Region:Middle East

Author(s):Dev

Product Code:KRAC4843

Pages:95

Published On:October 2025

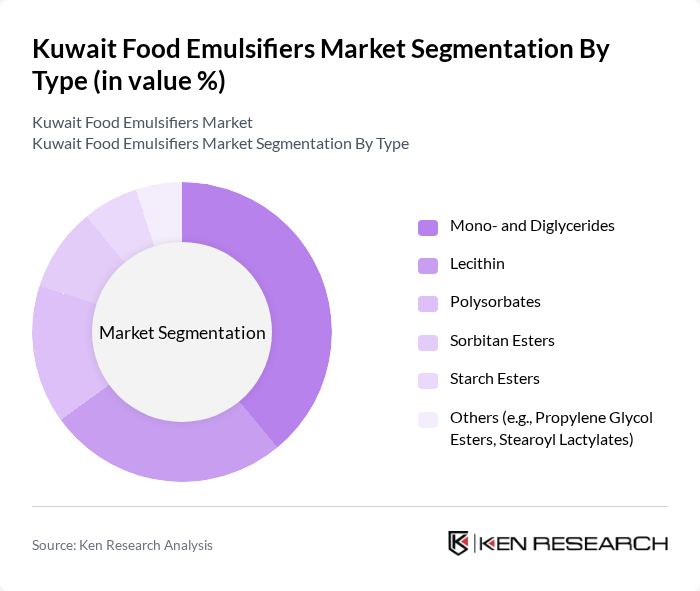

By Type:

The food emulsifiers market in Kuwait can be segmented into Mono- and Diglycerides, Lecithin, Polysorbates, Sorbitan Esters, Starch Esters, and Others (such as Propylene Glycol Esters and Stearoyl Lactylates). Among these, Mono- and Diglycerides hold the largest share, attributed to their versatility and widespread use in bakery, dairy, and confectionery applications. Their functional benefits include improved texture, extended shelf life, and enhanced product stability. Lecithin is increasingly favored in health-oriented and clean-label products, particularly as it is derived from natural sources like soy and sunflower .

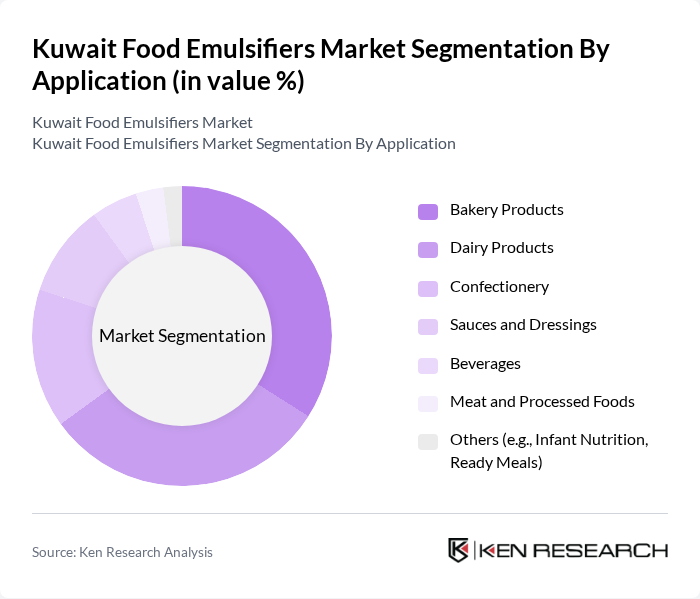

By Application:

Food emulsifiers in Kuwait are applied across Bakery Products, Dairy Products, Confectionery, Sauces and Dressings, Beverages, Meat and Processed Foods, and Others (including Infant Nutrition and Ready Meals). Bakery products constitute the leading application, driven by the rising demand for convenient and premium baked goods. Emulsifiers play a critical role in improving crumb structure, moisture retention, and product shelf life. Dairy products are another significant segment, where emulsifiers ensure the stability and uniformity of creams, spreads, and processed cheeses .

The Kuwait Food Emulsifiers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cargill, Incorporated, Archer Daniels Midland Company (ADM), BASF SE, DuPont de Nemours, Inc. (IFF), Ingredion Incorporated, Kerry Group plc, Palsgaard A/S, Univar Solutions Inc., Wilmar International Limited, Riken Vitamin Co., Ltd., Solvay S.A., Tate & Lyle PLC, AAK AB, Corbion N.V., Estelle Chemicals Pvt. Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait food emulsifiers market appears promising, driven by evolving consumer preferences and technological advancements. The increasing focus on sustainability and clean label products is expected to shape product development, with manufacturers investing in innovative formulations. Additionally, the rise of e-commerce in food retailing is likely to enhance market accessibility, allowing for greater distribution of emulsifiers. As health trends continue to influence purchasing decisions, the demand for plant-based and vegan emulsifiers will likely see significant growth, further diversifying the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Mono- and Diglycerides Lecithin Polysorbates Sorbitan Esters Starch Esters Others (e.g., Propylene Glycol Esters, Stearoyl Lactylates) |

| By Application | Bakery Products Dairy Products Confectionery Sauces and Dressings Beverages Meat and Processed Foods Others (e.g., Infant Nutrition, Ready Meals) |

| By End-User | Food Manufacturers Retailers Food Service Providers Households |

| By Distribution Channel | Direct Sales Distributors/Wholesalers Online Retail Supermarkets/Hypermarkets |

| By Packaging Type | Bulk Packaging Retail Packaging Custom Packaging |

| By Price Range | Economy Mid-Range Premium |

| By Formulation Type | Liquid Emulsifiers Powder Emulsifiers Granular and Other Forms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Bakery Product Manufacturers | 100 | Production Managers, Quality Assurance Specialists |

| Dairy Product Producers | 60 | Product Development Managers, R&D Scientists |

| Food Service Industry | 50 | Executive Chefs, Menu Development Specialists |

| Retail Food Brands | 70 | Marketing Managers, Brand Development Executives |

| Food Ingredient Distributors | 40 | Sales Managers, Supply Chain Coordinators |

The Kuwait Food Emulsifiers Market is valued at approximately USD 140 million, reflecting a growing demand for processed and convenience food products that utilize emulsifiers for enhanced texture, shelf stability, and product consistency.