Region:Middle East

Author(s):Rebecca

Product Code:KRAD4961

Pages:88

Published On:December 2025

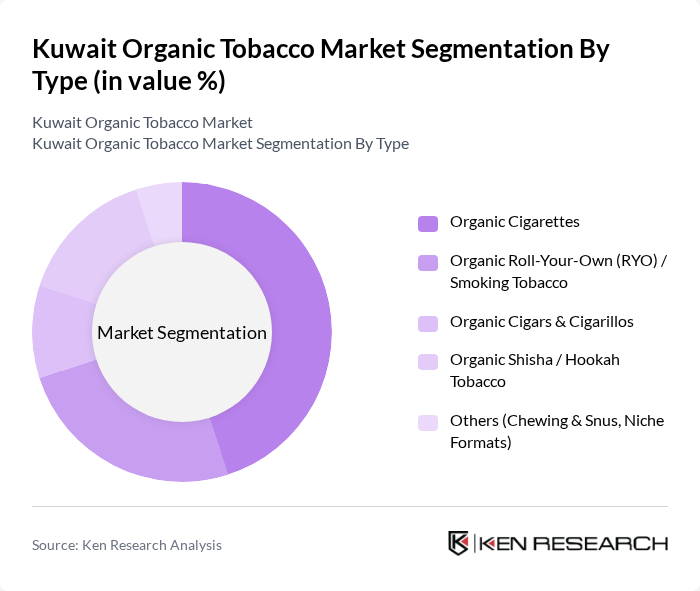

By Type:The organic tobacco market is segmented into various types, including organic cigarettes, organic roll-your-own (RYO) tobacco, organic cigars and cigarillos, organic shisha or hookah tobacco, and other niche formats such as chewing tobacco and snus. Among these, organic cigarettes are the most popular due to their widespread availability in retail channels and consumer preference for convenient, ready-to-use products, in line with global organic tobacco consumption patterns where smoking products dominate. Organic roll-your-own tobacco is also gaining traction as consumers seek customizable smoking experiences and perceive RYO formats as more economical and controllable in terms of blend and strength. The market is characterized by a growing trend towards premium, low-additive, and organic offerings in both cigarettes and shisha, reflecting a shift in consumer behavior towards perceived cleaner-label alternatives while still maintaining traditional smoking habits.

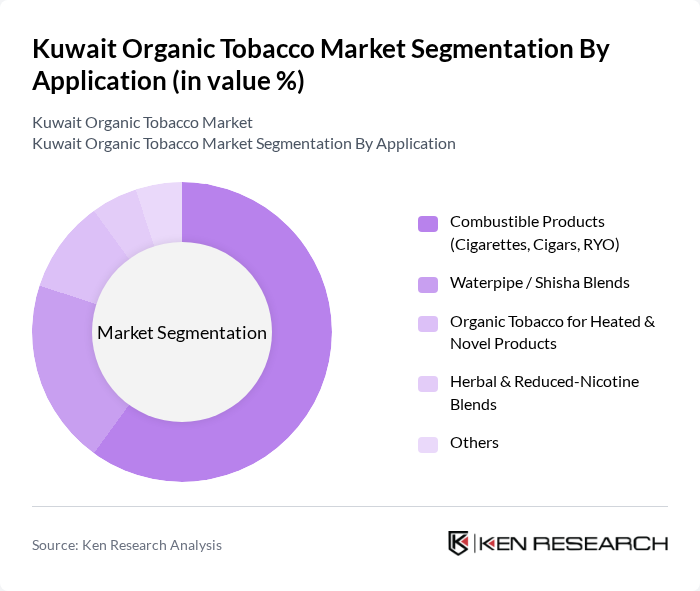

By Application:The applications of organic tobacco products include combustible products such as cigarettes, cigars, and roll-your-own tobacco, waterpipe or shisha blends, organic tobacco for heated and novel products, herbal and reduced-nicotine blends, and other applications. The combustible products segment dominates the market, consistent with both global and regional organic tobacco trends where smoked formats account for the majority of demand. This segment is supported by entrenched cigarette consumption patterns in Kuwait and the introduction of organic and additive-free variants within mainstream brands. Waterpipe tobacco is also popular, particularly among younger consumers and expatriates in urban centers, as it aligns with café-based and social smoking trends and benefits from growing interest in premium and flavored shisha blends, including “natural” and low-additive lines. The market is evolving with a growing interest in innovative applications such as organic tobacco inputs for heated products, hybrid herbal blends, and reduced-nicotine or low-additive formulations, reflecting changing consumer preferences and the broader shift toward differentiated, perceived lower-risk tobacco offerings.

The Kuwait Organic Tobacco Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philip Morris International Inc. (Marlboro Crafted / Organic & Additive-Free Lines), British American Tobacco p.l.c. (BAT), Japan Tobacco International (JTI), Imperial Brands PLC, KT&G Corporation, Eastern Company SAE, Gulf Tobacco Company, Al Fakher Distribution & Manufacturers (Shisha & Related Organic/Natural Lines), Al Nakhla Tobacco Company (Nakhla), The Ababil Group, Casdagli Cigars, Local Kuwaiti Importers & Distributors of Organic and Natural Tobacco Products, Private-Label Organic Tobacco Brands in Kuwait Modern Trade, Regional Online Retailers Specializing in Organic / Additive-Free Tobacco, Other Emerging Niche & Boutique Organic Tobacco Brands in GCC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the organic tobacco market in Kuwait appears promising, driven by increasing health awareness and a growing preference for organic products. As consumer demand continues to rise, producers are likely to innovate and diversify their offerings, including the development of unique blends and flavors. Additionally, the expansion of e-commerce platforms will facilitate greater access to organic tobacco products, enhancing market penetration. Overall, the sector is poised for growth, supported by favorable government policies and evolving consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Organic Cigarettes Organic Roll-Your-Own (RYO) / Smoking Tobacco Organic Cigars & Cigarillos Organic Shisha / Hookah Tobacco Others (Chewing & Snus, Niche Formats) |

| By Application | Combustible Products (Cigarettes, Cigars, RYO) Waterpipe / Shisha Blends Organic Tobacco for Heated & Novel Products Herbal & Reduced-Nicotine Blends Others |

| By Distribution Channel | Duty-Free & Travel Retail Modern Trade (Supermarkets/Hypermarkets) Specialty Tobacco & Vape Stores Convenience Stores & Baqalas Online & Direct-to-Consumer HoReCa Channels (Hotels, Restaurants, Cafés, Lounges) |

| By Certification & Organic Standard | Certified Organic (EU, USDA, Equivalent) “Natural” / Additive-Free (Non-Certified) Fair-Trade & Sustainability-Certified Tobacco Private-Label / Retailer-Certified Organic Others |

| By Price Range | Premium & Super-Premium Mid-Range Value / Economy Private Label |

| By Consumer Demographics | Age Group (18–24, 25–34, 35–44, 45+) Gender Income Level (Mass, Affluent, High-Net-Worth) Nationality (Kuwaiti vs Expatriate) Others |

| By Geographic Distribution (Within Kuwait) | Kuwait City & Metropolitan Area Other Urban Governorates (Hawalli, Farwaniya, Ahmadi) Semi-Urban & Emerging Retail Clusters Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Organic Tobacco Retailers | 100 | Store Owners, Retail Managers |

| Organic Tobacco Farmers | 75 | Farm Owners, Agricultural Consultants |

| Distributors of Organic Tobacco | 50 | Distribution Managers, Supply Chain Coordinators |

| Consumers of Organic Tobacco Products | 120 | Regular Users, Occasional Buyers |

| Health and Regulatory Experts | 40 | Public Health Officials, Regulatory Advisors |

The Kuwait Organic Tobacco Market is valued at approximately USD 7 million, reflecting a growing trend towards organic and additive-free tobacco products driven by consumer health awareness and preferences for sustainable sourcing.