KSA Healthcare Analytics Market Outlook to 2030

Region:Middle East

Author(s):Sanjana

Product Code:KROD704

October 2024

94

About the Report

KSA Healthcare Analytics Market Overview

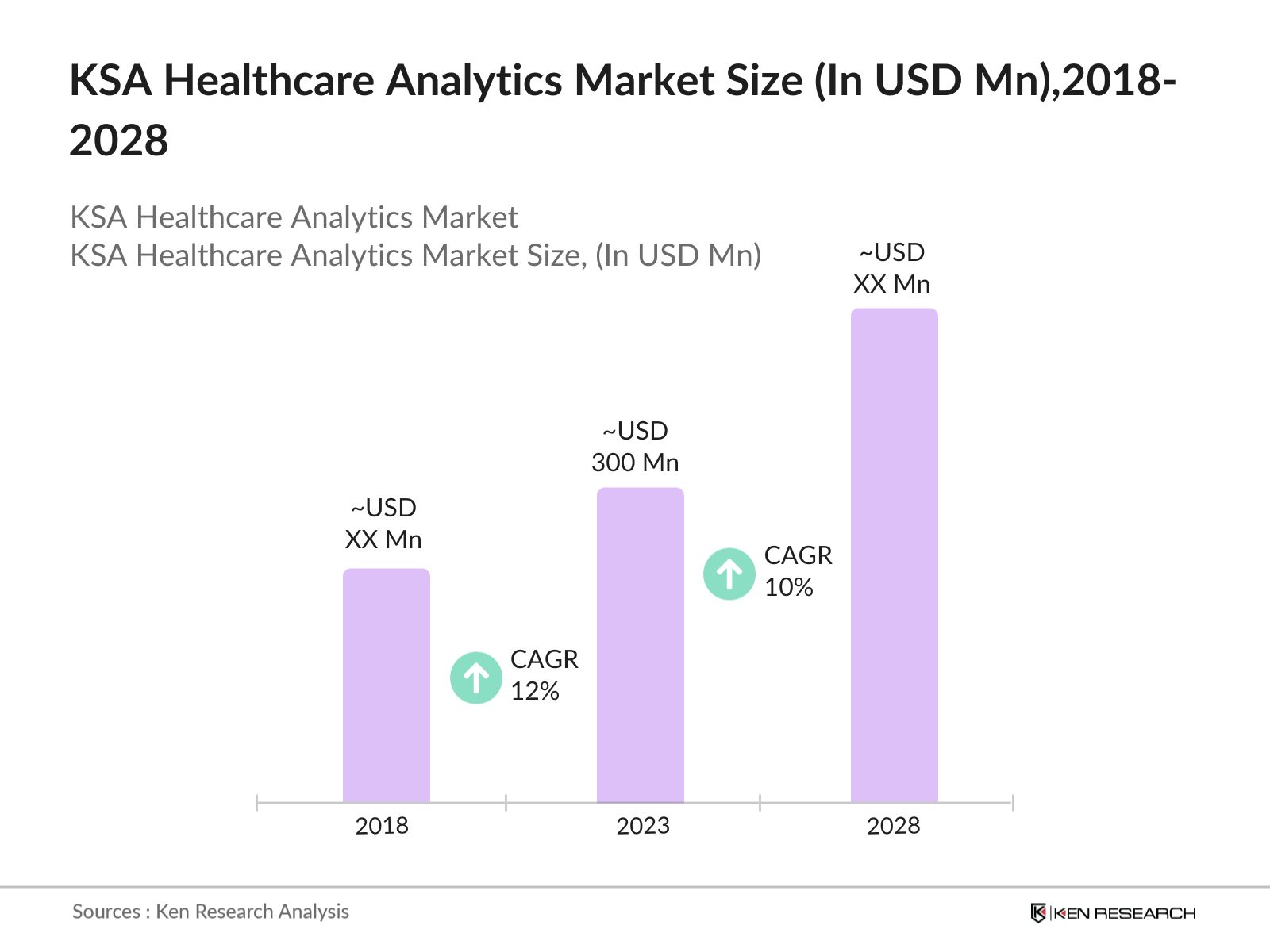

- KSA Healthcare Analytics Market is growing at a notable rate at USD 300 million in 2023. This growth is driven by the increasing adoption of electronic health records (EHR) and the government's emphasis on digital health transformation.

- Prominent players in the KSA Healthcare Analytics Market include IBM Watson Health, Cerner Corporation, Philips Healthcare, Oracle Health Sciences, and SAS Institute. These companies are leading the market with their innovative solutions and extensive experience in healthcare analytics.

- In 2024, SDAIA and IBM took a significant step forward by signing a memorandum of understanding (MoU) to integrate SDAIA's Arabic Large Language Model (ALLaM) into IBM's Watsonx platform. This collaboration aimed to revolutionize AI applications and enhance AI's generative abilities, creating more intelligent and responsive systems.

- Riyadh and Jeddah dominate the KSA Healthcare Analytics Market due to their advanced healthcare infrastructure and concentration of leading healthcare institutions. These cities host several specialized hospitals and clinics that actively adopt healthcare analytics solutions to improve patient care and streamline operations, making them pivotal hubs for market growth.

KSA Healthcare Market Segmentation

The KSA Healthcare Analytics Market can be segmented based on several factors:

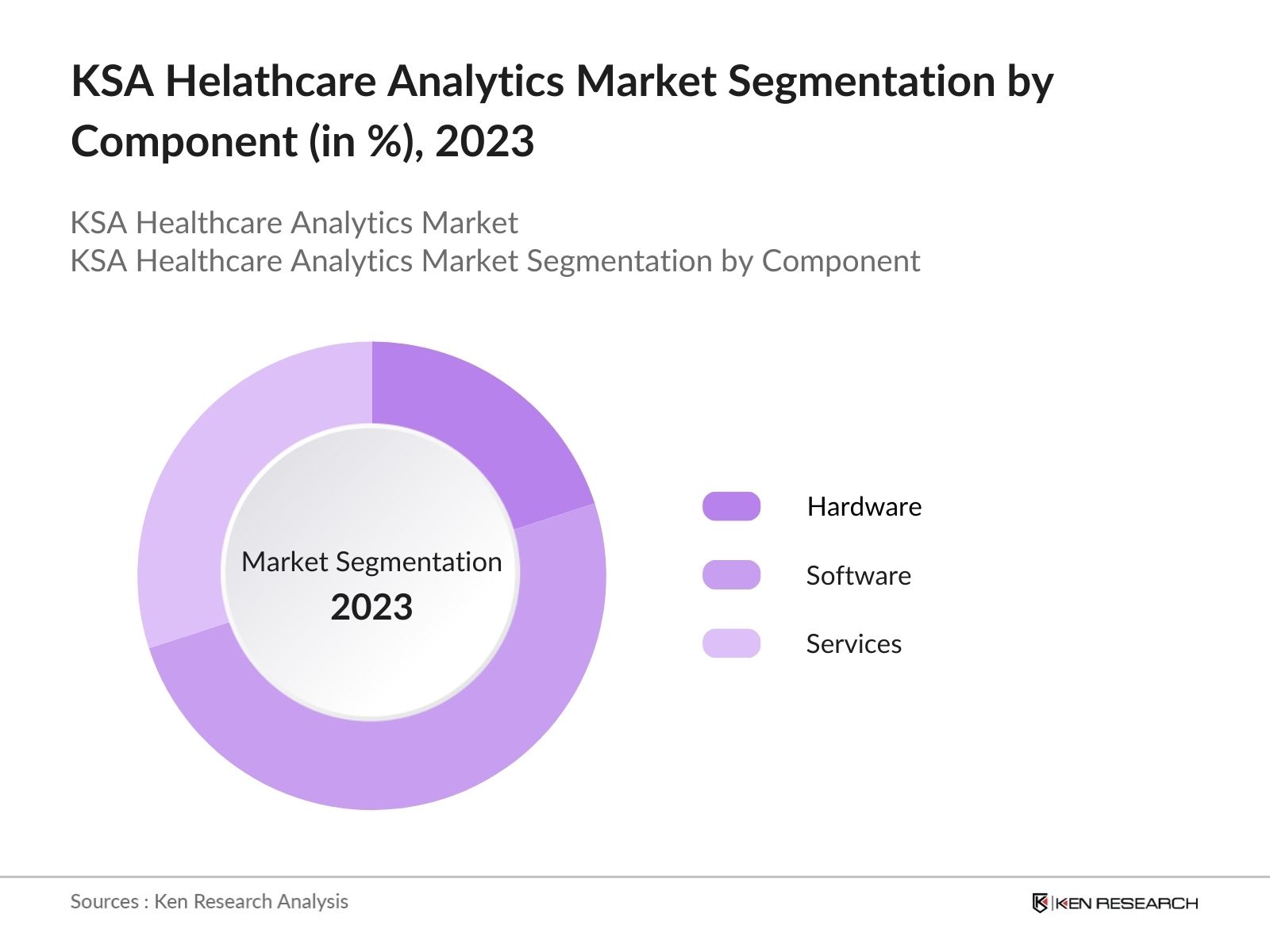

By Component: KSA Healthcare Analytics Market is segmented by Product Type into Hardware, Software & Services. In 2023, software segment dominates due to the increasing digitization of healthcare records and the need for sophisticated data management solutions. The rise in cloud-based solutions also contributes to the dominance of the software segment, offering scalability, flexibility, and lower upfront costs, making it an attractive option for healthcare organizations.

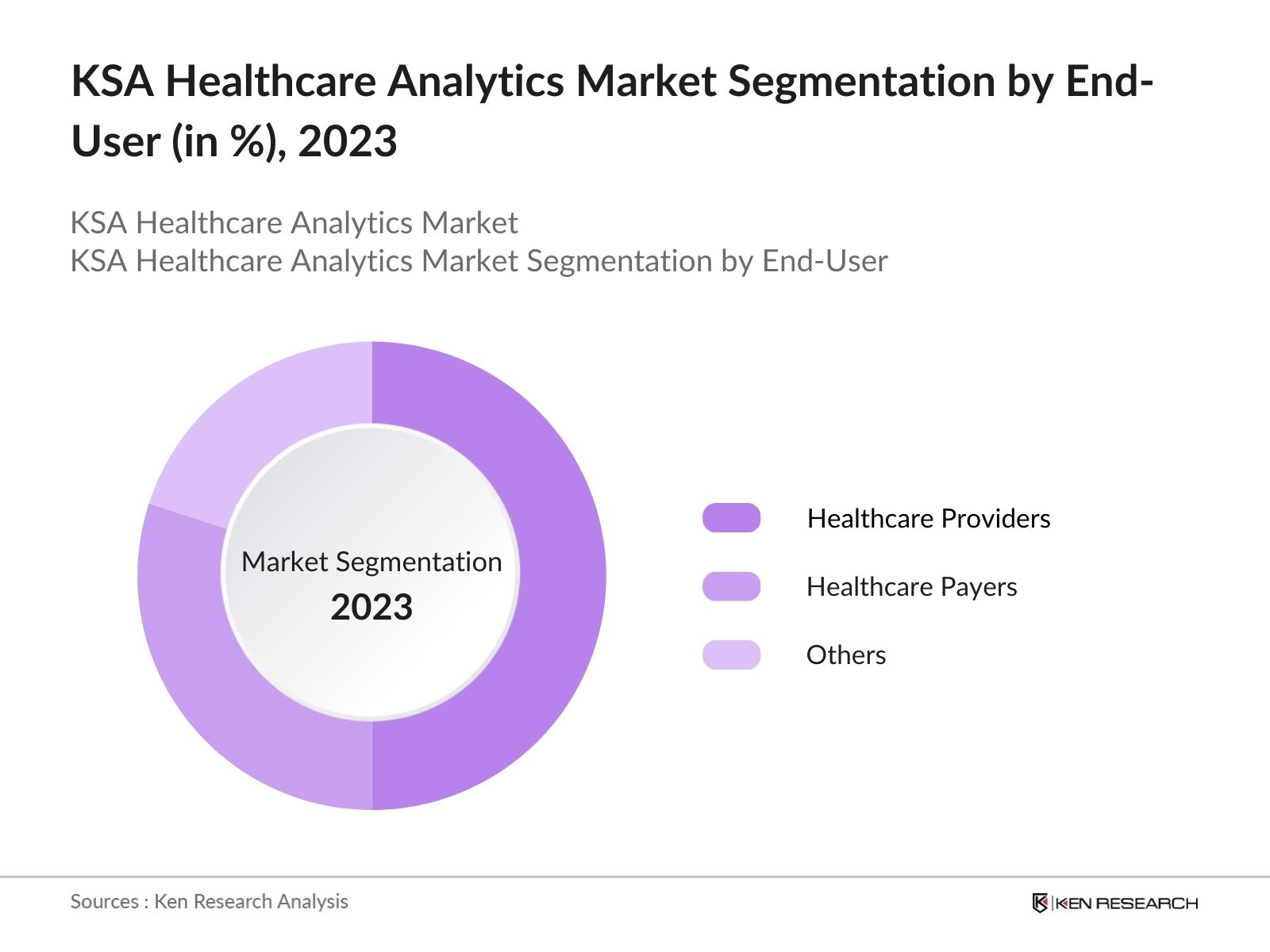

By End-User: KSA Healthcare Analytics Market is segmented by End-User into Healthcare Providers, Healthcare Payers & Others. In 2023, healthcare providers dominated due to the growing emphasis on improving patient care and outcomes drives healthcare providers to adopt advanced analytics solutions. By leveraging healthcare analytics, providers can gain valuable insights into patient data, enabling more accurate diagnoses, personalized treatment plans, and proactive care management.

By Region: KSA Healthcare Analytics Market is segmented by region into North, South, East & West regions. In 2023, the West region dominates due to the most advanced healthcare facilities in the country, including King Abdulaziz University Hospital and King Faisal Specialist Hospital. These institutions are at the forefront of adopting advanced healthcare technologies, including analytics, to improve patient care and operational efficiency.

KSA Healthcare Analytics Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

IBM Watson Health |

2015 |

New York, USA |

|

Cerner Corporation |

1979 |

Missouri, USA |

|

Philips Healthcare |

1891 |

Amsterdam, Netherlands |

|

Oracle Health Sciences |

1977 |

California, USA |

|

SAS Institute |

1976 |

North Carolina, USA |

- SDAIA Launches ALLaM on Watsonx: In May 2024, SDAIA launched ALLaM, an Arabic Large Language Model, on IBM's watsonx platform. This open-source model, featuring governance tools for responsible deployment, aims to enhance Arabic AI capabilities across sectors, including healthcare. The initiative aligns with IBM's ethical AI guidelines and promotes Arabic within generative AI, reinforcing Saudi Arabia's leadership in AI tailored to its market needs.

- GE Healthcare and Dr. Sulaiman Al Habib Group: In 2024, GE Healthcare partnered with Dr. Sulaiman Al Habib Medical Group in Saudi Arabia to provide advanced digital healthcare technology solutions. This collaboration focuses on improving healthcare delivery and infrastructure through innovative technologies and medical equipment, supporting the expansion of private hospitals and clinics in the Kingdom, and aligning with broader healthcare advancement goals.

KSA Healthcare Analytics Industry Analysis

KSA Healthcare Analytics Market Growth Drivers:

- Adoption of Electronic Health Records (EHR): The Saudi Ministry of Health began implementing electronic medical records (EMRs) in select healthcare facilities. A significant push occurred in 2008 when the Ministry declared eHealth a priority, allocating substantial financial resources over USD 1.04 billion. The implementation of EHR systems enhances patient care and operational efficiency, providing a substantial boost to the market.

- Rising Incidences of Chronic Diseases: According to United Nations Development Programme, the four main non-communicable diseases (NCDs) kill around 22,000 people in KSA per year. The need for predictive analytics to manage and prevent these conditions is growing, prompting healthcare providers to invest in advanced analytics solutions that can identify high-risk patients and implement early intervention strategies.

- Government Investments in Digital Health: The Saudi government has allocated approximately $1.5 billion towards healthcare IT and digital transformation programs from 2021 to 2024. This funding supports the implementation of sophisticated analytics platforms in public healthcare facilities, enhancing data-driven decision-making processes and improving overall healthcare delivery.

KSA Healthcare Analytics Market Challenges:

- Data Privacy and Security Concerns: Ensuring data privacy and security remains a significant challenge in the KSA Healthcare Analytics Market. There have been multiple data breaches affecting healthcare providers, highlighting vulnerabilities in data protection mechanisms. The healthcare sector's increasing reliance on digital platforms necessitates stringent security protocols to safeguard sensitive patient information, posing a continuous challenge for market growth.

- High Implementation Costs: The high costs associated with implementing advanced healthcare analytics solutions are a barrier to market expansion. In 2023, the average cost of deploying a comprehensive analytics platform in a hospital was $100,000 to $250,000. These substantial expenses can be prohibitive for smaller healthcare facilities, limiting widespread adoption and slowing market growth.

KSA Healthcare Analytics Market Government Initiatives:

- National Transformation Program (NTP): The National Transformation Program (NTP), launched in 2016, aims to improve various sectors, including healthcare, through digital transformation. The NTP has successfully expanded online services and improved internet connectivity, which are essential for digital health initiatives. By the end of 2020, the program had achieved significant milestones like increasing internet speed and expanding government services online.

- Saudi Data and Artificial Intelligence Authority (SDAIA): Established in 2019, the Saudi Data and Artificial Intelligence Authority (SDAIA) plays a critical role in promoting the use of data and AI across sectors, including healthcare. SDAIA's initiatives aim to enhance efficiency and productivity in healthcare through data-driven decision-making and improved health outcomes.

KSA Healthcare Analytics Future Market Outlook

The future of the KSA Healthcare Analytics Market is poised for substantial growth, driven by government initiatives and technological advancements. The Vision 2030 healthcare reform continues to push for digital transformation, with significant investments in healthcare IT infrastructure.

Future Market Trends

- Expansion of AI and Machine Learning in Healthcare Analytics: By 2028, the integration of AI and machine learning technologies into healthcare analytics is anticipated to experience substantial growth. These advancements will enhance predictive analytics capabilities, allowing healthcare providers to identify trends and potential health issues more accurately and proactively, ultimately improving patient care and outcomes.

- Increased Focus on Personalized Medicine: The future of healthcare analytics in Saudi Arabia is shifting towards personalized medicine. Advanced analytics solutions will enable healthcare professionals to customize treatments and interventions based on individual patients unique health data, resulting in improved patient outcomes and more efficient allocation of healthcare resources.

Scope of the Report

|

By Component |

Hardware Software Services |

|

By End User |

Healthcare Providers Healthcare Payers Others |

|

By Region |

North South East West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Healthcare IT Companies

Medical Device Manufacturers

Biotechnology Companies

Cloud Service Providers

Pharmaceutical Manufacturers

Remote Diagnostics Firms

Investment & Venture Capitalist Firms

Government & Regulatory Bodies (Ministry of Health, Saudi Food & Drug Authority etc.)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Major Players Mentioned in the Report:

IBM Watson Health

Cerner Corporation

Philips Healthcare

Oracle Health Sciences

SAS Institute

McKesson Corporation

Allscripts Healthcare Solutions

OptumHealth

Siemens Healthineers

QlikTech International

Table of Contents

1. KSA Healthcare Analytics Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

2. KSA Healthcare Analytics Market Size (in USD Mn), 2023

2.1. Current Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments

3. KSA Healthcare Analytics Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Adoption of Electronic Health Records (EHR)

3.1.2. Government Focus on Digital Health Transformation

3.1.3. Rising Incidences of Chronic Diseases

3.2. Restraints

3.2.1. Data Privacy and Security Concerns

3.2.2. High Implementation Costs

3.3. Opportunities

3.3.1. Expansion of AI and Machine Learning in Healthcare

3.3.2. Increased Focus on Personalized Medicine

3.4. Trends

3.4.1. Integration of AI and Analytics for Predictive Healthcare

3.4.2. Rising Adoption of Cloud-Based Solutions

3.5. Government Regulations

3.5.1. National Transformation Program (NTP)

3.5.2. SDAIAs Digital Health Initiatives

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. KSA Healthcare Analytics Market Segmentation, 2023

4.1. By Component (in Value %)

4.1.1. Hardware

4.1.2. Software

4.1.3. Services

4.2. By End-User (in Value %)

4.2.1. Healthcare Providers

4.2.2. Healthcare Payers

4.2.3. Others

4.3. By Region (in Value %)

4.3.1. North Region

4.3.2. South Region

4.3.3. East Region

4.3.4. West Region

5. KSA Healthcare Analytics Market Competitive Landscape

5.1. Major Companies Profiled

5.1.1. IBM Watson Health

5.1.2. Cerner Corporation

5.1.3. Philips Healthcare

5.1.4. Oracle Health Sciences

5.1.5. SAS Institute

5.2. Company Cross Comparison (No. of Employees, Headquarters, Inception Year, Revenue)

5.3. Strategic Initiatives

5.4. Partnerships and Collaborations

6. KSA Healthcare Analytics Market Regulatory Framework

6.1. Industry Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. KSA Healthcare Analytics Market Future Outlook, 2023-2028

7.1. Future Market Size Projections

7.2. Key Drivers of Future Growth

8. KSA Healthcare Analytics Future Market Segmentation, 2028

8.1. By Component (in Value %)

8.2. By End-User (in Value %)

8.3. By Region (in Value %)

9. KSA Healthcare Analytics Market Future Trends

9.1. Growth of AI and Machine Learning in Healthcare Analytics

9.2. Focus on Personalized Medicine

10. KSA Healthcare Analytics Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building

Collating statistics on KSA Healthcare Analytics Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for KSA Healthcare Analytics Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing

Building market hypothesis and conducting CATIs with industry exerts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output

Our team will approach multiple healthcare analytics suppliers and distributors companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from healthcare analytics suppliers and distributors companies.

Frequently Asked Questions

01 How big is the KSA Healthcare Analytics Market?

The KSA Healthcare Analytics Market was valued at USD 300 million in 2023, driven by the increasing adoption of electronic health records (EHR), government investments in digital health, and the rising prevalence of chronic diseases.

02 What are the challenges in the KSA Healthcare Analytics Market?

Challenges in the KSA Healthcare Analytics Market include data privacy and security concerns, high implementation costs, and a lack of skilled professionals trained in data analytics. These factors can hinder the market's growth and widespread adoption of analytics solutions.

03 Who are the major players in the KSA Healthcare Analytics Market?

Key players in the KSA Healthcare Analytics Market include IBM Watson Health, Cerner Corporation, Philips Healthcare, Oracle Health Sciences, and SAS Institute. These companies lead the market with their innovative solutions and extensive experience in healthcare analytics.

04 What are the growth drivers of the KSA Healthcare Analytics Market?

KSA Healthcare Analytics Market is propelled by factors such as the widespread adoption of electronic health records (EHR), rising incidences of chronic diseases, and substantial government investments in digital health infrastructure. These drivers enhance data-driven decision-making and improve patient care.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.