KSA Rigid Plastic Packaging Market Outlook to 2030

Region:Middle East

Author(s):Shreya

Product Code:KROD2547

October 2024

88

About the Report

KSA Rigid Plastic Packaging Market Overview

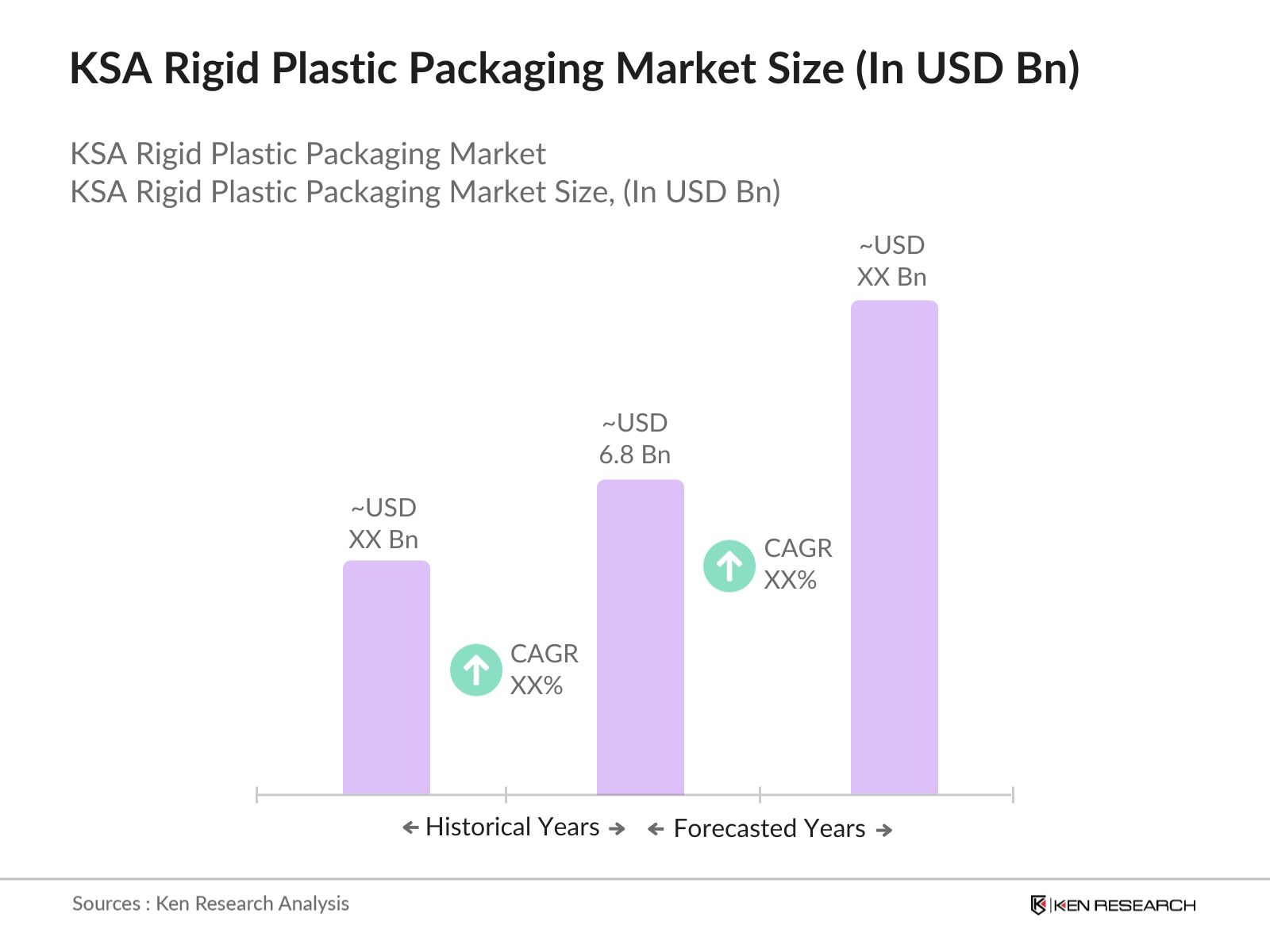

- The KSA rigid plastic packaging market is valued at USD 6.8 billion, based on a five-year historical analysis. This market growth is driven by the rising demand for packaged consumer goods, particularly in the food and beverage industry, where rigid plastic packaging offers durability and preservation benefits. The Kingdoms rapid urbanization, coupled with the increasing penetration of retail and e-commerce channels, has boosted the need for effective packaging solutions. Additionally, the growing emphasis on sustainability has influenced manufacturers to adopt innovative materials, supporting market expansion.

- The dominant regions driving the KSA rigid plastic packaging market are Riyadh and Jeddah, primarily due to their well-established industrial base and proximity to large-scale manufacturing and distribution hubs. Riyadh's strategic location as the Kingdom's capital facilitates significant economic activities, while Jeddah's position as a key port city enables efficient logistics for both domestic and international trade. These cities benefit from strong consumer demand and the presence of advanced infrastructure, contributing to their market dominance in rigid plastic packaging.

- Under the Saudi Vision 2030 initiative, the government has introduced stringent sustainability goals aimed at reducing environmental impact, directly affecting the packaging industry. The Saudi Green Initiative has set targets for reducing plastic waste and increasing the use of recyclable materials. As of 2024, the initiative mandates that 50% of all packaging used in Saudi Arabia must be recyclable by 2030, encouraging manufacturers to shift to more sustainable rigid plastic packaging solutions.

KSA Rigid Plastic Packaging Market Segmentation

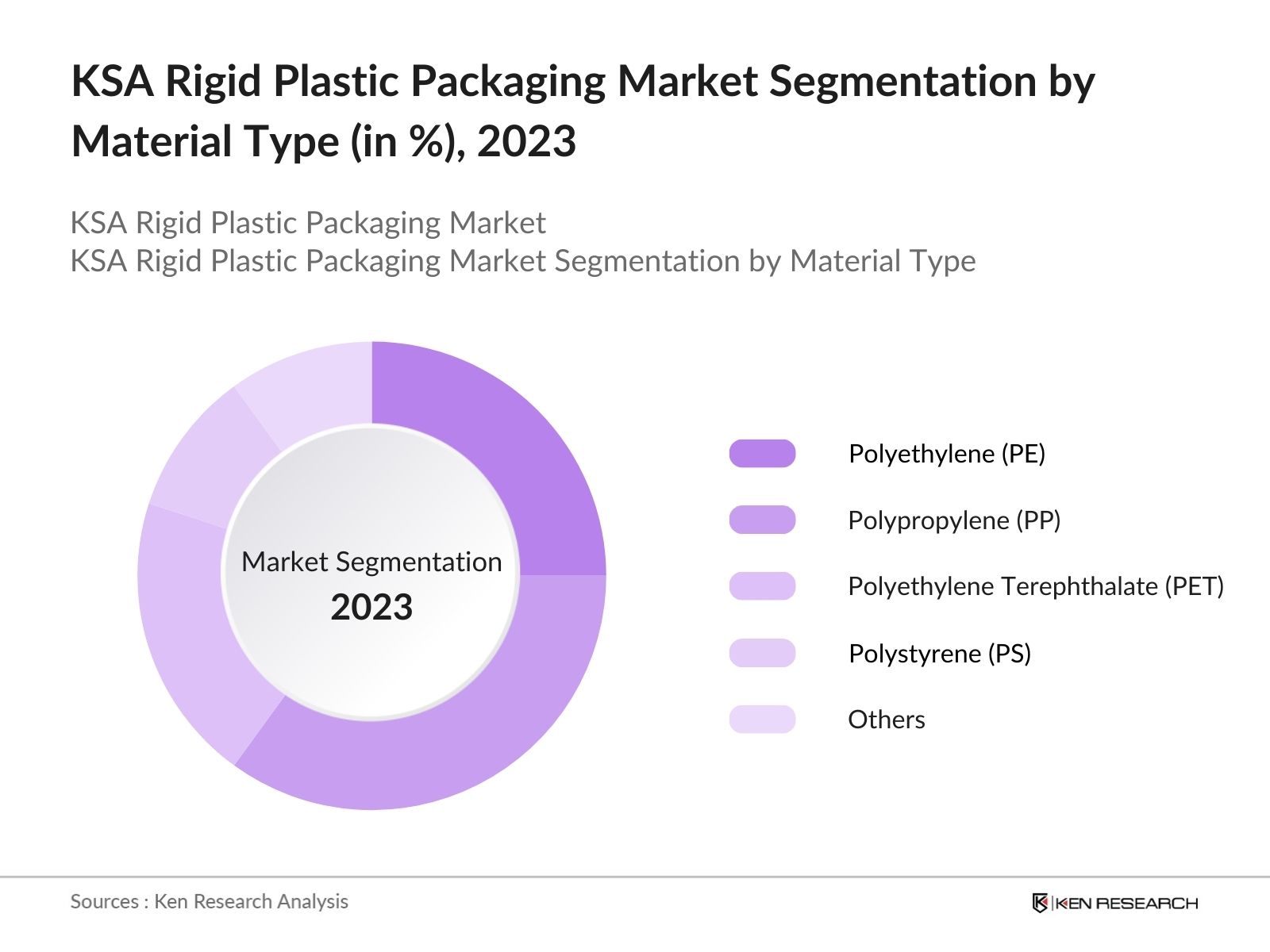

- By Material Type: The market is segmented by material type into polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), polystyrene (PS), and others. Recently, polypropylene (PP) has dominated this segment due to its versatile applications in various industries, particularly in food packaging. Its excellent moisture resistance, high melting point, and lightweight properties make it an ideal choice for manufacturers looking for cost-effective yet durable packaging solutions. Furthermore, PPs recyclability aligns with the increasing focus on sustainable packaging materials in the Kingdom.

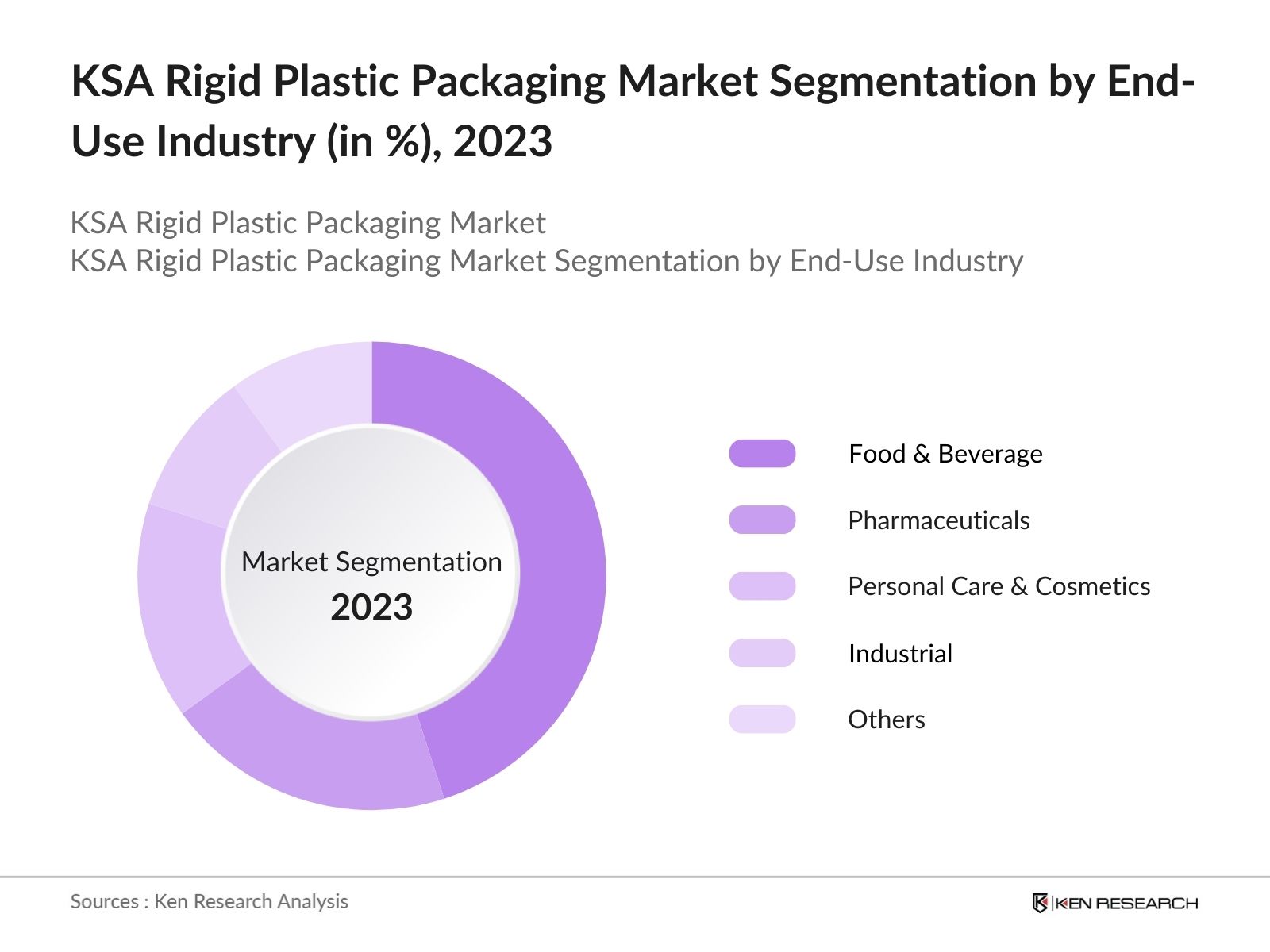

- By End-Use Industry: The market is segmented by end-use industry into food & beverage, pharmaceuticals, personal care & cosmetics, industrial, and others. The food & beverage segment holds a dominant share in this market, driven by the increasing demand for convenient, ready-to-eat food products and beverages. The robust growth of the fast-food industry and the rising consumption of packaged food have fueled the demand for rigid plastic packaging solutions that offer extended shelf life and protection from external contaminants. This sectors ongoing expansion continues to bolster the demand for rigid packaging in the KSA market.

KSA Rigid Plastic Packaging Market Competitive Landscape

The KSA rigid plastic packaging market is highly competitive, with a few key players dominating the landscape. These companies have leveraged their strong market presence, extensive distribution networks, and focus on product innovation to maintain their competitive edge. The industry is marked by a blend of local giants and international players, reflecting the diversity and vibrancy of the market. For instance, SABIC and Tasnee have solidified their market leadership due to their extensive production capabilities and emphasis on sustainability. Other players, like Greif and Napco National, continue to expand their offerings through strategic mergers and acquisitions.

Table: Major Players in KSA Rigid Plastic Packaging Market

|

Company Name |

Establishment Year |

Headquarters |

Production Capacity |

Global Presence |

Sustainability Initiatives |

Innovation & Technology |

Product Portfolio |

R&D Investments |

Market Share |

|---|---|---|---|---|---|---|---|---|---|

|

SABIC |

1976 |

Riyadh |

|||||||

|

Tasnee |

1985 |

Riyadh |

|||||||

|

Greif |

1877 |

Delaware, USA |

|||||||

|

Napco National |

1956 |

Dammam |

|||||||

|

Zamil Plastic Industries |

1977 |

Dammam |

KSA Rigid Plastic Packaging Industry Analysis

Growth Drivers

- Urbanization and Construction Boom: Saudi Arabias rapid urbanization has significantly impacted the rigid plastic packaging market. With over 84% of the population now living in urban areas, there has been an increasing demand for durable and efficient packaging, particularly in the construction sector where rigid plastic packaging is used for items like adhesives, paints, and sealants. Saudi Arabia's construction sector is valued at over $140 billion in 2024, as supported by the Saudi Ministry of Investment, highlighting the continued expansion of infrastructure and residential projects, driving demand for packaging materials across various industries.

- Rising Food & Beverage Industry: Saudi Arabia's food and beverage sector is a major growth driver for the rigid plastic packaging market. As of 2024, the country is expected to have over 8,000 food and beverage processing plants, a direct result of the rising demand for packaged food products. According to the Saudi Food and Drug Authority (SFDA), the domestic food industry has seen a significant expansion due to urbanization, rising incomes, and shifting consumer preferences toward packaged foods. This growth directly fuels the demand for rigid plastic packaging, which provides durability and extended shelf life for food products.

- Technological Advancements in Packaging Materials: Technological advancements in rigid plastic packaging have led to innovative solutions that enhance product preservation and transportation efficiency. In Saudi Arabia, packaging companies are investing in smart packaging technologies that extend shelf life, particularly in the food, beverage, and pharmaceutical sectors. The Saudi Standards, Metrology and Quality Organization (SASO) has supported the implementation of advanced materials, ensuring compliance with international standards. This technological shift has helped to streamline logistics while reducing overall material usage, increasing adoption in 2024.

Market Challenges

- Environmental Regulations and Sustainability Issues: Saudi Arabia is tightening environmental regulations in line with its Vision 2030 goals, creating challenges for the rigid plastic packaging market. The Saudi Waste Management Law, enacted in 2020, mandates stringent penalties for improper plastic disposal and imposes sustainability guidelines on packaging materials. As a result, companies must invest in recyclable materials and sustainable practices. In 2024, over 30% of packaging manufacturers faced challenges in meeting these new regulatory demands, as reported by the Saudi Ministry of Environment, Water, and Agriculture.

- Logistical and Distribution Challenges: The logistics and distribution infrastructure in Saudi Arabia continues to pose challenges for the rigid plastic packaging industry, especially in rural and underdeveloped regions. According to the Saudi Ministry of Transport, 40% of packaging manufacturers face delays due to inadequate logistics networks, increasing lead times and transportation costs. Additionally, as of 2024, high fuel prices and insufficient cold chain logistics have further exacerbated distribution issues, especially for temperature-sensitive products requiring rigid plastic packaging.

KSA Rigid Plastic Packaging Market Future Outlook

Over the next five years, the KSA rigid plastic packaging market is expected to exhibit remarkable growth driven by rising demand in the food & beverage sector, expansion in the e-commerce industry, and advancements in packaging technology. The increasing focus on sustainability and government initiatives aimed at reducing plastic waste will also play a crucial role in shaping the future of this market. Key innovations in bio-based plastics and circular economy practices will be pivotal in driving both growth and competition in the industry.

Future Market Opportunities

- Growth in E-commerce and Retail Industry: The rapid growth of e-commerce in Saudi Arabia presents significant opportunities for the rigid plastic packaging market. As of 2024, Saudi Arabias e-commerce market is growing immensely, according to the Communications and Information Technology Commission (CITC), with a high demand for durable, protective packaging for items ranging from electronics to food. With more consumers shopping online, retailers are seeking efficient, robust packaging solutions, driving demand for rigid plastic packaging to ensure product safety during transport.

- Adoption of Bio-Based Plastics: The adoption of bio-based plastics presents an emerging opportunity for rigid plastic packaging in Saudi Arabia. In 2024, the Saudi Ministry of Industry and Mineral Resources reported a growing number of manufacturers investing in biodegradable materials as part of the shift towards sustainability. This has been driven by government incentives and growing consumer demand for eco-friendly products. Bio-based rigid plastic packaging is particularly gaining traction in the food and beverage sector, where companies seek sustainable packaging solutions to align with national environmental goals.

Scope of the Report

|

Segment |

Sub-Segment |

|---|---|

|

By Material Type |

Polyethylene (PE) |

|

By End-Use Industry |

Food & Beverage |

|

By Packaging Type |

Bottles and Jars |

|

By Application |

Food Packaging |

|

By Region |

Riyadh |

Products

Key Target Audience

Packaging Material Manufacturers

Food & Beverage Companies

Pharmaceutical Firms

Personal Care & Cosmetics Brands

Industrial Packaging Users

Government and Regulatory Bodies (Saudi Standards, Metrology and Quality Organization)

Investments and Venture Capitalist Firms

Banks and Financial Institutes

Environmental Agencies (Saudi Environmental Society)

Companies

Major Players in the KSA Rigid Plastic Packaging Market

SABIC

Tasnee

Greif

Napco National

Zamil Plastic Industries

Almarai

Saudi Modern Packaging Co. (Modernpack)

Berry Global Group

Plastico Saudi Arabia

Huhtamaki PPL

RPC Group Plc

Middle East Packaging Company (MEPCO)

Jeddah Plastic Factory

Al-Obaikan Group

Al Bayader International

Table of Contents

1. KSA Rigid Plastic Packaging Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Rigid Plastic Packaging Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Rigid Plastic Packaging Market Analysis

3.1. Growth Drivers

3.1.1. Urbanization and Construction Boom

3.1.2. Rising Food & Beverage Industry

3.1.3. Technological Advancements in Packaging Materials

3.1.4. Government Initiatives for Sustainable Packaging

3.2. Market Challenges

3.2.1. Environmental Regulations and Sustainability Issues

3.2.2. Volatility in Raw Material Prices (Petrochemical Based)

3.2.3. Logistical and Distribution Challenges

3.3. Opportunities

3.3.1. Growth in E-commerce and Retail Industry

3.3.2. Adoption of Bio-Based Plastics

3.3.3. Expansion of Regional Manufacturing Plants

3.4. Trends

3.4.1. Shift towards Lightweight Packaging

3.4.2. Increased Demand for Customized Packaging Solutions

3.4.3. Circular Economy Initiatives (Recycling and Reusability)

3.5. Government Regulation

3.5.1. Saudi Vision 2030 Sustainability Goals

3.5.2. Plastic Waste Management Regulations

3.5.3. Environmental Packaging Standards and Certifications

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. KSA Rigid Plastic Packaging Market Segmentation

4.1. By Material Type (In Value %)

4.1.1. Polyethylene (PE)

4.1.2. Polypropylene (PP)

4.1.3. Polyethylene Terephthalate (PET)

4.1.4. Polystyrene (PS)

4.1.5. Others

4.2. By End-Use Industry (In Value %)

4.2.1. Food & Beverage

4.2.2. Pharmaceuticals

4.2.3. Personal Care & Cosmetics

4.2.4. Industrial

4.2.5. Others

4.3. By Packaging Type (In Value %)

4.3.1. Bottles and Jars

4.3.2. Cups and Containers

4.3.3. Rigid Trays

4.3.4. Caps & Closures

4.3.5. Others

4.4. By Application (In Value %)

4.4.1. Food Packaging

4.4.2. Beverage Packaging

4.4.3. Industrial Packaging

4.4.4. Pharmaceutical Packaging

4.4.5. Others

4.5. By Region (In Value %)

4.5.1. Riyadh

4.5.2. Jeddah

4.5.3. Dammam

4.5.4. Makkah

4.5.5. Others

5. KSA Rigid Plastic Packaging Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Tasnee

5.1.2. SABIC

5.1.3. Almarai

5.1.4. Zamil Plastic Industries

5.1.5. Greif

5.1.6. Napco National

5.1.7. Middle East Packaging Company (MEPCO)

5.1.8. RPC Group Plc

5.1.9. Berry Global Group

5.1.10. Plastico Saudi Arabia

5.1.11. Al Bayader International

5.1.12. Jeddah Plastic Factory

5.1.13. Al-Obaikan Group

5.1.14. Saudi Modern Packaging Co. (Modernpack)

5.1.15. Huhtamaki PPL

5.2. Cross Comparison Parameters (Revenue, Market Share, Production Capacity, Product Portfolio, Sustainability Initiatives, Innovation & Technology Adoption, Number of Employees, Global Presence)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants

5.8. Private Equity Investments

6. KSA Rigid Plastic Packaging Market Regulatory Framework

6.1. Environmental Standards for Packaging

6.2. Plastic Waste Management Policies

6.3. Compliance with Global Packaging Standards

6.4. Certification Processes

7. KSA Rigid Plastic Packaging Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Rigid Plastic Packaging Future Market Segmentation

8.1. By Material Type (In Value %)

8.2. By End-Use Industry (In Value %)

8.3. By Packaging Type (In Value %)

8.4. By Application (In Value %)

8.5. By Region (In Value %)

9. KSA Rigid Plastic Packaging Market Analyst's Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. White Space Opportunity Analysis

9.4. Strategic Marketing Initiatives

Research Methodology

Step 1: Identification of Key Variables

In this initial phase, we constructed an ecosystem map encompassing all key stakeholders within the KSA rigid plastic packaging market. This process involved extensive desk research and the utilization of proprietary databases to identify critical market dynamics.

Step 2: Market Analysis and Construction

We compiled and analyzed historical data relating to market penetration, product innovation, and revenue generation within the rigid plastic packaging sector. This step involved assessing market trends, key developments, and production statistics.

Step 3: Hypothesis Validation and Expert Consultation

To ensure accuracy, market hypotheses were validated through expert interviews with leading packaging companies and industry specialists. These consultations provided valuable insights that were instrumental in refining our market estimates.

Step 4: Research Synthesis and Final Output

The final phase involved direct engagement with packaging manufacturers to obtain detailed insights into market segments, consumer demand, and key performance indicators. This step ensured a comprehensive, accurate, and validated analysis of the KSA rigid plastic packaging market.

Frequently Asked Questions

1. How big is the KSA Rigid Plastic Packaging Market?

The KSA rigid plastic packaging market is valued at USD 6.8 billion, driven by the growing demand for food packaging and the expansion of the retail and e-commerce industries.

2. What are the challenges in the KSA Rigid Plastic Packaging Market?

Challenges in KSA rigid plastic packaging market include fluctuating raw material prices, increasing regulatory pressures regarding plastic waste management, and competition from alternative packaging materials like biodegradable plastics.

3. Who are the major players in the KSA Rigid Plastic Packaging Market?

Key players in KSA rigid plastic packaging market include SABIC, Tasnee, Greif, Napco National, and Zamil Plastic Industries, all of which hold significant market shares due to their strong production capacities and extensive product portfolios.

4. What are the growth drivers of the KSA Rigid Plastic Packaging Market?

Growth drivers in KSA rigid plastic packaging market include rising demand from the food & beverage sector, increasing urbanization, technological advancements in packaging materials, and government initiatives promoting sustainable packaging solutions.

5. What trends are shaping the KSA Rigid Plastic Packaging Market?

Key trends in KSA rigid plastic packaging market include the shift towards lightweight packaging, growing adoption of bio-based and recyclable materials, and the increasing focus on innovative and sustainable packaging solutions aligned with Saudi Vision 2030.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.