Region:Middle East

Author(s):Dev

Product Code:KRAA9530

Pages:92

Published On:November 2025

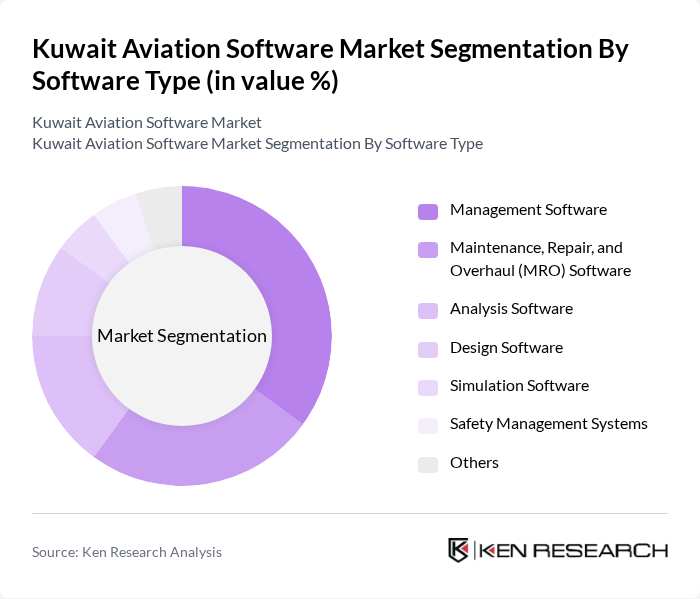

By Software Type:The software type segmentation includes categories such as Management Software, Maintenance, Repair, and Overhaul (MRO) Software, Analysis Software, Design Software, Simulation Software, Safety Management Systems, and Others. Management Software is currently the leading sub-segment, driven by its role in streamlining airline operations, optimizing resource allocation, and enabling real-time decision-making. The increasing complexity of airline networks and the need for integrated analytics and workflow automation are accelerating demand for management solutions. MRO Software also holds substantial market share, reflecting the sector’s focus on predictive maintenance and operational reliability.

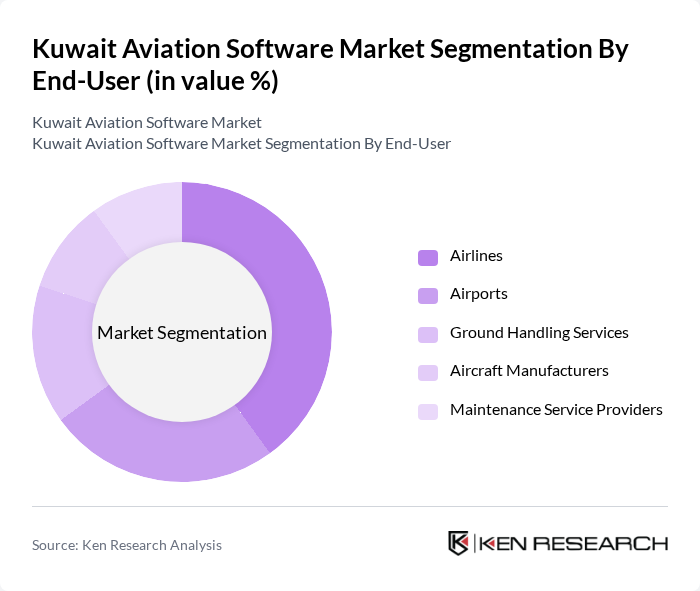

By End-User:The end-user segmentation encompasses Airlines, Airports, Ground Handling Services, Aircraft Manufacturers, and Maintenance Service Providers. Airlines are the dominant end-user segment, propelled by the need for operational efficiency, cost reduction, and enhanced customer service. The competitive landscape among airlines, rising passenger volumes, and the adoption of digital platforms for scheduling, crew management, and customer engagement are driving demand for specialized aviation software. Airports and ground handling services are also investing in integrated solutions for passenger flow management, baggage tracking, and security compliance.

The Kuwait Aviation Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Airways, Jazeera Airways, Honeywell International Inc., General Electric Company (Aviation Division), Amadeus IT Group, Sabre Corporation, IFS (Industrial and Financial Systems), Ramco Systems, SITA, Lufthansa Systems, Airbus SE, CHAMP Cargosystems, ADB Safegate, Inmarsat, Collins Aerospace contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait aviation software market appears promising, driven by ongoing digital transformation initiatives and a growing emphasis on sustainability. As the aviation sector continues to expand, investments in innovative technologies such as artificial intelligence and machine learning are expected to rise. Additionally, the integration of mobile applications will enhance customer engagement, providing airlines with new avenues to improve service delivery and operational efficiency, ultimately shaping a more competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Software Type | Management Software Maintenance, Repair, and Overhaul (MRO) Software Analysis Software Design Software Simulation Software Safety Management Systems Others |

| By End-User | Airlines Airports Ground Handling Services Aircraft Manufacturers Maintenance Service Providers |

| By Deployment Model | On-Premises Cloud-Based Hybrid Software-as-a-Service (SaaS) |

| By Functionality | Flight Operations Management Crew and Fleet Management Maintenance Tracking Air Traffic Control Passenger Services and CRM Airport Management |

| By Region | Kuwait City Al Ahmadi Hawalli Others |

| By Company Size | Large Enterprises Medium Enterprises Small Enterprises |

| By Customer Type | Commercial Aviation Cargo Aviation Helicopter Operations Private Aviation |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Airline Operations Software | 60 | IT Managers, Operations Directors |

| Airport Management Systems | 50 | Airport Operations Managers, IT Specialists |

| Maintenance Management Software | 40 | Maintenance Managers, Engineering Directors |

| Passenger Service Systems | 55 | Customer Experience Managers, IT Analysts |

| Flight Scheduling Software | 45 | Flight Operations Managers, Scheduling Coordinators |

The Kuwait Aviation Software Market is valued at approximately USD 15 million, reflecting a five-year historical analysis. This growth is driven by the increasing demand for efficient air traffic management and advanced technologies in the aviation sector.