Region:Middle East

Author(s):Geetanshi

Product Code:KRAD6041

Pages:81

Published On:December 2025

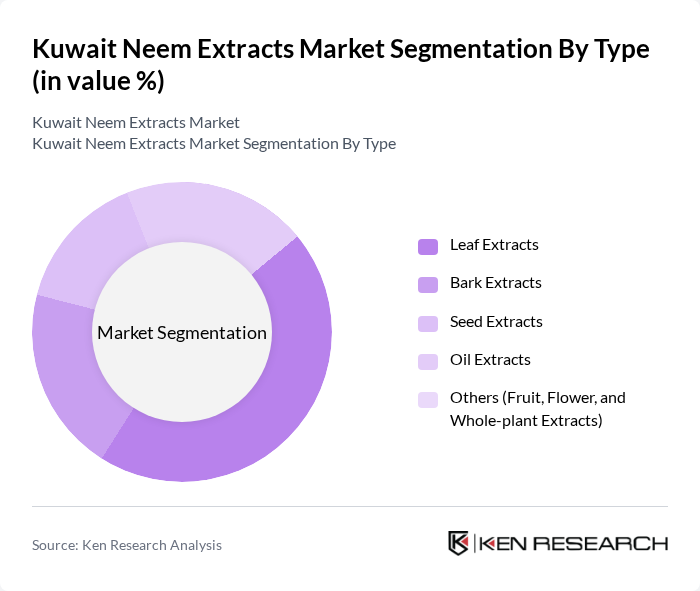

By Type:The market is segmented into various types of neem extracts, including leaf extracts, bark extracts, seed extracts, oil extracts, and others such as fruit, flower, and whole-plant extracts. Among these, leaf extracts are the most popular due to their extensive use in traditional medicine and cosmetics. The demand for oil extracts is also significant, driven by their applications in personal care products and agriculture.

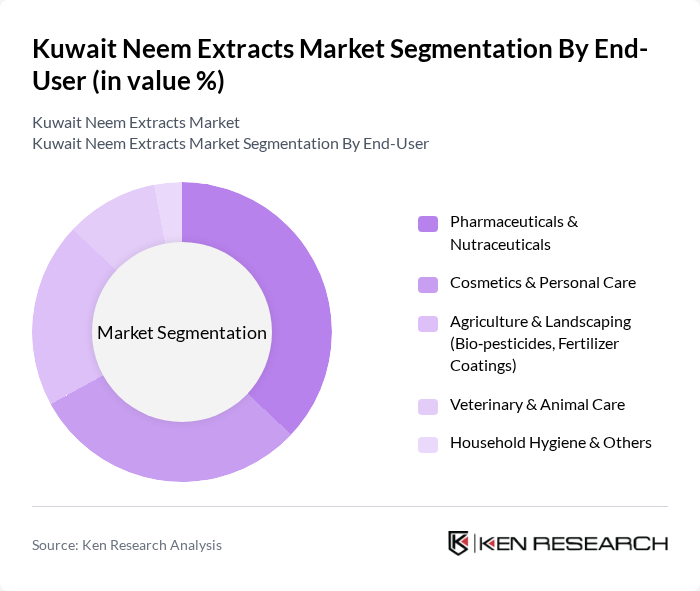

By End-User:The end-user segmentation includes pharmaceuticals & nutraceuticals, cosmetics & personal care, agriculture & landscaping, veterinary & animal care, and household hygiene. The pharmaceuticals & nutraceuticals segment leads the market due to the increasing use of neem extracts in dietary supplements and herbal medicines. The cosmetics sector is also growing rapidly, driven by the rising demand for natural ingredients in skincare and haircare products.

The Kuwait Neem Extracts Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Jazeera Perfumes Manufacturing Co. (Herbal & Personal Care Division, Kuwait), Kuwait Saudi Pharmaceutical Industries Co. (KSPICO), Life Pharmacy Kuwait (Private-label Herbal & Neem Products), Boots Pharmacy Kuwait (Alliance Boots – Herbal & Natural Range), Dabur International Ltd. (Middle East & GCC Operations), Himalaya Wellness Company (Middle East Region), Emami Ltd. – Zandu & Other Herbal Brands (GCC Distribution), Biotech Laboratories LLC (Neem-based Veterinary & Agro Solutions, GCC), Al Mulla Group – Retail & FMCG Distribution (Herbal & Natural Products Portfolio), Lulu Hypermarket Kuwait (Private-label Organic & Herbal Products), Carrefour Kuwait (Majid Al Futtaim Retail – Natural Personal Care Range), Al-Dawaa Pharmacy Group – GCC Distribution into Kuwait (Herbal & Neem SKUs), Green Fields Factory for Agricultural Products (Regional Bio?pesticides & Neem Oil Supplier), Al-Nakheel Agricultural Co. (Agro-inputs & Bio?pesticides Distribution in Kuwait), Gulf Center for Foodstuffs Co. (Herbal Nutraceutical & Functional Food Imports) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait neem extracts market appears promising, driven by increasing consumer interest in natural health solutions and sustainable sourcing practices. As the market matures, companies are likely to focus on product innovation and diversification, particularly in the cosmetics and personal care sectors. Additionally, the rise of e-commerce platforms will facilitate broader access to neem products, enabling manufacturers to reach a wider audience and enhance market penetration in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Leaf Extracts Bark Extracts Seed Extracts Oil Extracts Others (Fruit, Flower, and Whole-plant Extracts) |

| By End-User | Pharmaceuticals & Nutraceuticals Cosmetics & Personal Care Agriculture & Landscaping (Bio?pesticides, Fertilizer Coatings) Veterinary & Animal Care Household Hygiene & Others |

| By Distribution Channel | Online Retail (E?commerce Platforms, Company Webstores) Pharmacies & Health Stores Supermarkets/Hypermarkets B2B Institutional Sales (Hospitals, Farms, Clinics) Specialty Organic & Herbal Stores |

| By Formulation | Liquid Extracts & Concentrates Powdered Extracts Capsules/Tablets Topical Gels/Creams/Ointments Ready-to-use Sprays & Solutions |

| By Application | Medicinal & Therapeutic Uses Agricultural & Pest-control Uses Cosmetic & Dermatological Uses Oral Care & Nutraceutical Uses Household, Pet-care & Other Uses |

| By Packaging Type | Bottles & Droppers Sachets & Blister Packs Bulk Drums & Industrial Containers Pouches, Jars & Others |

| By Region | Kuwait City & Capital Governorate Al Farwaniyah & Al Jahra Governorates Hawalli Governorate Al Ahmadi & Mubarak Al-Kabeer Governorates |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Sector Stakeholders | 60 | Farmers, Agricultural Product Distributors |

| Manufacturers of Herbal Products | 50 | Production Managers, R&D Heads |

| Cosmetic Industry Representatives | 40 | Product Development Managers, Marketing Executives |

| Pharmaceutical Companies | 40 | Procurement Officers, Quality Assurance Managers |

| Retailers of Natural Products | 50 | Store Managers, Category Buyers |

The Kuwait Neem Extracts Market is valued at approximately USD 16 million, reflecting a growing demand for natural and organic products across various sectors, including pharmaceuticals, cosmetics, and agriculture.