Region:Middle East

Author(s):Geetanshi

Product Code:KRAD8170

Pages:97

Published On:December 2025

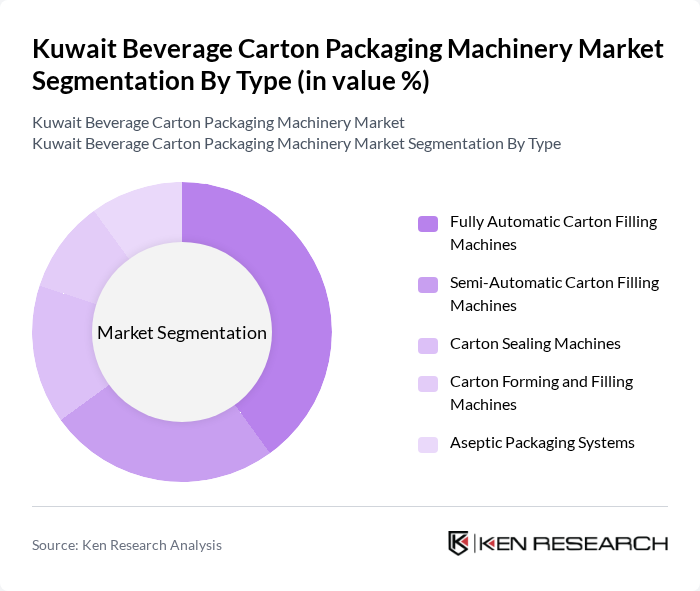

By Type:The market is segmented into various types of machinery, including fully automatic carton filling machines, semi-automatic carton filling machines, carton sealing machines, carton forming and filling machines, and aseptic packaging systems. Each of these types serves specific needs within the beverage industry, catering to different production scales and operational efficiencies.

The fully automatic carton filling machines segment dominates the market due to their efficiency and ability to handle high volumes of production. These machines are favored by large beverage manufacturers who require rapid packaging solutions to meet consumer demand. The trend towards automation in manufacturing processes has led to increased investments in fully automatic systems, as they reduce labor costs and improve production consistency. As a result, this segment is expected to maintain its leadership position in the market.

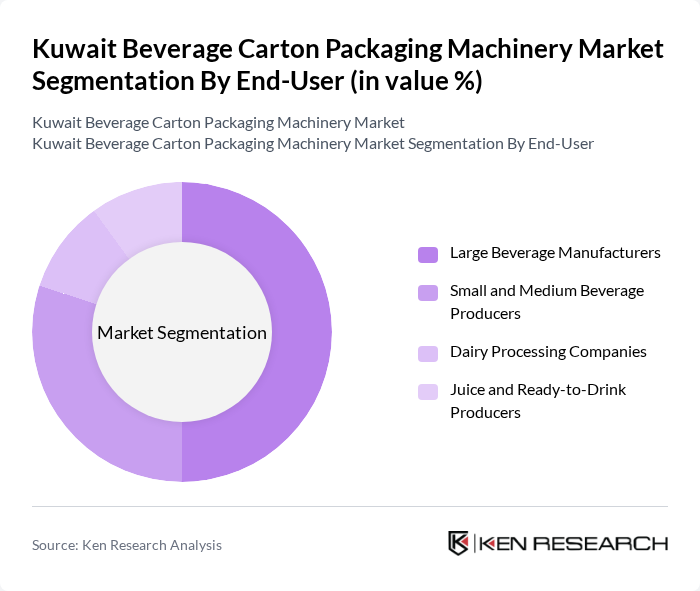

By End-User:The market is segmented based on end-users, including large beverage manufacturers, small and medium beverage producers, dairy processing companies, and juice and ready-to-drink producers. Each segment has unique requirements and preferences for packaging machinery, influencing the overall market dynamics.

Large beverage manufacturers are the leading end-users in the market, primarily due to their extensive production capabilities and the need for high-efficiency packaging solutions. These companies often invest in advanced machinery to streamline their operations and meet the growing consumer demand for packaged beverages. The trend towards sustainability and eco-friendly packaging is also influencing large manufacturers to adopt innovative packaging technologies, further solidifying their market leadership.

The Kuwait Beverage Carton Packaging Machinery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tetra Pak, SIG Combibloc, Krones AG, Bosch Packaging Technology, Elopak, Stora Enso, Mondi Group, Smurfit Kappa, Amcor Limited, WestRock Company, DS Smith PLC, International Paper Company, Sealed Air Corporation, Huhtamaki Oyj, Graphic Packaging Holding Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait beverage carton packaging machinery market appears promising, driven by ongoing trends in sustainability and technological innovation. As consumer preferences shift towards eco-friendly packaging, manufacturers are likely to invest in sustainable materials and processes. Additionally, the integration of smart technologies will enhance operational efficiency, allowing companies to meet the growing demand for high-quality beverage products. This evolving landscape presents significant opportunities for growth and development in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Fully Automatic Carton Filling Machines Semi-Automatic Carton Filling Machines Carton Sealing Machines Carton Forming and Filling Machines Aseptic Packaging Systems |

| By End-User | Large Beverage Manufacturers Small and Medium Beverage Producers Dairy Processing Companies Juice and Ready-to-Drink Producers |

| By Beverage Type | Dairy Products Juices and Fruit Drinks Plant-Based Beverages Water and Soft Drinks |

| By Automation Level | Fully Automatic Systems Semi-Automatic Systems Manual Systems |

| By Technology | Traditional Packaging Technology Robotics and Automation IoT-Integrated Systems |

| By Distribution Channel | Direct Sales Authorized Distributors Online Sales Equipment Leasing |

| By Region | Central Kuwait (Kuwait City) Southern Kuwait (Ahmadi, Mubarak Al-Kabeer) Northern Kuwait (Jahra) Western Kuwait (Subiya) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Beverage Manufacturers | 45 | Production Managers, Quality Assurance Heads |

| Packaging Machinery Suppliers | 40 | Sales Directors, Technical Support Engineers |

| Regulatory Bodies | 25 | Policy Makers, Compliance Officers |

| Retail Sector Stakeholders | 35 | Supply Chain Managers, Procurement Specialists |

| Industry Experts and Consultants | 30 | Market Analysts, Packaging Consultants |

The Kuwait Beverage Carton Packaging Machinery Market is valued at approximately USD 12 million, reflecting a five-year historical analysis. This growth is driven by increasing demand for packaged beverages and a shift towards sustainable packaging solutions.