Region:Middle East

Author(s):Rebecca

Product Code:KRAD1484

Pages:96

Published On:November 2025

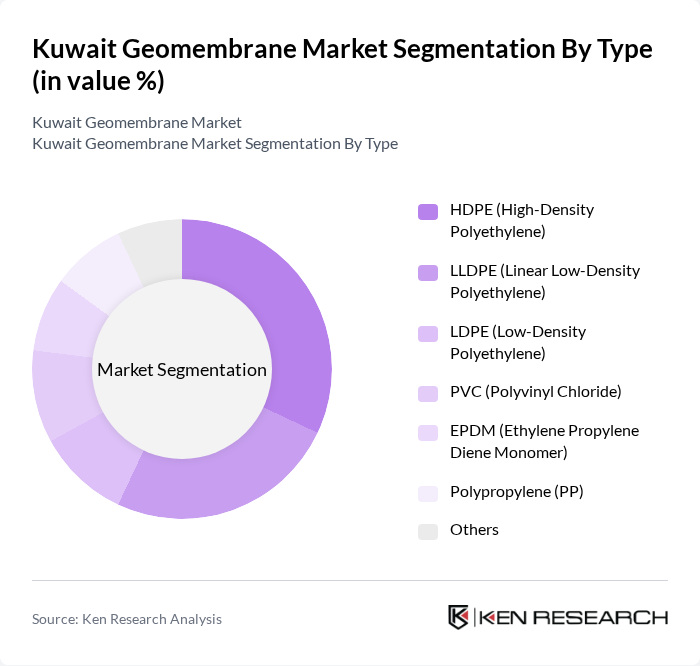

By Type:The geomembrane market is segmented into HDPE (High-Density Polyethylene), LLDPE (Linear Low-Density Polyethylene), LDPE (Low-Density Polyethylene), PVC (Polyvinyl Chloride), EPDM (Ethylene Propylene Diene Monomer), Polypropylene (PP), and others. Among these, HDPE geomembranes hold the largest share, driven by their superior chemical resistance, durability, and cost-effectiveness. These properties make HDPE the preferred choice for waste management, water conservation, and environmental containment applications .

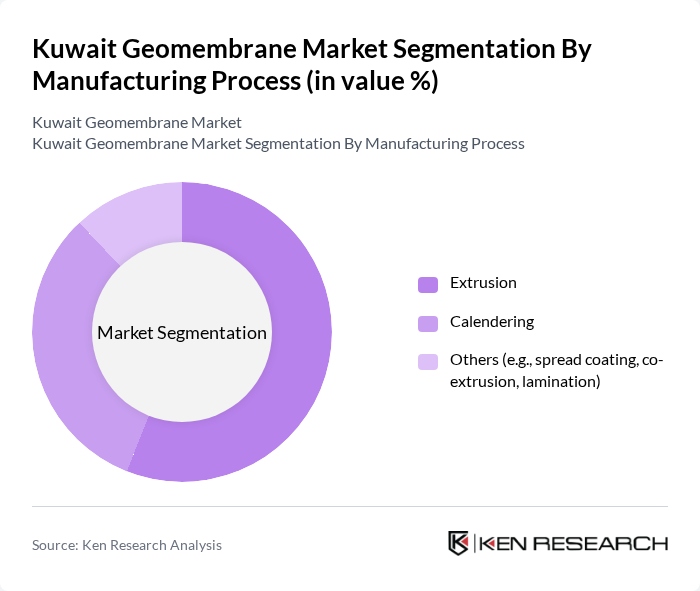

By Manufacturing Process:The manufacturing processes for geomembranes include extrusion, calendering, and others such as spread coating, co-extrusion, and lamination. The extrusion process is the most widely adopted, accounting for the majority of production due to its efficiency and ability to deliver geomembranes with consistent thickness and high mechanical properties. This method is particularly favored in civil construction and environmental containment projects .

The Kuwait Geomembrane Market is characterized by a dynamic mix of regional and international players. Leading participants such as GSE Environmental, Solmax, AGRU Kunststofftechnik GmbH, Naue GmbH & Co. KG, Firestone Building Products (now part of Holcim), Raven Industries (now part of Industrial Opportunity Partners), Layfield Group, Sotrafa, Geomembrane Technologies Inc. (GTI, now part of Evoqua Water Technologies), CETCO (Minerals Technologies Inc.), Atarfil, TenCate Geosynthetics, HUESKER Group, Polyguard Products, BTL Liners, Al Yousifi Engineering & Construction (local distributor/installer), Gulf Lining Materials FZE (regional supplier), Geosynthetics Technologies Co. (local/regional player) contribute to innovation, geographic expansion, and service delivery in this space.

The Kuwait geomembrane market is poised for significant growth, driven by increasing environmental awareness and regulatory pressures. As the government intensifies its focus on sustainable practices, the demand for eco-friendly geomembrane solutions is expected to rise. Additionally, advancements in material technology will likely lead to the development of more efficient and cost-effective products. Collaborations between manufacturers and end-users will further enhance product customization, ensuring that geomembranes meet specific industry needs and applications, thereby fostering market expansion.

| Segment | Sub-Segments |

|---|---|

| By Type | HDPE (High-Density Polyethylene) LLDPE (Linear Low-Density Polyethylene) LDPE (Low-Density Polyethylene) PVC (Polyvinyl Chloride) EPDM (Ethylene Propylene Diene Monomer) Polypropylene (PP) Others |

| By Manufacturing Process | Extrusion Calendering Others (e.g., spread coating, co-extrusion, lamination) |

| By Application | Waste Management Water Management Mining Civil Construction Environmental Containment Others |

| By End-User | Construction Agriculture Mining Oil & Gas Municipal (Wastewater, Landfills) Others |

| By Thickness | Thin (up to 1mm) Medium (1mm - 2mm) Thick (above 2mm) Others |

| By Color | Black White Green Others |

| By Region | Central Kuwait Southern Kuwait Northern Kuwait Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Projects Utilizing Geomembranes | 100 | Project Managers, Site Engineers |

| Environmental Compliance in Waste Management | 80 | Environmental Consultants, Compliance Officers |

| Agricultural Applications of Geomembranes | 70 | Agronomists, Farm Managers |

| Infrastructure Development Initiatives | 90 | Urban Planners, Civil Engineers |

| Research and Development in Geomembrane Technology | 60 | R&D Managers, Product Development Engineers |

The Kuwait Geomembrane Market is valued at approximately USD 5 million, driven by increasing infrastructure projects, environmental regulations, and the demand for advanced waste management solutions.