KSA Modular Construction Market Outlook to 2030

Region:Middle East

Author(s):Naman Rohilla

Product Code:KROD744

November 2024

97

About the Report

KSA Modular Construction Market Overview

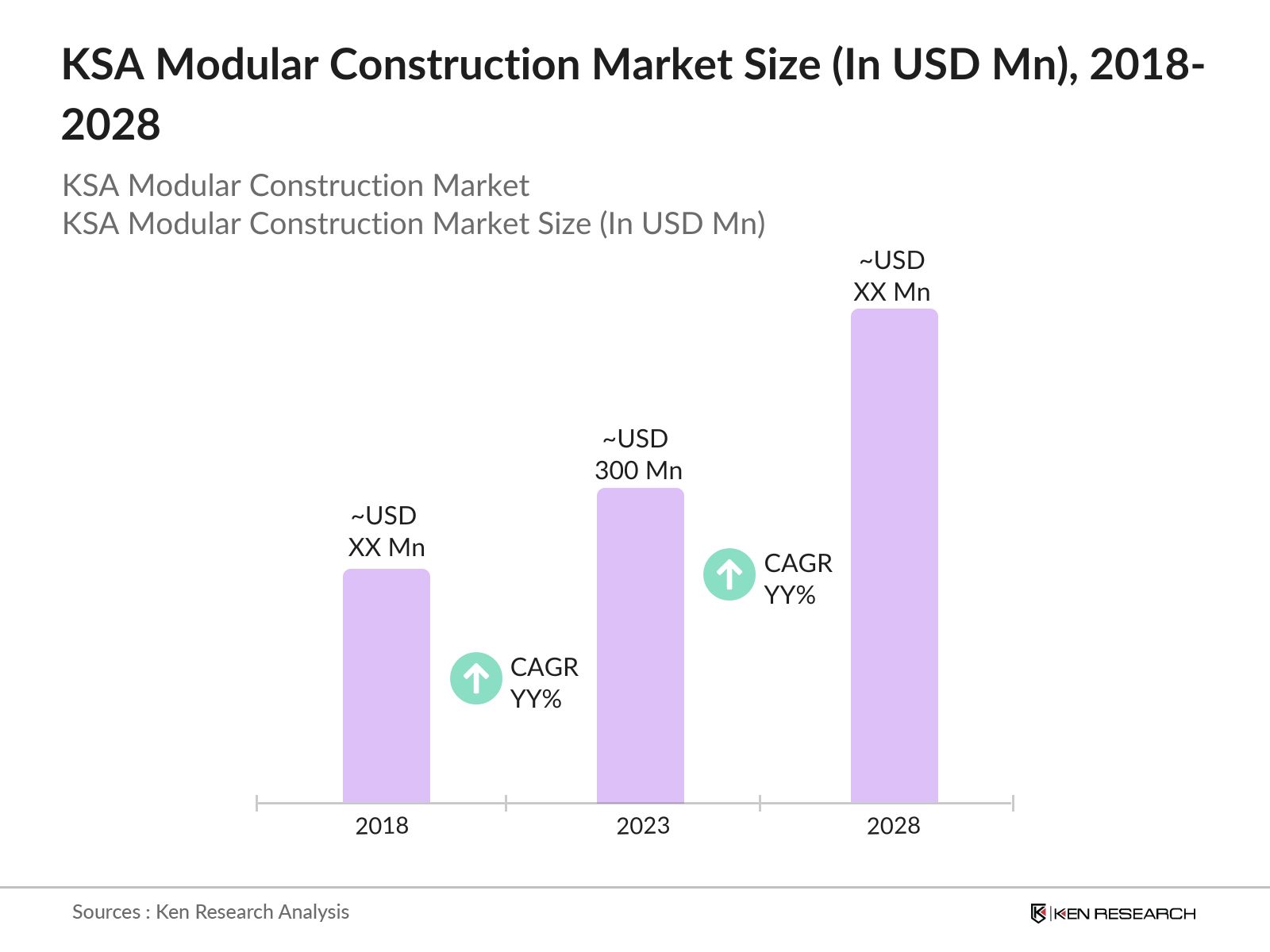

- The KSA modular construction market was valued at USD 300 million in 2023. This growth is driven by several factors, including the increasing need for efficient construction solutions, the government's focus on infrastructure development under Vision 2030, and the rising demand for residential and commercial spaces due to urbanization.

- The key players in the KSA Modular Construction Market include Red Sea Housing Services, Almoayyed Contracting Group, Dorce Prefabricated Building & Construction, Gulf Modular Group, and Katerra. These companies have established a strong presence in the market by offering innovative and customized modular solutions that cater to the diverse needs of the KSA construction sector.

- In 2023, Katerra secured a contract worth SAR 750 million to construct a series of modular schools across Riyadh. This project aims to address the growing demand for educational facilities and utilizes Katerra's state-of-the-art modular construction technology to ensure high-quality standards and expedited delivery.

- In 2023, Riyadh, the capital city of Saudi Arabia, dominated the modular construction market in the region, driven by the city's rapid urbanization, infrastructure development, and the implementation of several large-scale residential and commercial projects.

KSA Modular Construction Market Segmentation

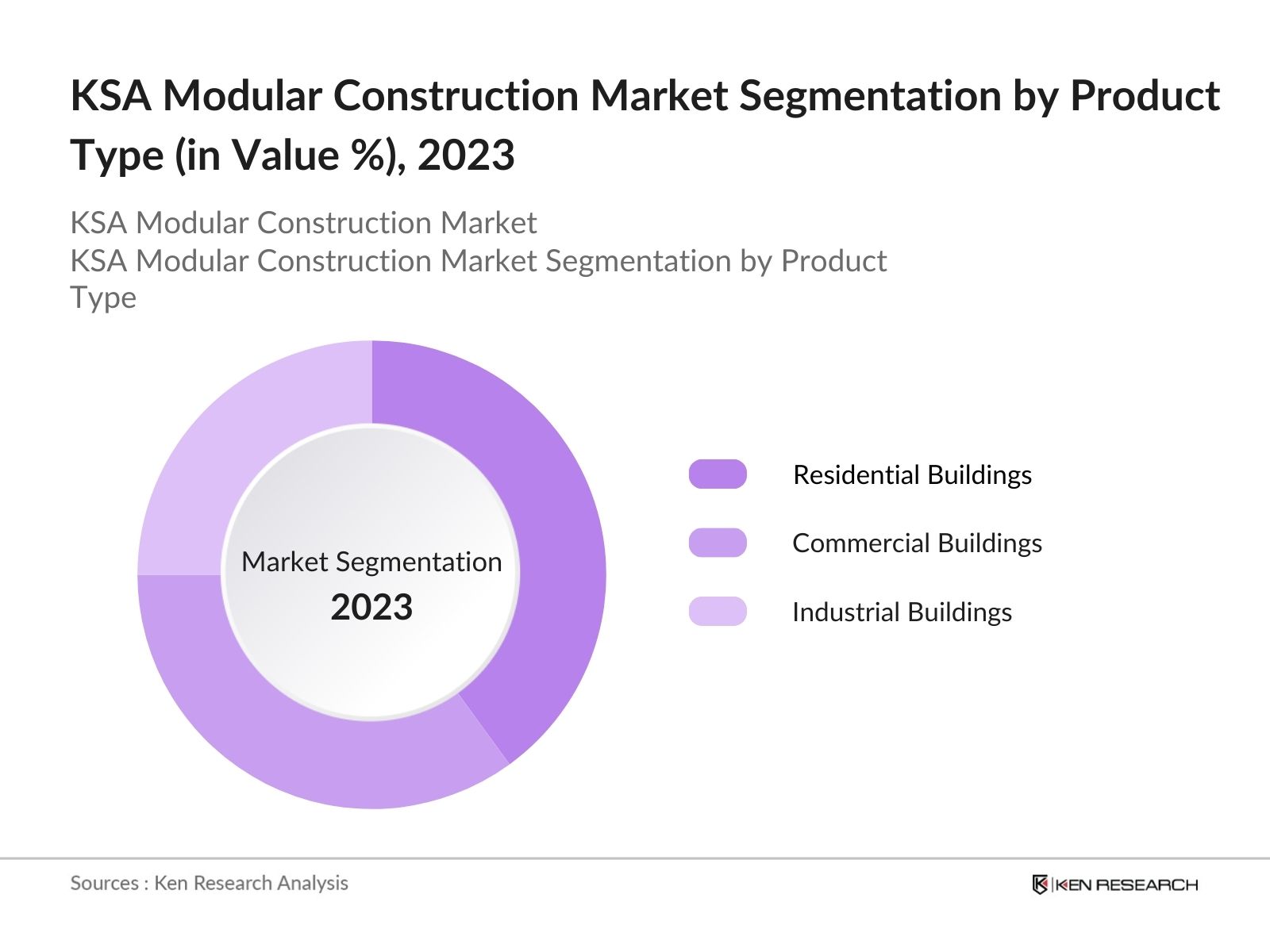

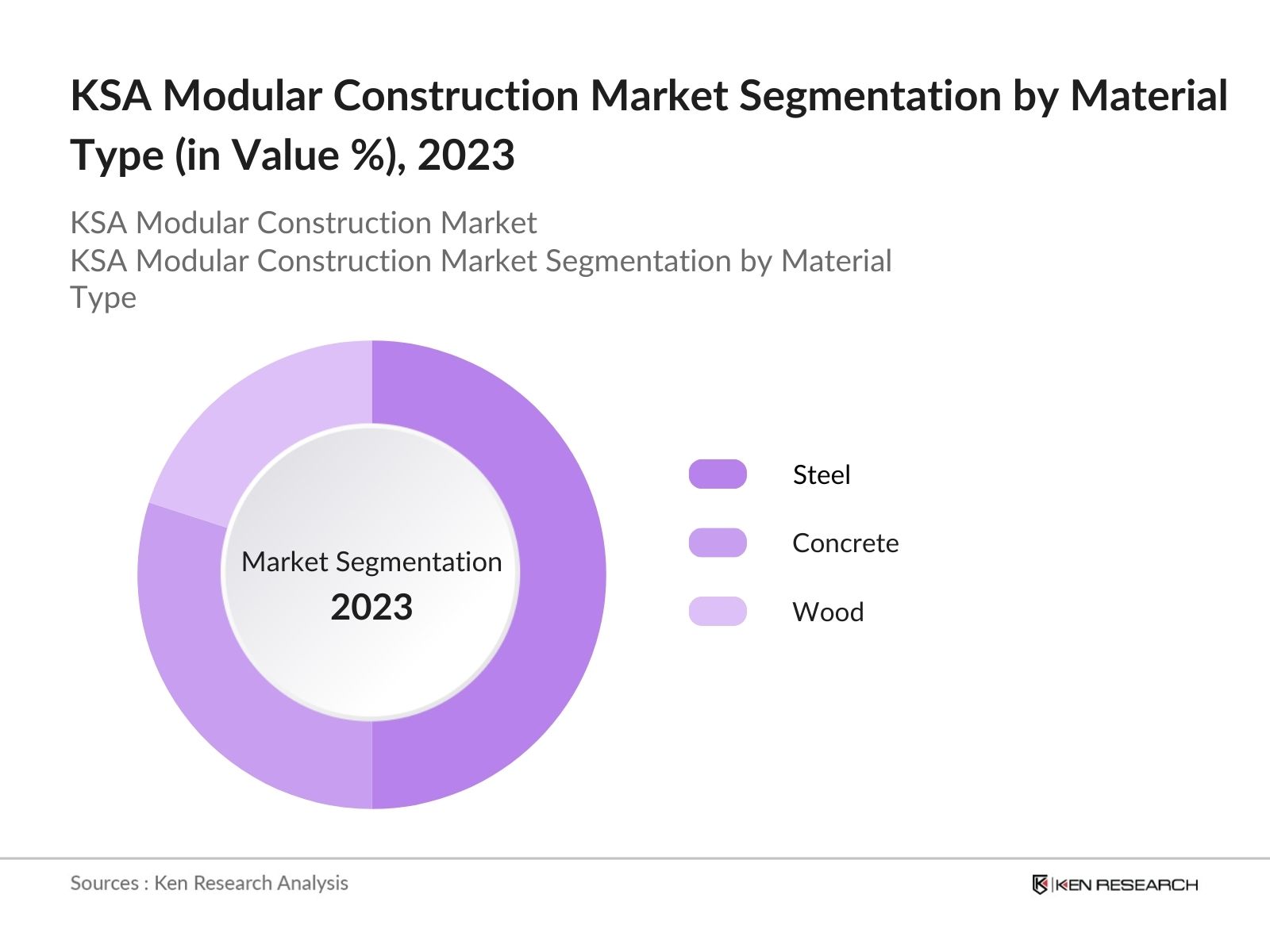

KSA's Modular Construction market is segmented into product type, material type, and region.

- By Product Type: The KSA Modular Construction Market is segmented by product type into Residential Buildings, Commercial Buildings, and Industrial Buildings. In 2023, the residential buildings segment holds the dominant market share in the KSA modular construction market. This dominance is attributed to the high demand for affordable housing solutions driven by the growing population and urbanization.

- By Material Type: The market is segmented by material type into steel, concrete, and wood. In 2023, Steel is the dominant material type in the KSA modular construction market. The preference for steel is due to its strength, durability, and flexibility, which make it suitable for a wide range of construction applications.

- By Region: The market is segmented by region into North, South, East, and West. In 2023, the northern region of Saudi Arabia, including cities like Tabuk, dominated the market. The region's growth is driven by the Neom project, which aims to create a technologically advanced and sustainable city.

KSA Modular Construction Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Red Sea Housing Services |

1976 |

Saudi Arabia |

|

Almoayyed Contracting Group |

1979 |

Bahrain |

|

Dorce Prefabricated |

1982 |

Turkey |

|

Gulf Modular Group |

1996 |

Saudi Arabia |

|

Katerra |

2015 |

USA |

- Red Sea Housing Services: In 2024, Red Sea Housing Services announced the expansion of its manufacturing facility in Jeddah, with an investment of SAR 200 million. This expansion aims to increase the production capacity of modular units to meet the rising demand from residential and commercial projects.

- Dorce Prefabricated: In 2023, Dorce Prefabricated introduced a new range of eco-friendly modular homes, incorporating advanced insulation materials and energy-efficient designs. This innovation is expected to reduce energy consumption by 30%, aligning with the global trend towards sustainable construction practices.

KSA Modular Construction Market Analysis

KSA Modular Construction Market Growth Drivers:

- Infrastructure Development Projects: In 2024, the KSA government allocated around SAR 50 billion for various infrastructure development projects, including smart cities and transportation networks. This investment is driving the demand for modular construction methods, which offer faster and more efficient building solutions.

- Housing Initiatives: The Saudi Ministry of Housing has planned to develop over 1.5 million housing units by 2025 as part of the Vision 2030 initiative. This large-scale housing project necessitates the adoption of modular construction to meet the tight deadlines and cost constraints. The Sakani program alone is expected to utilize modular construction for 500,000 housing units by 2025.

- Industrial Growth: The industrial sector in Saudi Arabia is expanding with investments totalling SAR 20 billion in 2024 for the development of industrial zones and logistic hubs. Modular construction is being increasingly adopted in these projects due to its ability to provide scalable and adaptable building solutions.

KSA Modular Construction Market Challenges:

- High Initial Investment: Modular construction requires substantial initial investment in manufacturing facilities and technology. In 2024, the cost of setting up a modular construction plant in KSA was estimated to be around SAR 500 million. This high upfront cost can be a barrier for new entrants and small-scale construction firms, limiting market expansion.

- Cultural and Market Acceptance: Traditional construction methods are deeply ingrained in the Saudi construction industry. Convincing stakeholders and clients to adopt modular construction techniques remains a challenge. Despite its benefits, there is still scepticism about the quality and durability of modular buildings among certain sections of the market.

KSA Modular Construction Market Government Initiatives:

- Neom Project: The Neom project, a futuristic mega-city with a budget of SAR 1.9 trillion, is a flagship initiative under Vision 2030. Modular construction is a key component of this project, which aims to create technologically advanced and sustainable living and working spaces. The project is expected to generate substantial demand for modular construction over the next decade.

- Industrial Development Strategy: The Saudi Industrial Development Fund (SIDF) has launched a new strategy to support the growth of the industrial sector with a focus on modular construction. In 2024, the SIDF allocated SAR 10 billion in loans and grants to companies adopting modular construction techniques for industrial projects, promoting innovation and efficiency in the sector.

KSA Modular Construction Future Market Outlook

KSA's Modular Construction market is expected to grow in the coming years. The market is also likely to shift towards more organized with established players and online platforms expanding their reach.

KSA Modular Construction Future Market Trends:

- Increased Adoption of Smart Technologies: By 2028, the integration of smart technologies in modular construction will become more prevalent. IoT-enabled modular units will offer enhanced energy efficiency, security, and comfort, making them an attractive option for residential and commercial projects.

- Expansion of Modular Industrial Buildings: The industrial sector's growth will spur the demand for modular construction in manufacturing, logistics, and warehousing. By 2028, the modular industrial buildings market in KSA is projected to grow substantially, driven by the need for scalable and adaptable construction solutions in the industrial sector.

Scope of the Report

|

By Product Type |

Residential Buildings Commercial Buildings Industrial Buildings |

|

By Material Type |

Steel Concrete Wood |

|

By Region |

North South East West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Government and Regulatory Bodies

Banks and Financial Institutes

Investors and Venture Capitalists

Construction Companies

Urban Planners

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Red Sea Housing Services

Almoayyed Contracting Group

Dorce Prefabricated Building & Construction

Gulf Modular Group

Katerra

Laing O'Rourke

Modular Building Solutions

Z Modular

Palomar Modular Buildings

Atco Structures & Logistics

Bouygues Construction

Vinci Construction

Skanska AB

Larsen & Toubro

Turner Construction Company

Al-Futtaim Carillion

Conxtech

Blokable

Sekisui House

TDR Projects

Table of Contents

1. KSA Modular Construction Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Modular Construction Market Size (in USD Million), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Modular Construction Market Analysis

3.1. Growth Drivers

3.1.1. Infrastructure Development Projects

3.1.2. Housing Initiatives

3.1.3. Industrial Growth

3.2. Restraints

3.2.1. High Initial Investment

3.2.2. Cultural and Market Acceptance

3.3. Opportunities

3.3.1. Increased Adoption of Smart Technologies

3.3.2. Expansion of Modular Industrial Buildings

3.4. Trends

3.4.1. Integration of Eco-Friendly Materials

3.4.2. Growth of Modular Schools and Hospitals

3.5. Government Regulation

3.5.1. Neom Project

3.5.2. Industrial Development Strategy

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. KSA Modular Construction Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Residential Buildings

4.1.2. Commercial Buildings

4.1.3. Industrial Buildings

4.2. By Material Type (in Value %)

4.2.1. Steel

4.2.2. Concrete

4.2.3. Wood

4.3. By Region (in Value %)

4.3.1. North

4.3.2. South

4.3.3. East

4.3.4. West

5. KSA Modular Construction Market Cross Comparison

5.1 Detailed Profiles of Major Companies

5.1.1. Red Sea Housing Services

5.1.2. Almoayyed Contracting Group

5.1.3. Dorce Prefabricated Building & Construction

5.1.4. Gulf Modular Group

5.1.5. Katerra

5.1.6. Laing O'Rourke

5.1.7. Modular Building Solutions

5.1.8. Z Modular

5.1.9. Palomar Modular Buildings

5.1.10. Atco Structures & Logistics

5.1.11. Bouygues Construction

5.1.12. Vinci Construction

5.1.13. Skanska AB

5.1.14. Larsen & Toubro

5.1.15. Turner Construction Company

5.1.16. Al-Futtaim Carillion

5.1.17. Conxtech

5.1.18. Blokable

5.1.19. Sekisui House

5.1.20. TDR Projects

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. KSA Modular Construction Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. KSA Modular Construction Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. KSA Modular Construction Market Future Market Size (in USD Million), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. KSA Modular Construction Market Future Market Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Material Type (in Value %)

9.3. By Region (in Value %)

10. KSA Modular Construction Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step: 1 Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate industry-level information.

Step: 2 Market Building

Collating statistics on the KSA Modular Construction market over the years and analysing the penetration of marketplaces as well as the ratio of service providers to compute the revenue generated for the market. We will also review service quality statistics to understand the revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing

Building market hypotheses and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output

Our team will approach multiple construction materials suppliers and manufacturing companies and understand the nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through the bottom-to-top approach from the construction materials suppliers and manufacturing companies.

Frequently Asked Questions

01 How big is the KSA Modular Construction Market?

The KSA modular construction market was valued at USD 300 million in 2023. This growth is driven by several factors, including the increasing need for efficient construction solutions, the government's focus on infrastructure development under Vision 2030, and the rising demand for residential and commercial spaces due to urbanization.

02 Who are the major players in the KSA Modular Construction Market?

The major players in the KSA modular construction market include Red Sea Housing Services, Almoayyed Contracting Group, Dorce Prefabricated Building & Construction, Gulf Modular Group, and Katerra. These companies have established themselves as leaders by offering innovative and customized modular solutions, contributing to the market's growth.

03 What are the growth drivers of the KSA Modular Construction Market?

The growth drivers of the KSA modular construction market include substantial infrastructure investments (SAR 50 billion in 2024), the Vision 2030 housing initiative with 1.5 million units by 2025, expanding industrial zones with SAR 20 billion investments, and supportive government regulations promoting sustainability.

04 What are the challenges in the KSA Modular Construction Market?

The KSA modular construction market faces challenges including a skilled labour shortage, supply chain disruptions affecting material availability, high initial investment costs, and cultural resistance to adopting modular methods despite their efficiency and sustainability benefits.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.