KSA Logistics Automation Market Overview to 2030

Region:Middle East

Author(s):Yogita Sahu

Product Code:KROD2676

October 2024

88

About the Report

KSA Logistics Automation Market Overview

- The KSA Logistics Automation Market is valued at USD 556 million based on a five-year historical analysis, driven primarily by the expansion of e-commerce, demand for efficient supply chain management, and increased adoption of automation technologies in warehousing. The market's growth has also been fueled by government investment under Saudi Arabias Vision 2030 initiative, which aims to modernize infrastructure and logistics to transform the Kingdom into a global logistics hub.

- Key cities like Riyadh and Jeddah dominate the logistics automation market in the Kingdom, primarily due to their strategic location, well-established industrial zones, and access to major ports and airports. These cities serve as the primary entry points for imports and exports, enabling the efficient distribution of goods across the region.

- The Saudi government launched the NIDLP with an investment of $453 billion to strengthen the logistics infrastructure. The program promotes the adoption of advanced logistics automation technologies, including AI-driven supply chain management and robotics, to enhance the country's position as a global logistics hub. As part of the initiative, automation has been integrated into several logistics centers, improving the overall efficiency of the sector.

KSA Logistics Automation Market Segmentation

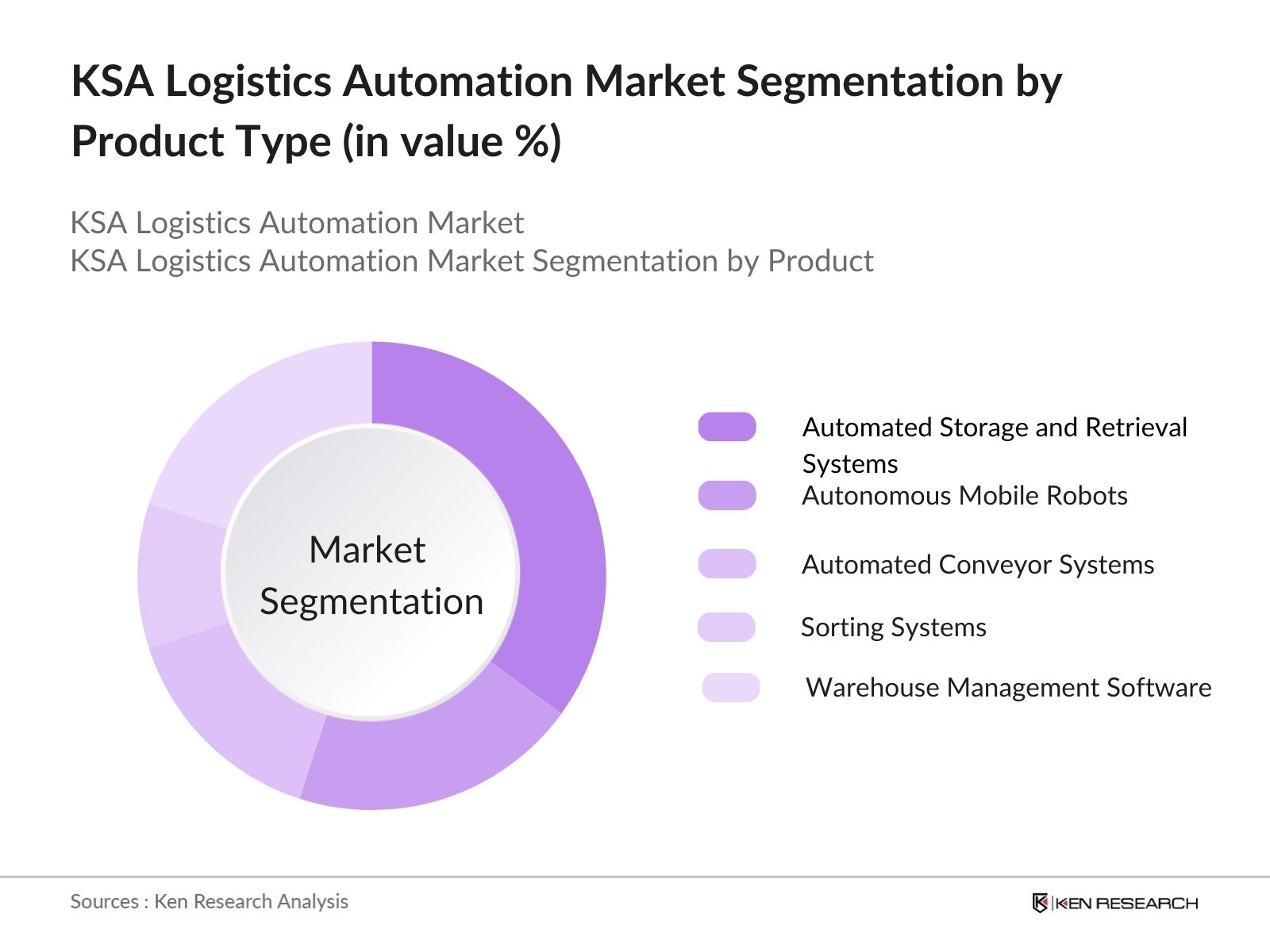

By Product Type: The market is segmented by product type into Automated Storage and Retrieval Systems (ASRS), Autonomous Mobile Robots (AMRs), Automated Conveyor Systems, Sorting Systems, and Warehouse Management Software (WMS). The Automated Storage and Retrieval Systems (ASRS) segment holds a dominant market share due to its ability to optimize space utilization, improve inventory accuracy, and enhance order fulfillment speed.

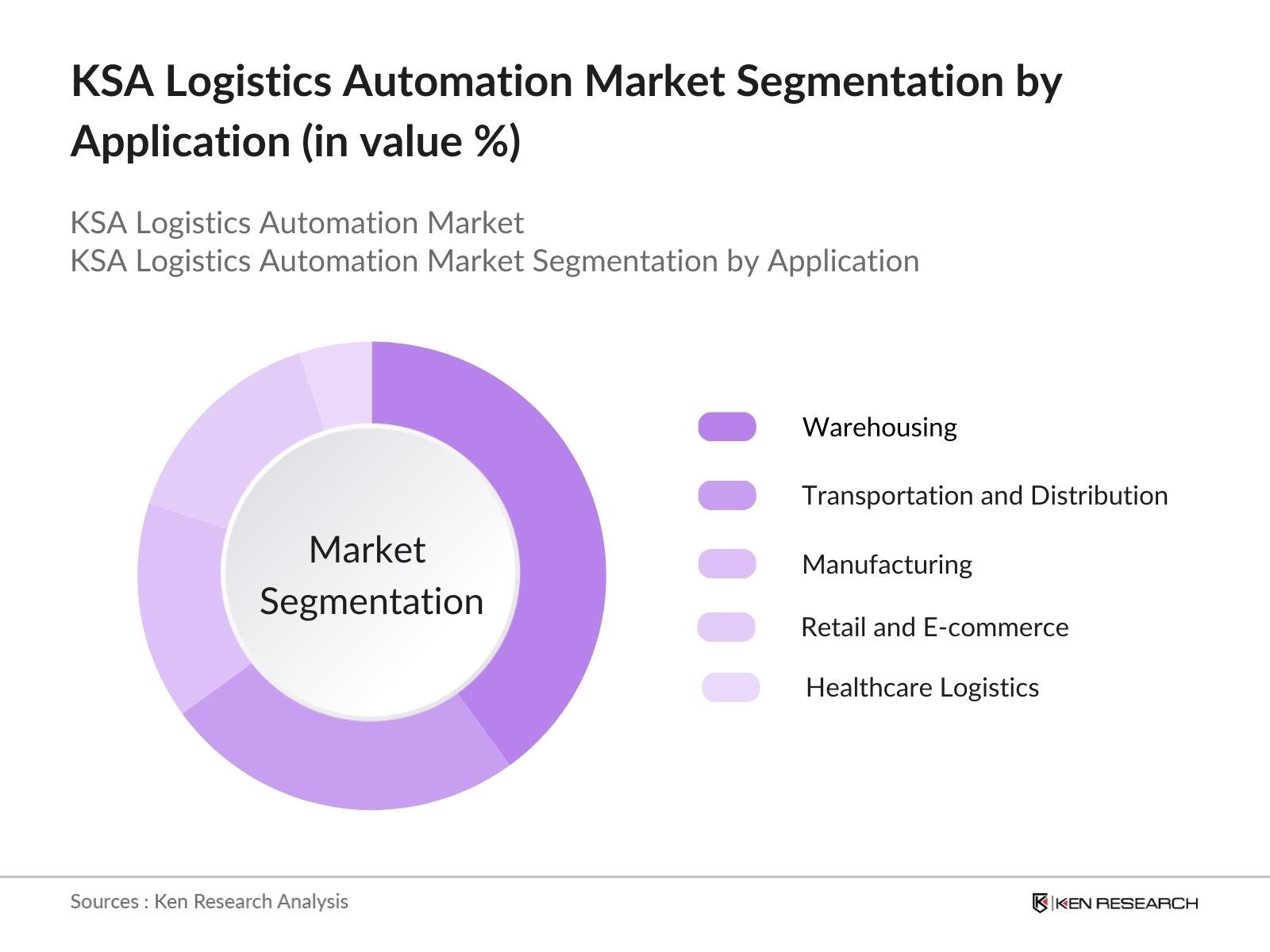

By Application: The market is also segmented by application into Warehousing, Transportation and Distribution, Manufacturing, Retail and E-commerce, and Healthcare Logistics. Warehousing dominates the market as it plays a crucial role in logistics automation. The Kingdoms growing retail and e-commerce sectors are driving significant demand for automated warehousing solutions.

KSA Logistics Automation Market Competitive Landscape

The market is dominated by a few key players, including local and global companies that provide solutions for warehouses, transportation, and distribution. The consolidation of these key companies highlights their significant influence in shaping the market.

|

Company |

Year Established |

Headquarters |

Market Specialization |

Revenue (USD Bn) |

No. of Employees |

Technology Focus |

Geographical Presence |

R&D Spending |

|

Dematic |

1819 |

Atlanta, USA |

||||||

|

Honeywell Intelligrated |

1893 |

Charlotte, USA |

||||||

|

Swisslog |

1900 |

Buchs, Switzerland |

||||||

|

SSI Schaefer |

1937 |

Neunkirchen, Germany |

||||||

|

KUKA AG |

1898 |

Augsburg, Germany |

KSA Logistics Automation Market Analysis

Market Growth Drivers

- Growing E-Commerce Sector: E-commerce is a driver of logistics automation in Saudi Arabia. The Ministry of Communications and Information Technology (MCIT) reported that the e-commerce sector in KSA exceeded $12 billion in sales in 2022. The rapid growth of e-commerce requires fast, efficient, and scalable logistics solutions, making automation essential to handle high order volumes and streamline distribution processes. Automated warehousing, robotics, and advanced tracking systems are increasingly being adopted by retailers and logistics providers to meet this demand.

- Automation in Transportation: The demand for automated solutions in the transportation segment, particularly for last-mile delivery, is on the rise. According to the Saudi Ministry of Transport, the number of automated delivery vehicles, including electric and autonomous trucks, increased in 2023. Automated route optimization and AI-powered fleet management systems are being adopted to improve efficiency, reduce fuel consumption, and enhance delivery speed, especially in urban areas.

- Rising Investments in Smart Logistics Hubs: Saudi Arabia has been investing heavily in the development of smart logistics hubs across the country. The National Industrial Development and Logistics Program (NIDLP) allocated $50 billion to smart logistics and automated transport infrastructure in 2022. The goal is to create a network of smart logistics centers integrated with automated systems, such as automated cargo sorting, intelligent warehouse management systems, and real-time tracking technologies, to support the rapid growth of the logistics sector.

Market Restraints

- Technical Challenges: Despite the push towards automation, technical challenges related to system integration, software interoperability, and customization of automation technologies pose significant barriers. The International Monetary Fund (IMF) reported in 2022 that 43% of companies in KSA faced difficulties in integrating automated systems into existing logistics frameworks.

- Lack of Skilled Workforce: The dearth of a skilled workforce to operate and maintain automated logistics systems remains a major challenge. As of 2022, the Saudi Ministry of Human Resources and Social Development reported that only 19% of the workforce possessed the necessary technical skills for advanced automation systems. The shortage of trained technicians and engineers who specialize in logistics automation is particularly pronounced, further slowing the adoption rate of automation technologies in the logistics sector.

KSA Logistics Automation Market Future Outlook

Over the next five years, the KSA Logistics Automation industry is expected to experience growth driven by continued investment in smart infrastructure, advancements in autonomous technologies, and the expansion of the e-commerce sector. The Kingdoms strategic plans under Vision 2030 emphasize developing the logistics and warehousing industry to reduce dependence on oil and become a global logistics hub.

Future Market Opportunities

- Increased Use of AI and Machine Learning: The logistics sector in Saudi Arabia will see a rise in the use of AI and machine learning technologies for supply chain optimization. By 2028, AI-driven logistics systems will be implemented by over 70% of logistics companies in the country, leading to better demand forecasting, inventory management, and real-time tracking of goods.

- Growth in Drone-Based Deliveries: Drone-based deliveries are set to revolutionize the logistics industry in Saudi Arabia. By 2027, drone deliveries will be widely used, particularly in rural and remote areas, following the introduction of commercial drone regulations. The use of drones will improve delivery times in hard-to-reach locations and reduce transportation costs for logistics companies.

Scope of the Report

|

By Product Type |

Automated Storage and Retrieval Systems (ASRS) Autonomous Mobile Robots (AMRs) Automated Conveyor Systems Sorting Systems Warehouse Management Software (WMS) |

|

By Application |

Warehousing Transportation and Distribution Manufacturing Retail and E-commerce Healthcare Logistics |

|

By Industry |

Automotive Retail FMCG Oil and Gas Pharmaceutical |

|

By Technology |

RFID and Barcode Technology Automated Picking Solutions Robotics and AI Integration Drones for Delivery Cloud-Based Logistics Solutions |

|

By Region |

North East West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Logistics Companies

Government and Regulatory Bodies (Ministry of Transport, Saudi Customs, etc.)

Investments and Venture Capital Firms

Manufacturing Companies

Automotive Manufacturers

Pharmaceutical and Healthcare Companies

Construction and Infrastructure Companies

Telecommunications Companies

Airlines and Airport Logistics Companies

Financial Institutions and Private Equity Firms

Companies

Players Mentioned in the Report:

Dematic

Honeywell Intelligrated

Swisslog

SSI Schaefer

KUKA AG

Zebra Technologies

Blue Yonder (JDA Software)

Manhattan Associates

Geek+

Locus Robotics

Toyota Material Handling

Daifuku

Vanderlande

Kardex Group

Siemens Logistics

Table of Contents

1. KSA Logistics Automation Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Logistics Automation Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Logistics Automation Market Analysis

3.1. Growth Drivers

3.1.1. Expansion of E-commerce Sector

3.1.2. Increased Government Investment in Infrastructure (Vision 2030)

3.1.3. Growing Demand for Same-Day Delivery

3.1.4. Adoption of Industry 4.0 in Supply Chain

3.2. Market Challenges

3.2.1. High Initial Capital Investments

3.2.2. Limited Skilled Workforce

3.2.3. Regulatory Compliance

3.3. Opportunities

3.3.1. Growth of Smart Warehousing

3.3.2. Rising Adoption of Autonomous Vehicles and Robotics

3.3.3. Integration of Artificial Intelligence (AI) in Logistics

3.4. Trends

3.4.1. Adoption of Automated Guided Vehicles (AGVs)

3.4.2. Implementation of Internet of Things (IoT) in Warehouses

3.4.3. Real-time Tracking and Monitoring Solutions

3.5. Government Regulation

3.5.1. Vision 2030 Initiatives

3.5.2. National Industrial Development and Logistics Program (NIDLP)

3.5.3. Customs and Tariff Regulations

3.5.4. Public-Private Partnerships

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Technology Providers, End-users, Regulatory Bodies, etc.)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. KSA Logistics Automation Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Automated Storage and Retrieval Systems (ASRS)

4.1.2. Autonomous Mobile Robots (AMRs)

4.1.3. Automated Conveyor Systems

4.1.4. Sorting Systems

4.1.5. Warehouse Management Software (WMS)

4.2. By Application (In Value %)

4.2.1. Warehousing

4.2.2. Transportation and Distribution

4.2.3. Manufacturing

4.2.4. Retail and E-commerce

4.2.5. Healthcare Logistics

4.3. By Industry (In Value %)

4.3.1. Automotive

4.3.2. Retail

4.3.3. FMCG

4.3.4. Oil and Gas

4.3.5. Pharmaceutical

4.4. By Technology (In Value %)

4.4.1. RFID and Barcode Technology

4.4.2. Automated Picking Solutions

4.4.3. Robotics and AI Integration

4.4.4. Drones for Delivery

4.4.5. Cloud-Based Logistics Solutions

4.5. By Region (In Value %)

4.5.1. Riyadh

4.5.2. Jeddah

4.5.3. Eastern Province

4.5.4. Makkah

4.5.5. Al Madinah

5. KSA Logistics Automation Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Dematic

5.1.2. Honeywell Intelligrated

5.1.3. Swisslog

5.1.4. SSI Schaefer

5.1.5. Daifuku

5.1.6. Zebra Technologies

5.1.7. Toyota Material Handling

5.1.8. KUKA AG

5.1.9. Blue Yonder (JDA Software)

5.1.10. Manhattan Associates

5.1.11. Geek+

5.1.12. Locus Robotics

5.1.13. Vanderlande

5.1.14. Kardex Group

5.1.15. Siemens Logistics

5.2 Cross Comparison Parameters (Revenue, Headquarters, No. of Employees, Core Competencies, Technology Focus, R&D Spending, Market Share, Geographical Reach)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. KSA Logistics Automation Market Regulatory Framework

6.1. Standards for Automation in Warehousing and Logistics

6.2. Compliance Requirements for Automated Technologies

6.3. Certification Processes for Automated Systems

7. KSA Logistics Automation Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Logistics Automation Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Industry (In Value %)

8.4. By Technology (In Value %)

8.5. By Region (In Value %)

9. KSA Logistics Automation Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This step involves creating an extensive ecosystem map of the major stakeholders in the KSA Logistics Automation market. Using secondary research, relevant variables such as product types, applications, and technology adoption are identified to understand the market dynamics.

Step 2: Market Analysis and Construction

Historical data related to logistics automation adoption, revenue generation, and market penetration is compiled. This includes evaluating logistics companies' use of automation technologies and calculating market performance metrics.

Step 3: Hypothesis Validation and Expert Consultation

Expert interviews with industry professionals and market players are conducted using computer-assisted telephone interviews (CATIs) to validate market trends, operational challenges, and future projections.

Step 4: Research Synthesis and Final Output

Through in-depth interviews with automation solution providers and logistics operators, the final analysis is synthesized. This step ensures that bottom-up research is corroborated with field data, providing a clear picture of the KSA Logistics Automation market.

Frequently Asked Questions

01. How big is the KSA Logistics Automation Market?

The KSA Logistics Automation market is valued at USD 556 million, driven by e-commerce growth and increased adoption of automation technologies in logistics and warehousing.

02. What are the challenges in the KSA Logistics Automation Market?

Challenges in KSA Logistics Automation market include high initial investment costs, limited availability of skilled labor, and regulatory compliance issues. The need to continuously upgrade technologies also adds pressure on companies.

03. Who are the major players in the KSA Logistics Automation Market?

Key players in KSA Logistics Automation market include Dematic, Honeywell Intelligrated, Swisslog, SSI Schaefer, and KUKA AG, each dominating specific areas of warehousing and automation solutions.

04. What are the growth drivers of the KSA Logistics Automation Market?

Growth in KSA Logistics Automation market is driven by increasing demand for efficient supply chain management, investments in smart logistics infrastructure, and rising e-commerce activities in the Kingdom.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.