Region:Middle East

Author(s):Rebecca

Product Code:KRAD5052

Pages:92

Published On:December 2025

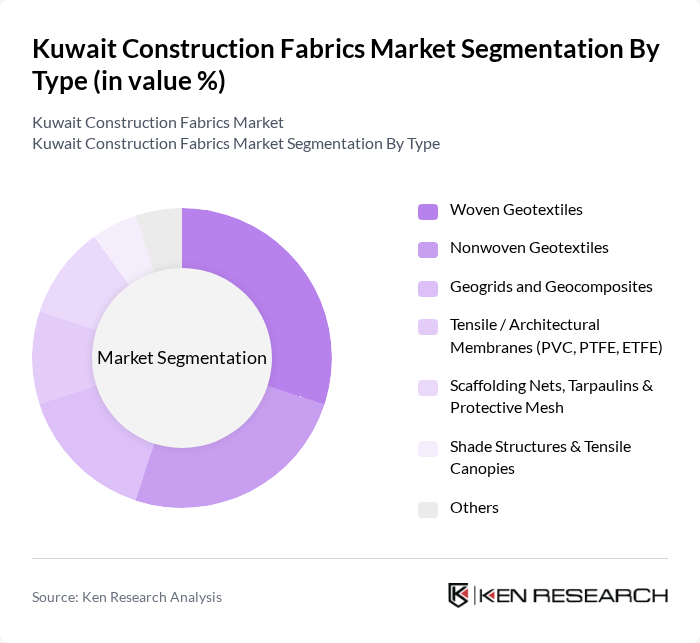

By Type:The market is segmented into various types of construction fabrics, including Woven Geotextiles, Nonwoven Geotextiles, Geogrids and Geocomposites, Tensile / Architectural Membranes (PVC, PTFE, ETFE), Scaffolding Nets, Tarpaulins & Protective Mesh, Shade Structures & Tensile Canopies, and Others. Among these, Woven Geotextiles and Tensile / Architectural Membranes are particularly prominent due to their extensive applications in soil stabilization, road and highway construction, land reclamation, and iconic tensile roofing and façade projects. The demand for these materials is driven by their strength, durability, resistance to harsh climatic conditions, and versatility in various construction scenarios, especially in foundation works, drainage, erosion control, temporary structures, and large-span shading systems.

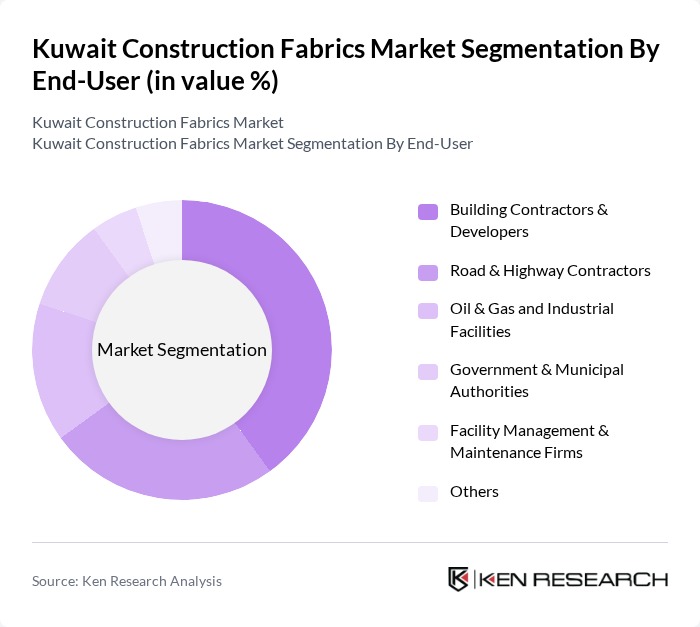

By End-User:The end-user segmentation includes Building Contractors & Developers, Road & Highway Contractors, Oil & Gas and Industrial Facilities, Government & Municipal Authorities, Facility Management & Maintenance Firms, and Others. Building Contractors & Developers represent the largest segment, driven by the ongoing construction boom in residential, commercial, and mixed?use projects across Kuwait City and surrounding governorates, supported by Kuwait Vision 2035 and public–private partnership schemes. The increasing focus on infrastructure development by the government, particularly in roads, bridges, ports, and logistics corridors, also significantly contributes to the demand from Road & Highway Contractors, where geotextiles, geogrids, and protective fabrics are extensively used for pavement reinforcement, drainage, and erosion control.

The Kuwait Construction Fabrics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sika AG, TenCate Geosynthetics, Huesker Group, Low & Bonar (Freudenberg Performance Materials), Saint-Gobain ADFORS, Serge Ferrari Group, Mehler Texnologies (Freudenberg Performance Materials), Taiyo Middle East LLC, Al Khayam Al Arabiah Tents & Sheds Manufacturing Co., Geotex Gulf Factory for Geotextiles, BMC Gulf LLC, GSE Environmental, Officine Maccaferri S.p.A., Naue GmbH & Co. KG, Royal TenCate (Materials Business) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait construction fabrics market appears promising, driven by ongoing infrastructure projects and a growing emphasis on sustainability. As the government continues to invest heavily in construction, the demand for innovative and eco-friendly fabric solutions is expected to rise. Additionally, advancements in technology, such as digital fabrication and smart fabrics, will likely enhance product offerings, catering to the evolving needs of the construction industry while addressing environmental concerns effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Woven Geotextiles Nonwoven Geotextiles Geogrids and Geocomposites Tensile / Architectural Membranes (PVC, PTFE, ETFE) Scaffolding Nets, Tarpaulins & Protective Mesh Shade Structures & Tensile Canopies Others |

| By End-User | Building Contractors & Developers Road & Highway Contractors Oil & Gas and Industrial Facilities Government & Municipal Authorities Facility Management & Maintenance Firms Others |

| By Application | Roads, Highways & Pavement Stabilization Soil Reinforcement, Embankments & Retaining Structures Foundations, Landfills & Drainage Roofing, Façade & Tensile Structures Scaffolding Safety, Site Enclosures & Weather Protection Shading, Parking Structures & Stadiums Others |

| By Material | Polyester (PET) Polypropylene (PP) Polyethylene (PE) Fiberglass & Composite Fabrics PTFE, PVC, ETFE and Other Coated Fabrics Others |

| By Durability | Temporary & Short-Term Fabrics Medium-Term Performance Fabrics Long-Life & Permanent Structural Fabrics High-Chemical / UV-Resistant Specialty Fabrics Others |

| By Region | Capital Governorate (Kuwait City) Hawalli Governorate Al Ahmadi Governorate Farwaniya Governorate Al Jahra & Mubarak Al-Kabeer Governorates Others |

| By Market Segment | Premium / High-Performance Segment Mid-Range Segment Value / Budget Segment Project-Specific / Custom-Engineered Solutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Construction Projects | 100 | Project Managers, Procurement Officers |

| Residential Fabric Usage | 80 | Architects, Interior Designers |

| Industrial Fabric Applications | 70 | Facility Managers, Operations Managers |

| Government Infrastructure Initiatives | 60 | Policy Makers, Urban Planners |

| Fabric Suppliers and Distributors | 90 | Sales Managers, Business Development Managers |

The Kuwait Construction Fabrics Market is valued at approximately USD 120 million, reflecting a robust growth trajectory driven by significant government investments in infrastructure and urban development projects under Kuwait Vision 2035.