Region:Middle East

Author(s):Geetanshi

Product Code:KRAC8335

Pages:95

Published On:November 2025

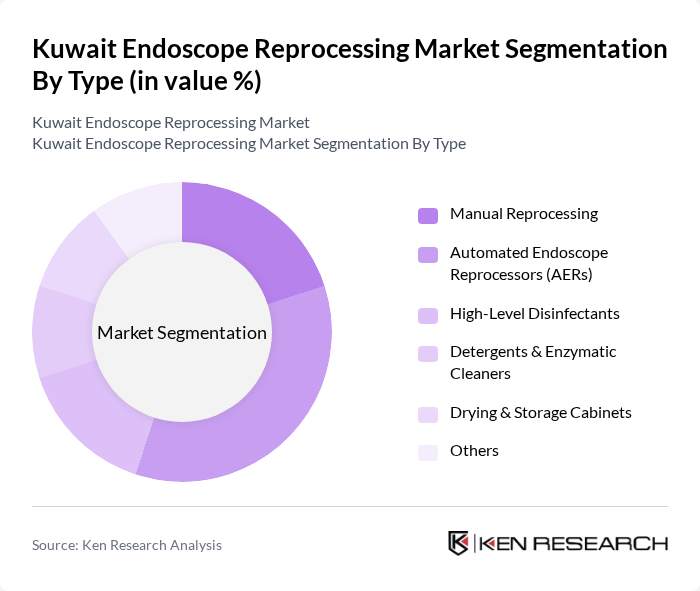

By Type:The market is segmented into various types, including Manual Reprocessing, Automated Endoscope Reprocessors (AERs), High-Level Disinfectants, Detergents & Enzymatic Cleaners, Drying & Storage Cabinets, and Others. Among these, Automated Endoscope Reprocessors (AERs) are gaining traction due to their efficiency and ability to minimize human error in the reprocessing cycle. High-level disinfectants represent a significant segment, reflecting the critical importance of chemical disinfection in endoscope reprocessing protocols.

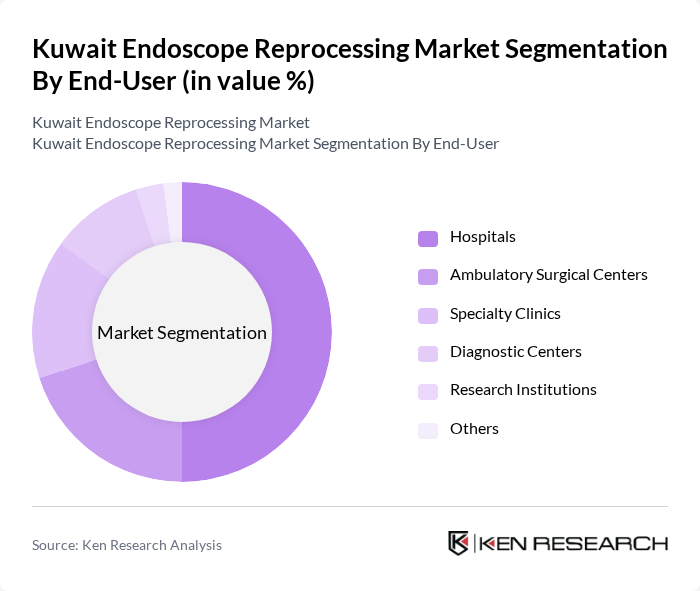

By End-User:The end-user segment includes Hospitals, Ambulatory Surgical Centers, Specialty Clinics, Diagnostic Centers, Research Institutions, and Others. Hospitals are the leading end-users, driven by the high volume of endoscopic procedures performed and the need for stringent infection control measures.

The Kuwait Endoscope Reprocessing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Olympus Corporation, Pentax Medical (HOYA Corporation), Karl Storz SE & Co. KG, STERIS plc, Medivators Inc. (Cantel Medical, now part of STERIS), Getinge AB, Advanced Sterilization Products (ASP, a Fortive company), Ecolab Inc., 3M Company, B. Braun Melsungen AG, Halyard Health, Inc. (now part of Owens & Minor), Sterigenics International LLC, Wassenburg Medical (A Member of Hoya Group), Steelco S.p.A. (A Member of Miele Group), Belimed AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the endoscope reprocessing market in Kuwait appears promising, driven by ongoing advancements in technology and a growing emphasis on patient safety. As healthcare facilities increasingly adopt automated reprocessing systems, efficiency and compliance with sterilization standards will improve. Additionally, the integration of IoT technologies is expected to enhance monitoring capabilities, ensuring higher quality assurance. These trends will likely lead to a more robust market, addressing both current challenges and future demands in the healthcare sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Manual Reprocessing Automated Endoscope Reprocessors (AERs) High-Level Disinfectants Detergents & Enzymatic Cleaners Drying & Storage Cabinets Others |

| By End-User | Hospitals Ambulatory Surgical Centers Specialty Clinics Diagnostic Centers Research Institutions Others |

| By Application | Gastroenterology Pulmonology Urology Gynecology ENT (Ear, Nose, Throat) Others |

| By Equipment Type | Endoscope Washers/Disinfectors Sterilizers High-Level Disinfection Systems Drying Cabinets Test Strips & Indicators Accessories Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Capital Governorate Hawalli Governorate Al Ahmadi Governorate Farwaniya Governorate Mubarak Al-Kabeer Governorate Jahra Governorate Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Endoscopy Departments | 100 | Endoscopy Unit Managers, Infection Control Officers |

| Outpatient Surgical Centers | 60 | Clinical Directors, Surgical Coordinators |

| Endoscope Manufacturers | 40 | Product Managers, Sales Executives |

| Reprocessing Equipment Suppliers | 40 | Technical Support Managers, Sales Representatives |

| Healthcare Regulatory Bodies | 30 | Policy Analysts, Compliance Officers |

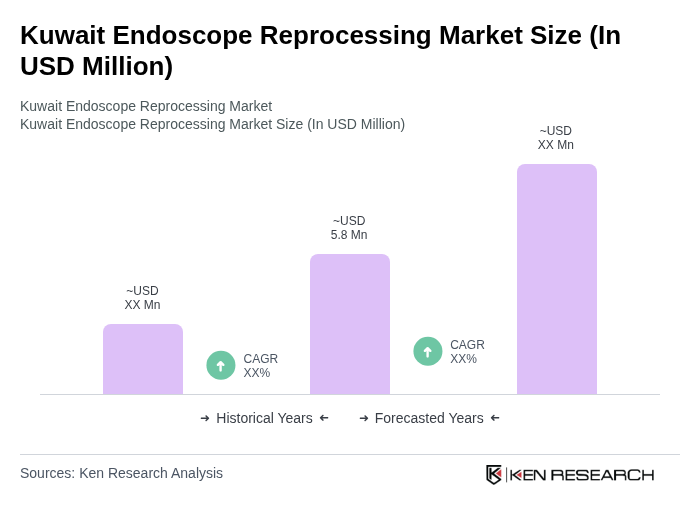

The Kuwait Endoscope Reprocessing Market is valued at approximately USD 5.8 million. This valuation reflects the increasing prevalence of gastrointestinal diseases and the rising number of endoscopic procedures in healthcare facilities across the country.