Region:Middle East

Author(s):Rebecca

Product Code:KRAD1389

Pages:82

Published On:November 2025

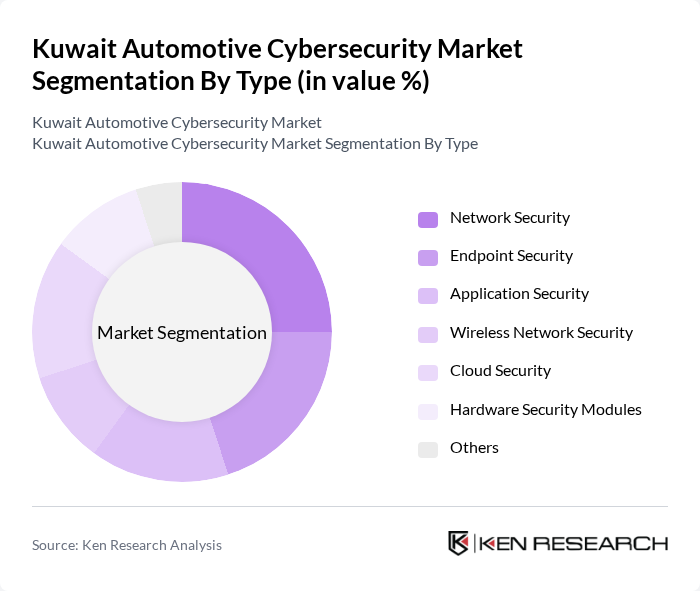

By Type:The market is segmented into various types of cybersecurity solutions, including Network Security, Endpoint Security, Application Security, Wireless Network Security, Cloud Security, Hardware Security Modules, and Others. Each of these sub-segments plays a crucial role in safeguarding automotive systems from cyber threats.

The leading sub-segment in the market is Network Security, which accounts for a significant portion of the market share. This dominance is attributed to the increasing number of connected vehicles and the rising threats of cyberattacks targeting vehicle networks. As automotive systems become more interconnected, the need for robust network security solutions has become paramount, driving investments and innovations in this area.

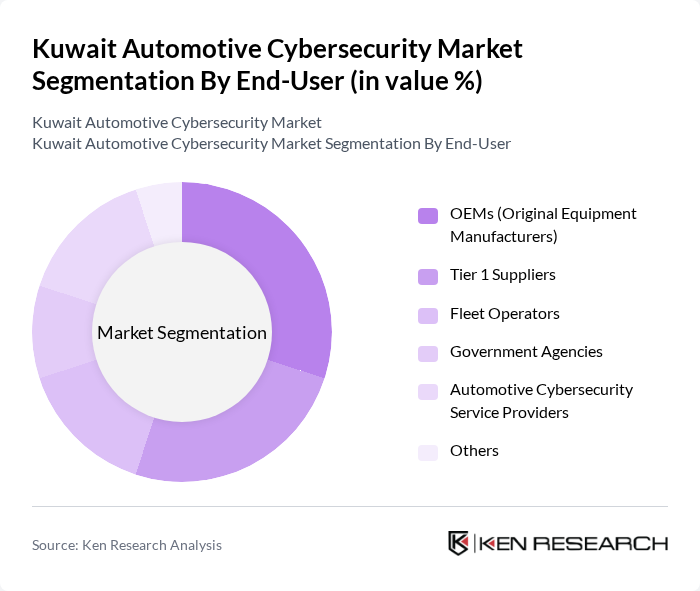

By End-User:The market is segmented based on end-users, including OEMs (Original Equipment Manufacturers), Tier 1 Suppliers, Fleet Operators, Government Agencies, Automotive Cybersecurity Service Providers, and Others. Each end-user category has distinct requirements and plays a vital role in the overall cybersecurity landscape.

OEMs are the leading end-user segment, driven by their need to integrate advanced cybersecurity measures into their vehicles to comply with regulatory standards and protect consumer data. The increasing focus on connected and autonomous vehicles has further propelled OEMs to invest heavily in cybersecurity solutions, ensuring the safety and security of their products in a competitive market.

The Kuwait Automotive Cybersecurity Market is characterized by a dynamic mix of regional and international players. Leading participants such as Argus Cyber Security, Upstream Security, Karamba Security, Harman International (Samsung), GuardKnox, Trillium Secure, Cisco Systems, IBM Security, Continental AG, Infineon Technologies, NXP Semiconductors, Kaspersky Lab, Trend Micro, Honeywell, Darktrace contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive cybersecurity market in Kuwait appears promising, driven by increasing investments in technology and a growing awareness of cybersecurity risks. As the adoption of connected and autonomous vehicles accelerates, the demand for advanced security solutions will intensify. Furthermore, collaboration between automotive manufacturers and cybersecurity firms is expected to enhance the development of innovative security measures. The focus on regulatory compliance will also push companies to prioritize cybersecurity, ensuring a safer automotive environment for consumers in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Endpoint Security Application Security Wireless Network Security Cloud Security Hardware Security Modules Others |

| By End-User | OEMs (Original Equipment Manufacturers) Tier 1 Suppliers Fleet Operators Government Agencies Automotive Cybersecurity Service Providers Others |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles Heavy Commercial Vehicles Electric Vehicles Autonomous Vehicles Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid Others |

| By Service Type | Consulting Services Managed Security Services Training and Support Services Incident Response Services Others |

| By Region | Central Kuwait Southern Kuwait Northern Kuwait Others |

| By Policy Support | Government Grants Tax Incentives Regulatory Compliance Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturers | 100 | Chief Technology Officers, Cybersecurity Managers |

| Cybersecurity Solution Providers | 60 | Product Development Leads, Sales Directors |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Automotive Industry Associations | 50 | Research Analysts, Industry Advocates |

| End-Users (Vehicle Owners) | 80 | Car Owners, Fleet Managers |

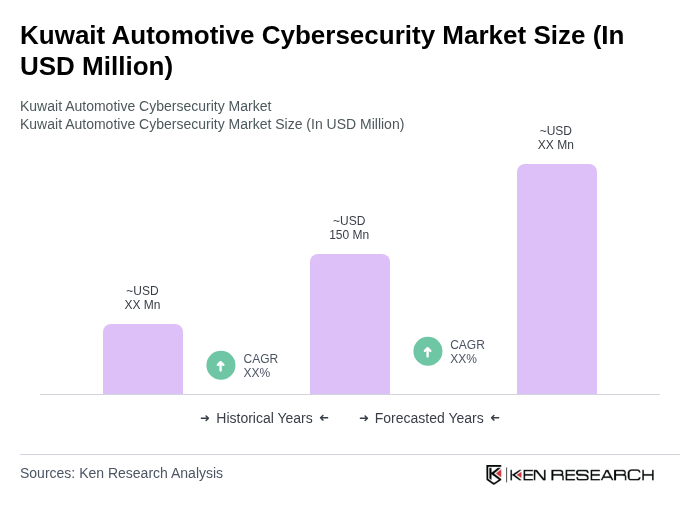

The Kuwait Automotive Cybersecurity Market is valued at approximately USD 150 million, reflecting a significant growth trend driven by the increasing integration of advanced technologies in vehicles and the rising awareness of cyber risks in the automotive sector.