Region:Middle East

Author(s):Shubham

Product Code:KRAD5410

Pages:89

Published On:December 2025

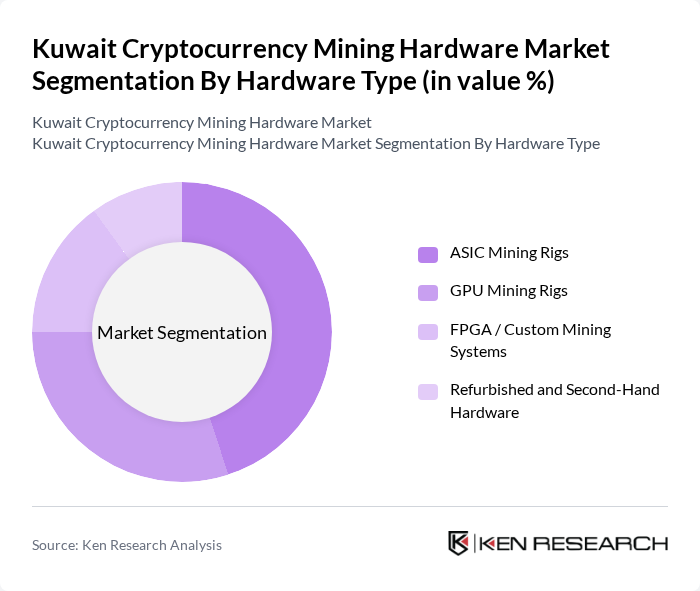

By Hardware Type:The hardware type segmentation includes various categories such as ASIC Mining Rigs, GPU Mining Rigs, FPGA / Custom Mining Systems, and Refurbished and Second-Hand Hardware. Each of these subsegments caters to different mining needs and preferences among users. ASIC Mining Rigs are particularly popular due to their efficiency in mining specific cryptocurrencies like Bitcoin, while GPU Mining Rigs are favored for their versatility in mining various altcoins. The demand for refurbished hardware has also seen a rise as miners look for cost-effective solutions.

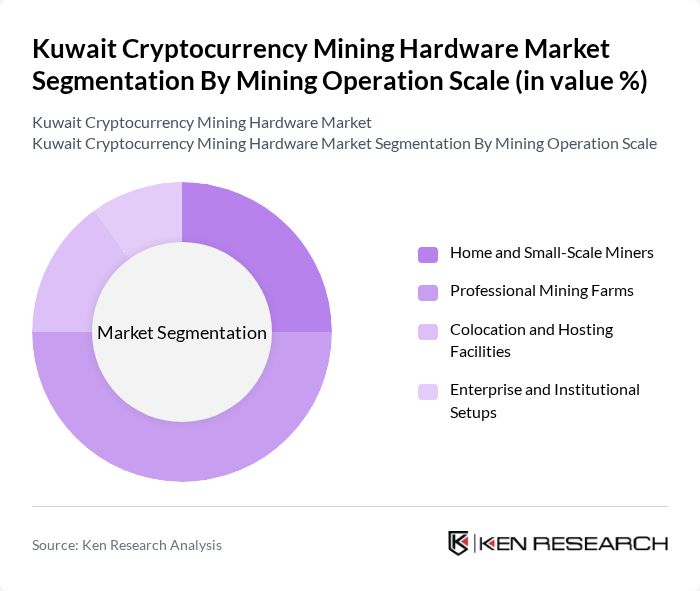

By Mining Operation Scale:This segmentation includes Home and Small-Scale Miners, Professional Mining Farms, Colocation and Hosting Facilities, and Enterprise and Institutional Setups. Home and Small-Scale Miners are increasingly popular due to the accessibility of mining hardware and the potential for personal profit. Professional Mining Farms dominate the market due to their economies of scale and efficiency, while Colocation and Hosting Facilities provide a solution for those who prefer not to manage hardware directly. Enterprise setups are also emerging as larger organizations recognize the potential of cryptocurrency mining.

The Kuwait Cryptocurrency Mining Hardware Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bitmain Technologies Ltd., MicroBT (Shenzhen MicroBT Electronics Technology Co., Ltd.), Canaan Inc., NVIDIA Corporation, Advanced Micro Devices, Inc. (AMD), Innosilicon Technology Ltd., Ebang International Holdings Inc., Bitfury Holding B.V., WhatsMiner MENA (regional distributors for MicroBT), Phoenix Store (Phoenix Technology Consultants LLC), Matrix Mining & Hosting, Binance Pool, F2Pool, NiceHash, Local and Regional Crypto Hardware Resellers in Kuwait contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cryptocurrency mining hardware market in Kuwait appears promising, driven by technological innovations and a supportive regulatory framework. As the demand for cryptocurrencies continues to rise, local miners are likely to adopt more efficient and eco-friendly technologies. Additionally, the integration of renewable energy sources into mining operations could enhance sustainability. The anticipated growth in institutional investment may also provide a significant boost, fostering a more robust mining ecosystem in the region.

| Segment | Sub-Segments |

|---|---|

| By Hardware Type | ASIC Mining Rigs GPU Mining Rigs FPGA / Custom Mining Systems Refurbished and Second-Hand Hardware |

| By Mining Operation Scale | Home and Small-Scale Miners Professional Mining Farms Colocation and Hosting Facilities Enterprise and Institutional Setups |

| By Cooling & Infrastructure Configuration | Air-Cooled Mining Racks Immersion-Cooled Systems Containerized / Modular Mining Units Other Infrastructure Setups |

| By Power Source | Grid-Powered Mining Renewable-Backed Mining (Solar, Wind) Hybrid Power Solutions Other Power Arrangements |

| By Cryptocurrency Mined | Bitcoin (BTC) Ethereum Classic and Other GPU-Mined Coins Altcoins (Litecoin, Dogecoin, etc.) Multi-Coin / Switchable Mining |

| By Procurement Channel | Direct Imports from OEMs Local Distributors and Resellers Online Cross-Border Marketplaces Grey Market and Secondary Channels |

| By Buyer Type | Retail Investors and Enthusiasts High-Net-Worth Individuals and Family Offices Crypto-Focused Start-ups and SMEs Regional and International Mining Operators |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cryptocurrency Miners | 120 | Individual Miners, Mining Pool Operators |

| Hardware Suppliers | 80 | Sales Managers, Product Specialists |

| Energy Providers | 60 | Energy Analysts, Business Development Managers |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| IT Infrastructure Managers | 50 | IT Managers, System Administrators |

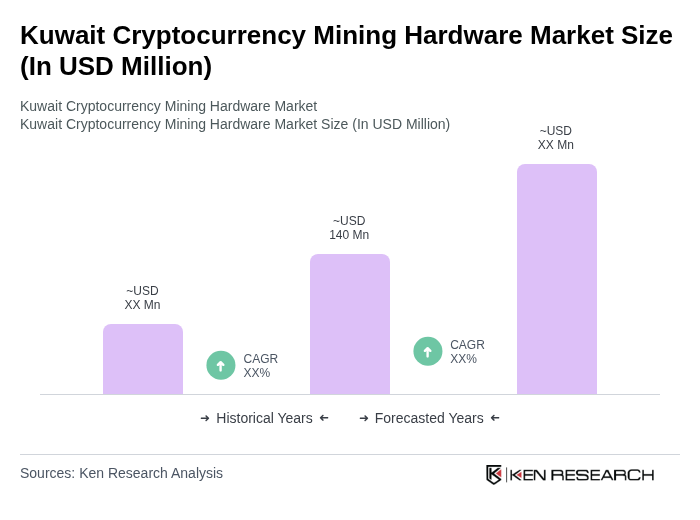

The Kuwait Cryptocurrency Mining Hardware Market is valued at approximately USD 140 million, reflecting significant growth driven by increased cryptocurrency adoption, technological advancements in mining hardware, and a rise in mining operations within the region.