Kuwait Luxury Jewelry Market Overview

- The Kuwait Luxury Jewelry Market is valued at USD 1.1 billion, based on a five-year historical analysis. This growth is primarily driven by increasing disposable incomes, a rising number of affluent consumers, and a growing preference for luxury goods among the population. The market has seen a significant uptick in demand for high-end jewelry, particularly in urban areas where luxury shopping is a popular activity. Gold jewelry remains a cornerstone of jewelry consumption, especially for weddings and family celebrations, while demand for diamond and platinum jewelry is rising among the wealthy consumer base. International luxury brands are increasingly targeting Kuwaiti buyers, who favor bespoke and branded designs. The market is further supported by strong government backing for retail and economic stability, ensuring sustained demand for both traditional and modern jewelry .

- Kuwait City is the dominant hub for luxury jewelry, benefiting from its status as a financial center and a shopping destination in the Gulf region. The city's affluent population, coupled with a strong tourism sector, contributes to its leadership in the luxury jewelry market. Additionally, the presence of numerous international luxury brands enhances its appeal as a shopping destination .

- In 2023, the Kuwaiti government implemented regulations aimed at enhancing consumer protection in the luxury goods sector. This includes stricter guidelines for the certification of precious metals and gemstones, ensuring that consumers receive authentic products. The initiative is designed to bolster consumer confidence and promote ethical practices within the luxury jewelry market. The key regulatory instrument is the "Executive Regulations for the Control of Precious Metals and Gemstones, 2023" issued by the Ministry of Commerce and Industry, which sets out requirements for hallmarking, certification, and the licensing of jewelry retailers .

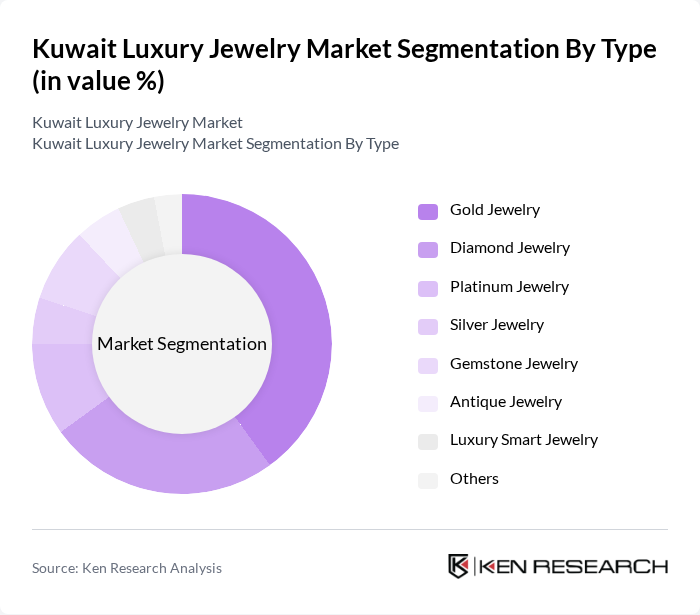

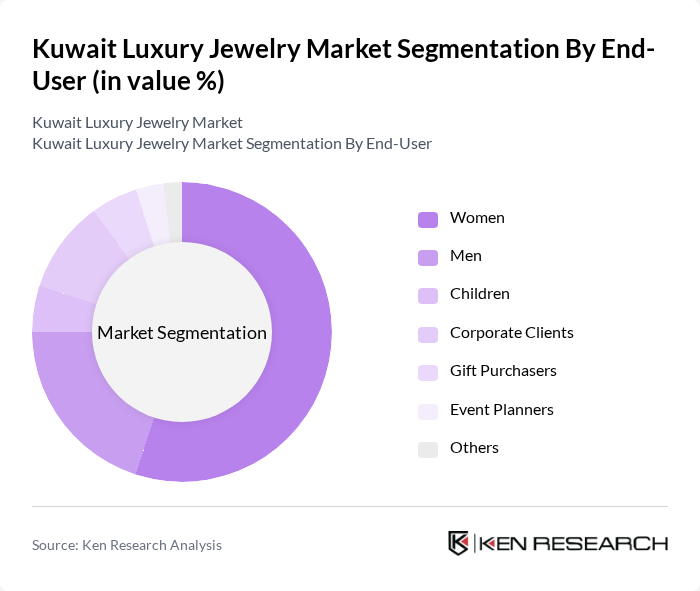

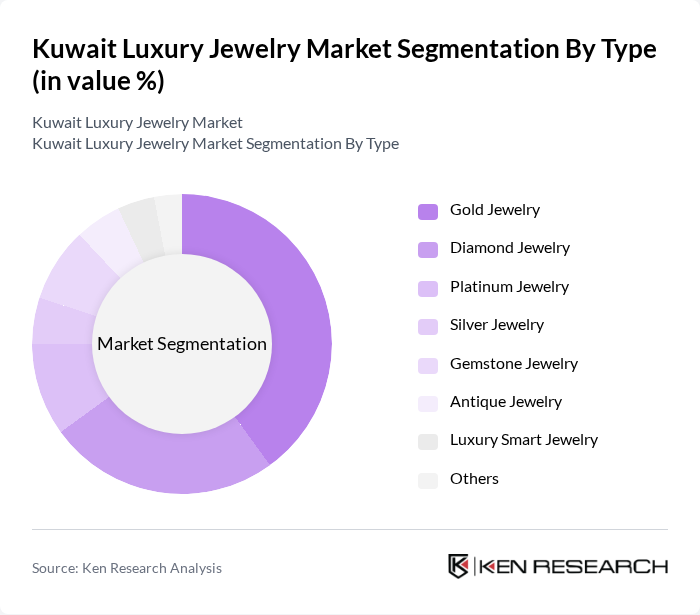

Kuwait Luxury Jewelry Market Segmentation

By Type:The luxury jewelry market in Kuwait is segmented into various types, including Gold Jewelry, Diamond Jewelry, Platinum Jewelry, Silver Jewelry, Gemstone Jewelry, Antique Jewelry, Luxury Smart Jewelry, and Others. Among these, Gold Jewelry remains the most popular due to cultural significance and investment value. Diamond Jewelry follows closely, driven by its association with luxury and special occasions. The demand for Platinum and Antique Jewelry is also notable, reflecting changing consumer preferences towards unique and high-quality pieces. The luxury smart jewelry segment, while still niche, is gaining traction, particularly in fitness tracking and heart rate monitoring applications .

By End-User:The end-user segmentation of the luxury jewelry market includes Women, Men, Children, Corporate Clients, Gift Purchasers, Event Planners, and Others. Women are the primary consumers, driven by fashion trends and cultural practices that encourage jewelry purchases for personal adornment. Men are increasingly participating in the luxury jewelry market, particularly for gifts and personal use. Corporate clients and event planners also contribute significantly, often purchasing high-end pieces for corporate events and gifts. The market is also seeing a gradual rise in demand from younger consumers and tech-savvy buyers, especially in the luxury smart jewelry segment .

Kuwait Luxury Jewelry Market Competitive Landscape

The Kuwait Luxury Jewelry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Damas Jewelry, Al-Hussaini Jewelry, L'azurde, Mouawad Jewelry, Tiffany & Co., Cartier, Bvlgari, Chopard, Van Cleef & Arpels, Graff Diamonds, Harry Winston, Piaget, Mikimoto, Buccellati, Jawhara Jewelry, Malabar Gold & Diamonds, Joyalukkas, Al Zain Jewelry, Al Fardan Jewellery, Al-Sarraf Jewelry contribute to innovation, geographic expansion, and service delivery in this space.

Kuwait Luxury Jewelry Market Industry Analysis

Growth Drivers

- Increasing Disposable Income:The average disposable income in Kuwait is projected to reach approximately $38,000 per capita in future, reflecting a 6% increase from the previous year. This rise in income enables consumers to allocate more funds towards luxury purchases, including high-end jewelry. As disposable income grows, the demand for luxury items, particularly jewelry, is expected to surge, driving market growth significantly. The affluent population's purchasing power is a key factor in this trend.

- Rising Demand for Bespoke Jewelry:The bespoke jewelry segment in Kuwait is experiencing a notable increase, with sales expected to reach $160 million in future. This growth is driven by consumers seeking unique, personalized pieces that reflect their individual styles and stories. The cultural emphasis on personal expression and status through jewelry is fueling this demand, as more consumers are willing to invest in custom designs that cater to their specific preferences and tastes.

- Growth of E-commerce Platforms:E-commerce sales in the luxury jewelry sector in Kuwait are anticipated to exceed $120 million in future, marking a 25% increase from the previous year. The convenience of online shopping, coupled with the rise of digital marketing strategies, is attracting a younger demographic. This shift towards online retail is enhancing accessibility to luxury jewelry, allowing brands to reach a broader audience and cater to changing consumer shopping habits effectively.

Market Challenges

- Economic Fluctuations:Kuwait's economy is heavily reliant on oil exports, which can lead to volatility. In future, oil prices are projected to fluctuate between $75 and $85 per barrel, impacting government revenues and consumer spending. Economic instability can result in reduced discretionary spending on luxury items, including jewelry, posing a significant challenge for market growth. Brands must navigate these fluctuations to maintain sales and profitability in uncertain economic conditions.

- High Competition Among Luxury Brands:The luxury jewelry market in Kuwait is characterized by intense competition, with over 60 established brands vying for market share. This saturation leads to aggressive pricing strategies and marketing campaigns, making it challenging for new entrants to gain traction. In future, the competitive landscape is expected to intensify, requiring brands to differentiate themselves through unique offerings and exceptional customer service to attract discerning consumers.

Kuwait Luxury Jewelry Market Future Outlook

The Kuwait luxury jewelry market is poised for dynamic growth, driven by increasing disposable incomes and a shift towards personalized shopping experiences. As e-commerce continues to expand, brands will need to enhance their online presence to capture the attention of tech-savvy consumers. Additionally, the focus on sustainability and ethical sourcing will shape consumer preferences, pushing brands to adopt responsible practices. Overall, the market is expected to evolve, presenting both challenges and opportunities for stakeholders in the luxury jewelry sector.

Market Opportunities

- Expansion of Online Retail Channels:The growth of online retail channels presents a significant opportunity for luxury jewelry brands in Kuwait. With e-commerce sales projected to reach $120 million in future, brands can leverage digital platforms to enhance visibility and accessibility. This shift allows for targeted marketing strategies that cater to the preferences of younger consumers, ultimately driving sales and brand loyalty.

- Collaborations with Local Artisans:Collaborating with local artisans can create unique jewelry pieces that resonate with cultural significance. This approach not only supports local craftsmanship but also appeals to consumers seeking authenticity and heritage in their purchases. By integrating traditional techniques with modern designs, brands can differentiate themselves in a competitive market, enhancing their appeal to discerning customers.