Region:Middle East

Author(s):Geetanshi

Product Code:KRAD5905

Pages:85

Published On:December 2025

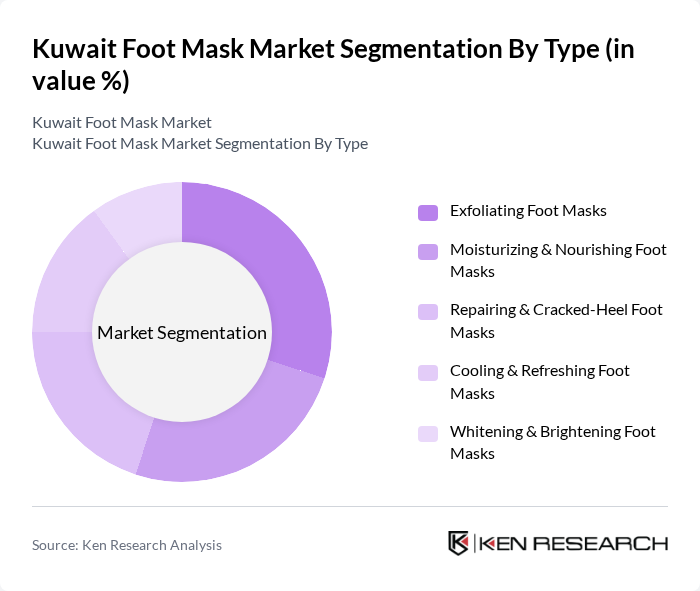

By Type:The foot mask market can be segmented into various types, including Exfoliating Foot Masks, Moisturizing & Nourishing Foot Masks, Repairing & Cracked-Heel Foot Masks, Cooling & Refreshing Foot Masks, and Whitening & Brightening Foot Masks. This structure is consistent with global segmentation of foot mask products into exfoliation and whitening/moisturizing-focused formulations. Each type caters to specific consumer needs, with exfoliating and moisturizing masks being particularly popular due to their effectiveness in addressing common issues such as hard skin, calluses, and dryness.

The Exfoliating Foot Masks segment leads the market, driven by consumer demand for effective solutions to remove dead skin and improve foot texture, mirroring global trends where exfoliation-based foot masks are a core product category. This type of mask is favored for its quick results and ease of use, making it a staple in many households and in at-home pedicure routines. The popularity of social media, beauty influencers, and “peeling mask” before-and-after content has also contributed to the rise of exfoliating masks, as consumers seek visible improvements and shareable results, particularly among younger, digitally engaged demographics in GCC markets including Kuwait.

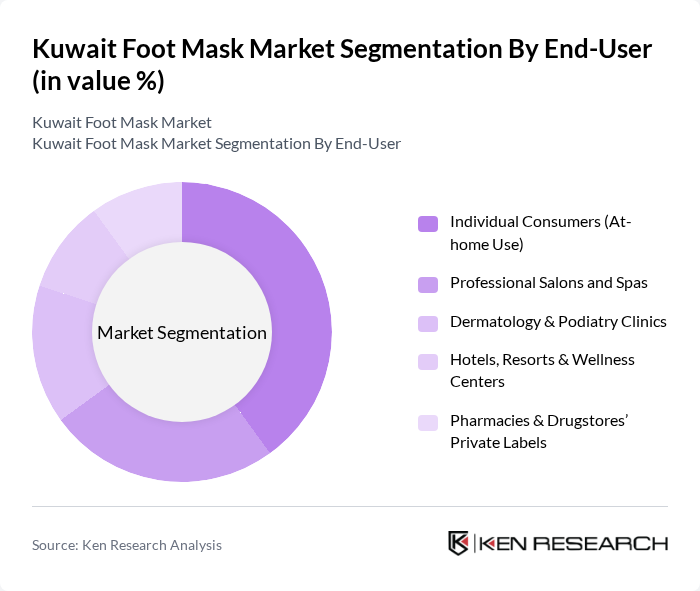

By End-User:The market is segmented by end-user categories, including Individual Consumers (At-home Use), Professional Salons and Spas, Dermatology & Podiatry Clinics, Hotels, Resorts & Wellness Centers, and Pharmacies & Drugstores’ Private Labels. This reflects the broader usage patterns seen in foot care, where both retail and professional channels are important. Each segment serves different consumer needs, with individual consumers and professional salons being the most significant contributors to market growth, supported by the popularity of home-use masks and professional pedicure services incorporating foot mask treatments.

The Individual Consumers segment dominates the market, as more people are opting for at-home foot care solutions due to convenience, cost-effectiveness, and the increasing penetration of online retail and delivery platforms in Kuwait. The rise of e-commerce platforms and omnichannel strategies by pharmacies and beauty retailers has further facilitated access to a variety of foot masks, allowing consumers to compare ingredients, reviews, and prices and choose products that best suit their needs without the need to visit physical stores.

The Kuwait Foot Mask Market is characterized by a dynamic mix of regional and international players, aligned with the broader global foot mask landscape where multinational and Korean, Japanese, and European brands are active. Leading participants such as Sephora Middle East (Sephora Collection), Boots Middle East (Boots Foot Care Range), Watsons Middle East (Watsons Foot Mask Range), Scholl (Reckitt Benckiser Group plc), Dr. Scholl's, The Body Shop, Lush Fresh Handmade Cosmetics, Farmstay, Tony Moly, Etude, Innisfree, Neutrogena, Nivea, Aveeno, CeraVe contribute to innovation, geographic expansion, and service delivery in this space through diversified product portfolios, frequent new product introductions, and strong presence across online and offline retail channels in GCC markets including Kuwait.

The future of the foot mask market in Kuwait appears promising, driven by evolving consumer preferences and technological advancements. As consumers increasingly prioritize self-care and wellness, the demand for innovative foot care solutions is expected to rise. Additionally, the integration of digital marketing strategies and e-commerce platforms will likely enhance product accessibility, further stimulating market growth. Companies that adapt to these trends and invest in sustainable practices will be well-positioned to capture a larger market share in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Exfoliating Foot Masks Moisturizing & Nourishing Foot Masks Repairing & Cracked-Heel Foot Masks Cooling & Refreshing Foot Masks Whitening & Brightening Foot Masks |

| By End-User | Individual Consumers (At-home Use) Professional Salons and Spas Dermatology & Podiatry Clinics Hotels, Resorts & Wellness Centers Pharmacies & Drugstores’ Private Labels |

| By Distribution Channel | Hypermarkets & Supermarkets Pharmacies & Drugstores Specialty Beauty & Personal Care Stores E-commerce & Online Marketplaces Direct Sales & Social Commerce |

| By Ingredient Type | Natural & Botanical Ingredients Synthetic & Chemical-based Ingredients Organic & Clean-label Certified Dermatologist-recommended / Medicinal Actives |

| By Packaging Type | Single-use Sock-type Sachets Multi-use Tubes & Jars Value Packs (Multi-sachet) Eco-friendly & Recyclable Packaging |

| By Price Range | Mass / Budget Mass Premium / Mid-range Premium & Prestige Professional-grade (Salon/Clinic) |

| By Consumer Demographics | Age Group (18–24, 25–34, 35–44, 45+) Gender (Female, Male, Unisex) Income Level (Low, Middle, High) Expat vs Kuwaiti Nationals |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Foot Mask Sales | 100 | Store Managers, Beauty Advisors |

| Consumer Foot Care Preferences | 120 | Regular Foot Mask Users, Occasional Buyers |

| Online Foot Mask Purchases | 80 | E-commerce Managers, Digital Marketing Specialists |

| Dermatological Insights on Foot Masks | 50 | Dermatologists, Podiatrists |

| Market Trends and Innovations | 60 | Product Development Managers, Brand Strategists |

The Kuwait Foot Mask Market is valued at approximately USD 12 million, reflecting a growing consumer interest in foot care and wellness products. This market is part of the broader skin care and foot care categories in Kuwait.