Kuwait Hydrocolloids Market Overview

- The Kuwait Hydrocolloids Market is valued at USD 15 million, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for natural food additives, rising health consciousness among consumers, and the expanding food and beverage industry. The market is also supported by the growing pharmaceutical and cosmetic sectors, which utilize hydrocolloids for their gelling and thickening properties. Notably, the adoption of clean-label and plant-based ingredients is accelerating market growth, reflecting global trends in wellness and sustainable sourcing .

- Kuwait City is the dominant hub for the hydrocolloids market, owing to its strategic location and well-established infrastructure. The city serves as a central point for trade and distribution, facilitating access to both local and international markets. Additionally, the presence of key players and manufacturers in the region further strengthens its position in the hydrocolloids market .

- In 2023, the Kuwaiti government implemented regulations aimed at enhancing food safety standards, which include stricter guidelines for the use of hydrocolloids in food products. This regulation mandates that all food additives, including hydrocolloids, must be approved by the Kuwait Food Safety Authority, ensuring that they meet safety and quality standards before reaching consumers .

Kuwait Hydrocolloids Market Segmentation

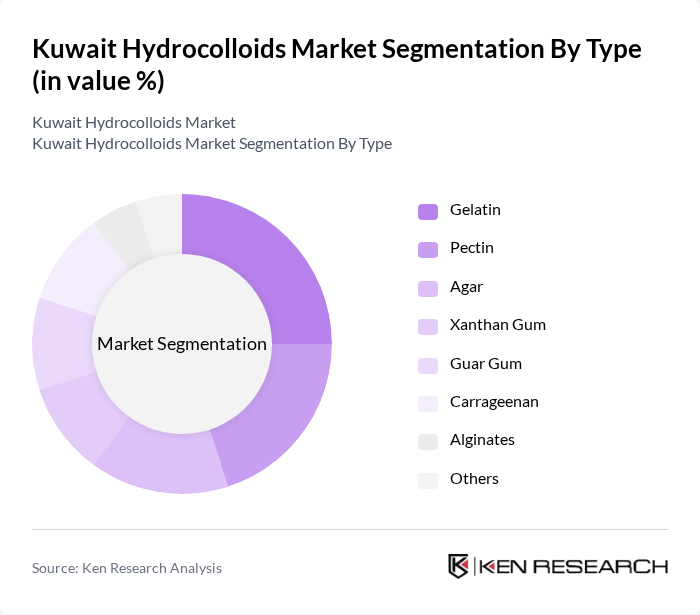

By Type:The hydrocolloids market can be segmented into various types, including Gelatin, Pectin, Agar, Xanthan Gum, Guar Gum, Carrageenan, Alginates, and Others. Each type serves distinct functions across multiple industries, with specific applications in food, pharmaceuticals, and cosmetics.

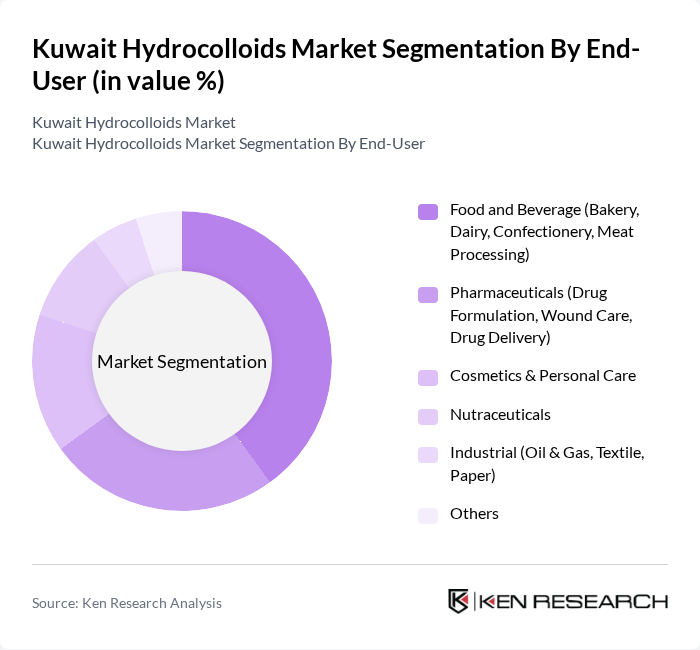

By End-User:The end-user segmentation includes Food and Beverage, Pharmaceuticals, Cosmetics & Personal Care, Nutraceuticals, Industrial, and Others. Each sector utilizes hydrocolloids for various applications, such as thickening, stabilizing, and gelling.

Kuwait Hydrocolloids Market Competitive Landscape

The Kuwait Hydrocolloids Market is characterized by a dynamic mix of regional and international players. Leading participants such as DuPont de Nemours, Inc. (IFF), Kerry Group plc, Ingredion Incorporated, Cargill, Incorporated, Ashland Global Holdings Inc., Tate & Lyle PLC, DSM Food Specialties (Koninklijke DSM N.V.), Fufeng Group Company Limited, CP Kelco U.S., Inc., Naturex S.A. (now part of Givaudan), Gelita AG, Wacker Chemie AG, Emsland Group, BENEO GmbH, Nexira S.A., Jungbunzlauer Suisse AG, Fuerst Day Lawson Ltd., Archer Daniels Midland Company (ADM), AEP Colloids Inc., Givaudan SA contribute to innovation, geographic expansion, and service delivery in this space.

Kuwait Hydrocolloids Market Industry Analysis

Growth Drivers

- Increasing Demand for Natural Food Additives:The Kuwait hydrocolloids market is experiencing a surge in demand for natural food additives, driven by consumer preferences shifting towards healthier options. In future, the natural food additives market in Kuwait is projected to reach approximately 150 million KWD, reflecting a growth rate of 10% annually. This trend is supported by the rising awareness of the health benefits associated with natural ingredients, as consumers increasingly seek products free from synthetic additives, thereby boosting hydrocolloid usage in food applications.

- Rising Health Consciousness Among Consumers:Health consciousness among Kuwaiti consumers is significantly influencing the hydrocolloids market. With a reported 60% of the population actively seeking healthier food options, the demand for hydrocolloids, which enhance texture and stability without compromising health, is on the rise. The World Health Organization indicates that obesity rates in Kuwait are among the highest globally, prompting consumers to opt for products that support healthier lifestyles, thus driving hydrocolloid adoption in food and beverage sectors.

- Expanding Applications in the Pharmaceutical Industry:The pharmaceutical sector in Kuwait is increasingly utilizing hydrocolloids for drug formulation and delivery systems. In future, the pharmaceutical market is expected to reach 1.2 billion KWD, with hydrocolloids playing a crucial role in enhancing drug stability and bioavailability. The growing focus on innovative drug delivery methods, such as controlled-release formulations, is propelling the demand for hydrocolloids, thereby creating new opportunities for manufacturers in this segment.

Market Challenges

- Fluctuating Raw Material Prices:The hydrocolloids market in Kuwait faces challenges due to fluctuating raw material prices, which can significantly impact production costs. For instance, the price of guar gum, a key hydrocolloid, has seen variations of up to 30% over the past year due to supply chain disruptions and climatic factors. Such volatility can lead to increased operational costs for manufacturers, ultimately affecting pricing strategies and profit margins in the competitive market landscape.

- Stringent Regulatory Requirements:Compliance with stringent regulatory requirements poses a significant challenge for hydrocolloid manufacturers in Kuwait. The Ministry of Health has implemented rigorous food safety standards, requiring extensive testing and documentation for hydrocolloid products. In future, the cost of compliance is estimated to rise by 15%, as companies invest in quality assurance and regulatory adherence. This can strain resources, particularly for smaller manufacturers, limiting their ability to compete effectively in the market.

Kuwait Hydrocolloids Market Future Outlook

The future of the Kuwait hydrocolloids market appears promising, driven by increasing consumer demand for natural and health-oriented products. As the food processing sector continues to expand, innovations in hydrocolloid formulations are expected to enhance product offerings. Additionally, the growing emphasis on sustainability will likely lead to more eco-friendly sourcing practices. Companies that adapt to these trends and invest in research and development will be well-positioned to capitalize on emerging opportunities in the market.

Market Opportunities

- Expansion in the Organic Food Segment:The organic food segment in Kuwait is projected to grow significantly, with sales expected to reach 50 million KWD by future. This growth presents an opportunity for hydrocolloid manufacturers to develop organic-certified products, catering to the increasing consumer preference for clean label and organic options, thereby enhancing market penetration and brand loyalty.

- Innovations in Hydrocolloid Formulations:There is a growing opportunity for innovation in hydrocolloid formulations, particularly in developing multifunctional products that meet diverse consumer needs. Research indicates that investments in R&D could increase by 20% in future, allowing companies to create advanced hydrocolloids that improve texture, stability, and nutritional value, thus attracting a broader customer base.