KSA Customer Experience Management Market Outlook to 2030

Region:Middle East

Author(s):Meenakshi Bisht

Product Code:KROD2297

December 2024

100

About the Report

KSA Customer Experience Management Market Overview

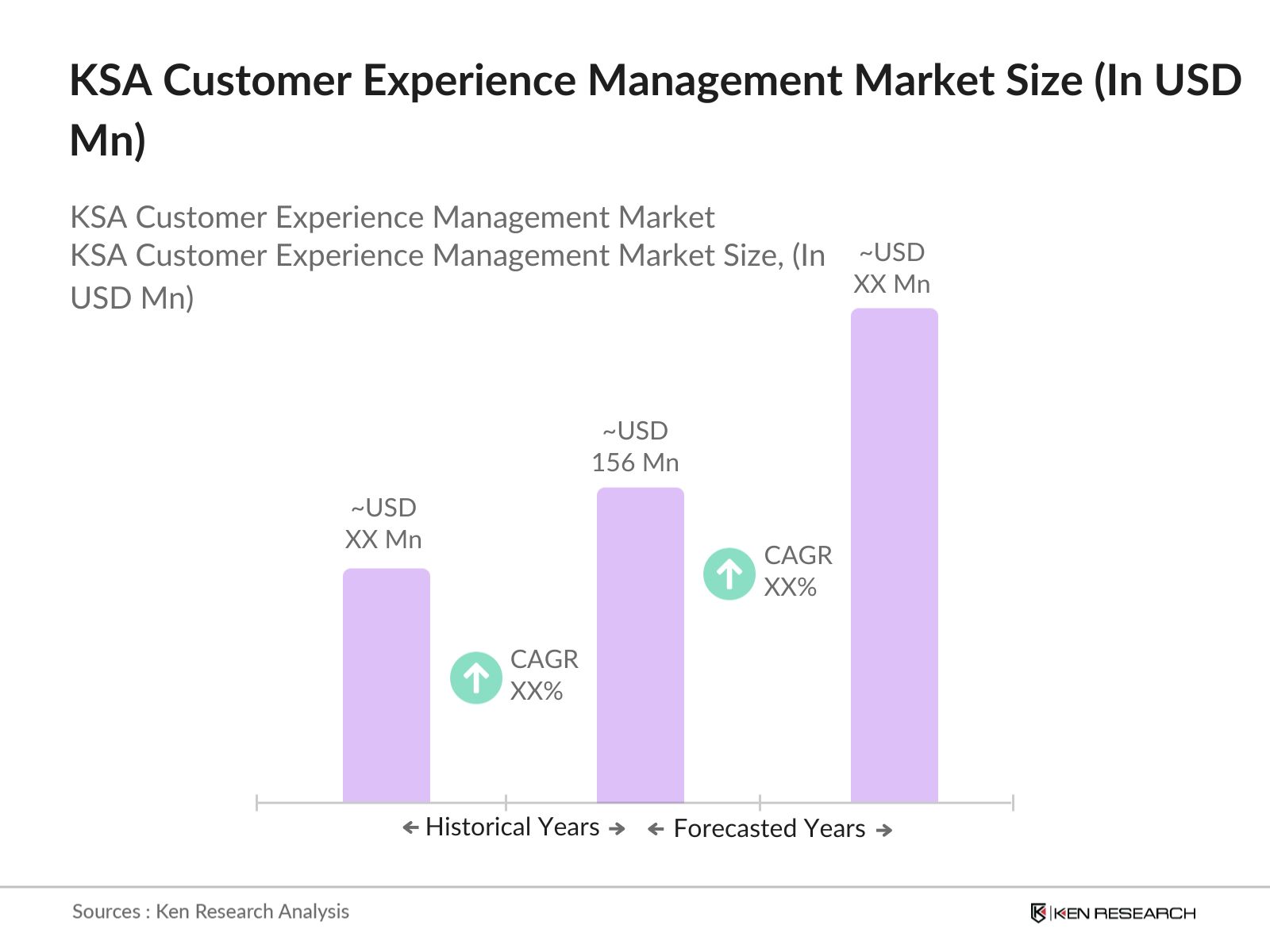

- The KSA Customer Experience Management (CXM) Market is valued at USD 156 million, driven primarily by digital transformation initiatives and the rapid growth of the e-commerce sector. Over the past five years, the market has witnessed increasing adoption of CXM technologies, including cloud-based solutions and AI-driven analytics. The growing emphasis on customer retention strategies and the expanding role of omnichannel engagement have also fueled the demand for CXM platforms, particularly in retail, banking, and telecommunications industries.

- Dominant cities such as Riyadh, Jeddah, and Dammam have emerged as key players in the market, largely due to their advanced technological infrastructure and the concentration of major industries, including finance, healthcare, and telecom. Riyadh, as the capital, also benefits from substantial government support under the Vision 2030 initiative, aimed at driving digital transformation. These cities are hubs for innovation and have a high concentration of businesses investing in CXM solutions to enhance customer loyalty and satisfaction.

- Saudi Vision 2030 is a comprehensive plan to diversify Saudi Arabia's economy by reducing dependence on oil and promoting industries like tourism, defense, and renewable energy. Key goals include increasing Umrah visitors, enhancing cultural and entertainment sectors, boosting SME contributions to GDP, and modernizing education. The plan also emphasizes transparency, governance reforms, and the development of cities and infrastructure to create a thriving economy and a vibrant society.

KSA Customer Experience Management Market Segmentation

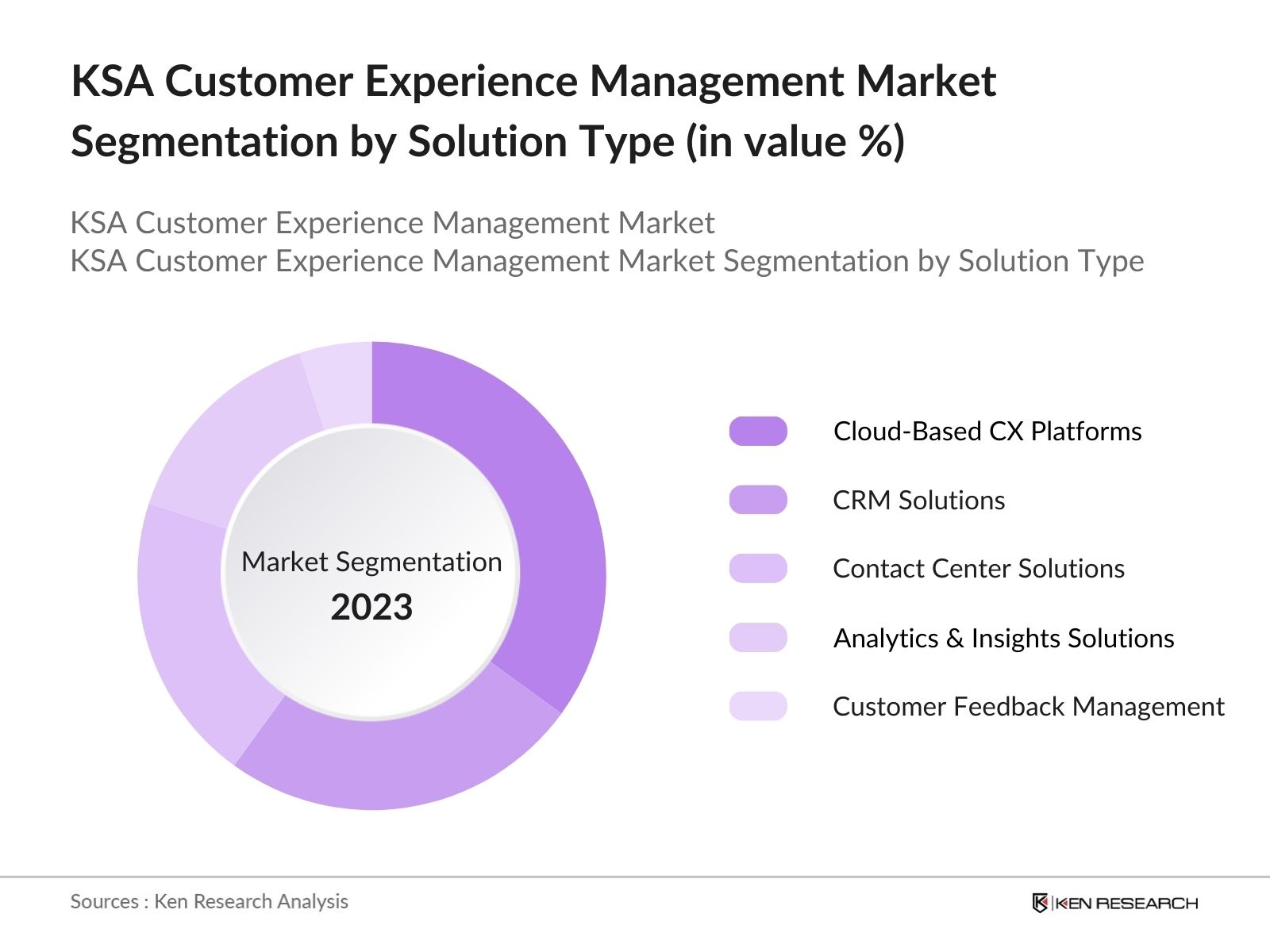

By Solution Type: The KSA CXM Market is segmented by solution type into cloud-based CX platforms, CRM solutions, contact center solutions, analytics and insights solutions, and customer feedback management solutions. Recently, cloud-based CX platforms have gained a dominant market share under this segmentation, owing to their flexibility, scalability, and cost-effectiveness. The shift toward cloud adoption is driven by businesses seeking to streamline operations and enhance data accessibility across multiple channels, particularly as companies aim to provide a unified customer experience through omnichannel strategies.

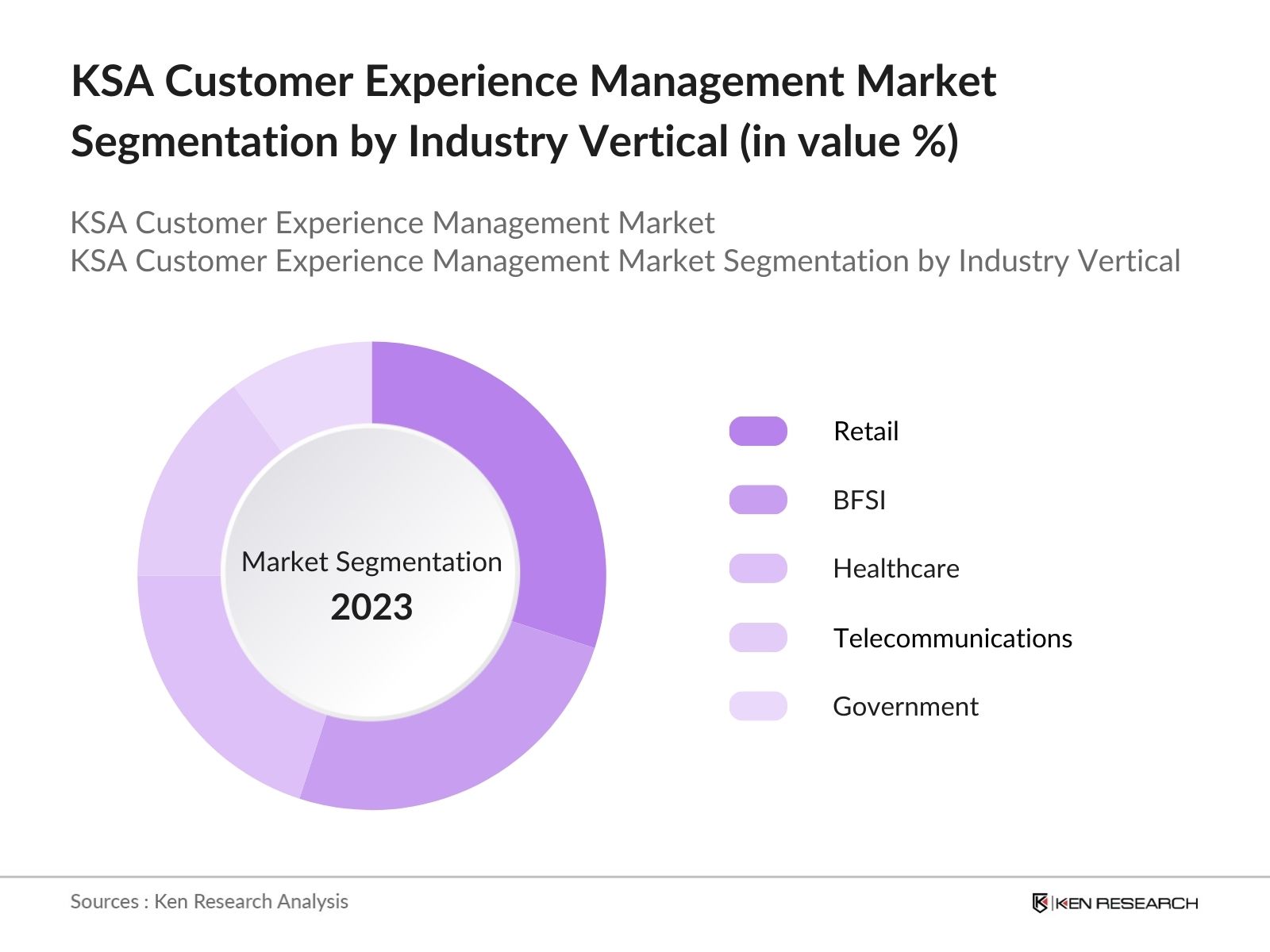

By Industry Vertical: The KSA CXM Market is segmented by industry vertical into retail, BFSI (Banking, Financial Services, and Insurance), healthcare, telecommunications, and government. The retail sector holds a significant share of the market, as businesses in this industry increasingly adopt CXM platforms to enhance customer satisfaction through personalized experiences. The growth of e-commerce and the rise of digital payment solutions have necessitated investments in customer experience management, as brands look to build loyalty in a competitive landscape. Additionally, with consumers becoming more tech-savvy, the demand for seamless and integrated digital customer journeys is driving the retail sectors dominance.

KSA Customer Experience Management Market Competitive Landscape

The market is dominated by both global technology giants and local players. Key competitors leverage their technological expertise, regional presence, and product innovation to cater to the diverse needs of businesses in the region. Many companies are adopting strategic partnerships to expand their product portfolios and provide end-to-end CXM solutions. Major players in the market, including global giants such as Oracle and Microsoft, compete alongside local and regional firms to offer specialized solutions that address the unique needs of the KSA business landscape.

|

Company Name |

Establishment Year |

Headquarters |

Market Focus |

Revenue (USD Bn) |

CX Products Offered |

Global Reach |

SaaS Integration |

AI Capabilities |

Partnership Initiatives |

|---|---|---|---|---|---|---|---|---|---|

|

Oracle Corporation |

1977 |

Austin, USA |

|||||||

|

Microsoft Corporation |

1975 |

Redmond, USA |

|||||||

|

SAP SE |

1972 |

Walldorf, Germany |

|||||||

|

Zendesk Inc. |

2007 |

San Francisco, USA |

|||||||

|

Freshworks Inc. |

2010 |

Chennai, India |

KSA Customer Experience Management Industry Analysis

Growth Drivers

- Growing E-commerce and Retail Sector: Saudi Arabia's e-commerce sector is expected to see significant growth, supported by a population of over 33.6 million, many of whom are digital-savvy and prefer online shopping. This surge in online retailing requires businesses to prioritize the customer experience, leading to a rise in demand for CXM solutions. The growing retail market, especially during events like Black Friday and Ramadan, has encouraged companies to optimize customer engagement across channels. The shift from traditional retail to digital channels is reshaping the competitive landscape, making CXM essential for success.

- Increased Consumer Demand for Personalization: The market for smartphones in Saudi Arabia has seen a significant boost, with a54% year-on-year increasein smartphone shipments reported for Q1 2024, consumers are increasingly demanding personalized experiences across digital platforms. Companies are leveraging AI-driven solutions to deliver tailored experiences. The need to cater to these expectations has driven businesses to invest in customer experience management (CXM) tools to deliver personalized interactions across sectors like e-commerce, financial services, and telecommunications.

- Digitalization and Cloud-Based Solutions: The growing emphasis on digitalization in Saudi Arabia is transforming industries, with cloud computing playing a pivotal role. Government-led initiatives are encouraging the adoption of cloud services, contributing to the rapid integration of Customer Experience Management (CXM) platforms across sectors. The increasing reliance on digital platforms for services, particularly in industries like banking and retail, is driving the need for businesses to enhance their customer experience strategies. As digital transformation accelerates, companies are turning to CXM solutions to meet rising consumer expectations and improve customer satisfaction across various touchpoints.

Market Restraints

- Initial Investment and Technology Costs: The implementation of advanced CXM platforms requires substantial upfront investment in technology infrastructure and training. Many businesses, particularly SMEs, face challenges in adopting CXM systems due to high initial costs, ranging from cloud infrastructure to AI-based customer interaction tools. Despite government incentives under Vision 2030, many companies struggle to justify the high expenses needed to implement and maintain CXM technologies. The high cost barrier often delays adoption in non-tech sectors, limiting the widespread use of these solutions in the market.

- Skill Gap in CX Management: Saudi Arabias workforce faces a skills gap in customer experience management, particularly in advanced analytics, AI, and digital tools. Only about 24% of the workforce is engaged in high-tech services, which slows down the adoption of advanced CXM systems. This gap results in inefficient customer service operations and suboptimal use of CXM technologies, especially in sectors like retail and healthcare. The government has launched several training initiatives to upskill the workforce, but the shortage of expertise continues to challenge the market.

KSA Customer Experience Management Market Future Outlook

Over the next five years, the KSA CXM market is expected to experience strong growth, driven by ongoing digital transformation initiatives, the proliferation of AI-based customer experience solutions, and increasing customer expectations for personalized services. As Saudi Vision 2030 accelerates the adoption of technology across sectors, businesses will continue to invest in advanced CXM tools to enhance customer engagement and loyalty. The rise of cloud adoption and AI-driven solutions will also drive market growth, particularly in industries such as retail and BFSI.

Market Opportunities

- AI Integration in Customer Journeys: AI is becoming essential in enhancing customer journeys in Saudi Arabia, allowing businesses to automate responses and predict customer needs. This shift enables organizations to personalize experiences and provide real-time support. AI-powered tools, such as chatbots, are already transforming sectors like banking and retail by streamlining interactions and improving service efficiency. As a result, AI integration in Customer Experience Management (CXM) is shaping the way businesses engage with customers.

- Growing Demand for Multichannel Customer Experience: As digital platforms expand in Saudi Arabia, consumers expect seamless interactions across various channels. Businesses are increasingly adopting multichannel strategies to ensure consistent customer experiences across mobile, desktop, and physical stores. This demand for coherent engagement has opened opportunities for CXM providers to offer integrated solutions that help businesses manage customer interactions efficiently across all platforms.

Scope of the Report

|

Solution Type |

Cloud-Based CX Platforms CRM Solutions Contact Center Solutions Analytics and Insights Solutions Customer Feedback Management Solutions |

|

Enterprise Size |

SMEs Large Enterprises |

|

Industry Vertical |

Retail BFSI Healthcare Telecommunications Government |

|

Deployment Type |

Cloud-Based On-Premise |

|

Region |

Riyadh Jeddah Dammam Mecca Al Khobar |

Products

Key Target Audience

CXM Solution Providers

IT Infrastructure Vendors

Cloud Service Providers

Retail Businesses

Telecommunications Providers

Financial Institutions

Government and Regulatory Bodies (Communications and Information Technology Commission, Ministry of Investment)

Investment and Venture Capital Firms

Companies

Players Mentioned in the Report

Oracle Corporation

Microsoft Corporation

SAP SE

Zendesk Inc.

Freshworks Inc.

Salesforce Inc.

Genesys Telecommunications Laboratories

Adobe Systems Incorporated

Medallia Inc.

IBM Corporation

NICE Ltd.

Pegasystems Inc.

SAS Institute Inc.

Verint Systems Inc.

Qualtrics LLC

Table of Contents

1. KSA Customer Experience Management Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA CXM Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA CXM Market Analysis

3.1. Growth Drivers (Customer Loyalty, Digital Transformation, Government Initiatives, Increasing Competition, Rising Consumer Expectations)

3.1.1. Digitalization and Cloud-Based Solutions

3.1.2. Government Focus on Saudi Vision 2030

3.1.3. Increased Consumer Demand for Personalization

3.1.4. Growing E-commerce and Retail Sector

3.2. Market Challenges (Data Privacy Concerns, High Investment Costs, Lack of CX Expertise)

3.2.1. Privacy and Data Security Regulations

3.2.2. Initial Investment and Technology Costs

3.2.3. Skill Gap in CX Management

3.3. Opportunities (AI and Automation, Omni-Channel Integration, Real-Time Customer Insights)

3.3.1. AI Integration in Customer Journeys

3.3.2. Growing Demand for Multichannel Customer Experience

3.3.3. Expansion in Healthcare and Financial Services

3.4. Trends (AI, Personalization, Data Analytics, Omnichannel Strategy, Cloud Adoption)

3.4.1. Shift Toward AI-Powered CX

3.4.2. Increasing Role of Analytics in CX Decisions

3.4.3. Cloud-Based Customer Experience Platforms

3.5. Government Regulation (Saudi Vision 2030, Data Protection Laws, E-Commerce Laws)

3.5.1. Saudi Vision 2030 Initiatives

3.5.2. Data Privacy and Cybersecurity Regulations

3.5.3. Regulations Around Digital Services and E-commerce

3.6. SWOT Analysis

3.7. Stake Ecosystem (CX Vendors, IT Service Providers, Consulting Firms, System Integrators)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. KSA CXM Market Segmentation

4.1. By Solution Type (In Value %)

4.1.1. Cloud-Based CX Platforms

4.1.2. CRM Solutions

4.1.3. Contact Center Solutions

4.1.4. Analytics and Insights Solutions

4.1.5. Customer Feedback Management Solutions

4.2. By Enterprise Size (In Value %)

4.2.1. SMEs

4.2.2. Large Enterprises

4.3. By Industry Vertical (In Value %)

4.3.1. Retail

4.3.2. BFSI (Banking, Financial Services, and Insurance)

4.3.3. Healthcare

4.3.4. Telecommunications

4.3.5. Government

4.4. By Deployment Type (In Value %)

4.4.1. Cloud-Based

4.4.2. On-Premise

4.5. By Region (In Value %)

4.5.1. Riyadh

4.5.2. Jeddah

4.5.3. Dammam

4.5.4. Mecca

4.5.5. Al Khobar

5. KSA CXM Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. SAP SE

5.1.2. Oracle Corporation

5.1.3. Salesforce Inc.

5.1.4. Adobe Systems Incorporated

5.1.5. Zendesk Inc.

5.1.6. Microsoft Corporation

5.1.7. IBM Corporation

5.1.8. Genesys Telecommunications Laboratories

5.1.9. SAS Institute Inc.

5.1.10. NICE Ltd.

5.1.11. Freshworks Inc.

5.1.12. Medallia Inc.

5.1.13. Verint Systems Inc.

5.1.14. Pegasystems Inc.

5.1.15. Qualtrics LLC

5.2. Cross Comparison Parameters (No. of Employees, Revenue, Headquarters, Market Share, Digital Transformation Initiatives, SaaS Product Adoption, Customer Retention Rate, CX Solution Focus)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, Expansions, Technology Developments)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants and Incentives

5.8. Private Equity Investments

5.9. Venture Capital Funding

6. KSA CXM Market Regulatory Framework

6.1. Data Protection and Cybersecurity Laws

6.2. CX Standards and Compliance Requirements

6.3. Certification Processes

7. KSA CXM Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Digital Services Expansion, AI and Machine Learning, Mobile CX Solutions)

8. KSA CXM Future Market Segmentation

8.1. By Solution Type (In Value %)

8.2. By Enterprise Size (In Value %)

8.3. By Industry Vertical (In Value %)

8.4. By Deployment Type (In Value %)

8.5. By Region (In Value %)

9. KSA CXM Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. White Space Opportunity Analysis

9.3. Go-to-Market Strategy for New Entrants

9.4. CX Technology Adoption Recommendations

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, we mapped the entire KSA CXM ecosystem, including technology vendors, service providers, and end-users. This involved extensive desk research and analysis of proprietary and secondary databases to define the key factors that influence market growth, such as technological advancements and customer behavior trends.

Step 2: Market Analysis and Construction

We analyzed historical market data to understand the trends in service provider penetration, customer engagement metrics, and revenue generation. By evaluating these parameters, we constructed reliable market estimates and projections for the KSA CXM market.

Step 3: Hypothesis Validation and Expert Consultation

Through consultations with industry experts using CATIs, we validated our market hypotheses and gathered insights into CX strategies, spending patterns, and future technology adoption. This process helped ensure the accuracy of the market forecasts.

Step 4: Research Synthesis and Final Output

The final phase of the research involved synthesizing primary data gathered from industry experts with secondary data from published reports. This helped us refine the market projections and develop comprehensive insights into the KSA CXM market.

Frequently Asked Questions

01. How big is the KSA Customer Experience Management (CXM) Market?

The KSA CXM market is valued at USD 156 million, driven by increasing digital transformation initiatives and the growing demand for personalized customer experiences across various sectors.

02. What are the challenges in the KSA CXM Market?

Key challenges in KSA CXM Market include high implementation costs for advanced CXM platforms, data privacy concerns, and a lack of skilled CXM professionals. These factors limit the scalability of CXM solutions, especially among smaller businesses.

03. Who are the major players in the KSA CXM Market?

Major players in KSA CXM Market include Oracle Corporation, Microsoft Corporation, SAP SE, Zendesk Inc., and Freshworks Inc. These companies lead the market due to their extensive product portfolios and cloud-based CX solutions.

04. What are the growth drivers of the KSA CXM Market?

The growth of the KSA CXM market is driven by rapid digitalization, the rise of cloud-based platforms, and increasing consumer expectations for seamless, personalized customer interactions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.