Region:Middle East

Author(s):Shubham

Product Code:KRAD0892

Pages:86

Published On:November 2025

Market.png)

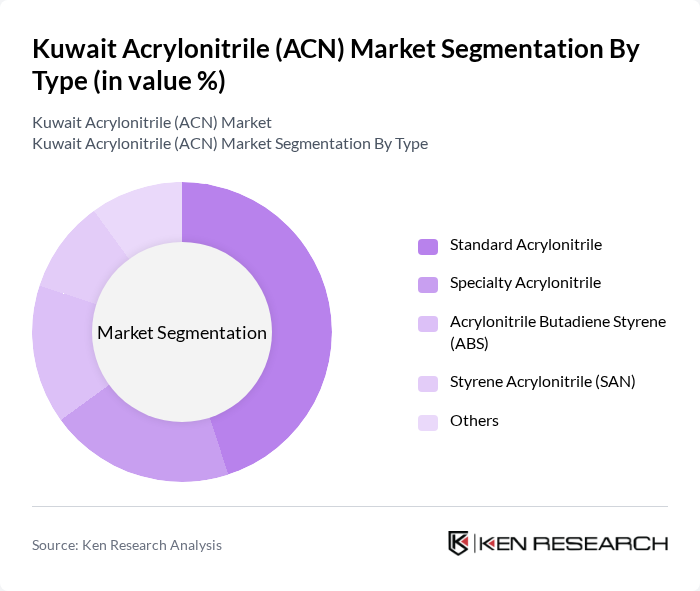

By Type:The market is segmented into various types of acrylonitrile products, including Standard Acrylonitrile, Specialty Acrylonitrile, Acrylonitrile Butadiene Styrene (ABS), Styrene Acrylonitrile (SAN), and Others. Each type serves different industrial applications, with Standard Acrylonitrile being the most widely used due to its versatility in manufacturing processes. Specialty Acrylonitrile is gaining traction in high-performance applications, while ABS and SAN are increasingly used in automotive and consumer goods sectors .

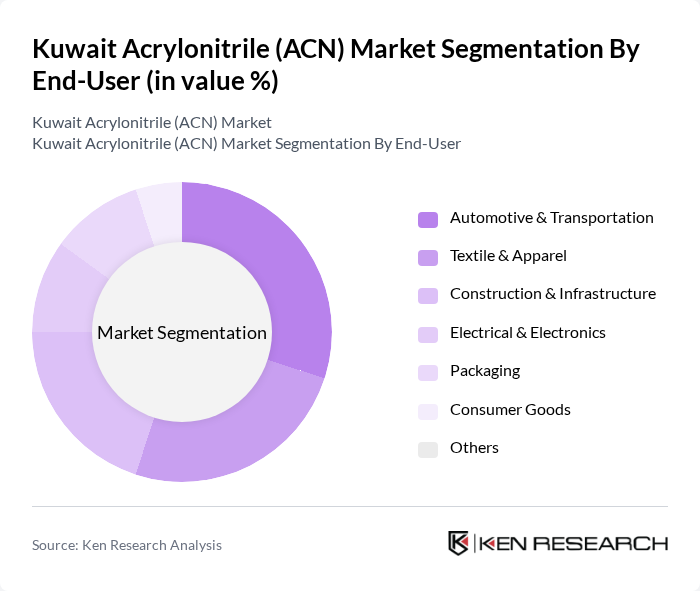

By End-User:The end-user segmentation includes Automotive & Transportation, Textile & Apparel, Construction & Infrastructure, Electrical & Electronics, Packaging, Consumer Goods, and Others. The automotive and textile sectors are the largest consumers of acrylonitrile, driven by the increasing demand for lightweight and durable materials. The construction sector is also witnessing growth due to infrastructure development projects, while the packaging and electronics industries are adopting acrylonitrile-based polymers for improved performance and sustainability ; .

The Kuwait Acrylonitrile (ACN) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Petroleum Corporation (KPC), Equate Petrochemical Company, Petrochemical Industries Company (PIC), Kuwait National Petroleum Company (KNPC), Gulf Petrochemical Industries Company, Boubyan Petrochemical Company, Qurain Petrochemical Industries Company, Kuwait Styrene Company, Al-Dar Al-Kuwaitia for General Trading, Gulf Chemical Industries, KPC Chemicals, Kuwait Oil Company (KOC), Al-Mansour Holding Company, Al-Fouzan Trading & Contracting Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait acrylonitrile market appears promising, driven by technological advancements and a growing emphasis on sustainability. As manufacturers adopt eco-friendly production methods, the demand for bio-based acrylonitrile is expected to rise. Furthermore, strategic partnerships with global players will enhance market access and innovation. The focus on lightweight materials in automotive applications will continue to propel growth, ensuring that acrylonitrile remains a vital component in various industries.

| Segment | Sub-Segments |

|---|---|

| By Type | Standard Acrylonitrile Specialty Acrylonitrile Acrylonitrile Butadiene Styrene (ABS) Styrene Acrylonitrile (SAN) Others |

| By End-User | Automotive & Transportation Textile & Apparel Construction & Infrastructure Electrical & Electronics Packaging Consumer Goods Others |

| By Application | Acrylic Fiber Acrylonitrile Butadiene Styrene (ABS) Styrene Acrylonitrile (SAN) Acrylamide Carbon Fiber Nitrile Rubber Coatings & Adhesives Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Geography | Kuwait City Al Ahmadi Hawalli Others |

| By Production Process | Ammoxidation Process Batch Process Continuous Process Others |

| By Product Form | Liquid Acrylonitrile Solid Acrylonitrile Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Textile Industry Applications | 100 | Procurement Managers, Production Supervisors |

| Automotive Sector Utilization | 80 | Supply Chain Managers, Quality Control Engineers |

| Plastics Manufacturing Insights | 90 | Operations Managers, Product Development Specialists |

| Research & Development Perspectives | 70 | R&D Managers, Chemical Engineers |

| Regulatory Compliance Feedback | 60 | Compliance Officers, Environmental Managers |

The Kuwait Acrylonitrile (ACN) Market is valued at approximately USD 1.1 billion, reflecting a robust growth trajectory driven by increasing demand across various sectors, including automotive, textiles, and construction.