Region:Middle East

Author(s):Rebecca

Product Code:KRAD8191

Pages:99

Published On:December 2025

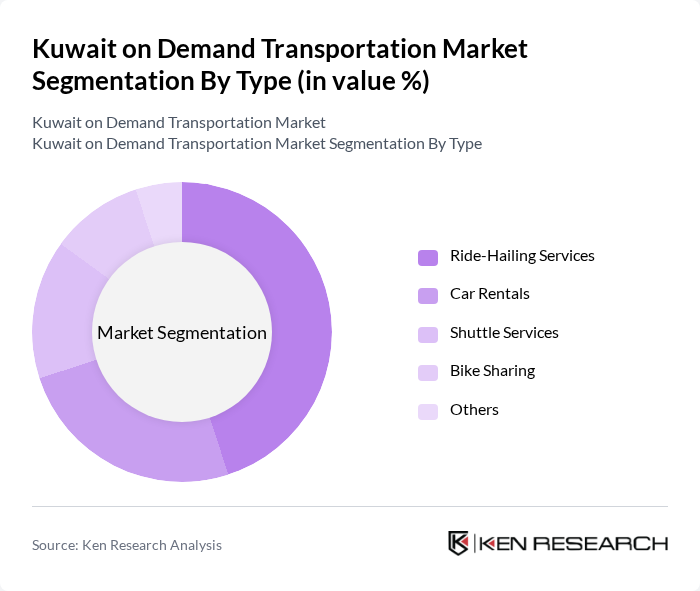

By Type:The market can be segmented into various types, including Ride-Hailing Services, Car Rentals, Shuttle Services, Bike Sharing, and Others. Among these, Ride-Hailing Services have emerged as the most popular choice due to their convenience and accessibility. The increasing smartphone penetration and the availability of user-friendly apps have further fueled the growth of this segment. Car Rentals and Shuttle Services also hold significant market shares, catering to both individual and corporate clients.

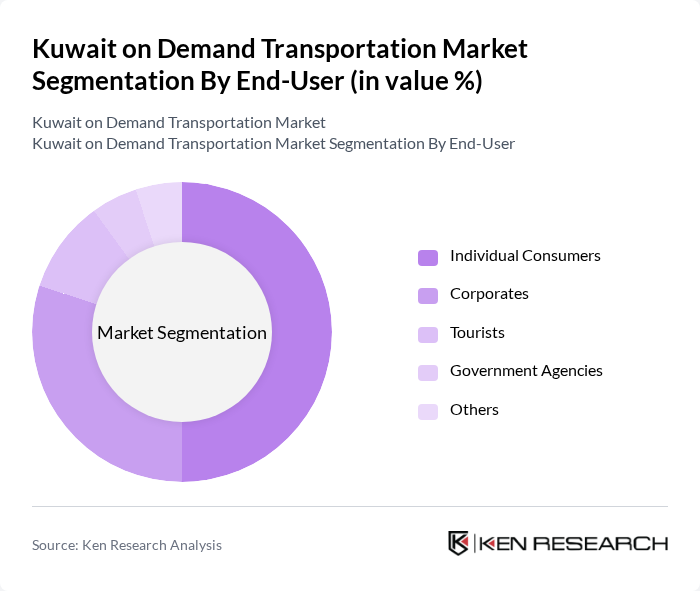

By End-User:The end-user segmentation includes Individual Consumers, Corporates, Tourists, Government Agencies, and Others. Individual Consumers dominate the market, driven by the growing trend of convenience and the need for flexible transportation options. Corporates also represent a significant segment, utilizing on-demand services for business travel and employee transportation. Tourists contribute to the market through their demand for car rentals and ride-hailing services, especially during peak travel seasons.

The Kuwait on Demand Transportation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Careem, Uber, Talabat, Kiwitaxi, OTaxi, Buseet, Q8 Taxi, Zain Ride, KNET, Mwasalat, Udrive, Fennel, Bidoor, KWT Taxi, GoBus contribute to innovation, geographic expansion, and service delivery in this space.

The future of the on-demand transportation market in Kuwait appears promising, driven by technological advancements and changing consumer preferences. As urbanization continues, the demand for efficient and convenient transportation solutions will likely increase. Additionally, the integration of electric vehicles and sustainable practices will play a crucial role in shaping the market landscape. Companies that adapt to these trends and prioritize user experience will be well-positioned to thrive in this evolving environment, fostering growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Ride-Hailing Services Car Rentals Shuttle Services Bike Sharing Others |

| By End-User | Individual Consumers Corporates Tourists Government Agencies Others |

| By Vehicle Type | Sedans SUVs Vans Electric Vehicles Others |

| By Service Model | On-Demand Services Pre-Booked Services Subscription Services Others |

| By Payment Method | Credit/Debit Cards Mobile Wallets Cash Payments Others |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas Others |

| By Customer Segment | Business Travelers Leisure Travelers Daily Commuters Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ride-Hailing Service Users | 120 | Frequent Users, Occasional Users, Non-Users |

| Food Delivery Service Customers | 100 | Regular Customers, New Users, Business Clients |

| Logistics and Delivery Service Providers | 80 | Operations Managers, Business Development Executives |

| Urban Mobility Experts | 60 | Transportation Planners, Policy Makers, Academics |

| Technology Providers in Transportation | 70 | Product Managers, Software Developers, Business Analysts |

The Kuwait on Demand Transportation Market is valued at approximately USD 1.1 billion, driven by urbanization, rising disposable incomes, and a growing preference for convenient transportation options among consumers.