KSA Gaming Market Outlook to 2030

Region:Middle East

Author(s):Meenakshi

Product Code:KROD2492

November 2024

82

About the Report

KSA Gaming Market Overview

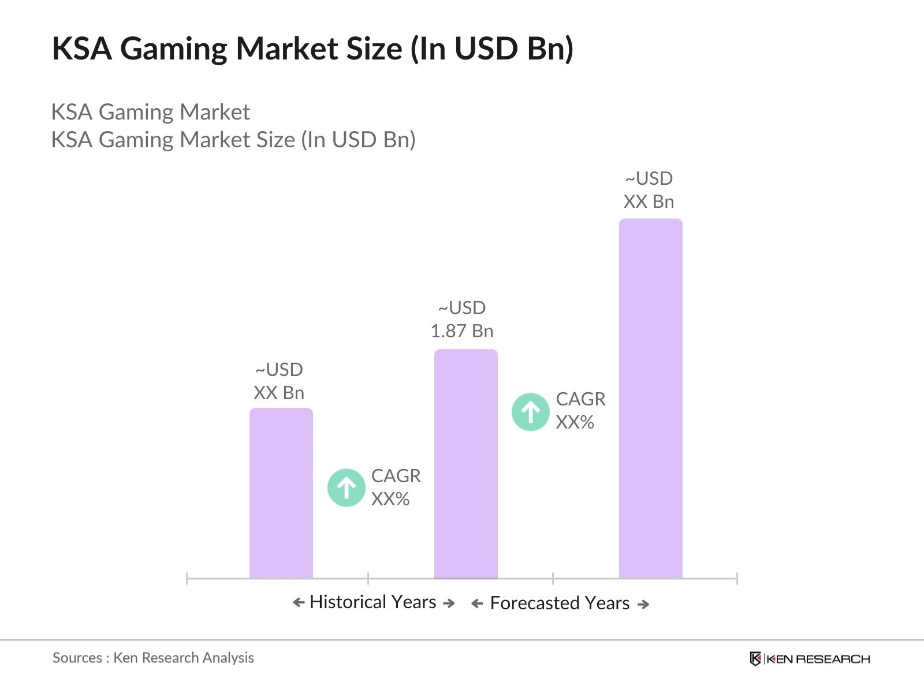

- The Saudi Arabia gaming market is valued at USD 1.87 billion, driven by the rapid adoption of mobile gaming, increased internet penetration, and government initiatives like Vision 2030. These factors have contributed significantly to the market's expansion, with an increase in disposable income and a tech-savvy younger population. Additionally, the Saudi governments investments in technology and the entertainment sector, as part of its diversification plan, have created a favorable environment for the gaming industry to thrive.

- Key cities dominating the gaming market in Saudi Arabia include Riyadh, Jeddah, and Dammam. These cities have a higher concentration of tech infrastructure, urbanization, and wealth, which drives greater access to gaming devices and high-speed internet. Riyadh leads due to its position as the capital and the hub of economic and technological growth. Jeddah follows closely due to its population density and its status as a commercial center. These cities also host major gaming events and e-sports competitions, further contributing to their dominance in the sector.

- Saudi Arabia enforces strict censorship policies on gaming content, primarily through the General Commission for Audiovisual Media (GCAM). These regulations aim to ensure that all gaming content aligns with cultural and religious norms. For example, games with themes of violence, sexuality, or political dissent are often subject to bans or modifications. This regulatory framework can limit the availability of certain games in the market, impacting both international and local developers.

KSA Gaming Market Segmentation

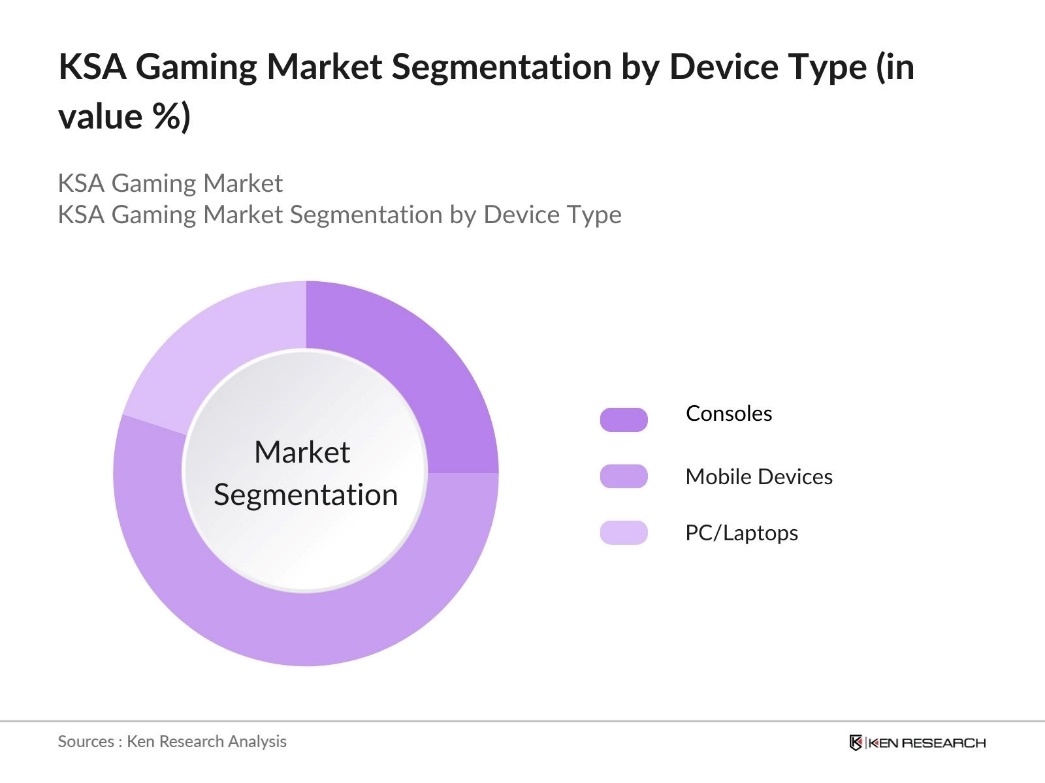

By Device Type: The Saudi Arabia gaming market is segmented by device type into consoles, mobile devices, and PC/laptops. Recently, mobile devices have dominated the market due to the high penetration of smartphones and affordable mobile data plans. With a growing number of mobile gamers, particularly among the youth, mobile gaming has become the most popular gaming medium. Games like PUBG Mobile and Call of Duty: Mobile have seen a significant rise in Saudi Arabia, attributed to the convenience of gaming on the go.

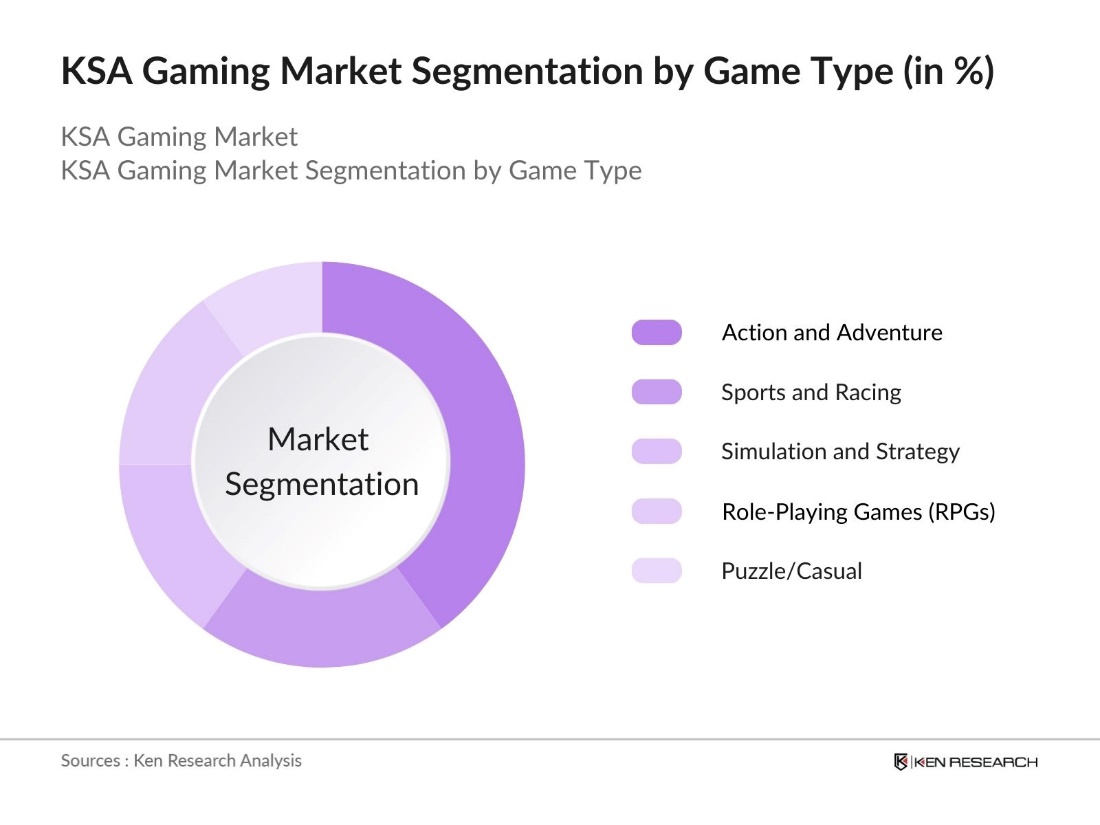

By Game Type: The Saudi Arabia gaming market is segmented by game type into action and adventure, sports and racing, simulation and strategy, role-playing games (RPGs), and puzzle/casual games. Action and adventure games hold the largest market share, driven by their immersive experiences and the popularity of titles like Call of Duty, Fortnite, and Assassins Creed. This genre is particularly appealing due to its competitive nature and social interaction components, which are key drivers in Saudi Arabias highly connected gaming community.

KSA Gaming Market Competitive Landscape

The Saudi Arabia gaming market is dominated by a few key global and regional players, who have established a strong presence through partnerships, localized content, and e-sports sponsorships. Key companies include Sony Interactive Entertainment and Microsoft Corporation, which continue to dominate the console market, while Tencent and NetEase have seen significant success in mobile gaming. Additionally, local developers are emerging with support from government initiatives.

|

Company |

Establishment Year |

Headquarters |

Gaming Titles |

Revenue |

Employees |

Market Penetration |

Partnerships |

|

Sony Interactive Entertainment |

1993 |

Tokyo, Japan |

|||||

|

Microsoft Corporation |

1975 |

Redmond, USA |

|||||

|

Tencent Games |

1998 |

Shenzhen, China |

|||||

|

NetEase Games |

2001 |

Hangzhou, China |

|||||

|

Falafel Games |

2010 |

Riyadh, Saudi Arabia |

KSA Gaming Industry Analysis

Growth Drivers

- Rising Youth Population: Saudi Arabia has a predominantly young population, with about 70% of its citizens under the age of 35, according to the World Bank. This demographic structure fuels the demand for digital entertainment, particularly gaming, as young people are more likely to engage in gaming activities. The youth also have high disposable income levels, supporting gaming adoption. The population of gamers has increased rapidly with the advancement of mobile technology and better internet connectivity. These factors make the youth segment a key driver of gaming market growth.

- Increased Internet Penetration and Mobile Device Adoption: As of 2024, Saudi Arabia boasts an internet penetration rate of over 99%. This high level of internet access, coupled with a significant rise in mobile device usageestimated to be around 41 million deviceshas facilitated widespread adoption of mobile gaming. The increased availability of 5G networks further enhances mobile gaming experiences, driving user engagement and contributing to the gaming market's rapid growth.

- E-sports Growth and Sponsorship Deals: Saudi Arabia is becoming a key player in global e-sports, hosting large-scale events such as the Gamers8 festival, which attracts top international teams. The government is also forming partnerships with leading e-sports organizations to strengthen the countrys position as a hub for competitive gaming in the Middle East. These initiatives are driving the rapid growth of e-sports and enhancing the overall gaming market in Saudi Arabia.

Market Challenges

- Regulatory Constraints: The Saudi gaming market faces strict content regulations, with certain games being censored or banned due to cultural considerations. The regulatory body enforces policies that restrict the sale or modification of games to comply with local norms, posing challenges for developers. These restrictions can hinder market growth and complicate entry for both international and local game developers, creating additional hurdles in content creation and distribution.

- High Localization Costs: Gaming companies entering the Saudi market must invest in localization, ensuring games are translated into Arabic and adapted to fit cultural expectations. This process involves significant costs, including meeting regulatory requirements. The ongoing need to adjust content for evolving cultural norms and regulations adds further complexity, making it especially difficult for smaller developers to compete in the market

KSA Gaming Market Future Outlook

Over the next few years, the Saudi Arabia gaming market is expected to witness continuous growth, driven by a rapidly expanding digital infrastructure, government support for the gaming and e-sports sectors, and the increasing popularity of mobile and cloud gaming. The market's trajectory will also benefit from growing youth engagement, rising investments in game development, and the hosting of major e-sports tournaments.

Market Opportunities

- Growing Female Gamer Segment: The number of female gamers in Saudi Arabia is steadily increasing due to changing societal norms and greater access to digital entertainment. This emerging demographic offers a promising opportunity for gaming companies to create content specifically tailored to female gamers, from casual mobile games to more complex narrative-driven experiences. This shift opens up a previously untapped market segment, encouraging more diverse game development and engagement.

- Development of Local Game Studios: Government initiatives to diversify the economy are creating opportunities for the growth of local game studios in Saudi Arabia. These initiatives include training programs and funding aimed at nurturing local talent in game design and development. As a result, Saudi developers are gaining the skills and support needed to create culturally relevant games and compete on the global stage, boosting the local gaming ecosystem.

Scope of the Report

|

Device Type |

Consoles Mobile Devices PC/Laptops |

|

Gaming Platform |

Online Offline |

|

Game Type |

Action/Adventure Sports/Racing Simulation/Strategy Puzzle/Casual Role-Playing Games (RPG) |

|

Distribution Channel |

Digital Physical Retail |

|

Region |

North South East West |

Products

Key Target Audience

Gaming Device Manufacturers

Telecommunications Companies

Data Analytics and AI Companies

Event Management Companies

Merchandising and Gaming Accessories Companies

Government and Regulatory Bodies (e.g., Saudi General Entertainment Authority)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Sony Interactive Entertainment

Microsoft Corporation

Tencent Games

NetEase Games

Ubisoft Entertainment

Riot Games

Activision Blizzard

Electronic Arts

Square Enix Holdings

Falafel Games

Table of Contents

1. Saudi Arabia Gaming Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (Gaming Devices, Platforms, Distribution Channels, Content Types, Consumer Demographics)

1.3. Market Growth Rate

1.4. Market Segmentation Overview

1.5. Market Ecosystem and Key Stakeholders

2. Saudi Arabia Gaming Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

2.4. Market Size by Segment (Gaming Devices, Platforms, Content, Demographics)

3. Saudi Arabia Gaming Market Analysis

3.1. Growth Drivers

3.1.1. Rising Youth Population

3.1.2. Government Initiatives (e.g., Vision 2030)

3.1.3. Increased Internet Penetration and Mobile Device Adoption

3.1.4. E-sports Growth and Sponsorship Deals

3.2. Market Challenges

3.2.1. Regulatory Constraints

3.2.2. High Localization Costs

3.2.3. Limited Game Development Ecosystem

3.3. Opportunities

3.3.1. Growing Female Gamer Segment

3.3.2. Development of Local Game Studios

3.3.3. Potential for VR/AR Gaming Expansion

3.4. Trends

3.4.1. Mobile Gaming Domination

3.4.2. Shift to Cloud Gaming Platforms

3.4.3. Growth in Subscription-Based Gaming Services

3.5. Government Regulation

3.5.1. Gaming Content Censorship Policies

3.5.2. Public-Private Partnerships for E-sports

3.5.3. Incentives for Local Game Developers

3.6. SWOT Analysis

3.7. Porters Five Forces Analysis

3.8. Competition Ecosystem

4. Saudi Arabia Gaming Market Segmentation

4.1. By Device Type

4.1.1. Consoles

4.1.2. Mobile Devices (Smartphones, Tablets)

4.1.3. PC/Laptops

4.2. By Gaming Platform

4.2.1. Online (Cloud Gaming, Streaming)

4.2.2. Offline (Physical Games, Disks)

4.3. By Game Type

4.3.1. Action and Adventure

4.3.2. Sports and Racing

4.3.3. Simulation and Strategy

4.3.4. Puzzle and Casual

4.3.5. Role-Playing Games (RPG)

4.4. By Distribution Channel

4.4.1. Digital (PlayStation Store, Steam, App Store)

4.4.2. Physical Retail (Game Stores, Malls)

4.5. By Consumer Demographics

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

5. Saudi Arabia Gaming Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Electronic Arts Inc.

5.1.2. Activision Blizzard Inc.

5.1.3. Tencent Games

5.1.4. Sony Interactive Entertainment

5.1.5. Microsoft Corporation

5.1.6. NetEase Games

5.1.7. PUBG Corporation

5.1.8. Ubisoft Entertainment SA

5.1.9. Riot Games, Inc.

5.1.10. Square Enix Holdings Co., Ltd.

5.1.11. Gameloft SE

5.1.12. AppLovin Corporation

5.1.13. Saudi Game Development Companies (Falafel Games, Khosouf Studio)

5.1.14. Epic Games

5.1.15. Nintendo Co., Ltd.

5.2. Cross Comparison Parameters (Employee Size, Revenue, Headquarters, Gaming Titles, User Base, Market Share, R&D Investments, M&A Activity)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Saudi Arabia Gaming Market Regulatory Framework

6.1. Content Rating System (Local Censorship Guidelines, Age Ratings)

6.2. Taxation on Gaming Revenues

6.3. E-sports Licensing and Event Regulations

6.4. Incentives for Local Game Development

7. Saudi Arabia Gaming Future Market Size (In USD Mn)

7.1. Market Growth Projections by Device

7.2. Future Market Segmentation by Platform

7.3. Key Factors Driving Future Market Growth (Population Dynamics, Technological Advancements, Government Support)

8. Saudi Arabia Gaming Future Market Segmentation

8.1. By Device Type

8.2. By Game Type

8.3. By Distribution Channel

8.4. By Platform (Cloud Gaming, Streaming Services)

8.5. By Region

9. Saudi Arabia Gaming Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. White Space Opportunity Analysis

9.3. Product/Content Development Strategies

9.4. Marketing and Brand Positioning Initiatives

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial step involved identifying critical market variables within the Saudi Arabia gaming market. This was done through desk research and analysis of proprietary databases, allowing us to map out the major industry stakeholders.

Step 2: Market Analysis and Construction

Historical data analysis was performed to assess market dynamics, including gaming device penetration and mobile gaming growth. Market penetration and revenue generation were evaluated across the gaming segments to ensure data accuracy.

Step 3: Hypothesis Validation and Expert Consultation

We developed market hypotheses regarding the growth of mobile and cloud gaming, which were validated through interviews with industry experts from top gaming companies in the region.

Step 4: Research Synthesis and Final Output

The final synthesis of research involved gathering detailed insights from gaming manufacturers and developers in Saudi Arabia to corroborate the market data, ensuring a robust analysis.

Frequently Asked Questions

01. How big is the Saudi Arabia Gaming Market?

The Saudi Arabia gaming market is valued at USD 1.87 billion, driven by the increased adoption of mobile gaming and government support for e-sports initiatives.

02. What are the key growth drivers for the Saudi Arabia Gaming Market?

Key growth drivers in Saudi Arabia gaming market include the rising youth population, high smartphone penetration, and government initiatives like Vision 2030, which support the development of the gaming and entertainment sectors.

03. Who are the major players in the Saudi Arabia Gaming Market?

Key players in the Saudi Arabia gaming market include Sony Interactive Entertainment, Microsoft Corporation, Tencent Games, NetEase Games, and local developer Falafel Games, all of whom are shaping the gaming landscape.

04. What challenges does the Saudi Arabia Gaming Market face?

Challenges in Saudi Arabia gaming market include regulatory constraints regarding content censorship, high localization costs for global developers, and a relatively small local game development ecosystem.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.