Kuwait Lab on a Chip Market Overview

- The Kuwait Lab on a Chip Market is valued at USD 140 million, based on a five-year historical analysis and extrapolation from global and Middle East insights indicating strong but still emerging adoption in Kuwait. This growth is primarily driven by advancements in microfluidics technology, increasing demand for rapid diagnostics, and the rising prevalence of chronic diseases such as diabetes and cardiovascular diseases in the country. The integration of lab-on-a-chip devices in various applications, including genomics, proteomics, and point-of-care testing, as well as their use in miniaturized, cost-effective, and high-throughput analysis, has further fueled market expansion.

- Kuwait City is the dominant hub in the Kuwait Lab on a Chip Market due to its advanced healthcare infrastructure, concentration of tertiary care hospitals, and significant public investments in biotechnology and digital health within major medical complexes. The presence of leading research-focused institutions and referral hospitals in the city supports clinical research, molecular diagnostics, and adoption of innovative lab-on-a-chip and biochip technologies, making it a focal point for market growth.

- In 2023, the Kuwaiti government strengthened the framework for advanced diagnostics and medical devices relevant to lab-on-a-chip technologies through instruments such as the Medical Devices Interim Regulation issued by the Kuwait Drug and Food Control Administration (KDFCA) under the Ministry of Health, which aligns classifications, safety, and performance requirements for in vitro diagnostic and medical device technologies with Gulf and international standards. This regulatory environment, combined with government-backed funding programs for research and development in precision medicine and molecular diagnostics, aims to enhance diagnostic capabilities and improve patient outcomes, and is expected to accelerate the adoption of lab-on-a-chip platforms across the healthcare sector.

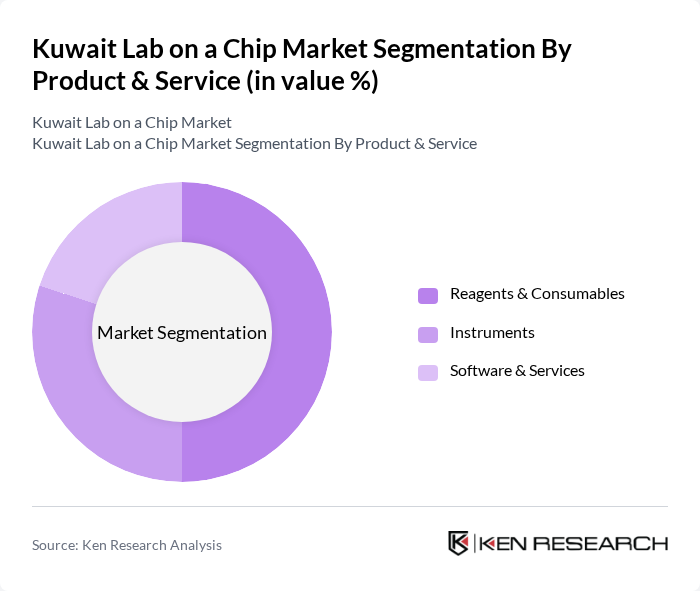

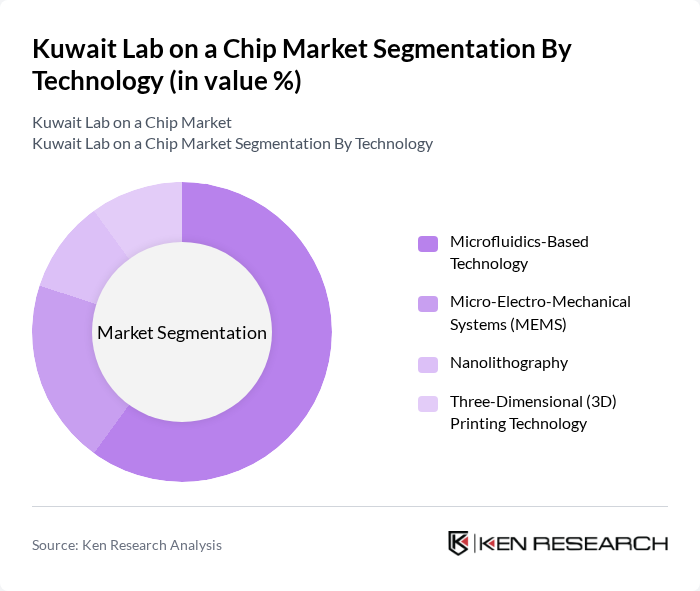

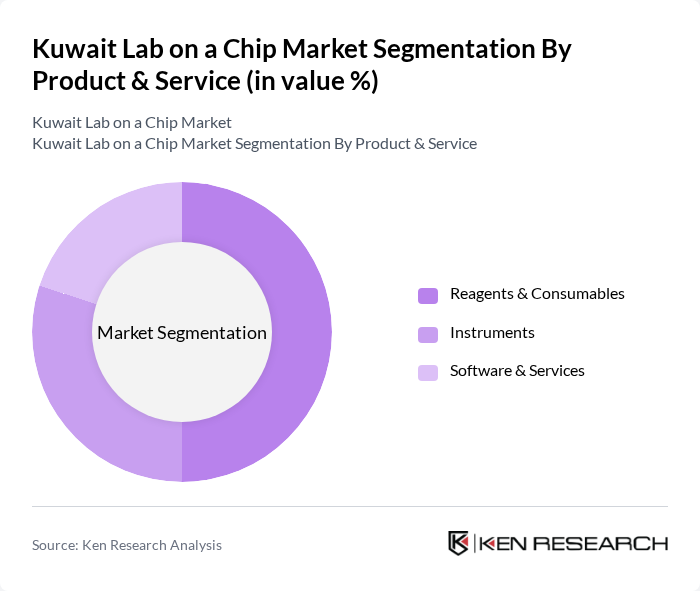

Kuwait Lab on a Chip Market Segmentation

By Product & Service:The product and service segmentation includes reagents & consumables, instruments, and software & services. Each of these subsegments plays a crucial role in the overall market, with reagents & consumables being the most significant due to their essential role in repetitive testing workflows, assay development, and routine operation of lab-on-a-chip platforms, which is consistent with global trends where reagents and consumables form the largest revenue-contributing product category.

By Technology:The technology segmentation encompasses microfluidics-based technology, micro-electro-mechanical systems (MEMS), nanolithography, and three-dimensional (3D) printing technology. Microfluidics-based technology is leading this segment due to its versatility, low sample and reagent consumption, rapid turnaround times, and broad applicability in point-of-care testing, molecular diagnostics, and research workflows, mirroring its leading position in the global lab-on-a-chip market.

Kuwait Lab on a Chip Market Competitive Landscape

The Kuwait Lab on a Chip Market is characterized by a dynamic mix of regional and international players. Leading participants such as Agilent Technologies, Bio-Rad Laboratories, Illumina, Inc., Thermo Fisher Scientific, PerkinElmer, Inc., Siemens Healthineers, Roche Diagnostics, Abbott Laboratories, QIAGEN N.V., Becton, Dickinson and Company, Merck KGaA, bioMérieux, Cepheid, Luminex Corporation, Eppendorf AG contribute to innovation, geographic expansion, and service delivery in this space, leveraging their global portfolios in microfluidics, molecular diagnostics, and biochip solutions.

Kuwait Lab on a Chip Market Industry Analysis

Growth Drivers

- Increasing Demand for Point-of-Care Testing:The demand for point-of-care testing in Kuwait is projected to reach approximately 1.2 million tests in future, driven by the need for rapid diagnostics. This surge is supported by a healthcare expenditure of around $4.8 billion, reflecting a 5% annual increase. The convenience and efficiency of lab-on-a-chip technologies align with the healthcare system's goals to enhance patient outcomes and reduce hospital visits, making this a significant growth driver.

- Advancements in Microfluidics Technology:The microfluidics market in Kuwait is expected to grow significantly, with investments in R&D projected to exceed $160 million in future. Innovations in this field are leading to the development of more efficient lab-on-a-chip devices, which can perform multiple tests simultaneously. This technological advancement is crucial for improving diagnostic accuracy and speed, thereby attracting more healthcare providers to adopt these solutions in clinical settings.

- Rising Prevalence of Chronic Diseases:Chronic diseases, such as diabetes and cardiovascular conditions, affect approximately 30% of the Kuwaiti population, leading to an increased demand for effective diagnostic tools. The healthcare system is responding with a projected increase in spending on chronic disease management, estimated at $1.3 billion in future. This trend is driving the adoption of lab-on-a-chip technologies, which offer rapid and accurate diagnostics essential for managing these conditions effectively.

Market Challenges

- High Initial Investment Costs:The high initial investment required for lab-on-a-chip technology can be a significant barrier, with costs for advanced devices averaging around $260,000. This financial hurdle limits accessibility for smaller healthcare facilities and startups. As a result, many potential users may opt for traditional diagnostic methods, which can hinder the overall growth of the lab-on-a-chip market in Kuwait.

- Limited Awareness Among Healthcare Professionals:A survey indicated that only 40% of healthcare professionals in Kuwait are familiar with lab-on-a-chip technologies. This lack of awareness can impede adoption rates, as practitioners may be hesitant to integrate new technologies into their practices. Educational initiatives and training programs are essential to bridge this knowledge gap and promote the benefits of these innovative diagnostic solutions.

Kuwait Lab on a Chip Market Future Outlook

The future of the lab-on-a-chip market in Kuwait appears promising, driven by technological advancements and increasing healthcare investments. In future, the integration of artificial intelligence in diagnostics is expected to enhance the accuracy and efficiency of lab-on-a-chip devices. Additionally, the shift towards home-based testing solutions will likely expand market reach, catering to the growing demand for convenient healthcare options. These trends indicate a robust growth trajectory for the industry, fostering innovation and improved patient care.

Market Opportunities

- Expansion of Research and Development Activities:With government funding for healthcare R&D projected to increase by 20% to $240 million in future, there is a significant opportunity for innovation in lab-on-a-chip technologies. This investment can lead to the development of more advanced diagnostic tools, enhancing the overall healthcare landscape in Kuwait.

- Collaborations with Academic Institutions:Partnerships between healthcare providers and academic institutions are expected to grow, with at least five new collaborations anticipated in future. These alliances can facilitate knowledge transfer and accelerate the development of lab-on-a-chip technologies, ultimately improving diagnostic capabilities and patient outcomes in Kuwait.