Kuwait Fitness App Market Overview

- The Kuwait Fitness App Market is valued at USD 47 million, based on a five-year historical analysis. This growth is primarily driven by the increasing health consciousness among the population, coupled with the rising penetration of smartphones and internet connectivity. The demand for fitness solutions has surged as more individuals seek to maintain a healthy lifestyle through technology-driven platforms.

- Kuwait City is the dominant hub in the fitness app market, attributed to its high urbanization rate and a young, tech-savvy population. The concentration of fitness centers and health clubs in urban areas further fuels the demand for fitness applications, as users seek convenient solutions to track their health and fitness goals.

- In 2023, the Kuwaiti government implemented the “Kuwait National e-Health Strategy 2023–2027” issued by the Ministry of Health, which includes operational guidelines for digital health platforms and mobile health applications. The framework mandates compliance with data privacy, user consent, and interoperability standards, supporting the development of digital health solutions and encouraging local startups to innovate in the fitness app sector.

Kuwait Fitness App Market Segmentation

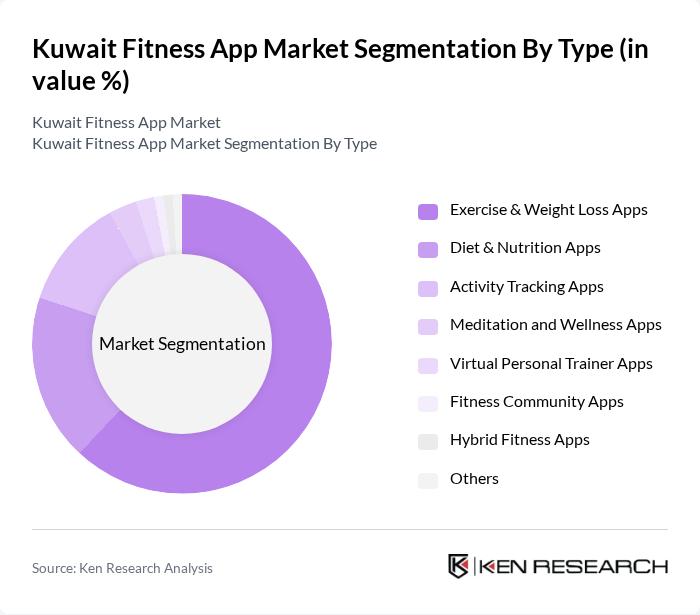

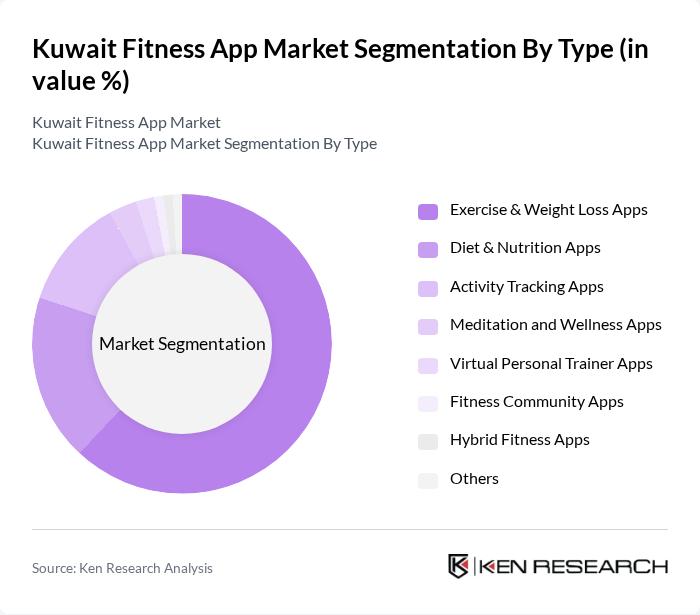

By Type:The fitness app market can be segmented into various types, including Exercise & Weight Loss Apps, Diet & Nutrition Apps, Activity Tracking Apps, Meditation and Wellness Apps, Virtual Personal Trainer Apps, Fitness Community Apps, Hybrid Fitness Apps, and Others. Among these, Exercise & Weight Loss Apps are particularly popular, accounting for the largest revenue share, driven by the increasing focus on weight management and fitness among users. The trend towards personalized fitness solutions has also led to a rise in Virtual Personal Trainer Apps, which offer tailored workout plans and guidance.

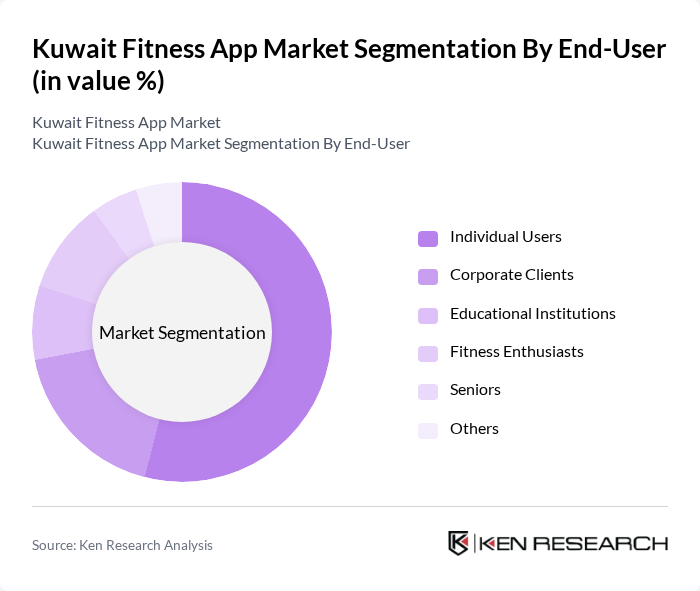

By End-User:The end-user segmentation includes Individual Users, Corporate Clients, Educational Institutions, Fitness Enthusiasts, Seniors, and Others. Individual Users dominate the market, driven by the growing trend of personal fitness and health management. Corporate Clients are also increasingly adopting fitness apps as part of employee wellness programs, while Educational Institutions are integrating these tools into their health curricula.

Kuwait Fitness App Market Competitive Landscape

The Kuwait Fitness App Market is characterized by a dynamic mix of regional and international players. Leading participants such as MyFitnessPal, Fitbit, Nike Training Club, Freeletics, Strava, 8fit, Sworkit, Aaptiv, Lifesum, MapMyRun, Zova, Fitify, Gymondo, ClassPass, Les Mills contribute to innovation, geographic expansion, and service delivery in this space.

Kuwait Fitness App Market Industry Analysis

Growth Drivers

- Increasing Health Awareness:The health awareness in Kuwait has surged, with 72% of the population actively seeking ways to improve their fitness levels. This trend is supported by the World Health Organization, which reported that non-communicable diseases account for 72% of deaths in Kuwait. Consequently, fitness apps are becoming essential tools for individuals aiming to monitor their health and fitness, leading to a significant increase in app downloads and user engagement.

- Rise in Smartphone Penetration:Smartphone penetration in Kuwait is among the highest globally, with estimates from the International Telecommunication Union and national sources indicating penetration rates of approximately 90% of the population. This widespread access to smartphones facilitates the adoption of fitness apps, allowing users to track workouts, nutrition, and health metrics conveniently. The increasing availability of affordable smartphones further enhances this trend, making fitness applications accessible to a broader audience, including younger demographics.

- Growth of Online Fitness Communities:The rise of online fitness communities in Kuwait has fostered a supportive environment for fitness enthusiasts. Approximately 45% of users engage in social media platforms dedicated to fitness, as reported by local surveys. These communities encourage participation in fitness challenges and sharing of personal achievements, driving user engagement with fitness apps. This social aspect enhances motivation and retention, contributing to the overall growth of the fitness app market.

Market Challenges

- High Competition Among Apps:The Kuwait fitness app market is saturated, with over 150 fitness applications available, leading to intense competition. This abundance makes it challenging for new entrants to gain market share and for existing apps to retain users. According to industry reports, only 20% of fitness apps achieve sustained user engagement beyond the first month, highlighting the difficulty in standing out in a crowded marketplace.

- User Retention Issues:User retention remains a significant challenge, with studies indicating that 70% of users abandon fitness apps within the first month. Factors contributing to this trend include lack of personalized content and insufficient engagement features. As the market matures, developers must focus on enhancing user experience and providing tailored solutions to maintain user interest and loyalty, which is crucial for long-term success.

Kuwait Fitness App Market Future Outlook

The future of the Kuwait fitness app market appears promising, driven by technological advancements and evolving consumer preferences. As more users prioritize health and wellness, the demand for innovative features such as AI-driven personalized fitness plans and integration with wearable devices is expected to rise. Additionally, the increasing focus on mental health and holistic wellness will likely shape app development, encouraging companies to diversify their offerings and enhance user engagement through community-driven initiatives.

Market Opportunities

- Integration with Wearable Technology:The integration of fitness apps with wearable technology presents a significant opportunity, as the wearable market in Kuwait is projected to grow by 25% in future. This synergy allows users to track their fitness metrics in real-time, enhancing the overall user experience and encouraging consistent app usage, which can lead to higher retention rates.

- Expansion of Corporate Wellness Programs:With 60% of Kuwaiti companies investing in employee wellness programs, fitness apps can play a crucial role in these initiatives. By partnering with businesses, app developers can offer tailored solutions that promote physical activity and health among employees, creating a win-win situation that boosts app usage while improving workplace health outcomes.