

4.1.4. Specialty Pigments

4.2. By Application (In Value %)

4.2.1. Facial Makeup

4.2.2. Eye Makeup

4.2.3. Lip Products

4.2.4. Nail Products

4.3. By Region (In Value %)

4.3.1. Riyadh

4.3.2. Jeddah

4.3.3. Dammam

4.3.4. Mecca

4.3.5. Medina

4.4. By End-User (In Value %)

4.4.1. Beauty & Personal Care Manufacturers

4.4.2. Contract Manufacturers

4.4.3. Private Label Brands

4.5. By Distribution Channel (In Value %)

4.5.1. Online Channels

4.5.2. Specialty Stores

4.5.3. Departmental Stores

5. KSA Cosmetic Pigments Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. BASF SE

5.1.2. Clariant AG

5.1.3. Sensient Cosmetic Technologies

5.1.4. Sun Chemical

5.1.5. Kobo Products, Inc.

5.1.6. Merck KGaA

5.1.7. Geotech International B.V.

5.1.8. ECKART GmbH

5.1.9. LANXESS

5.1.10. Huntsman Corporation

5.1.11. Daito Kasei Kogyo Co., Ltd.

5.1.12. Sudarshan Chemical Industries

5.1.13. Venator Materials PLC

5.1.14. Pylam Products Company

5.1.15. Nihon Koken Kogyo Co., Ltd.

5.2. Cross Comparison Parameters (Market Share, Regional Presence, Product Portfolio, Manufacturing Capacity, Innovations, Revenue, Distribution Network, Strategic Collaborations)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. New Product Launches

6. KSA Cosmetic Pigments Market Regulatory Framework

6.1. Certification and Compliance Standards (KSA-Specific Compliance for Cosmetic Ingredients)

6.2. Trade Barriers and Tariff Structure

6.3. Environmental and Sustainability Regulations

7. KSA Cosmetic Pigments Future Market Size (In USD Mn)

7.1. Future Market Growth Projections

7.2. Key Growth Factors (Rising Cosmetic Pigment Demand)

8. KSA Cosmetic Pigments Future Market Segmentation

8.1. By Pigment Type (In Value %)

8.2. By Application (In Value %)

8.3. By Region (In Value %)

8.4. By End-User (In Value %)

8.5. By Distribution Channel (In Value %)

9. KSA Cosmetic Pigments Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. White Space Opportunity Analysis

9.3. Marketing Strategies for Future Growth

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first stage involves identifying critical variables that impact the KSA cosmetic pigments market. This is done by reviewing industry databases, government regulations, and secondary research sources. Key areas of focus include pigment production trends, demand across different cosmetic segments, and regulatory developments.

Step 2: Market Analysis and Construction

In this step, historical data regarding cosmetic pigment demand and sales performance is analyzed. The market is further segmented by product type, application, and region to evaluate growth trends. Primary data from industry stakeholders is integrated with secondary data to generate reliable market estimates.

Step 3: Hypothesis Validation and Expert Consultation

To ensure the accuracy of market data, consultations are carried out with industry experts through surveys and interviews. These consultations provide insights into pigment technology advancements, consumer preferences, and market drivers, which are then incorporated into the analysis.

Step 4: Research Synthesis and Final Output

The final phase compiles all data points into a coherent market report. Industry feedback is cross-verified with financial data from major market players, ensuring a comprehensive understanding of the KSA cosmetic pigments market.

Frequently Asked Questions

01. How big is the KSA Cosmetic Pigments Market?

The KSA cosmetic pigments market is valued at USD 14.22 million, driven by increased demand for organic and specialty pigments, especially in the beauty and personal care segments.

02. What are the challenges in the KSA Cosmetic Pigments Market?

Challenges in the market include high production costs for specialty pigments, stringent regulatory requirements, and the lack of local pigment manufacturing, leading to a reliance on imports.

03. Who are the major players in the KSA Cosmetic Pigments Market?

Key players in the market include BASF SE, Clariant AG, Sun Chemical, Sensient Cosmetic Technologies, and Merck KGaA. These companies lead the market due to their focus on product innovation and sustainability.

04. What are the growth drivers for the KSA Cosmetic Pigments Market?

The market is driven by the increasing demand for natural and organic cosmetics, rising disposable incomes, and the expanding beauty industry in key regions like Riyadh and Jeddah.

05. What are the trends in the KSA Cosmetic Pigments Market?

Key trends include a shift towards clean beauty products, increased use of effect pigments like metallic and pearlescent colors, and the growing male grooming sector in KSA.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.