Region:Middle East

Author(s):Geetanshi

Product Code:KRAD8002

Pages:89

Published On:December 2025

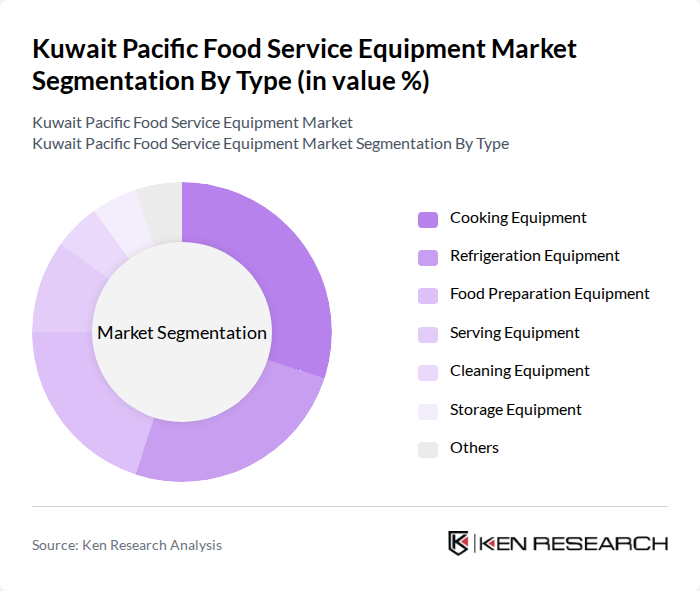

By Type:The market is segmented into various types of food service equipment, including cooking equipment, refrigeration equipment, food preparation equipment, serving equipment, cleaning equipment, storage equipment, and others. Each of these segments plays a crucial role in the overall functionality and efficiency of food service operations. Among these, cooking equipment is the most dominant segment due to the high demand for various cooking appliances in restaurants and commercial kitchens.

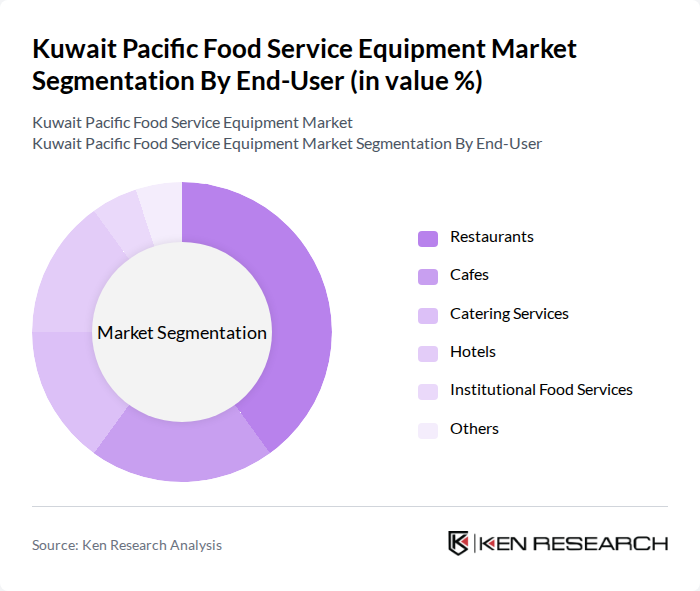

By End-User:The end-user segmentation includes various categories such as restaurants, cafes, catering services, hotels, institutional food services, and others. Restaurants are the leading end-user segment, driven by the growing trend of dining out and the increasing number of food establishments in urban areas. This segment's growth is further supported by the rising consumer preference for diverse culinary experiences.

The Kuwait Pacific Food Service Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Hokair Group, Al-Mansour Group, Al-Bahar Group, Al-Futtaim Group, Al-Majed Group, Al-Sayer Group, Al-Khaldi Group, Al-Muhaidib Group, Al-Qatami Group, Al-Sarraf Group, Al-Mansour Al-Sabah Group, Al-Muhanna Group, Al-Sabhan Group, Al-Sharhan Group, Al-Tamimi Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait Pacific food service equipment market appears promising, driven by ongoing technological advancements and a growing emphasis on sustainability. As consumer preferences shift towards healthier dining options, restaurants are likely to invest in energy-efficient and eco-friendly equipment. Additionally, the expansion of online food delivery services will further stimulate demand for innovative kitchen solutions, enabling businesses to optimize their operations and meet evolving consumer expectations effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Cooking Equipment Refrigeration Equipment Food Preparation Equipment Serving Equipment Cleaning Equipment Storage Equipment Others |

| By End-User | Restaurants Cafes Catering Services Hotels Institutional Food Services Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Wholesalers Others |

| By Material | Stainless Steel Aluminum Plastic Glass Others |

| By Price Range | Budget Mid-Range Premium Others |

| By Brand | Local Brands International Brands Private Labels Others |

| By Application | Commercial Kitchens Food Processing Units Bakery and Confectionery Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Restaurant Equipment Purchases | 120 | Restaurant Owners, Purchasing Managers |

| Catering Services Equipment Needs | 100 | Catering Managers, Event Coordinators |

| Hotel Kitchen Equipment Requirements | 80 | Executive Chefs, Hotel Operations Managers |

| Food Truck Equipment Insights | 60 | Food Truck Owners, Mobile Kitchen Operators |

| Institutional Food Service Equipment | 70 | Facility Managers, Procurement Officers |

The Kuwait Pacific Food Service Equipment Market is valued at approximately USD 260 million, reflecting a significant growth trend driven by increased demand for food service establishments and advancements in food service technology.