Region:Middle East

Author(s):Shubham

Product Code:KRAD0966

Pages:81

Published On:November 2025

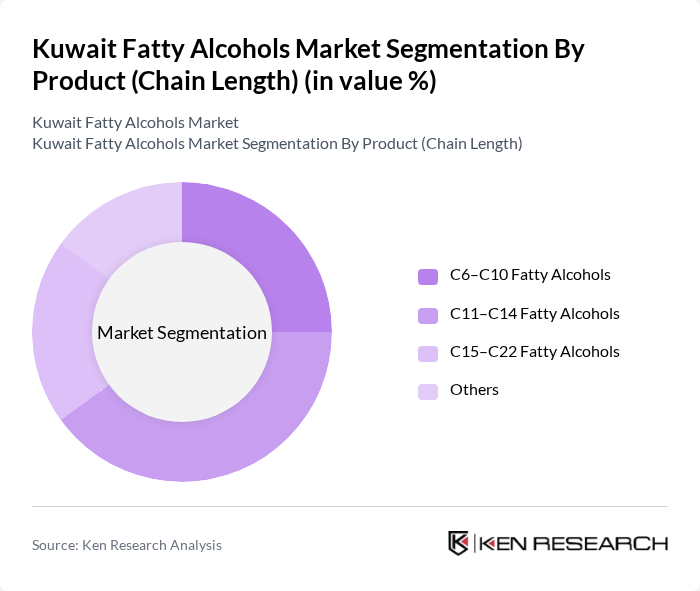

By Product (Chain Length):The market is segmented based on the chain length of fatty alcohols, which includes C6–C10 Fatty Alcohols, C11–C14 Fatty Alcohols, C15–C22 Fatty Alcohols, and Others. Each segment serves distinct applications: C6–C10 are typically used in plasticizers and lubricants; C11–C14 are favored for personal care products and detergents due to their excellent emulsifying properties; C15–C22 find use in industrial lubricants and specialty chemicals. C11–C14 Fatty Alcohols remain the most popular segment, reflecting their versatility and broad adoption in consumer and industrial formulations .

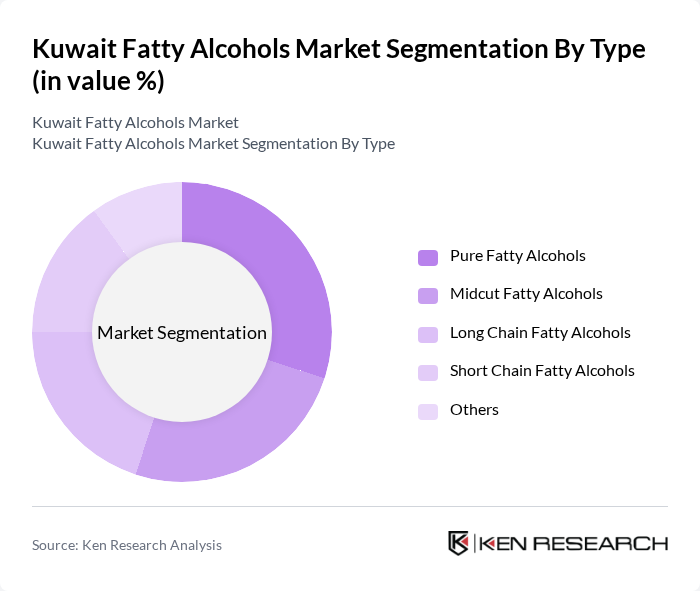

By Type:The market is also segmented by type, which includes Pure Fatty Alcohols, Midcut Fatty Alcohols, Long Chain Fatty Alcohols, Short Chain Fatty Alcohols, and Others. Pure Fatty Alcohols are widely used in surfactants and emulsifiers for personal and home care products. Midcut and Long Chain Fatty Alcohols are preferred in lubricants, cosmetics, and specialty industrial applications, while Short Chain Fatty Alcohols are utilized in plasticizers and chemical intermediates. The segmentation reflects evolving consumer preferences and industrial requirements, with a clear trend toward bio-based and high-purity grades .

The Kuwait Fatty Alcohols Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Petroleum Corporation (KPC), Wilmar International Limited, Sasol Limited, BASF SE, KLK OLEO (Kuala Lumpur Kepong Berhad), Godrej Industries Limited, Emery Oleochemicals, Stearinerie Dubois, Royal Dutch Shell plc, Oleon NV, Al-Kout Industrial Projects Company, Gulf Chemical Industries Co. (Gulf Chlorine), Al-Dhow Engineering, Al-Qatami Group, Al-Shaheen Group contribute to innovation, geographic expansion, and service delivery in this space.

The Kuwait fatty alcohols market is poised for significant transformation, driven by increasing consumer demand for sustainable and eco-friendly products. As the personal care and cosmetics industry continues to expand, manufacturers are likely to innovate and develop new formulations that incorporate natural ingredients. Additionally, the government's commitment to sustainability will likely foster collaborations between local producers and international companies, enhancing the market's competitiveness and resilience against global challenges.

| Segment | Sub-Segments |

|---|---|

| By Product (Chain Length) | C6–C10 Fatty Alcohols C11–C14 Fatty Alcohols C15–C22 Fatty Alcohols Others |

| By Type | Pure Fatty Alcohols Midcut Fatty Alcohols Long Chain Fatty Alcohols Short Chain Fatty Alcohols Others |

| By Source | Plant-Based (e.g., Palm Oil, Coconut Oil) Animal-Based Petrochemical-Based Others |

| By Application | Detergents & Surfactants Personal Care & Cosmetics Food & Beverages Pharmaceuticals Plasticizers Lubricants Paints & Coatings Textile & Leather Processing Others |

| By End-User Industry | Household Cleaning Personal Care Industrial Food & Beverage Pharmaceuticals Others |

| By Distribution Channel | Direct Sales Distributors Online Retail (Company Websites, E-Commerce Platforms) Others |

| By Region | Central Kuwait Southern Kuwait Northern Kuwait Others |

| By Product Form | Liquid Solid Powder Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Personal Care Product Manufacturers | 60 | Product Development Managers, R&D Directors |

| Industrial Chemical Distributors | 50 | Sales Managers, Supply Chain Coordinators |

| Food and Beverage Sector Users | 40 | Quality Assurance Managers, Procurement Specialists |

| Household Cleaning Product Companies | 40 | Marketing Managers, Product Line Managers |

| Research Institutions and Universities | 40 | Academic Researchers, Industry Analysts |

The Kuwait Fatty Alcohols Market is valued at approximately USD 15 million, reflecting its smaller share within the overall GCC fatty alcohols market, which is valued at USD 137 million. This valuation is based on a five-year historical analysis.