Region:Middle East

Author(s):Rebecca

Product Code:KRAD7353

Pages:100

Published On:December 2025

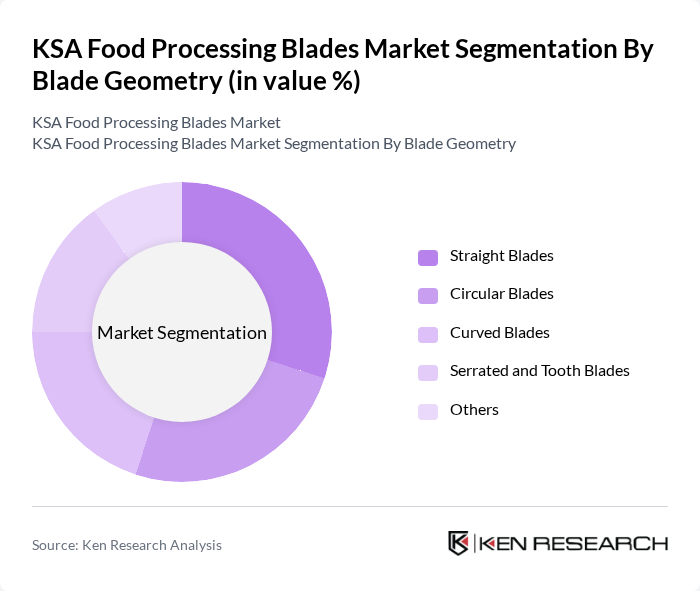

By Blade Geometry:The segmentation by blade geometry includes various types of blades that cater to different food processing needs. The subsegments are Straight Blades, Circular Blades, Curved Blades, Serrated and Tooth Blades, and Others. Each type serves specific applications in food processing, influencing consumer preferences and market dynamics.

The Straight Blades segment is currently dominating the market due to their versatility and efficiency in various food processing applications. These blades are widely used in meat and vegetable processing, bakery, and general-purpose cutting operations, where precision and durability are crucial. The demand for Straight Blades is driven by the need for high-quality cuts, minimal product waste, and the ability to handle different types of food products on high-speed automated lines. Additionally, advancements in blade manufacturing technology—such as improved stainless steel alloys, surface coatings, and precision grinding—have improved the performance, hygiene, and longevity of these blades, further solidifying their market leadership.

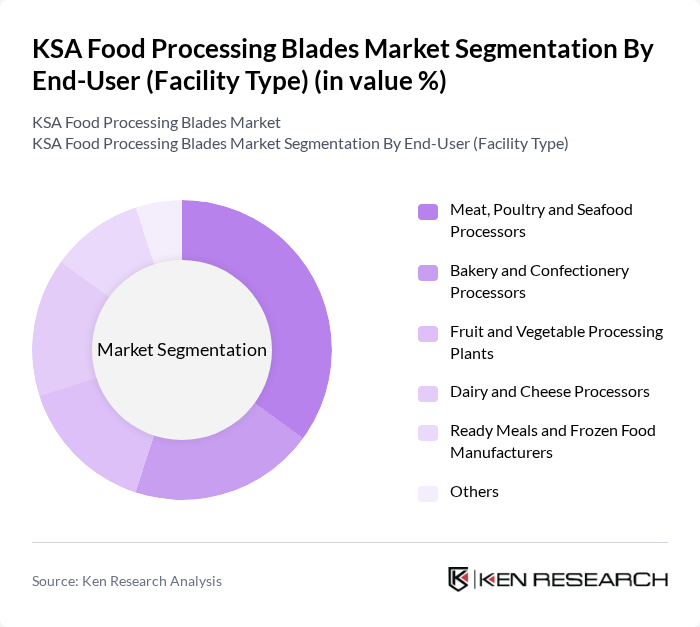

By End-User (Facility Type):The segmentation by end-user includes various facility types that utilize food processing blades. The subsegments are Meat, Poultry and Seafood Processors, Bakery and Confectionery Processors, Fruit and Vegetable Processing Plants, Dairy and Cheese Processors, Ready Meals and Frozen Food Manufacturers, and Others. Each facility type has unique requirements that influence the choice of blades used in their operations, driven by throughput, hygiene demands, and product characteristics.

The Meat, Poultry and Seafood Processors segment leads the market due to the high demand for meat and protein-rich products and the need for efficient processing solutions. This segment requires specialized blades that can handle tough materials, frozen products, bone-in cuts, and high-throughput slicing while providing precise and consistent cuts. The growth in this sector is driven by increasing consumer demand for animal protein, the expansion of domestic meat and poultry processing capacity in Saudi Arabia as part of food security strategies, and rising consumption of value-added products such as marinated cuts, portioned fillets, and processed seafood. Additionally, advancements in blade technology—such as wear-resistant materials, optimized tooth profiles, and improved sanitation-friendly designs—have enhanced the performance, safety, and durability of blades used in this segment, further solidifying its market position.

The KSA Food Processing Blades Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kemet International Ltd., Hyde Industrial Blade Solutions, TGW Global, Swann?Morton Limited, MRMK Limited, Martor KG, Cutco Industrial Solutions (Cutco Corporation), Jiangsu Lihong Tools Co., Ltd., Beijing SH Trade Co., Ltd., KAS Systems Co. (Saudi Arabia), Al-Babtain Trading Company (Industrial Equipment Division), AlKhorayef Group (Food & Industrial Equipment Division), Middle East Industrial Blades FZE, Al-Radwan Industrial Equipment Est., Al-Jazira Equipment Company (AutoWorld Industrial Tools Division) contribute to innovation, geographic expansion, and service delivery in this space.

The KSA food processing blades market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As automation becomes more prevalent in food processing, manufacturers will increasingly adopt smart technologies to enhance blade performance and efficiency. Additionally, the focus on sustainability will lead to the development of eco-friendly blades, aligning with global trends. These factors will create a dynamic environment for innovation, positioning the market for growth and adaptation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Blade Geometry | Straight Blades Circular Blades Curved Blades Serrated and Tooth Blades Others |

| By End-User (Facility Type) | Meat, Poultry and Seafood Processors Bakery and Confectionery Processors Fruit and Vegetable Processing Plants Dairy and Cheese Processors Ready Meals and Frozen Food Manufacturers Others |

| By Application (Process Stage) | Grinding and Mincing Slicing and Portioning Dicing and Cubing Skinning and Peeling Trimming and Deboning Others |

| By Sales Channel | OEM (Equipment Manufacturer) Sales Aftermarket / Replacement Sales Industrial Distributors Online and Direct Sales Others |

| By Material | Stainless Steel Blades High Carbon and Alloy Steel Blades Tungsten Carbide and Hard-Coated Blades Ceramic and Composite Blades Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Product Lifecycle Stage | Introduction Stage Growth Stage Maturity Stage Decline Stage Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Meat Processing Sector | 100 | Production Managers, Quality Assurance Officers |

| Dairy Processing Sector | 90 | Operations Managers, Equipment Procurement Specialists |

| Grain Processing Sector | 80 | Plant Managers, Supply Chain Coordinators |

| Food Packaging Sector | 70 | Product Development Managers, Packaging Engineers |

| Food Safety Compliance | 60 | Regulatory Affairs Managers, Compliance Officers |

The KSA Food Processing Blades Market is valued at approximately USD 85 million, reflecting the growth driven by increasing demand for processed food products and advancements in food processing technologies.