Region:Middle East

Author(s):Geetanshi

Product Code:KRAD5860

Pages:84

Published On:December 2025

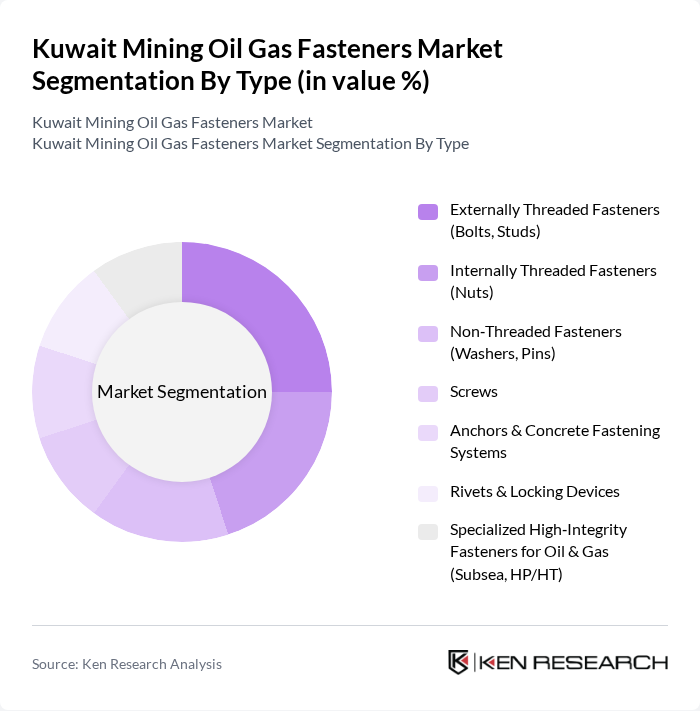

By Type:The fasteners market can be segmented into various types, including externally threaded fasteners, internally threaded fasteners, non-threaded fasteners, screws, anchors and concrete fastening systems, rivets and locking devices, and specialized high-integrity fasteners for oil and gas applications. This structure aligns with typical global mining and oil and gas fastener product groupings, where externally threaded fasteners account for the largest share, followed by internally threaded, non-threaded, and specialty fastening solutions used in high?pressure and high?temperature service.

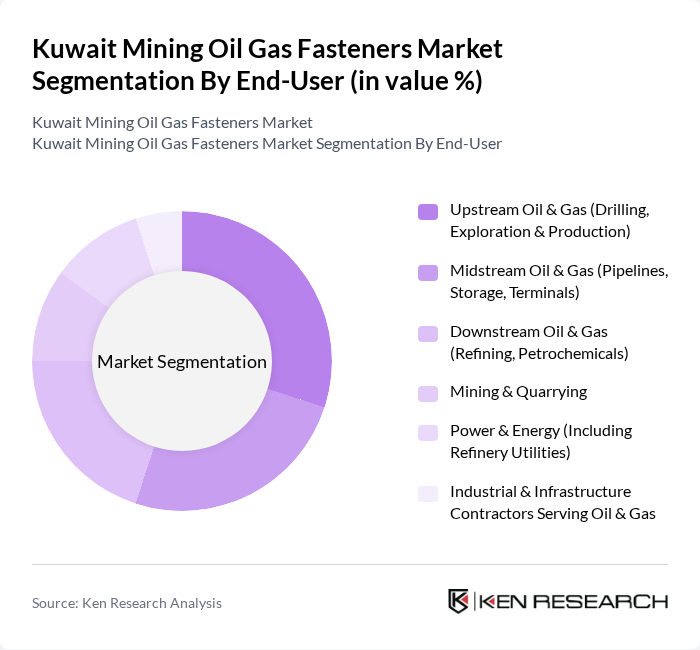

By End-User:The end-user segmentation includes upstream oil and gas, midstream oil and gas, downstream oil and gas, mining and quarrying, power and energy, and industrial and infrastructure contractors serving the oil and gas sector, which reflects how fastener demand typically concentrates in drilling and production equipment, pipeline and terminal infrastructure, refining and petrochemical complexes, and supporting utilities and construction works across the value chain.

The Kuwait Mining Oil Gas Fasteners Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Fasteners Manufacturing Co. W.L.L., Al Dhafra International General Trading Co. (Industrial Fasteners Division), Al Abbas Industrial & Specialty Fasteners Co., Al Mulla Group – Engineering & Industrial Products (Fasteners Business), Alghanim International General Trading & Contracting Co. – Industrial Supplies & Fasteners, KIPIC?Approved Fastener Suppliers (Selected Local Stockists & Service Centers), Gulf Fasteners Co. (Regional Supplier to Kuwait Oil & Gas Projects), Fastenal Company – Kuwait Operations, Würth Group – Middle East (Serving Kuwait Oil & Gas & Industrial Clients), Hilti Kuwait (Anchoring & High?Performance Fastening Systems), Cooper & Turner – GCC & Kuwait Project Supply, BUMAX AB – High?Strength Stainless Fasteners for Kuwait Applications, Nord?Lock Group – Bolt Securing Systems in Kuwait Oil & Gas, Unbrako (Deepak Fasteners Ltd.) – High?Tensile Fasteners Supply to Kuwait, Dokka Fasteners AS – High?Integrity Fasteners for Middle East Oil & Gas Including Kuwait contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait Mining Oil Gas Fasteners Market appears promising, driven by ongoing investments in infrastructure and the expansion of mining activities. As the demand for durable and high-quality fasteners continues to rise, manufacturers are likely to innovate and adopt advanced technologies. Additionally, the increasing focus on sustainability and renewable energy projects will create new avenues for growth, positioning the market for significant advancements in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Externally Threaded Fasteners (Bolts, Studs) Internally Threaded Fasteners (Nuts) Non?Threaded Fasteners (Washers, Pins) Screws Anchors & Concrete Fastening Systems Rivets & Locking Devices Specialized High?Integrity Fasteners for Oil & Gas (Subsea, HP/HT) |

| By End-User | Upstream Oil & Gas (Drilling, Exploration & Production) Midstream Oil & Gas (Pipelines, Storage, Terminals) Downstream Oil & Gas (Refining, Petrochemicals) Mining & Quarrying Power & Energy (Including Refinery Utilities) Industrial & Infrastructure Contractors Serving Oil & Gas |

| By Material | Carbon Steel Stainless Steel Alloy & High?Strength Steel Nickel & Corrosion?Resistant Alloys (e.g., Inconel, Duplex) Non?Metallic & Composite Fasteners |

| By Coating Type | Zinc?Plated & Electro?Galvanized Hot?Dip Galvanized PTFE / Fluoropolymer & Xylan Coatings Phosphate, Black Oxide & Other Protective Coatings |

| By Application | Critical Pressure?Containing Joints (Flanges, Valves) Structural Steel & Modular Skids Static & Rotating Equipment (Pumps, Compressors, Turbines) Pipelines, Flowlines & Wellheads Maintenance, Repair & Overhaul (MRO) |

| By Distribution Channel | Direct Sales to Oil & Gas Operators and EPCs Specialist Industrial Distributors OEM Supply Agreements Online & E?Procurement Platforms |

| By Region | Kuwait City & Eastern Industrial Corridor (Shuaiba, Ahmadi) Northern Oil Fields (Raudhatain, Sabriya & Adjacent Areas) Southern Oil Fields (Burgan, Wafra & Adjacent Areas) Western & Interior Kuwait (Support Bases, Infrastructure) Offshore & Neutral Zone Developments |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil and Gas Fasteners Supply Chain | 100 | Supply Chain Managers, Procurement Officers |

| Manufacturing Sector Fastener Usage | 80 | Production Managers, Quality Control Supervisors |

| Construction Industry Fastener Requirements | 70 | Project Managers, Site Engineers |

| Maintenance and Repair Operations | 60 | Maintenance Managers, Equipment Supervisors |

| Distribution and Retail of Fasteners | 90 | Retail Managers, Logistics Coordinators |

The Kuwait Mining Oil Gas Fasteners Market is valued at approximately USD 1.1 billion, driven by increasing demand for fasteners in the oil and gas sector, along with ongoing investments in infrastructure and energy projects.