Region:Middle East

Author(s):Rebecca

Product Code:KRAD1517

Pages:94

Published On:November 2025

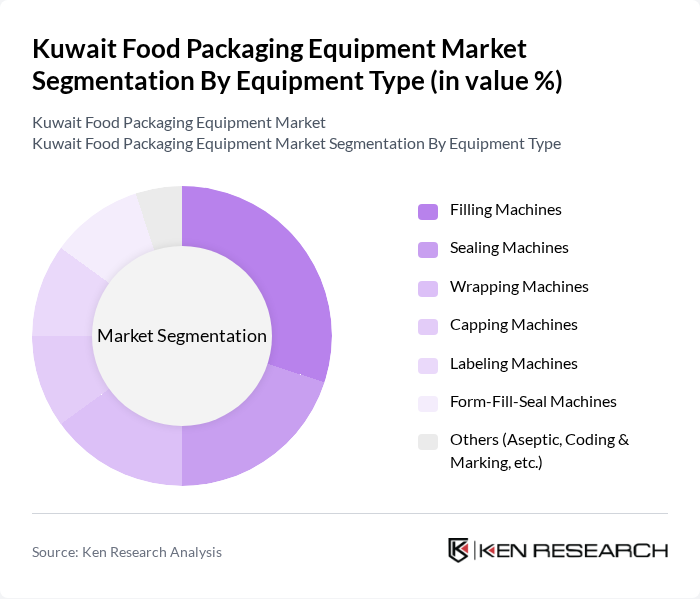

By Equipment Type:The equipment type segmentation includes various categories such as filling machines, sealing machines, wrapping machines, capping machines, labeling machines, form-fill-seal machines, and others. Among these, filling machines are the most dominant due to their essential role in the food packaging process, ensuring accurate portioning and minimizing waste. The increasing demand for ready-to-eat meals and beverages, as well as the integration of automation and high-speed production lines, has further propelled the growth of filling machines, making them a critical component in the food packaging industry .

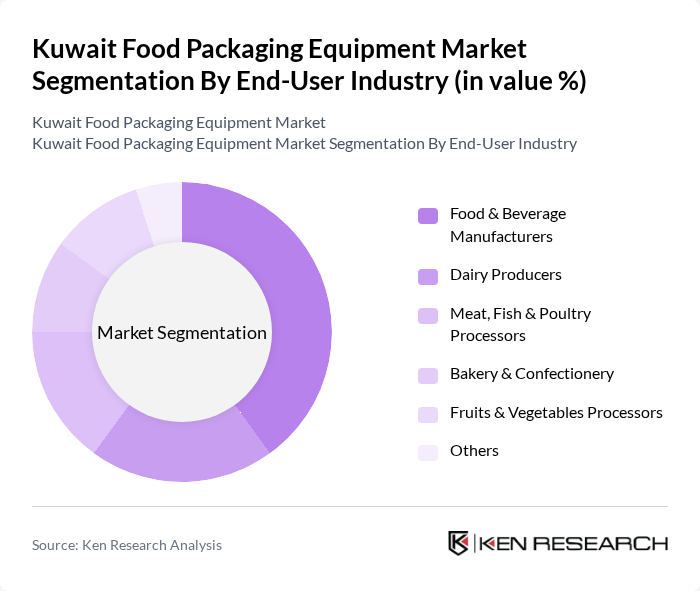

By End-User Industry:The end-user industry segmentation encompasses food and beverage manufacturers, dairy producers, meat, fish & poultry processors, bakery & confectionery, fruits & vegetables processors, and others. The food and beverage manufacturers segment leads the market, driven by the increasing consumer demand for packaged food products and the growing trend of convenience foods. This segment's growth is further supported by innovations in packaging technology that enhance product shelf life, safety, and compliance with food safety regulations .

The Kuwait Food Packaging Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tetra Pak Arabia, Ishida Middle East FZE, MULTIVAC Middle East, Syntegon Technology, IMA Group, ProMach, Marchesini Group, Nichrome India Ltd., Hayssen Flexible Systems, Al Kout Industrial Projects, Gulf Packaging Industries, Al-Qatami Group, Al-Shaheen Group, Al-Sayer Group, Al-Babtain Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait food packaging equipment market appears promising, driven by increasing consumer demand for convenience and safety. As e-commerce food delivery services expand, the need for efficient packaging solutions will grow. Additionally, the integration of smart technologies and sustainable practices will likely reshape the industry landscape, encouraging manufacturers to innovate. With government support for modernization and sustainability, the market is poised for significant advancements in the coming years, fostering a competitive environment.

| Segment | Sub-Segments |

|---|---|

| By Equipment Type | Filling Machines Sealing Machines Wrapping Machines Capping Machines Labeling Machines Form-Fill-Seal Machines Others (Aseptic, Coding & Marking, etc.) |

| By End-User Industry | Food & Beverage Manufacturers Dairy Producers Meat, Fish & Poultry Processors Bakery & Confectionery Fruits & Vegetables Processors Others |

| By Packaging Material | Plastic (HDPE, LDPE, PET) Paper & Board Metal Glass Others (Foils, etc.) |

| By Packaging Process | Filling Sealing Labeling Coding and Marking Wrapping Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Application | Food Preservation Product Protection Branding and Marketing Convenience Others |

| By Technology | Automated Packaging Manual Packaging Semi-Automated Packaging Robotic Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Processing Companies | 120 | Production Managers, Quality Assurance Heads |

| Packaging Equipment Suppliers | 70 | Sales Managers, Product Development Managers |

| Retail Food Outlets | 60 | Store Managers, Procurement Officers |

| Food Safety Regulators | 40 | Compliance Officers, Regulatory Affairs Managers |

| Sustainability Consultants | 40 | Environmental Managers, Sustainability Officers |

The Kuwait Food Packaging Equipment Market is valued at approximately USD 170 million, driven by increasing demand for packaged food products and advancements in packaging technologies. This growth reflects a significant trend towards convenience and ready-to-eat meals in the region.