Region:Middle East

Author(s):Rebecca

Product Code:KRAD2905

Pages:96

Published On:November 2025

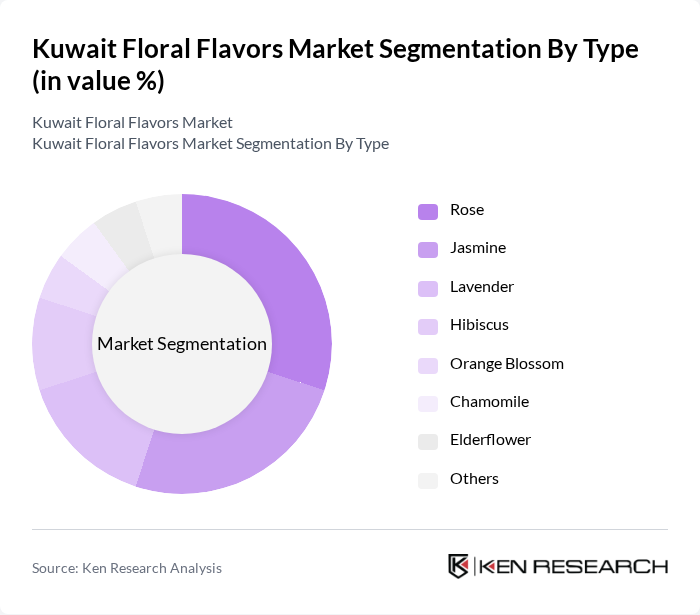

By Type:The floral flavors market can be segmented into various types, including Rose, Jasmine, Lavender, Hibiscus, Orange Blossom, Chamomile, Elderflower, and Others. Each type has unique characteristics and applications, catering to different consumer preferences and industry needs. Among these, Rose and Jasmine are particularly popular due to their widespread use in culinary applications and personal care products. The demand for Hibiscus and Lavender is also rising, driven by their association with wellness and functional benefits in beverages and skincare formulations .

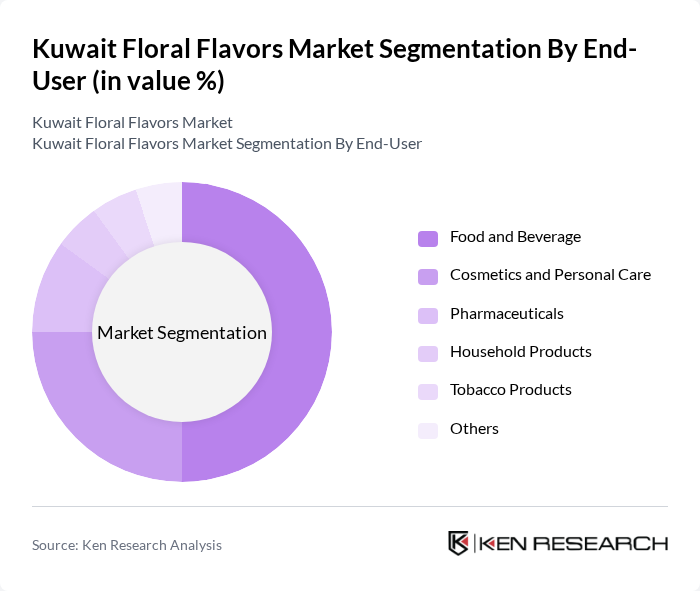

By End-User:The end-user segmentation includes Food and Beverage, Cosmetics and Personal Care, Pharmaceuticals, Household Products, Tobacco Products, and Others. The Food and Beverage sector is the largest consumer of floral flavors, driven by the growing trend of incorporating natural ingredients into products. Cosmetics and Personal Care also represent a significant portion of the market, as floral scents are highly sought after for their aromatic properties. The pharmaceutical and household products segments are witnessing steady growth due to the increasing use of floral extracts in wellness and cleaning products .

The Kuwait Floral Flavors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Givaudan, Firmenich (now dsm-firmenich), Symrise AG, International Flavors & Fragrances Inc. (IFF), Sensient Technologies Corporation, Takasago International Corporation, Kerry Group, Mane SA, Al Haramain Perfumes, Al Jazeera Perfumes, Al Shaya Group, Al Watania Agriculture, Al Khamis Group, Al Qatami Global for General Trading, Al Sayer Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait floral flavors market appears promising, driven by increasing consumer interest in natural and organic products. As the hospitality sector continues to expand, the incorporation of floral flavors in beverages and desserts is likely to gain traction. Additionally, the rise of e-commerce platforms will facilitate direct sales, allowing producers to reach a broader audience. These trends suggest a dynamic market landscape with significant growth potential in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Rose Jasmine Lavender Hibiscus Orange Blossom Chamomile Elderflower Others |

| By End-User | Food and Beverage Cosmetics and Personal Care Pharmaceuticals Household Products Tobacco Products Others |

| By Application | Culinary Uses Beverage Flavoring Perfume and Fragrance Aromatherapy Confectionery Dairy and Frozen Products Others |

| By Distribution Channel | Online Retail Supermarkets and Hypermarkets Specialty Stores Direct Sales Food Service Channels Others |

| By Region | Capital Governorate Hawalli Governorate Al Ahmadi Governorate Farwaniya Governorate Mubarak Al-Kabeer Governorate Jahra Governorate Others |

| By Product Form | Liquid Extracts Powdered Forms Concentrates Infusions Syrups Others |

| By Consumer Demographics | Age Group (18-25, 26-35, 36-50, 51+) Gender Income Level Lifestyle Preferences Nationality (Kuwaiti, Expatriate) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Floral Sales | 150 | Florists, Retail Managers |

| Wholesale Floral Distribution | 100 | Wholesale Distributors, Supply Chain Managers |

| Consumer Floral Purchases | 150 | End Consumers, Event Planners |

| Corporate Floral Services | 80 | Corporate Buyers, Office Managers |

| Floral Event Management | 70 | Event Coordinators, Wedding Planners |

The Kuwait Floral Flavors Market is valued at approximately USD 150 million, reflecting a significant growth trend driven by increasing consumer demand for natural and organic flavors in food and beverages.