Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4122

Pages:88

Published On:December 2025

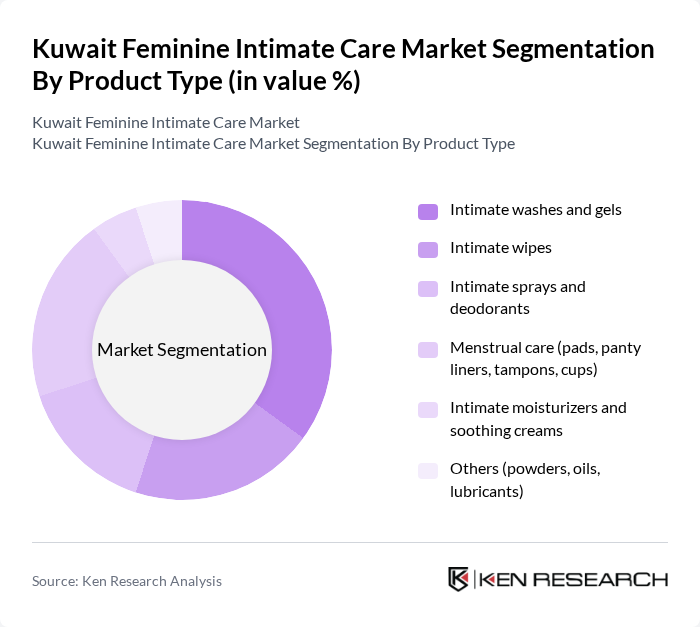

By Product Type:The product type segmentation includes various categories such as intimate washes and gels, intimate wipes, intimate sprays and deodorants, menstrual care (pads, panty liners, tampons, cups), intimate moisturizers and soothing creams, and others (powders, oils, lubricants). Among these, intimate washes and gels dominate the market due to their essential role in daily hygiene routines, with consumers increasingly opting for products that offer natural ingredients and pH balance. The growing awareness of personal hygiene and the importance of maintaining intimate health has led to a surge in demand for these products.

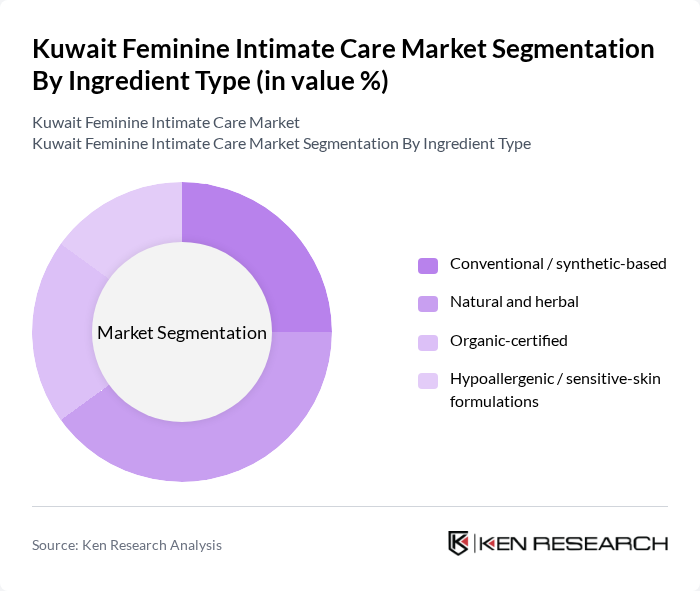

By Ingredient Type:The ingredient type segmentation encompasses conventional/synthetic-based, natural and herbal, organic-certified, and hypoallergenic/sensitive-skin formulations. The natural and herbal segment is currently leading the market, driven by a growing consumer preference for products that are free from harsh chemicals and synthetic additives. This trend is fueled by increased awareness of the benefits of using natural ingredients, which are perceived as safer and more effective for intimate care.

The Kuwait Feminine Intimate Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Procter & Gamble Co. (Always, Always Daily Liners), Kimberly-Clark Corporation (Kotex), Johnson & Johnson (Carefree), Unicharm Corporation (Sofy), Edgewell Personal Care Company (Playtex, o.b.), Combe Incorporated (Vagisil), Prestige Consumer Healthcare Inc. (Summer's Eve), Corman S.p.A. (Organyc), Natracare LLC, The Honey Pot Company LLC, Diva International Inc. (DivaCup), The Procter & Gamble Co. (Always Feminine Wash & Wipes), Local and regional brands active in Kuwait (e.g., private-label pharmacy brands), Online-first intimate care brands available in Kuwait via e-commerce platforms, Other emerging natural and organic intimate care brands present in GCC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the feminine intimate care market in Kuwait appears promising, driven by increasing awareness and changing consumer preferences. As more women prioritize personal hygiene, brands are likely to innovate and expand their product lines. Additionally, the rise of e-commerce will facilitate greater access to a variety of products, enhancing consumer choice. Companies that adapt to these trends and address cultural sensitivities will likely capture a larger market share, fostering sustainable growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Intimate washes and gels Intimate wipes Intimate sprays and deodorants Menstrual care (pads, panty liners, tampons, cups) Intimate moisturizers and soothing creams Others (powders, oils, lubricants) |

| By Ingredient Type | Conventional / synthetic-based Natural and herbal Organic-certified Hypoallergenic / sensitive-skin formulations |

| By Distribution Channel | Supermarkets / hypermarkets Pharmacies and drugstores Beauty and personal care stores Online retail and e-commerce platforms Others (hospital pharmacies, clinics) |

| By Consumer Segment | Teenagers and young adults (13–24 years) Adult women (25–44 years) Mature women (45 years and above) Pregnant and postpartum women |

| By Price Tier | Mass / economy Mid-range Premium Prestige / dermatological brands |

| By Country of Origin Perception | International brands Regional GCC brands Local Kuwaiti brands |

| By Usage Occasion | Daily hygiene Menstrual / period-related care Postpartum and gynecological care Travel and on-the-go usage |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Feminine Care | 150 | Women aged 18-45, Health-conscious Consumers |

| Healthcare Professional Insights | 60 | Gynecologists, Family Physicians |

| Retailer Perspectives on Product Demand | 50 | Pharmacy Owners, Store Managers |

| Market Trends and Innovations | 40 | Product Development Managers, Marketing Executives |

| Consumer Awareness and Education | 100 | Women’s Health Advocates, Community Leaders |

The Kuwait Feminine Intimate Care Market is valued at approximately USD 150 million, reflecting a significant growth trend driven by increased awareness of personal hygiene and rising disposable incomes among women.