Region:Middle East

Author(s):Shubham

Product Code:KRAD5520

Pages:88

Published On:December 2025

By Product Type:The product type segmentation includes various categories of digital dose inhalers, each catering to specific patient needs and preferences. The subsegments are Digital Metered Dose Inhalers (Digital MDIs), Digital Dry Powder Inhalers (Digital DPIs), Smart Soft Mist Inhalers, Connected Nebulizers, and Other Connected Inhalation Devices. Among these, Digital MDIs are leading the market due to their widespread clinical use in asthma and COPD, compatibility with commonly prescribed inhaled therapies, and effectiveness in delivering medication accurately with integrated dose counters and usage sensors, which is crucial for managing chronic respiratory conditions and reducing exacerbations.

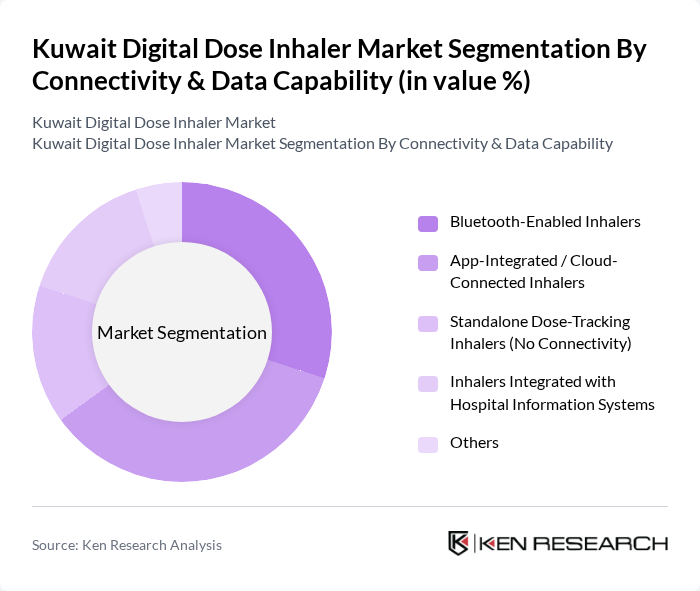

By Connectivity & Data Capability:This segmentation focuses on the technological features of digital dose inhalers, including Bluetooth-Enabled Inhalers, App-Integrated / Cloud-Connected Inhalers, Standalone Dose-Tracking Inhalers (No Connectivity), Inhalers Integrated with Hospital Information Systems, and Others. The App-Integrated / Cloud-Connected Inhalers are currently dominating this segment, driven by the increasing demand for remote patient monitoring, real?time adherence tracking, and integration with telemedicine platforms and electronic health records, which enhance treatment adherence, patient engagement, and data-driven clinical follow?up in chronic respiratory disease management.

The Kuwait Digital Dose Inhaler Market is characterized by a dynamic mix of regional and international players. Leading participants such as AstraZeneca plc, GlaxoSmithKline plc (GSK), Novartis AG, Boehringer Ingelheim International GmbH, Teva Pharmaceutical Industries Ltd., Chiesi Farmaceutici S.p.A., Cipla Ltd., Vectura Group plc, OPKO Health, Inc. (Inspira Technologies / InspiRx partners), ResMed Inc., Koninklijke Philips N.V. (Philips Respironics), OMRON Healthcare Co., Ltd., Hikma Pharmaceuticals plc, Kuwait Saudi Pharmaceutical Industries Company (KSPICO), Gulf Pharmaceutical Industries PSC (Julphar) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait digital dose inhaler market appears promising, driven by ongoing technological innovations and increasing healthcare investments. As telehealth services expand, more patients will have access to digital health solutions, enhancing treatment adherence. Additionally, collaborations between technology firms and healthcare providers are likely to foster the development of personalized inhaler solutions, further improving patient outcomes and driving market growth in the future.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Digital Metered Dose Inhalers (Digital MDIs) Digital Dry Powder Inhalers (Digital DPIs) Smart Soft Mist Inhalers Connected Nebulizers Other Connected Inhalation Devices |

| By Connectivity & Data Capability | Bluetooth-Enabled Inhalers App-Integrated / Cloud-Connected Inhalers Standalone Dose-Tracking Inhalers (No Connectivity) Inhalers Integrated with Hospital Information Systems Others |

| By End-User | Public Hospitals and Government Facilities Private Hospitals Specialized Respiratory Clinics & Pulmonology Centers Home Care & Remote Monitoring Programs Pharmacies & Retail Chains |

| By Distribution Channel | Hospital Pharmacies Retail & Chain Pharmacies Online Pharmacies & E?Commerce Platforms Tender-Based Government Procurement Direct Sales & Distributor-Led Sales |

| By Patient Segment | Pediatric Patients Adult Patients Geriatric Patients High-Risk / Poor-Adherence Patients |

| By Indication | Asthma Chronic Obstructive Pulmonary Disease (COPD) Exercise-Induced Bronchospasm Allergic Rhinitis & Other Respiratory Allergies Other Chronic Respiratory Conditions |

| By Region (Within Kuwait) | Capital (Al Asimah) Governorate Hawalli Governorate Al Ahmadi Governorate Farwaniya Governorate Al Jahra Governorate Mubarak Al-Kabeer Governorate |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 100 | Pulmonologists, General Practitioners |

| Patients Using Inhalers | 120 | Chronic Asthma and COPD Patients |

| Pharmacists | 80 | Community and Hospital Pharmacists |

| Healthcare Administrators | 60 | Hospital Managers, Health Policy Makers |

| Caregivers | 70 | Family Members of Patients, Home Health Aides |

The Kuwait Digital Dose Inhaler Market is valued at approximately USD 140 million, driven by the high prevalence of asthma and chronic respiratory diseases in the region, alongside advancements in digital health technologies and increased patient adherence to treatment.