KSA Dental Implants Market Outlook to 2030

Region:Middle East

Author(s):Shreya Garg

Product Code:KROD5029

November 2024

84

About the Report

KSA Dental Implants Market Overview

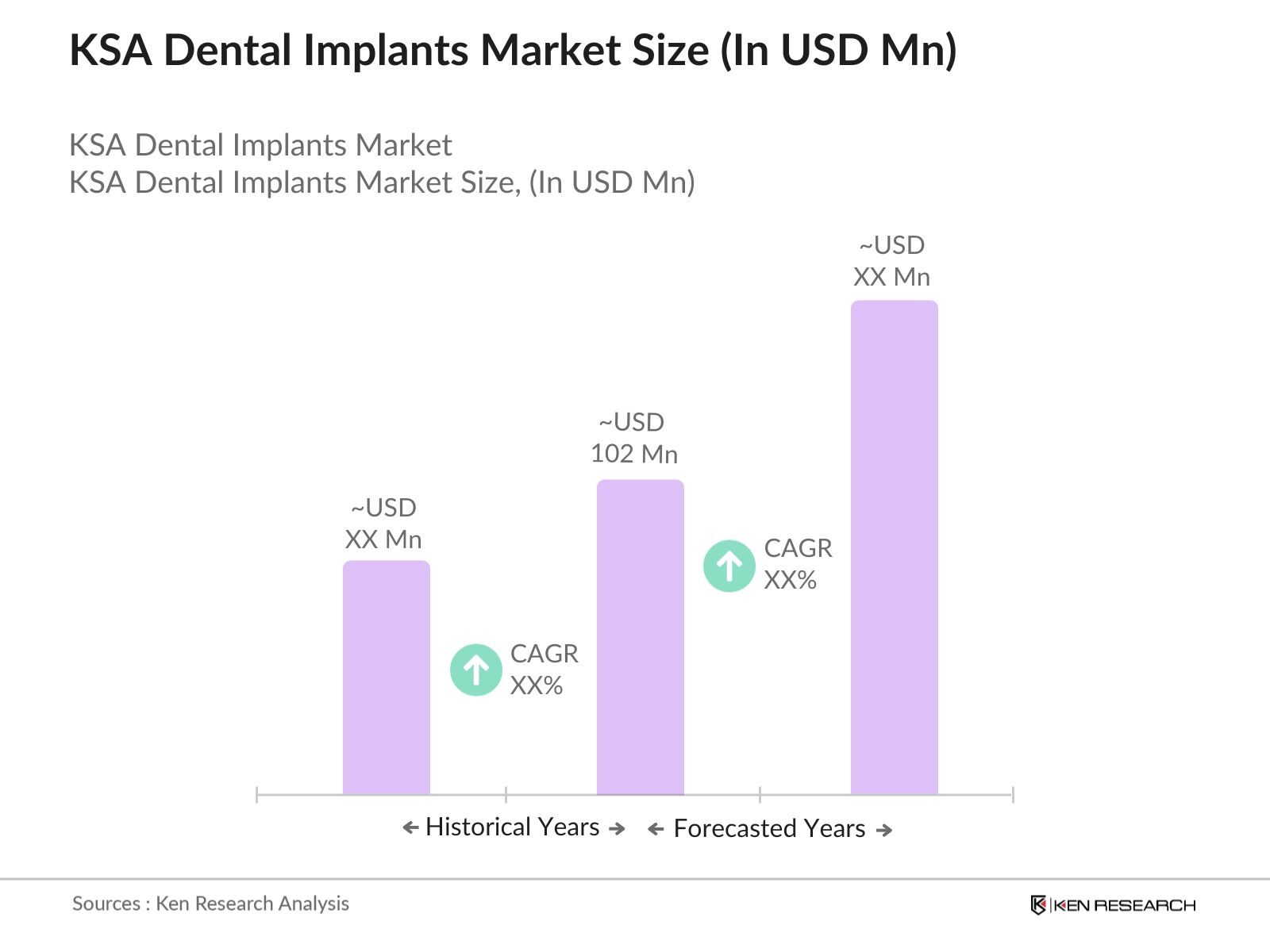

- The KSA dental implants market is valued at USD 102 million, based on a comprehensive five-year historical analysis. The market is primarily driven by increasing awareness of oral health, advancements in dental technology, and the rising prevalence of tooth loss due to aging and oral diseases. The growing demand for cosmetic dentistry, alongside government healthcare reforms, further propels market growth. Additionally, technological advancements such as 3D printing and CAD/CAM in dental implants have significantly contributed to market expansion.

- Dominant cities in the KSA dental implants market include Riyadh, Jeddah, and Dammam. These cities dominate due to their higher disposable incomes, well-established healthcare infrastructure, and a larger population of dental practitioners. Riyadh, as the capital and largest city, attracts significant medical tourism, which drives the demand for dental implants. Jeddah and Dammam follow closely due to their strategic positioning and the concentration of private dental clinics.

- The Saudi Ministry of Health regulates dental implant procedures to ensure safety and quality. In 2023, the Ministry introduced new guidelines for dental implantology, focusing on standardizing materials, surgical techniques, and practitioner qualifications. These regulations aim to enhance patient safety and ensure the highest standards in dental care. Clinics are now required to meet stricter certification requirements, which has led to improved quality in the delivery of implant procedures.

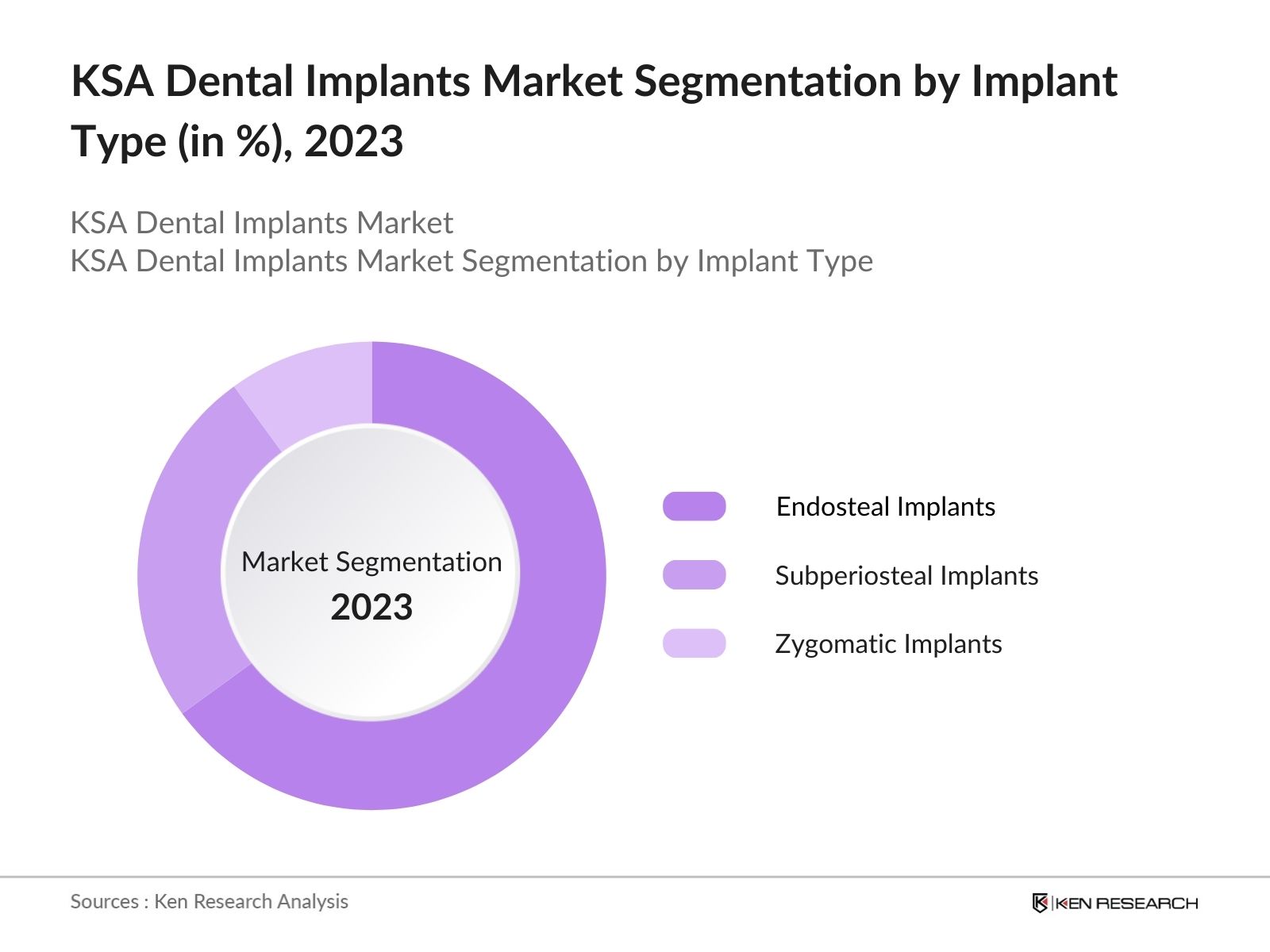

KSA Dental Implants Market Segmentation

By Implant Type: The market is segmented by implant type into endosteal, subperiosteal, and zygomatic implants. Endosteal implants hold the dominant market share, driven by their high success rate, biocompatibility, and their ability to provide long-term stability. These implants are most commonly used in cases of missing teeth due to their adaptability and ease of placement, contributing to their popularity among dentists and patients alike. The preference for endosteal implants is further reinforced by their compatibility with modern dental technologies like digital scanners.

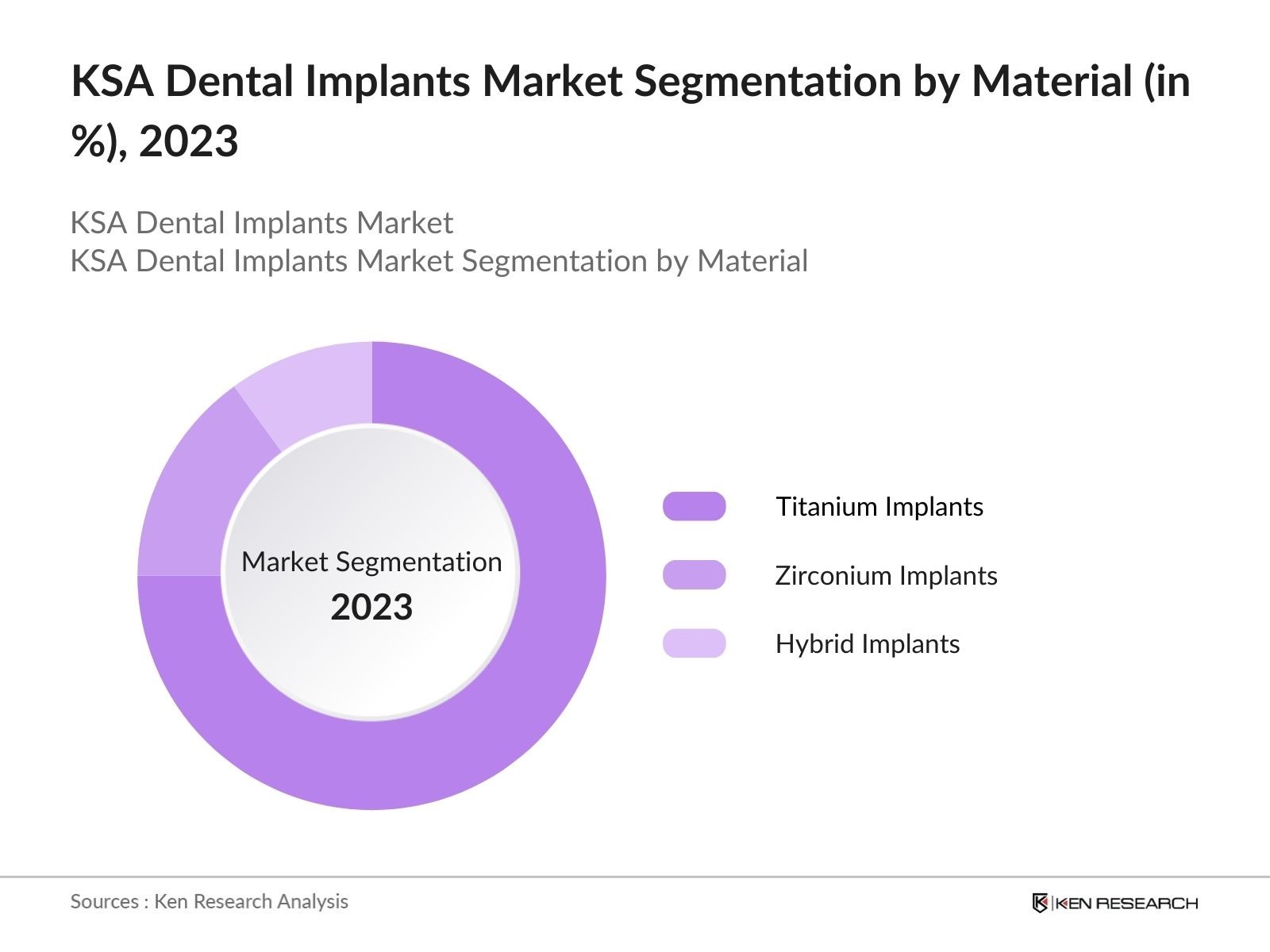

By Material: In terms of material, the market is segmented into titanium, zirconium, and hybrid implants. Titanium implants dominate the market, accounting for the largest share. The high success rate of titanium implants, coupled with their durability and biocompatibility, makes them the preferred choice for both dentists and patients. Additionally, titanium's ability to integrate well with bone (osseointegration) ensures long-lasting performance, which is a key factor driving its market dominance.

KSA Dental Implants Market Competitive Landscape

The KSA dental implants market is moderately consolidated, with a few key players holding a significant share. International companies like Straumann and Dentsply Sirona dominate due to their extensive product portfolio, advanced technologies, and established brand reputation. Local players are also emerging, leveraging government support and focusing on price competitiveness to gain a foothold in the market.

|

Company |

Established |

Headquarters |

No. of Employees |

Annual Revenue |

R&D Investments |

Product Portfolio |

Global Reach |

Local Presence |

|

Straumann Group |

1954 |

Switzerland |

||||||

|

Dentsply Sirona |

1877 |

USA |

||||||

|

Nobel Biocare |

1981 |

Switzerland |

||||||

|

Osstem Implant |

1997 |

South Korea |

||||||

|

BioHorizons |

1994 |

USA |

KSA Dental Implants Industry Analysis

Growth Drivers

- Increasing Geriatric Population: The aging population in Saudi Arabia is significantly driving the demand for dental implants, as older individuals are more prone to tooth loss and oral health issues. According to the World Bank, the population aged 65 and above has grown steadily, reaching over 1.2 million by 2022. This demographic shift increases the demand for dental care services, including implants, which cater to age-related tooth loss and other conditions. As the geriatric population continues to expand, so does the necessity for advanced dental solutions like implants.

- Rising Prevalence of Oral Health Issues: Oral diseases, particularly tooth decay and gum disease, are becoming more prevalent in Saudi Arabia, contributing to the rising demand for dental implants. According to the Saudi Ministry of Health, more than 50% of adults experience dental caries, and around 25% suffer from periodontal disease as of 2023. This growing burden of oral health issues, combined with an increase in awareness of dental treatments, boosts the dental implants market. The need for effective treatments to address tooth loss due to these conditions has led to increased adoption of implants.

- Increasing Cosmetic Dentistry Awareness: Cosmetic dentistry, which includes procedures like implants, has gained momentum as public awareness of aesthetic dental solutions increases. The Saudi Dental Society reported that demand for cosmetic dental procedures, including implants, saw a 30% increase from 2022 to 2023. This is fueled by social influences and a growing focus on personal appearance among younger demographics, leading to more individuals opting for implants as part of their cosmetic dental care.

Market Challenges

- High Cost of Implants and Procedures: Dental implants remain a high-cost solution for tooth replacement, and the affordability challenge persists in Saudi Arabia. While the government has made some procedures more accessible, private clinics dominate the dental implant market, where out-of-pocket expenses can exceed several thousand SAR. This limits access for middle and low-income groups, slowing the market growth despite demand. The lack of standardized pricing across the private sector further complicates affordability.

- Limited Reimbursement Coverage: Insurance coverage for dental implants is limited in Saudi Arabia, contributing to the high out-of-pocket expenses for patients. According to the General Authority for Statistics (GASTAT), less than 30% of private health insurance policies in the country cover dental procedures, and even fewer include dental implants. This limited reimbursement hinders patient accessibility to these services, as dental implants are seen as elective rather than essential, further impeding market growth.

KSA Dental Implants Market Future Outlook

Over the next five years, the KSA dental implants market is expected to show robust growth driven by increased demand for advanced dental solutions, an aging population, and a rise in medical tourism. Government initiatives to improve healthcare infrastructure and the rise of digital dentistry will further fuel market expansion. Moreover, the adoption of cutting-edge technologies like AI-driven diagnostics and 3D-printed implants will enhance the efficiency and effectiveness of dental procedures, driving market growth.

Future Market Opportunities

- Technological Advancements in Implantology: Technological advancements in dental implantology, such as CAD/CAM (Computer-Aided Design and Manufacturing) and 3D printing, are creating new opportunities in the Saudi dental implants market. These technologies allow for more precise implant placements and reduced recovery times, improving patient outcomes. According to a 2023 report from the Saudi Ministry of Health, the adoption of these technologies in dental clinics across the country has grown by 25%, with government initiatives encouraging digital innovation in healthcare.

- Expanding Medical Tourism in the KSA: Saudi Arabia is emerging as a hub for medical tourism, especially in the field of dentistry, with dental implants being a sought-after procedure for foreign patients. The Saudi Commission for Tourism and National Heritage reported that medical tourism brought in over 200,000 international patients in 2023, with dental services accounting for a significant portion. The government's push to position Saudi Arabia as a global medical destination under Vision 2030 has attracted patients from neighboring countries, driving demand for advanced dental treatments.

Scope of the Report

|

Type |

Endosteal Implants Subperiosteal Implants Zygomatic Implants |

|

Application |

Single Tooth Replacement Multiple Tooth Replacement Full Mouth Restoration |

|

Material |

Titanium Implants Zirconium Implants Hybrid Implants |

|

End User |

Dental Clinics Hospitals Academic & Research Institutes |

|

Region |

Riyadh Jeddah Eastern Province Mecca Others |

Products

Key Target Audience

Dental Clinics

Hospitals and Surgical Centers

Government and Regulatory Bodies (KSA Ministry of Health)

Medical Tourism Operators

Dental Equipment Manufacturers

Dental Practitioners and Specialists

Investor and Venture Capitalist Firms

Insurance Providers

Companies

Major Players

Straumann Group

Dentsply Sirona

Nobel Biocare

Osstem Implant

BioHorizons

CAMLOG Biotechnologies

Zimmer Biomet

Megagen Implant

Implant Direct

Neoss Limited

Southern Implants

Bicon, LLC

GC Implant Solutions

Dentium Co. Ltd.

Anthogyr

Table of Contents

KSA Dental Implants Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (CAGR, Market Size, Growth Drivers)

1.4 Market Segmentation Overview (By Type, Application, Material, End User, Region)

KSA Dental Implants Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

KSA Dental Implants Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Geriatric Population (Age Group Distribution)

3.1.2 Rising Prevalence of Oral Health Issues (Disease Statistics)

3.1.3 Increasing Cosmetic Dentistry Awareness

3.1.4 Favorable Government Healthcare Initiatives

3.2 Market Challenges

3.2.1 High Cost of Implants and Procedures

3.2.2 Limited Reimbursement Coverage (Insurance Penetration)

3.2.3 Shortage of Skilled Professionals (Workforce Analysis)

3.3 Opportunities

3.3.1 Technological Advancements in Implantology (CAD/CAM, 3D Printing)

3.3.2 Expanding Medical Tourism in the KSA (Patient Inflow Statistics)

3.3.3 Collaborations with Dental Clinics and Research Institutes

3.4 Trends

3.4.1 Shift Towards Non-invasive Implant Techniques

3.4.2 Increased Use of Biocompatible Implant Materials

3.4.3 Growing Adoption of Digital Dentistry

3.5 Government Regulation

3.5.1 Dental Implant Regulations by KSA Ministry of Health

3.5.2 Pricing Regulation and Subsidies for Dental Procedures

3.5.3 Initiatives to Promote Local Manufacturing of Implants

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Manufacturers, Distributors, Clinics, Hospitals)

3.8 Porters Five Forces (Threat of New Entrants, Bargaining Power of Buyers)

3.9 Competition Ecosystem (Domestic vs. International Players)

KSA Dental Implants Market Segmentation

4.1 By Type (In Value %)

4.1.1 Endosteal Implants

4.1.2 Subperiosteal Implants

4.1.3 Zygomatic Implants

4.2 By Application (In Value %)

4.2.1 Single Tooth Replacement

4.2.2 Multiple Tooth Replacement

4.2.3 Full Mouth Restoration

4.3 By Material (In Value %)

4.3.1 Titanium Implants

4.3.2 Zirconium Implants

4.3.3 Hybrid Implants

4.4 By End User (In Value %)

4.4.1 Dental Clinics

4.4.2 Hospitals

4.4.3 Academic & Research Institutes

4.5 By Region (In Value %)

4.5.1 Riyadh

4.5.2 Jeddah

4.5.3 Eastern Province

4.5.4 Mecca

4.5.5 Others

KSA Dental Implants Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Straumann Group

5.1.2 Dentsply Sirona

5.1.3 Zimmer Biomet

5.1.4 Osstem Implant

5.1.5 Nobel Biocare

5.1.6 Bicon, LLC

5.1.7 BioHorizons

5.1.8 CAMLOG Biotechnologies

5.1.9 MegaGen Implant

5.1.10 Neoss Limited

5.1.11 Dentium Co. Ltd

5.1.12 GC Implant Solutions

5.1.13 Southern Implants

5.1.14 Anthogyr

5.1.15 Implant Direct

5.2 Cross Comparison Parameters (Market Share, Revenue, Geographic Presence, R&D Investment, Key Partnerships, Technological Capabilities, Product Portfolio, Local Presence)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis (Private Equity, Venture Capital, Government Grants)

KSA Dental Implants Market Regulatory Framework

6.1 KSA Healthcare Regulations

6.2 ISO Certifications for Dental Implants

6.3 Compliance and Licensing Requirements

KSA Dental Implants Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth (Technological Innovations, New Materials)

KSA Dental Implants Future Market Segmentation

8.1 By Type (In Value %)

8.2 By Application (In Value %)

8.3 By Material (In Value %)

8.4 By End User (In Value %)

8.5 By Region (In Value %)

KSA Dental Implants Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Market Penetration Strategies

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

In the first phase, we mapped the ecosystem of the KSA dental implants market by identifying key stakeholders, including manufacturers, distributors, and dental clinics. Extensive secondary research was conducted using proprietary and public databases to gather relevant industry-level data, focusing on market dynamics and critical variables influencing demand.

Step 2: Market Analysis and Construction

Historical market data was compiled and analyzed, covering aspects like the penetration of dental implants, adoption of new technologies, and revenue generation by key players. This process included an evaluation of service quality and product pricing to ensure the reliability of the revenue estimates and market forecasts.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were developed and validated through direct consultations with industry experts and dental professionals. Computer-assisted telephone interviews (CATIs) were used to gather in-depth insights on operational challenges, customer preferences, and the competitive landscape.

Step 4: Research Synthesis and Final Output

In the final phase, the findings were synthesized into a comprehensive report that reflects accurate market data. This process included verifying the statistics obtained from various sources through cross-referencing with manufacturers and distributors, ensuring a well-rounded and validated analysis of the KSA dental implants market.

Frequently Asked Questions

01 How big is the KSA dental implants market?

The KSA dental implants market is valued at USD 102 million, driven by increasing awareness of oral health, advancements in dental technology, and rising demand for cosmetic dentistry.

02 What are the challenges in the KSA dental implants market?

Challenges in the KSA dental implants market include the high cost of implants and procedures, limited insurance coverage, and a shortage of skilled dental professionals, particularly in remote regions.

03 Who are the major players in the KSA dental implants market?

Key players in the KSA dental implants market include international brands like Straumann, Dentsply Sirona, and Nobel Biocare, alongside emerging local players.

04 What are the growth drivers of the KSA dental implants market?

The KSA dental implants market is driven by factors such as a growing aging population, increasing prevalence of oral diseases, advancements in implant technologies, and supportive government healthcare policies.

05 Which regions dominate the KSA dental implants market?

Riyadh, Jeddah, and Dammam dominate the market due to their higher disposable incomes, well-developed healthcare infrastructure, and large concentration of dental practitioners in the KSA dental implants market in the KSA dental implants market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.