Region:Middle East

Author(s):Dev

Product Code:KRAD0383

Pages:83

Published On:August 2025

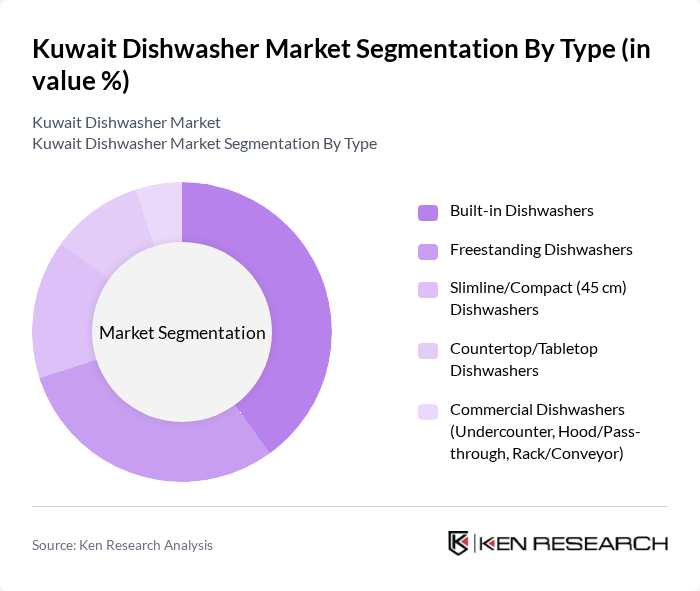

By Type:The market is segmented into built-in, freestanding, slimline/compact, countertop/tabletop, and commercial dishwashers. Built-in units are favored by homeowners for seamless integration in fitted kitchens, especially in new urban apartments and villa renovations. Freestanding models appeal to renters and households seeking flexibility in placement and easier replacement cycles. Slimline/compact options are gaining traction among smaller households and space-constrained apartments. Commercial dishwashers (undercounter, hood/pass-through, rack/conveyor) are essential in professional kitchens across hospitality and foodservice for hygiene and throughput, with demand supported by Kuwait’s active HORECA sector .

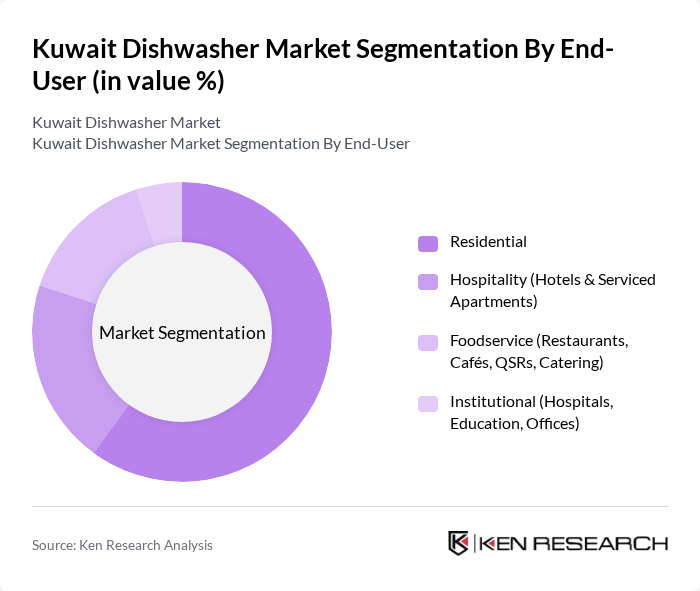

By End-User:The end-user segmentation includes residential, hospitality, foodservice, and institutional sectors. The residential segment dominates, underpinned by household income levels, urban apartment penetration, and retail promotion of smart, quiet, and stainless-steel interior models. Hospitality (hotels and serviced apartments) shows consistent demand for both in-unit and back-of-house solutions, while foodservice (restaurants, cafés, QSRs, catering) relies on commercial machines to maintain hygiene and operational efficiency. Institutional users (hospitals, education, offices) contribute a smaller, stable share through facilities management and catering operations .

The Kuwait Dishwasher Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bosch Home Appliances (BSH Hausgeräte GmbH), LG Electronics, Samsung Electronics, Whirlpool Corporation, Electrolux Group, Miele & Cie. KG, Panasonic Corporation, Haier Group (including Candy, Hoover), Midea Group, Beko (Arçelik A.?.), Smeg S.p.A., Sharp Corporation, AEG (Electrolux brand), Hisense, Siemens Home Appliances (BSH Hausgeräte GmbH) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the dishwasher market in Kuwait appears promising, driven by urbanization and rising disposable incomes. As consumers increasingly prioritize hygiene and convenience, the demand for dishwashers is expected to grow. Additionally, technological advancements will likely lead to more energy-efficient and smart models, appealing to environmentally conscious consumers. The market is poised for expansion, particularly as e-commerce platforms enhance accessibility and awareness, paving the way for increased adoption of dishwashing appliances in households across the nation.

| Segment | Sub-Segments |

|---|---|

| By Type | Built-in Dishwashers Freestanding Dishwashers Slimline/Compact (45 cm) Dishwashers Countertop/Tabletop Dishwashers Commercial Dishwashers (Undercounter, Hood/Pass-through, Rack/Conveyor) |

| By End-User | Residential Hospitality (Hotels & Serviced Apartments) Foodservice (Restaurants, Cafés, QSRs, Catering) Institutional (Hospitals, Education, Offices) |

| By Price Range | Entry/Budget (? KWD 120) Mid-Range (KWD 121–250) Premium (? KWD 251) |

| By Distribution Channel | Offline Retail (Hypermarkets, Electronics Chains, Specialty Kitchen Studios) Online Retail (Brand E-stores, Marketplaces) B2B/Project Sales (Dealers, System Integrators) |

| By Capacity (Place Settings) | –10 Place Settings –15 Place Settings Above 15 Place Settings |

| By Energy/Water Efficiency Rating | High Efficiency (A/A+ and equivalents) Standard Efficiency (B/C and equivalents) |

| By Features | Smart Connectivity (Wi?Fi/App, Voice) Noise Level (? 45 dB, 46–50 dB, > 50 dB) Specialized Programs (Quick, Eco, Hygiene/Intensive, Glass Care) Finish & Build (Stainless Steel Tub, Anti-fingerprint, Integrated Panel) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Household Dishwasher Purchases | 140 | Homeowners, Renters |

| Retail Appliance Sales Insights | 90 | Store Managers, Sales Representatives |

| Consumer Preferences and Usage | 120 | Families, Young Professionals |

| Market Trends and Innovations | 80 | Industry Experts, Product Managers |

| Post-Purchase Satisfaction Surveys | 100 | Recent Dishwasher Buyers |

The Kuwait Dishwasher Market is valued at approximately USD 35 million, reflecting steady growth driven by urbanization, rising disposable incomes, and a preference for convenience in household appliances.