Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7183

Pages:98

Published On:December 2025

By Type of IT Service:

The market for IT services in ambulatory surgical centers is primarily driven by Electronic Health Records (EHR) Implementation & Support, which holds the largest share in line with global ASC IT spending patterns. The increasing need for efficient patient data management, clinical documentation, and regulatory compliance has led to a surge in EHR adoption and integration with ancillary systems such as imaging and lab interfaces. Additionally, Practice Management & Scheduling Systems are gaining traction as healthcare providers seek to optimize operating room utilization, reduce waiting times, and enhance patient experiences through digital appointment and workflow tools. The focus on revenue cycle management is also significant, as centers aim to improve financial performance, reduce billing errors, and comply with payer requirements through specialized medical billing, claims processing, and denial management solutions tailored to outpatient surgery.

By End-User Facility Type:

Standalone Ambulatory Surgical Centers dominate the market due to their flexibility, higher procedure volumes in certain specialties, and ability to provide specialized services tailored to patient needs in a cost-efficient setting. Hospital-affiliated centers also play a crucial role, benefiting from the resources, referral networks, and reputation of larger healthcare institutions while increasingly deploying integrated IT platforms that connect inpatient and outpatient workflows. Specialty clinics are increasingly integrating ambulatory surgery units for ophthalmology, orthopedics, gastroenterology, and day-case procedures, supported by niche clinical and visualization systems, while government facilities are gradually adopting IT solutions to improve operational efficiency and reporting within the public health system. The trend towards outpatient care, driven by minimally invasive techniques, shorter recovery times, and payer emphasis on cost-effective settings, is driving growth across all facility types and accelerating investment in ASC-focused IT infrastructure.

The Kuwait Ambulatory Surgical Centers IT Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ministry of Health – Kuwait (MOH) Health Information Systems, DASMAN Center for Research & Treatment of Diabetes – IT & Clinical Systems, Kuwait Hospital Information System (KHIS) Program Vendors, Kuwait National Health Information System (KNHIS) Integrators, Ooredoo Kuwait – Healthcare & ASC Connectivity Solutions, Zain Kuwait – eHealth & Managed IT Services for Providers, Gulf Business Machines (GBM) Kuwait – Healthcare IT Solutions, International Turnkey Systems (ITS) Group – Healthcare & Clinical IT, Agfa HealthCare – Imaging & Clinical IT in Kuwait, Cerner (Oracle Health) – Clinical & ASC Solutions in Kuwait, InterSystems – TrakCare & Health Information Exchange in Kuwait, Philips Healthcare – Monitoring & IT Solutions for Ambulatory Settings, GE HealthCare – Healthcare IT & Surgical Workflow Solutions, Siemens Healthineers – Digital Health & ASC IT Offerings, Medas Kuwait – Hospital & Clinic Information Systems contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait ambulatory surgical centers IT services market appears promising, driven by technological innovations and a shift towards outpatient care. As healthcare providers increasingly adopt telemedicine and AI-driven solutions, the demand for integrated IT services will rise. Furthermore, the focus on patient-centric care is expected to enhance service delivery, leading to improved patient satisfaction and operational efficiency. This evolving landscape presents significant opportunities for growth and investment in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type of IT Service | Electronic Health Records (EHR) Implementation & Support Practice Management & Scheduling Systems Revenue Cycle Management & Medical Billing Services Clinical Documentation & Coding Services Supply Chain & Inventory Management Solutions Patient Engagement & Portal Solutions Other Managed & Consulting IT Services |

| By End-User Facility Type | Standalone Ambulatory Surgical Centers Hospital-Affiliated Ambulatory Surgical Centers Specialty Clinics with Ambulatory Surgery Units Government & Public Sector Outpatient Surgical Facilities Others |

| By Service Delivery Model | On-Premise IT Services Cloud-Hosted / Software-as-a-Service (SaaS) Hybrid Deployment Services Remote Managed IT & Helpdesk Services Others |

| By IT Solution Category | Clinical Information Systems (EHR, PACS, CDS) Administrative & Practice Management Systems Financial & Revenue Cycle Management Systems Cybersecurity & Data Protection Solutions Analytics, Reporting & Business Intelligence Tools Telehealth & Remote Monitoring Platforms Others |

| By Client Ownership | Public Sector / MOH-Operated Centers Private Domestic Providers Regional & International Healthcare Groups Others |

| By Geographic Distribution within Kuwait | Kuwait City & Capital Governorate Hawalli & Farwaniya Governorates Ahmadi & Mubarak Al-Kabeer Governorates Jahra Governorate Others |

| By Payment & Reimbursement Model Supported by IT | Self-Pay / Out-of-Pocket Billing Private Health Insurance Claims Processing Government & Public Payer Reimbursement (e.g., MOH) Corporate & Occupational Health Contracts Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ambulatory Surgical Centers IT Infrastructure | 120 | IT Managers, Healthcare Administrators |

| Patient Management Systems Adoption | 90 | Clinical Directors, IT Specialists |

| Telemedicine Implementation Strategies | 75 | Telehealth Coordinators, IT Consultants |

| Electronic Health Records Utilization | 110 | Healthcare IT Directors, Compliance Officers |

| Cybersecurity Measures in Healthcare | 65 | Security Analysts, Risk Management Officers |

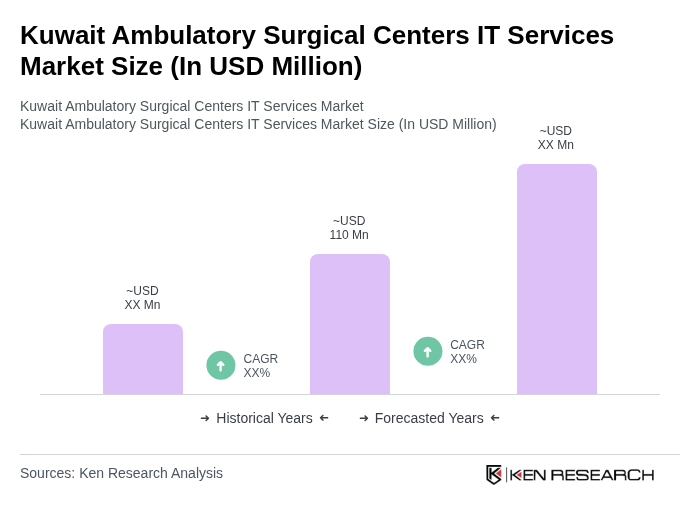

The Kuwait Ambulatory Surgical Centers IT Services Market is valued at approximately USD 110 million, reflecting a significant growth trend driven by the increasing demand for outpatient surgical procedures and advancements in healthcare IT solutions.