Region:Middle East

Author(s):Shubham

Product Code:KRAD5463

Pages:99

Published On:December 2025

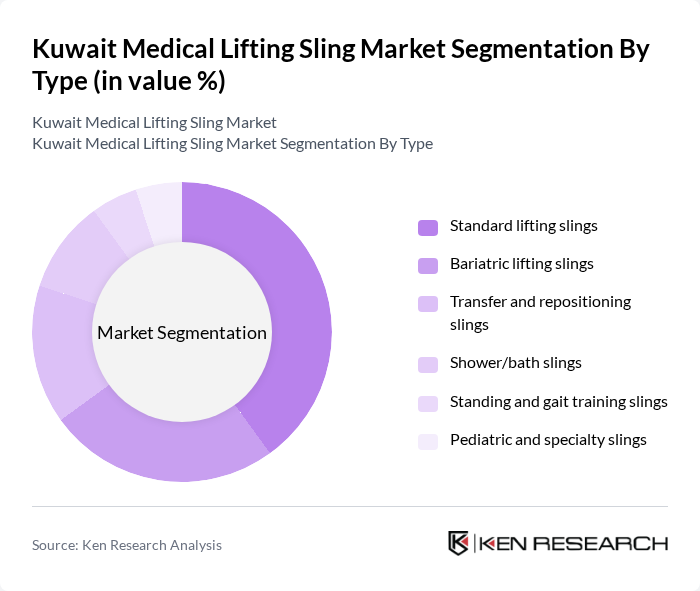

By Type:

The market is segmented into various types of lifting slings, including standard lifting slings, bariatric lifting slings, transfer and repositioning slings, shower/bath slings, standing and gait training slings, and pediatric and specialty slings. Among these, standard lifting slings dominate the market due to their versatility and widespread use in hospitals and home care settings. The increasing focus on patient safety and comfort has led to a higher adoption rate of these slings, making them a preferred choice for healthcare providers. Bariatric lifting slings are also gaining traction due to the rising prevalence of obesity, necessitating specialized equipment for safe patient handling.

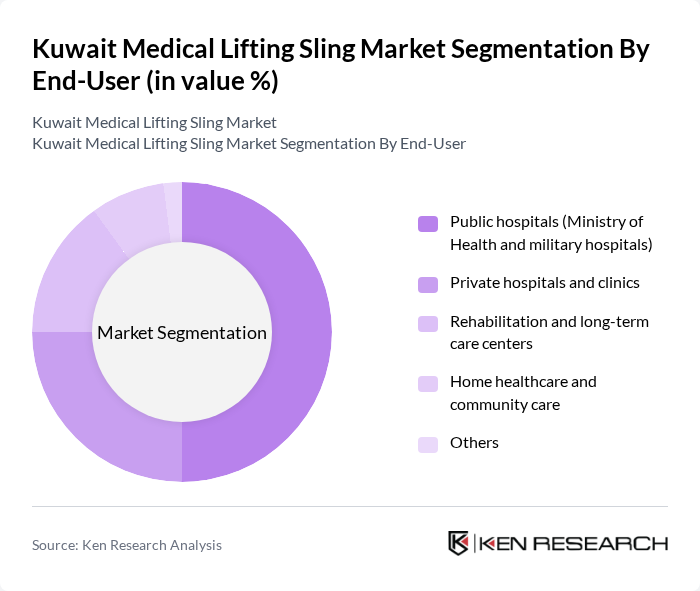

By End-User:

The end-user segmentation includes public hospitals (Ministry of Health and military hospitals), private hospitals and clinics, rehabilitation and long-term care centers, home healthcare and community care, and others. Public hospitals are the leading end-users due to their large patient volumes and the requirement for compliant medical equipment. The increasing number of private healthcare facilities and rehabilitation centers is also contributing to the growth of this segment. Home healthcare is emerging as a significant segment as more patients prefer receiving care in their homes, driving demand for lifting slings tailored for home use.

The Kuwait Medical Lifting Sling Market is characterized by a dynamic mix of regional and international players. Leading participants such as Arjo AB, Invacare Corporation, Hill-Rom Holdings, Inc. (Baxter International Inc.), Etac AB, Guldmann A/S, Handicare Group AB, Medline Industries, LP, Drive DeVilbiss Healthcare, Prism Medical Ltd., Joerns Healthcare LLC, Silvalea Ltd., Hill-Rom Middle East FZE, Al Essa Medical & Scientific Equipment Co. (Kuwait), United Medical Supplies Manufacturing Co. (Kuwait), Mediserv International Co. (Kuwait) contribute to innovation, geographic expansion, and service delivery in this space.

The Kuwait medical lifting sling market is poised for significant growth, driven by demographic changes and technological advancements. As the elderly population increases and the prevalence of mobility impairments rises, healthcare facilities will prioritize investments in patient handling solutions. Additionally, the integration of smart technology and ergonomic designs will enhance the functionality of lifting slings, making them more appealing to healthcare providers. This trend will likely lead to a more robust market landscape, fostering innovation and improved patient care.

| Segment | Sub-Segments |

|---|---|

| By Type | Standard lifting slings Bariatric lifting slings Transfer and repositioning slings Shower/bath slings Standing and gait training slings Pediatric and specialty slings |

| By End-User | Public hospitals (Ministry of Health and military hospitals) Private hospitals and clinics Rehabilitation and long-term care centers Home healthcare and community care Others |

| By Material | Polyester Nylon Cotton and blended fabrics Mesh and breathable technical textiles Disposable non?woven materials |

| By Weight Capacity | Up to 150 kg kg to 250 kg kg to 350 kg Above 350 kg (bariatric) |

| By Design | Full-body and universal slings U-shaped and hammock slings Standing/ambulation slings Toilet/commode and hygiene slings Others |

| By Distribution Channel | Direct sales to hospitals and government tenders Local medical equipment distributors Online and e-procurement platforms Retail pharmacies and homecare suppliers Others |

| By Region | Al Asimah (Kuwait City and surroundings) Hawalli & Farwaniya Ahmadi & Mubarak Al-Kabeer Jahra & Northern Kuwait |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 60 | Procurement Managers, Supply Chain Coordinators |

| Rehabilitation Centers | 50 | Physical Therapists, Rehabilitation Directors |

| Nursing Homes | 40 | Facility Managers, Care Coordinators |

| Home Care Providers | 40 | Home Health Aides, Care Managers |

| Medical Equipment Distributors | 50 | Sales Representatives, Product Managers |

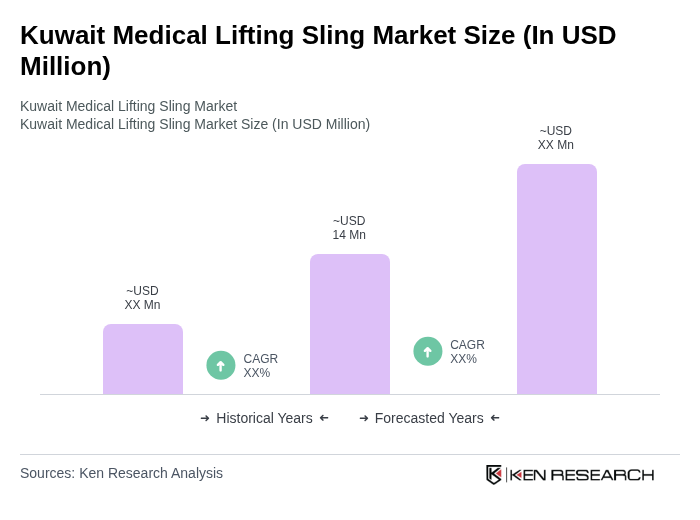

The Kuwait Medical Lifting Sling Market is valued at approximately USD 14 million, reflecting a five-year historical analysis. This growth is driven by factors such as an increasing elderly population and rising incidences of mobility impairments.