KSA Security Services Market Outlook to 2030

Region:Middle East

Author(s):Vijay Kumar

Product Code:KROD2612

December 2024

82

About the Report

KSA Security Services Market Overview

- The KSA Security Services market is valued at USD 200 billion, based on a five-year historical analysis. This market's growth is fueled by the increasing emphasis on national security and ongoing large-scale infrastructure projects like Neom and the Red Sea Development. The rising demand for both physical and electronic security solutions, driven by heightened concerns over terrorism and crime, along with regulatory requirements, has significantly contributed to the markets expansion.

- Cities like Riyadh, Jeddah, and Dammam are dominant in the KSA Security Services market. Riyadh is a hub for government institutions and large corporations, while Jeddah is a major commercial center and port city. Dammam, on the other hand, is the heart of the oil & gas industry. These cities are characterized by high security demands driven by their strategic importance, economic activities, and infrastructure development, necessitating robust security systems and personnel.

- The National Cybersecurity Authority in Saudi Arabia has implemented comprehensive guidelines to enhance cybersecurity measures. In 2023, these guidelines included stringent requirements for data protection and incident response protocols. Compliance with these regulations is mandatory for organizations handling sensitive information, impacting the security landscape across various sectors.

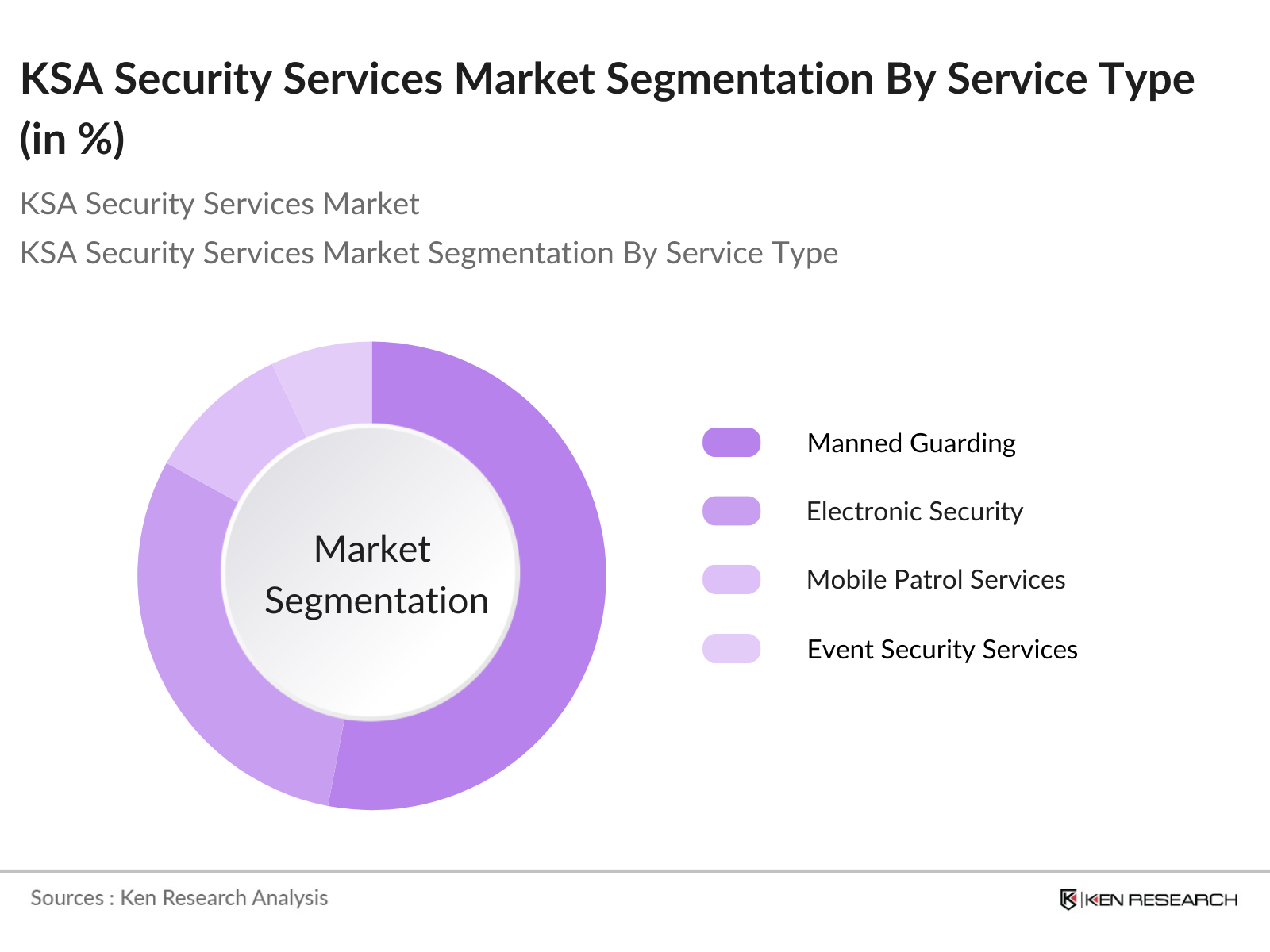

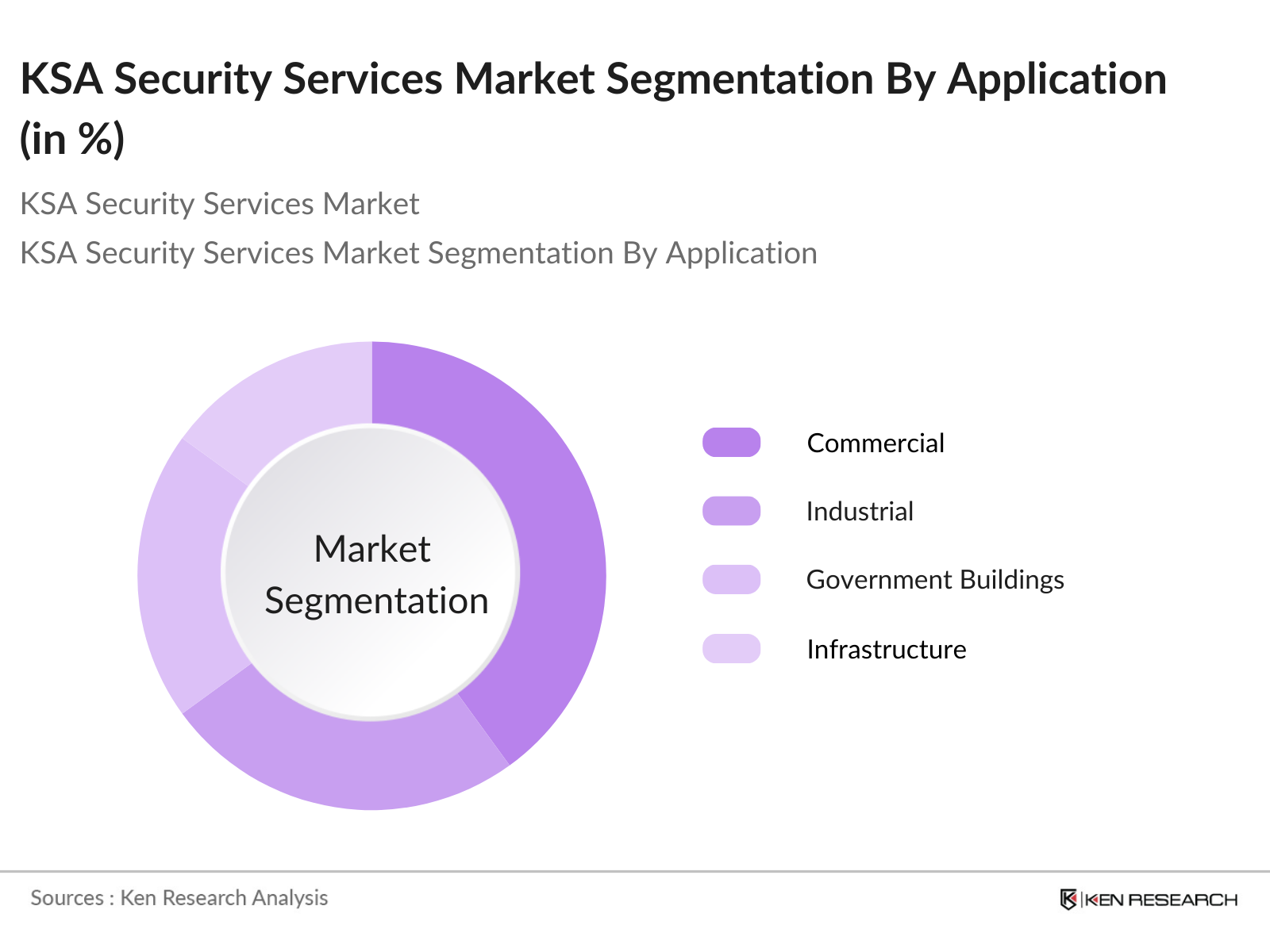

KSA Security Services Market Segmentation

By Service Type: The market is segmented by service type into manned guarding, electronic security, mobile patrol services, event security services, and security consulting. Manned guarding holds a dominant market share due to its integral role in providing physical security across various sectors, including commercial, industrial, and governmental facilities.

By Application: The market is also segmented by application into residential, commercial, industrial, government buildings, and infrastructure. The commercial segment leads in market share, driven by the high security demands of retail chains, banking institutions, and hospitality venues. The need for integrated security solutions, combining electronic surveillance with physical guarding, is particularly pronounced in these settings.

KSA Security Services Market Competitive Landscape

The KSA Security Services market is dominated by a mix of international and local players. Key players include G4S, Securitas AB, and local companies like Saudi Security Guarding Co. (SSGC). These companies are recognized for their extensive service portfolios, technological capabilities, and strong market presence. They invest heavily in research and development to offer innovative security solutions and maintain a competitive edge in the market.

KSA Security Services Market Industry Analysis

Growth Drivers

- Increasing Government Spending on Security Infrastructure: In 2022, the Saudi Arabian government allocated $10 billion to enhance national security infrastructure, part of its broader vision under the Vision 2030 plan. This allocation is aimed at modernizing and expanding security frameworks across the country. Additionally, Saudi Arabias budget for security infrastructure is expected to maintain this level of investment, reflecting the government's commitment to strengthening security measures as part of its national development goals.

- Rising Demand for Advanced Security Solutions (CCTV, Intrusion Detection): The demand for advanced security solutions in Saudi Arabia has surged due to increased urbanization and infrastructure development. In 2023, there were over 100,000 CCTV cameras installed across key urban areas in Saudi Arabia, reflecting a significant investment in surveillance technology.

- Smart City Projects (Neom, Red Sea Development): The Neom project, a key component of Saudi Arabias Vision 2030, involves a $500 billion investment in developing a smart city with advanced security systems, including AI-driven surveillance and integrated security solutions. Similarly, the Red Sea Development project is investing $2 billion in infrastructure, with a focus on implementing cutting-edge security technologies to protect the expansive area.

Market Challenges

- High Costs of Advanced Security Solutions: The high cost of implementing advanced security technologies can be a barrier to adoption, especially for smaller businesses and residential customers. The investment required for sophisticated systems, including installation, maintenance, and upgrades, can be substantial. This cost factor may limit access to cutting-edge security solutions for some segments of the market.

- Regulatory and Compliance Challenges: Navigating the complex regulatory environment related to security services and technology can be challenging. Compliance with stringent regulations and standards requires continuous updates and adaptations, which can be burdensome for companies. Adhering to evolving security protocols and data privacy laws is critical but may pose operational challenges for market players.

KSA Security Services Market Future Outlook

Over the next five years, the KSA Security Services market is expected to experience substantial growth, driven by ongoing investments in infrastructure, technological advancements, and heightened security needs. The integration of AI and IoT technologies into security systems is anticipated to enhance capabilities and efficiency. The continuous development of smart cities and large-scale projects will further propel the demand for comprehensive security solutions.

Market Opportunities

- Growing Adoption of AI in Surveillance Systems: In 2023, the adoption of AI in surveillance systems in Saudi Arabia increased by 20%, driven by advancements in technology and the need for more efficient security solutions. The integration of AI enhances real-time threat detection and response capabilities, reflecting a growing trend towards smart security solutions.

- Public-Private Partnerships for Infrastructure Security: Public-private partnerships (PPPs) have become increasingly prominent in Saudi Arabia, with several key projects focused on enhancing infrastructure security. In 2023, the government announced 15 new PPP projects involving security enhancements for critical infrastructure. These partnerships leverage both public funding and private expertise, driving innovation and improving security measures across various sectors.

Scope of the Report

|

Service Type |

Manned Guarding Electronic Security Mobile Patrol Services Event Security Security Consulting |

|

Application |

Residential Commercial Industrial Government Infrastructure |

|

Technology |

AI-Driven Surveillance, Access Control Perimeter Security Drones Cybersecurity Integration |

|

Region |

Riyadh, Jeddah, Dammam, Mecca, Al Khobar |

Products

Key Target Audience

Security Service Providers

Oil & Gas Companies

Financial Institutions

Retail Chains

Infrastructure Developers (Airports, Railways, Seaports)

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (National Cybersecurity Authority, Ministry of Interior)

Smart City Project Developers

Companies

Players Mentioned in the Report

G4S

Securitas AB

Allied Universal

Transguard Group

Saudi Security Guarding Co. (SSGC)

First Security Group (FSG)

Al Muhaidib Group

OCS Group

Prosegur

International Security & Defense Systems (ISDS)

Table of Contents

1. KSA Security Services Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. KSA Security Services Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. KSA Security Services Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Government Spending on Security Infrastructure

3.1.2. Rising Demand for Advanced Security Solutions (CCTV, Intrusion Detection)

3.1.3. Smart City Projects (Neom, Red Sea Development)

3.1.4. Private Sector Investment (Banking, Retail, Oil & Gas)

3.2. Market Challenges

3.2.1. High Cost of Advanced Technologies (AI-Driven Surveillance, Integrated Solutions)

3.2.2. Lack of Skilled Workforce in Security Technologies

3.2.3. Regulatory Compliance Complexities

3.3. Opportunities

3.3.1. Growing Adoption of AI in Surveillance Systems

3.3.2. Public-Private Partnerships for Infrastructure Security

3.3.3. Expansion of Security Solutions in the Commercial Sector

3.4. Trends

3.4.1. Integration of Cybersecurity with Physical Security

3.4.2. Adoption of Cloud-Based Monitoring Solutions

3.4.3. Use of Drones in Perimeter Security

3.5. Government Regulation

3.5.1. National Cybersecurity Authority Guidelines

3.5.2. KSA Vision 2030 Security Initiatives

3.5.3. Compliance with Saudi Aramco Security Standards

3.6. SWOT Analysis

3.6.1. Strengths (Established Infrastructure, Growing Economy)

3.6.2. Weaknesses (Dependence on Foreign Expertise)

3.6.3. Opportunities (Technological Innovations, Smart City Projects)

3.6.4. Threats (Geopolitical Tensions, Cyber Threats)

3.7. Stakeholder Ecosystem (Security Service Providers, Government Bodies, Technology Vendors)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. KSA Security Services Market Segmentation

4.1. By Service Type (In Value %)

4.1.1. Manned Guarding

4.1.2. Electronic Security (Surveillance, Intrusion Detection)

4.1.3. Mobile Patrol Services

4.1.4. Event Security Services

4.1.5. Security Consulting

4.2. By Application (In Value %)

4.2.1. Residential

4.2.2. Commercial (Retail, Offices, Malls)

4.2.3. Industrial (Oil & Gas, Petrochemical)

4.2.4. Government Buildings

4.2.5. Infrastructure (Airports, Seaports, Railways)

4.3. By Technology (In Value %)

4.3.1. AI-Driven Surveillance

4.3.2. Access Control Systems

4.3.3. Perimeter Security Systems

4.3.4. Drones and Unmanned Aerial Vehicles (UAVs)

4.3.5. Cybersecurity Integration

4.4. By Region (In Value %)

4.4.1. Riyadh

4.4.2. Jeddah

4.4.3. Dammam

4.4.4. Mecca

4.4.5. Al Khobar

5. KSA Security Services Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. G4S

5.1.2. Securitas AB

5.1.3. Allied Universal

5.1.4. Transguard Group

5.1.5. Saudi Security Guarding Co. (SSGC)

5.1.6. First Security Group (FSG)

5.1.7. Al Muhaidib Group

5.1.8. OCS Group

5.1.9. Prosegur

5.1.10. International Security & Defense Systems (ISDS)

5.1.11. Juffali Security Services

5.1.12. Naseej Security Services

5.1.13. Arkan Al-Khaleej Security Systems

5.1.14. Vision Security Group (VSG)

5.1.15. Al Yusr International Group

5.2. Cross Comparison Parameters (Employees, Headquarters, Revenue, Major Contracts, Technological Strength, Local Partnerships, Key Service Offerings, Market Penetration)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Contracts and Tender Awards

5.8. Private Equity Investments

6. KSA Security Services Market Regulatory Framework

6.1. Licensing and Certification Requirements

6.2. Compliance with Local Security Standards

6.3. Guidelines for International Security Providers

6.4. National Data Privacy Regulations

7. KSA Security Services Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. KSA Security Services Future Market Segmentation

8.1. By Service Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By Region (In Value %)

9. KSA Security Services Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out the entire ecosystem of the KSA Security Services Market, including all relevant stakeholders. This stage relies heavily on secondary research and proprietary databases, enabling the identification of the major factors influencing the market, such as security technology adoption rates and regulatory developments.

Step 2: Market Analysis and Construction

In this phase, historical data is collected to analyze the penetration of security services and solutions across various sectors like oil & gas, banking, and retail. This involves examining key performance indicators like service uptake, incident response times, and sectoral security spending.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market growth trends are validated through structured interviews with industry experts, including security service providers and key end-users in the commercial and industrial sectors. These consultations provide real-world insights to refine market estimates.

Step 4: Research Synthesis and Final Output

This phase synthesizes data from primary research and bottom-up market modeling. Direct engagement with security service firms helps ensure the accuracy of estimates related to service revenues, market penetration, and technology integration within the KSA Security Services market.

Frequently Asked Questions

01. How big is the KSA Security Services Market?

The KSA Security Services market is valued at USD 200 billion, driven by the expansion of smart city projects, rising security concerns, and governmental mandates for improved safety standards across industries like oil & gas and finance.

02. What are the challenges in the KSA Security Services Market?

Challenges in the KSA Security Services market include the high cost of implementing advanced security technologies such as AI-driven surveillance, a shortage of skilled security personnel, and regulatory complexities related to cybersecurity and data privacy.

03. Who are the major players in the KSA Security Services Market?

Major players in the KSA Security Services Market include G4S, Securitas AB, Allied Universal, Transguard Group, and Saudi Security Guarding Co. (SSGC). These companies dominate due to their strong service offerings, technological expertise, and presence in key sectors like banking, retail, and oil & gas.

04. What are the growth drivers of the KSA Security Services Market?

Key growth drivers in the KSA Security Services Market include rising investments in smart city projects, increased governmental security mandates, and the adoption of AI-powered surveillance and monitoring technologies across industries.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.